TIDMIGP

RNS Number : 9267W

Intercede Group PLC

29 November 2010

29 NOVEMBER 2010

INTERCEDE GROUP plc

('Intercede', 'the Company' or 'the Group')

Interim Results for the 6 Months Ended 30 September 2010

Intercede (AIM: IGP.L) is a leading producer of Identity and

Credential Management software, called MyID, which manages the

secure registration, issuance and life cycle of digital identities

for a wide range of uses.

SUMMARY

- 25% increase in sales to GBP3,506,000 (2009:

GBP2,811,000).

- Operating profit before exceptional items of GBP1,204,000

(2009: GBP674,000).

- Profit for the period of GBP1,225,000 (2009: GBP85,000).

- Basic and fully diluted earnings per share of 2.5p (2009:

0.2p).

- Cash generated from operations before exceptional items of

GBP630,000 (2009: GBP762,000).

- Cash balances of GBP4,470,000 at 30 September 2010 (30

September 2009: GBP3,913,000).

- No external borrowings.

- Increased investment in international sales and technical

capabilities to support growing demand for and use of Intercede's

proprietary MyID Identity and Credential Management System.

- Continued expansion of Intercede's customer base in the

US.

- Winning new contracts to supply MyID to government ministries,

banks and business corporations around the world.

Richard Parris, Chairman & Chief Executive of Intercede,

said today:

"We have made excellent progress this year, both commercially

and financially. Intercede MyID is being used by an increasing base

of new and existing customers and the pipeline of future orders is

stronger than it has ever been. The Company is increasingly

profitable, cash generative and financially strong.

"This year represents a tipping point in the evolution of

Intercede's business and is indicative of the strong commercial

progress we continue to make. We look forward to a favourable

outcome for the current financial year and to achieving further

growth thereafter."

Further Information on Intercede MyID

Intercede MyID is the only IDCMS software product that enables

organisations to easily and securely manage the identities of

people and their associated identity credentials within a single,

integrated, workflow driven platform. This includes enabling and

managing: secure registration, biometric capture, application

vetting and approval through to smart card personalisation,

issuance and management.

MyID was the first electronic personalisation product to achieve

compliance with the FIPS-201 standard and is widely deployed by

Federal Agencies, government contractors and other commercial

entities. In particular, it supports the latest standards

applicable for all PIV, PIV-Interoperable and PIV-Compatible

deployments.

It can issue and manage a wide variety of ID's and credentials,

providing customers with a platform that can meet their needs now

and in the future. It is a fully supported commercial off-the-shelf

product that can be quickly deployed for thousands or millions of

users.

About Intercede

Intercede is the producer of the MyID Identity and Credential

Management System (IDCMS).

Intercede MyID technology is being used around the world by

large corporations, governments and banks to manage millions of

identities for employees, citizens and customers. Notable

deployments in the US include 14 Federal Agencies, 1.7m smart cards

in support of the US Transportation Worker Identity Credential

program, two major US financial institutions and 310,000 smart

corporate identity badges for Lockheed Martin and another defense

contractor. In Europe and the Middle East, Intercede MyID is being

deployed in support of government identity health and corporate

employee ID security projects.

For more information visit http://www.intercede.com

ENQUIRIES

Intercede Group plc Tel. +44 (0)1455 558 111 Richard Parris,

Chairman & Chief Executive Andrew Walker, Finance Director

FinnCap Tel. +44 (0)20 7600 1658 Clive Carver Sarah Wharry

Pelham Bell Pottinger Tel. +44 (0)20 7861 3112 Archie Berens

Clare Gilbey

Chairman's Statement

Introduction

I am pleased to report that Intercede has made excellent

progress in the six months ended 30 September 2010. Revenues have

increased by 25% to GBP3,506,000 (2009: GBP2,811,000) and operating

profits have increased from GBP95,000 to GBP1,204,000.

