TIDMIGP

RNS Number : 5275T

Intercede Group PLC

21 November 2013

21 November 2013

INTERCEDE GROUP plc

('Intercede', 'the Company' or 'the Group')

Interim Results for the Six Months Ended 30 September 2013

Intercede (AIM: IGP.L) is a leading producer of Identity and

Credential Management software, called MyID, which manages the

secure registration, issuance and life cycle of digital identities

for a wide range of uses.

SUMMARY

-- Sales increased by 32% to GBP4,614,000 (H1 2012:

GBP3,508,000): the highest six month sales period to date.

-- Return to profitability: profit before tax of GBP256,000 (H1

2012: loss before tax of GBP185,000).

-- Basic and fully diluted earnings per share of 1.3p (H1 2012: loss per share of 0.2p).

-- Cash balances of GBP7,429,000 as at 30 September 2013 (30

September 2012: GBP7,183,000) demonstrating financial strength of

business.

-- Six new contracts signed in the period with major

international organisations in the telecoms, aerospace &

defence and law enforcement sectors; one further contract signed

since period end - all expected to contribute to revenues in

current financial year.

-- Increased investment in technology and sales & marketing

validated by the securing of launch customers and partners for our

MyID credentialing services, MyID Mail app and MyID

machine-certificate solutions.

Richard Parris, Chairman and Chief Executive of Intercede,

commented:

"We have experienced one of our strongest ever six month trading

periods and remain optimistic that this pattern will continue

through the second half. No fewer than six new revenue generating

contracts were signed in the half year, with a seventh earlier this

month. In addition, we have advanced our technological proposition,

enabling MyID to be applied in a growing range of devices and other

environments. We have also continued to invest in our own sales

capacity and expanded our indirect channels to market.

"The commercial outlook for the remainder of the year ending 31

March 2014 remains in line with expectations. Beyond that, I

believe 2014 will be an inflexion year for the adoption of

Intercede's technology by mainstream channel partners and large

customers. This underpins our focus on building a business and

technology platform to deliver our previously declared high growth

2020 vision. We remain confident that this strategy will maximise

long term shareholder value."

ENQUIRIES

Intercede Group plc Tel. +44 (0)1455 558 111

Richard Parris, Chairman & Chief Executive

Andrew Walker, Finance Director

FinnCap Tel. +44 (0)20 7220 0500

Stuart Andrews, Corporate Finance

Joanna Weaving, Corporate Broking

Bell Pottinger Tel. +44 (0)7802 442486

Archie Berens

About Intercede

Intercede(TM) is a security software provider whose MyID(R)

identity management platform enables global organisations and

governments to create trusted digital identities for employees and

citizens on secure devices such as smartcards, smartphones and

tablets. MyID(R) enables the protection of IP, assets, and digital

content, delivering trusted digital identities as the cornerstone

of cyber security strategies for government, defence, financial

services and other industries.

The Company operates in global markets (including the US, Europe

and Middle East) and works with large international partners to

deliver flexible digital identity solutions that are interoperable

with other existing technologies and which are tailored to customer

needs.

The world's largest governments, major corporations and mobile

network operators trust Intercede's deep expertise to deliver

effective solutions. The Company's technology achievements reflect

a significant investment in the development of intellectual

property, exemplary speed of deployment and adherence to

international standards including FIPS 201, where MyID(R) was the

first electronic personalisation product to obtain GSA approval.

This trust is reflected in Intercede's rate of repeat business with

its customers, which typically runs at 70-80% of annual

revenues.

Intercede has been developing ID management systems since 1992

and MyID(R) is currently deployed by end customers located in 24

countries. The company is headquartered in the UK, listed on the

London Stock Exchange (AIM: IGP) and is ISO 9001 and TickIT

certified.

For more information visit http://www.intercede.com

INTERCEDE GROUP plc

('Intercede', 'the Company' or 'the Group')

Interim Results for the Six Months Ended 30 September 2013

Chairman's Statement

Introduction

I am pleased to announce Intercede's interim results for the six

month period ended 30 September 2013. We have experienced one of

our strongest ever six month trading periods and remain optimistic

that this pattern will continue through the second half.

Financial Results

Revenues in the period totaled GBP4,614,000 compared to

GBP3,508,000 in the previous year, an increase of 32%. A net profit

of GBP652,000 for the period compares to a GBP84,000 net loss in

the prior year.

The Company has no debt and continues to be cash generative. The

cash balance at the end of September was GBP7,429,000 compared to

GBP6,770,000 at the end of March 2013 and GBP7,183,000 at the end

of September 2012.