The cash balance as at 30 September 2010 was GBP4,470,000

compared to GBP3,913,000 at 30 September 2009 and GBP4,664,000 at

31 March 2010. As previously reported, the Group effectively

entered the current financial year with a cash balance of

GBP3,917,000 net of post year end exceptional payments relating to

the previous financial year. As a result of strong orders received

during the period, the cash balance has subsequently increased to

in excess of GBP5,000,000 at 29 November 2010.

This year represents a tipping point in the evolution of

Intercede's business and is indicative of the strong commercial

progress we continue to make.

Commercial Progress

Major commercial progress made during the year to date

includes:

-- Large new US Federal Agency selects MyID for a PIV-Compatible

solution.

-- US manufacturing and defense systems company licenses MyID

for the issuance of 160,000 PIV-Compatible cards.

-- Sale of an additional 400,000 MyID licenses to BT for the NHS

Data Spine project bringing the total licenses sold to date to

1,200,000.

-- Securing additional orders totalling in excess of $1.0m for

MyID software licenses, custom development and professional

services in support of the internal identity badge programs at

Lockheed Martin and the US Federal Aviation Authority.

-- Supporting Lockheed Martin on the US Transportation Worker

Identity Credential (TWIC) program which has to date issued 1.7

million cards to US dock workers using MyID.

-- Supplying additional Intercede MyID licenses to Booz Allen

Hamilton, a large US based global management consultancy group, in

support of a PIV-Interoperable employee badging solution.

-- The addition of a major Intergovernmental Organisation (IGO)

to Intercede's customer list.

-- Securing additional orders totalling more than EUR 250,000

from the Road Transportation and Vehicle Licensing Agencies in

Ireland and the Netherlands.

-- The sale of Intercede MyID licenses to an Australian

government customer.

-- The provision of additional services to the State of Kuwait

in support of the National ID card project.

Financial Results

The financial results reflect the continued momentum from the

Group's involvement in an increasing number of projects around the

world. Sales increased by 25% to GBP3,506,000 (2009: GBP2,811,000)

which resulted in an increase in operating profit from GBP95,000 to

GBP1,204,000. There was also a substantial increase in operating

profit before exceptional items from GBP674,000 to

GBP1,204,000.

Staff costs continue to represent the main area of expense

totalling approximately 81% of the total operating costs during the

period. The average number of employees and contractors increased

from 54 to 56 year on year.

A profit for the period of GBP1,225,000 (2009: GBP85,000)

resulted in a basic and fully diluted earnings per share of 2.5p

(2009: 0.2p). The adjusted fully diluted earnings per share, based

upon profit prior to tax and exceptional item of GBP1,225,000

(2009: GBP664,000) is 2.5p (2009: 1.4p).

The cash balance as at 30 September 2010 was GBP4,470,000

compared to GBP3,913,000 at 30 September 2009 and GBP4,664,000 at

31 March 2010. As previously reported, the Group effectively

entered the current financial year with a cash balance of

GBP3,917,000 net of post year end exceptional payments relating to

the previous financial year. Therefore, the Group has generated

GBP630,000 of cash from operations before exceptional items during

the six month period (2009: GBP762,000).

Outlook

The first half of the year has been profitable and cash

generative. As in previous years, the full year outcome will be

dependent upon the timing of receipt of orders and our subsequent

ability to deliver and recognise revenues in accordance with the

Group's accounting policy. Nevertheless, the level and pace of

customer and partner activity is greater than in previous periods

and the sales pipeline is stronger than ever. We therefore remain

confident that our operating performance will continue to meet

expectations.

Richard Parris

Chairman & Chief Executive

29 November 2010

Consolidated Statement of Comprehensive Income

For the period ended 30 September 2010

6 Months ended 6 Months ended Year ended

30 September 30 September 31 March

2010 2009 2010

GBP'000 GBP'000 GBP'000

Continuing operations

Revenue 3,506 2,811 6,194

Cost of sales (8) (73) (66)

_________ _________ _________

Gross profit 3,498 2,738 6,128

Administrative expenses (2,294) (2,643) (5,619)

_________ _________ _________

Operating profit 1,204 95 509

Operating profit before

exceptional item 1,204 674 2,026

Exceptional item - (579) (1,517)

_________ _________ _________

Operating profit 1,204 95 509

------------------------------- --------------- --------------- -----------

Finance income 21 16 27

Finance costs - (26) (26)

_________ _________ _________

Profit before tax 1,225 85 510

Taxation - - (14)

_________ _________ _________

Profit for the period 1,255 85 496

_____ _____ _____

Total comprehensive income

attributable to owners

of the company 1,225 85 496

_____ _____ _____

Earnings per share 2.5p 0.2p 1.1p

(pence) - basic

- diluted 2.5p 0.2p 1.0p

_____ _____ _____

Consolidated Balance Sheet

As at 30 September 2010

As at As at As at

30 September 30 September 31 March

2010 2009 2010

GBP'000 GBP'000 GBP'000

Non-current assets

Property, plant and equipment 152 70 84

Deferred tax 280 280 280

_________ _________ _________

432 350 364

_________ _________ _________

Current assets

Trade and other receivables 1,867 687 954

Cash and cash equivalents 4,470 3,913 4,664

_________ _________ _________

6,337 4,600 5,618

_________ _________ _________

Total assets 6,769 4,950 5,982

_____ _____ _____

Equity

Called up share capital 4,413 4,413 4,413

Share premium account 4,718 4,718 4,718

Other reserves 1,508 1,508 1,508

Retained earnings (6,272) (7,908) (7,497)

_________ _________ _________

Total equity 4,367 2,731 3,142

_________ _________ _________

Current Liabilities

Trade and other payables 773 1,025 1,385

Deferred revenue 1,629 1,194 1,455

_________ _________ _________

2,402 2,219 2,840

_________ _________ _________

Total equity and liabilities 6,769 4,950 5,982

_____ _____ _____

Consolidated Statement of Changes in Equity

As at 30 September 2010

Share Share Other Equity Retained

capital premium reserves reserve earnings Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 31 March

2010 4,413 4,718 1,508 - (7,497) 3,142

Total

comprehensive

income - - - - 1,225 1,225

______ ______ ______ ______ ______ ______

At 30

September

2010 4,413 4,718 1,508 - (6,272) 4,367

___ ___ ___ ___ ___ ___

At 31 March

2009 4,305 2,875 1,508 109 (8,102) 695

Issue of

shares, net

of costs 108 1,843 - (109) 109 1,951

Total

comprehensive

income - - - - 85 85

______ ______ ______ ______ ______ ______

4,413 4,718 1,508 - (7,908) 2,731

___ ___ ___ ___ ___ ___

At 31 March

2009 4,305 2,875 1,508 109 (8,102) 695

Issue of

shares, net

of costs 108 1,843 - (109) 109 1,951

Total

comprehensive

income - - - - 496 496

______ ______ ______ ______ ______ ______

At 31 March

2010 4,413 4,718 1,508 - (7,497) 3,142

___ ___ ___ ___ ___ ___

Consolidated Cash Flow Statement

For the period ended 30 September 2010

As at As at 31

30 September As at 30 March

2010 September 2010

GBP'000 2009 GBP'000 GBP'000

Cash flows from operating

activities

Operating profit 1,204 95 509

Exceptional item - 579 1,517

_________ _________ _________

Operating profit before

exceptional item 1,204 674 2,026

Depreciation 21 15 31

(Increase) / decrease in

trade and other receivables (904) 214 (60)

Increase / (decrease) in

trade and other payables 309 (141) 88

_________ _________ _________

Cash generated from

operations before

exceptional item 630 762 2,085

Exceptional item (747) (549) (1,085)

Taxation - - (14)

_________ _________ _________

Net cash (used by) /

generated from operating

activities (117) 213 986

_________ _________ _________

Investing activities

Interest received 12 18 25

Purchases of property,

plant and equipment (89) (19) (48)

_________ _________ _________

Net cash used by investing

activites (77) (1) (23)