Operational Highlights

This has been a very busy period in terms of contract wins and

customer deliveries. The following contract wins were added to the

order book during the period, all of which will contribute to

revenues in the current financial year:

-- 9 April 2013: CertiPath announced its CIV-in-a-Box product,

based on MyID, at ISC West in Las Vegas. CertiPath has subsequently

secured its first customer for this solution.

-- 25 April 2013: Large scale US transportation security

programme - MyID licenses and development to support more than 2.5

million biometric identity smart cards. The contract value to

Intercede is likely to exceed GBP1.5 million in the current

financial year and GBP10 million over a five-year period.

-- 29 July 2013: Canadiantelecommunications company - more than

25,000 MyID licences in support of digital identities on mobile

devices for employees and to be expanded to external customers.

-- 29 July 2013: German telecommunications company - more than

100,000 MyID licenses in support of digital identities on smart

cards and mobile devices, initially for employees but with an

intention to later expand to external customers.

-- 25 September 2013: Major European aerospace & defence

contractor - initial order for 50,000 MyID licenses to manage

digital identities on employee smart badges. The total population

after full deployment is anticipated to be more than 100,000

users.

-- 25 September 2013: UK law enforcement organisation - order

received to replace an incumbent competitor's product with MyID.

The total population after full deployment is anticipated to be

more than 30,000 users.

In addition, on 5 November 2013, we signed a contract with a

major US aerospace & defence contractor, to replace an existing

credential management system with MyID. The total population after

full deployment is anticipated to be more than 60,000 users.

Business Development

During the period, Intercede advanced the use of MyID to manage

digital credentials on Windows 7, Windows 8 and 8.1 mobile devices

to enable customers to deploy virtual smartcards onto tablets,

laptops and phones equipped with TPM technology. These solutions

were demonstrated at an invitation-only CESG security event on 14

October 2013. Working with the Microsoft sales channel, a number of

opportunities are in the late stages of contract negotiation.

On 6 September 2013, Intercede entered into a technology and

marketing partnership with Trustonic to further develop our mobile

device credential management capability. Trustonic is a joint

venture between ARM, Gemalto and Giesecke & Devrient.

Extending from our work with both Microsoft and Trustonic,

Intercede is developing a MyID solution for managing the secure

identity of machines connected to trusted networks. Initial

contracts are currently being negotiated for the deployment of at

least 100,000 machine certificates managed by MyID licenses in

2014.

To demonstrate the use of digital identities on mobile devices,

Intercede has developed MyID Mail, a secure email app that is

available for purchase on iTunes. This works on any iPhone or iPad

equipped with a smart card reader. A major oil and gas company is

currently piloting the use of this solution for its senior

executives, reinforcing the potential demand for such

capability.

At government level, additional PIV and PIV-I licenses have been

sold to US Federal government agencies and HP have purchased the

first licenses under our previously announced reseller agreement to

support a large UK government agency. This endorses MyID as a

high-security trusted product.

In the US, at state and local level, Intercede MyID is powering

two managed service providers who have been contracted during the

period to roll out citizen-facing identity card solutions within

the Commonwealth of Virginia and the State of West Virginia. These

programs have the potential to provide healthy revenues in future

periods. Furthermore, another Intercede partner is poised to roll

out PIV-I credentials to more than 300,000 contractors accessing US

military bases.

We have previously highlighted our engagement with TSCP, an

aerospace and governmental organisation focused on secure

transglobal collaboration. On 18 September 2013, TSCP announced it

had been awarded a pilot grant by the Department of Commerce's

National Institute of Standards and Technology (NIST) to support

the National Strategy for Trusted Identities in Cyberspace (NSTIC).

The TSCP team brings together governments, leading system

integrators, technology solution providers, small and medium-sized

businesses and financial services sector participants to

collaborate in achieving NSTIC's goals. Intercede is a member of

this team. The TSCP pilots will use trusted credentials to conduct

secure business-to-business, government-to-business and retail

transactions for small and medium-sized businesses and financial

services companies. One outcome of the TSCP pilots will be the

development of an open source, technology-neutral Trust Framework

Development Guidance document. This is a highly significant

development, since it will create a standard for consistent and

convenient online transactions to enable secure and

privacy-enhancing online access for businesses and consumers.

Intercede is also a member of a pan-European consortium that has

been awarded an EU-funded grant to research and propose solutions

to support the concept of a situational awareness security

operations centre investigating converged physical, logical and

cyber security. The project, which has a value to Intercede in

excess of EUR300k over three years, includes protecting critical

national infrastructure, power utilities and major sports stadiums.

Intercede is contracted to a multinational prime contractor and

will be the identity management solutions provider to the

consortium.

Strategy and Outlook

This wide range of new business opportunities is driving

Intercede's growth trajectory in terms of revenue and headcount.

Our ability to win new customers and to displace competitors from

key accounts demonstrates our current leadership and the

competitive strength of the MyID software platform.

The sales potential behind each of the opportunities described

above is far greater than the revenue booked in the current period,

meaning the business is well structured for further growth. We

continue to invest in people and facilities to ensure we take

advantage of the opportunities we have created.

The securing of launch customers and partners for our MyID

mobile credentialing services, MyID Mail app and MyID

machine-certificate solutions also validates our investment

strategy and provides vital customer feedback.

Intercede's strapline for 2014 is 'ID Anywhere'. On smart cards,

in phones, on tablets, in servers, for employees, citizens,

consumers, in the office, on the move, Intercede delivers secure

and trusted identities - Anywhere. This Internet of Things promises

to be a very large market for Intercede to exploit in both the

medium and long term.

The commercial outlook for the remainder of the year ending 31

March 2014 remains in line with expectations. Beyond that, I

believe 2014 will be an inflexion year for the adoption of

Intercede's technology by mainstream channel partners and large

customers. This underpins our focus on building a business and

technology platform to deliver our previously declared high growth

2020 vision. We remain confident that this strategy will maximise

long term shareholder value.

Richard Parris

Chairman & Chief Executive

21 November 2013

Consolidated Statement of Comprehensive Income

For the period ended 30 September 2013

6 months 6 months

ended ended Year ended

30 September 30 September 31 March

2013 2012 2013

GBP'000 GBP'000 GBP'000

Continuing operations

Revenue 4,614 3,508 6,727

Cost of sales (18) (20) (24)

__________ __________ __________

Gross profit 4,596 3,488 6,703

Administrative expenses (4,376) (3,717) (7,467)

__________ __________ __________

Operating profit/(loss) 220 (229) (764)

Finance income 36 44 91

__________ __________ __________

Profit/(loss) before tax 256 (185) (673)

Taxation 396 101 101

__________ __________ __________

Profit/(loss) for the period 652 (84) (572)

__________ __________ __________

Total comprehensive income/(expense)

attributable to owners of the parent

company 652 (84) (572)

__________ __________ __________

Earnings/(loss) per share (pence)

- basic 1.3p (0.2)p (1.2p)

- diluted 1.3p (0.2)p (1.2p)

__________ __________ __________

Consolidated Balance Sheet

As at 30 September 2013

As at As at As at

30 September 30 September 31 March

2013 2012 2013

GBP'000 GBP'000 GBP'000

Non-current assets

Property, plant and equipment 658 624 644

__________ __________ __________

Current assets

Trade and other receivables 1,575 1,104 991

Cash and cash equivalents 7,429 7,183 6,770

__________ __________ __________

9,004 8,287 7,761

__________ __________ __________

Total assets 9,662 8,911 8,405

__________ __________ __________

Equity

Share capital 487 487 487

Share premium account 232 232 232

Other reserves 1,508 1,508 1,508

Retained earnings 4,250 3,946 3,530

__________ __________ __________

Total equity 6,477 6,173 5,757

__________ __________ __________

Current liabilities

Trade and other payables 1,225 890 998

Deferred revenue 1,960 1,848 1,650

__________ __________ __________

3,185 2,738 2,648

__________ __________ __________

Total equity and liabilities 9,662 8,911 8,405

__________ __________ __________

Consolidated Statement of Changes in Equity

As at 30 September 2013

Share Share Other Retained

capital premium reserves earnings Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 31 March 2013 487 232 1,508 3,530 5,757

Employee share option scheme

charge - - - 68 68

Total comprehensive income - - - 652 652

________ ________ ________ ________ _______

At 30 September 2013 487 232 1,508 4,250 6,477

________ ________ ________ _________________ ________

At 31 March 2012 484 110 1,508 3,930 6,032

Issue of shares, net of costs 3 122 - - 125

Employee share option scheme

charge - - - 100 100

Total comprehensive expense - - - (84) (84)

________ ________ ________ ________ _______

At 30 September 2012 487 232 1,508 3,946 6,173

________ ________ ________ ___________ ________

At 31 March 2012 484 110 1,508 3,930 6,032

Issue of shares, net of costs 3 122 - - 125

Employee share option scheme

charge - - - 172 172

Total comprehensive expense - - - (572) (572)