_________ _________ _________

Financing activities

Costs on issue of shares - (10) (10)

_________ _________ _________

Net (decrease) / increase

in cash and cash equivalents (194) 202 953

Cash and cash equivalents

at the beginning of the

period 4,664 3,711 3,711

_________ _________ _________

Cash and cash equivalents

at the end of the period 4,470 3,913 4,664

_____ _____ _____

Notes to the Accounts

For the period ended 30 September 2010

1 Preparation of the interim financial statements

These interim financial statements have been prepared under IFRS

as adopted by the European Union and on the basis of the accounting

policies set out in the Group's Annual Report for the year ended 31

March 2010.

The Group is not required to apply IAS 34 Interim Financial

Reporting at this time.

These interim financial statements have not been audited and do

not constitute statutory accounts as defined in Section 434 of the

Companies Act 2006. Statutory accounts for the year ended 31 March

2010 have been delivered to the Registrar of Companies. The

Auditors' Report on those accounts was unqualified and did not

contain any statement under Section 498 (2) or (3) of the Companies

Act 2006.

The Interim Report will be mailed to shareholders prior to the

end of December 2010 and copies will be available on the website

(www.intercede.com) and at the registered office: Intercede Group

plc, Lutterworth Hall, St Mary's Road, Lutterworth, Leicestershire,

LE17 4PS.

2 Revenue

All of the Group's revenue, operating profits and net assets

originate from operations in the United Kingdom. The Directors

consider that the activities of the Group constitute a single

business segment.

The split of revenue by geographical destination of the end

customer can be analysed as follows:

6 months ended 6 months ended Year ended

30 September 30 September 31 March

2010 2009 2010

GBP'000 GBP'000 GBP'000

United Kingdom 838 795 1,601

Rest of Europe 351 806 1,389

USA 2,032 1,085 2,795

Rest of World 285 125 409

__________ __________ __________

3,506 2,811 6,194

__________ __________ __________

3 Exceptional item

The exceptional item represents the costs associated with

defending a patent infringement lawsuit which was filed by

ActivIdentity in the United States District Court for the Northern

District of California on 1 October 2008. No further legal costs

are expected to arise following the settlement of this claim on 23

March 2010.

4 Taxation

There is no charge for corporation tax due to the availability

of losses brought forward from prior years.

5 Earnings per share

The calculations of earnings per ordinary share are based on the

profit and the weighted average number of ordinary shares in issue

during each period.

6 months ended 6 months ended Year ended

30 September 30 September 31 March

2010 2009 2010

Profit for the period 1,225 85 496

Adjusted profit before tax

and exceptional item 1,225 664 2,027

__________ __________ __________

Number Number Number

Weighted average number of

shares

- basic 48,178,005 44,704,340 46,304,420

- diluted 48,735,005 48,735,005 48,735,005

__________ __________ __________

Pence Pence Pence

Earnings per share - basic 2.5p 0.2p 1.1p

- diluted 2.5p 0.2p 1.0p

- adjusted* 2.5p 1.4p 4.2p

__________ __________ __________

* Adjusted fully diluted earnings per share based on profit

before tax and exceptional item.

6 Dividend

The Directors do not recommend the payment of a dividend.

7 Capital Reduction

On 2 November 2010, the Registrar of Companies issued the

certificate of registration of a court order for the reduction of

share capital of the Company and the cancellation of its share

premium account. The reduction of capital was approved by

shareholders at the Company's AGM held on 24 September 2010.

The effect of the capital reduction is to eliminate the deficit

showing as profit and loss account reserves, thereby facilitating

the payment of a dividend as and when the Board considers this to

be appropriate.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR BFBPTMBMTBLM

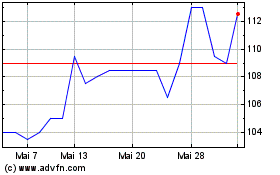

Intercede (LSE:IGP)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Intercede (LSE:IGP)

Historical Stock Chart

Von Jul 2023 bis Jul 2024