________ ________ ________ ________ _______

At 31 March 2013 487 232 1,508 3,530 5,757

________ ________ ________ ___________ ________

Consolidated Cash Flow Statement

For the period ended 30 September 2013

6 months 6 months

ended ended Year ended

30 September 30 September 31 March

2013 2012 2013

GBP'000 GBP'000 GBP'000

Cash flows from operating activities

Operating profit/(loss) 220 (229) (764)

Depreciation 55 45 92

Employee share option scheme charge 68 100 172

(Increase)/decrease in trade and other

receivables (584) 306 317

Increase in deferred income and trade

and other payables 537 308 218

__________ __________ __________

Cash generated from operations 296 530 35

Taxation 396 4 101

__________ __________ __________

Net cash generated from operating activities 692 534 136

__________ __________ __________

Investing activities

Interest received 36 42 94

Purchases of property, plant and equipment (69) (486) (553)

__________ __________ __________

Net cash used in investing activities (33) (444) (459)

__________ __________ __________

Financing activities

Proceeds on issue of shares - 125 125

__________ __________ __________

Net cash generated from financing activities - 125 125

__________ __________ __________

Net increase/(decrease) in cash and cash

equivalents 659 215 (198)

Cash and cash equivalents at the beginning

of the period 6,770 6,968 6,968

__________ __________ __________

Cash and cash equivalents at the end

of the period 7,429 7,183 6,770

__________ __________ __________

Notes to the Consolidated Accounts

For the period ended 30 September 2013

1 Preparation of the interim financial statements

These interim financial statements have been prepared under IFRS

as adopted by the European Union and on the basis of the accounting

policies set out in the Group's Annual Report for the year ended 31

March 2013.

The Group is not required to apply IAS 34 Interim Financial

Reporting at this time.

These interim financial statements have not been audited and do

not constitute statutory accounts as defined in Section 434 of the

Companies Act 2006. Statutory accounts for the year ended 31 March

2013 have been delivered to the Registrar of Companies. The

Auditors' Report on those accounts was unqualified and did not

contain any statement under Section 498 (2) or (3) of the Companies

Act 2006.

The Interim Report will be mailed to shareholders prior to the

end of December 2013 and copies will be available on the website

(www.intercede.com) and at the registered office: Intercede Group

plc, Lutterworth Hall, St Mary's Road, Lutterworth, Leicestershire,

LE17 4PS.

2 Revenue

All of the Group's revenue, operating profits and net assets

originate from operations in the UK. The Directors consider that

the activities of the Group constitute a single business

segment.

The split of revenue by geographical destination of the end

customer can be analysed as follows:

6 months

6 months ended ended Year ended

30 September 30 September 31 March

2013 2012 2013

GBP'000 GBP'000 GBP'000

UK 353 331 806

Rest of Europe 1,319 403 651

North America 2,812 2,555 4,823

Rest of World 130 219 447

__________ __________ __________

4,614 3,508 6,727

__________ __________ __________

3 Taxation

Taxation represents the net effect of amounts receivable from

HMRC in respect of research and development claims and US

corporation tax payable. There is no charge for UK corporation tax

due to the availability of losses brought forward from prior

years.

4 Earnings/(loss) per share

The calculations of the earnings/(loss) per ordinary share are

based on the profit/(loss) for the period and the weighted average

number of ordinary shares in issue during each period. The basic

and diluted loss per share are the same as potential dilution

cannot be applied to a loss making period.

6 months

ended 6 months ended Year ended

30 September 30 September 31 March

2013 2012 2013

GBP'000 GBP'000 GBP'000

Profit/(loss) for the period 652 (84) (572)

__________ __________ __________

Number Number Number

Weighted average number of shares

- basic 48,735,005 48,613,486 48,613,172

- diluted 50,228,664 50,228,664 50,228,664

__________ __________ __________

Pence Pence Pence

Earnings/(loss) per share -

basic 1.3p (0.2)p (1.2p)

- diluted 1.3p (0.2)p (1.2p)

__________ __________ __________

5 Dividend

The Directors do not recommend the payment of a dividend.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR GMMZMDGZGFZM

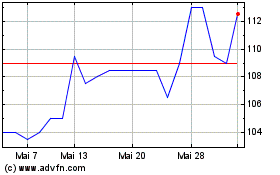

Intercede (LSE:IGP)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Intercede (LSE:IGP)

Historical Stock Chart

Von Jul 2023 bis Jul 2024