TIDMIGP

RNS Number : 6392T

Intercede Group PLC

10 June 2009

10 JUNE 2009

INTERCEDE GROUP plc

('Intercede', 'the Company' or 'the Group')

Preliminary Results for the Year Ended 31 March 2009

Intercede, a leading international developer and supplier of software for

identity and credential management software, today announces its preliminary

results for the year ended 31 March 2009.

SUMMARY

* Sales revenues have more than doubled from GBP2.8m to GBP5.7m.

* Full year profitability reported at all levels:

*

* Operating profit of GBP1.5m (2008: loss of GBP0.1m)

* Profit before tax of GBP1.4m (2008: loss of GBP0.2m

* Profit for the year of GBP1.7m (2008: loss of GBP0.1m)

* Cash inflow of GBP2.6m (2008: GBP0.5m) during the year which includes GBP0.1m

from the issue of shares (2008: GBP0.7m).

* Cash balances of GBP3.7m (2008: GBP1.15m) and convertible loan notes of GBP1.9m

(2008: GBP1.8m) at the financial year end.

* All external borrowings subsequently eliminated following the decision of the

convertible loan note holders to convert their loan notes into equity.

* Repositioning of MyID from being a smart card management system to a fully

featured Identity and Credential Management System.

* Contracts signed in support of two national ID card programmes, several public

sector projects and a large defence contractor.

Richard Parris, Chairman & Chief Executive of Intercede, said today:

"This was the year when Intercede bridged the chasm between market opportunity

and commercial success, resulting in a rapid increase in profitability. We have

spent a number of years laying the foundations for future exploitation of the

identity security market, which we always believed would present a major

commercial opportunity."

"These results demonstrate that our product is now being adopted as the security

management system of choice by governments and large corporations all around the

world. Demand continues to be strong and, with cash in the bank and a healthy

pipeline of business, we are extremely optimistic about our future prospects."

ENQUIRIES

+-----------------------------------------+-------------------------------------+

| Intercede Group plc | Tel. +44 (0)1455 558111 |

+-----------------------------------------+-------------------------------------+

| Richard Parris, Chairman & Chief | |

| Executive | |

+-----------------------------------------+-------------------------------------+

| Andrew Walker, Finance Director | |

+-----------------------------------------+-------------------------------------+

| | |

+-----------------------------------------+-------------------------------------+

| FinnCap | Tel. +44 (0)20 7600 1658 |

+-----------------------------------------+-------------------------------------+

| Charles Cunningham | |

+-----------------------------------------+-------------------------------------+

| | |

+-----------------------------------------+-------------------------------------+

| Pelham Public Relations | |

+-----------------------------------------+-------------------------------------+

| Archie Berens | Tel. +44 (0)20 7337 1509 |

+-----------------------------------------+-------------------------------------+

About Intercede

Intercede is the producer of the MyID Identity and Credential Management System

(IDCMS). Intercede's MyID is the only IDCMS software product that enables

organizations to easily and securely manage the identities of people and their

associated identity credentials within a single, integrated, workflow driven

platform. This includes enabling and managing: secure registration, biometric

capture, application vetting and approval through to smart card personalization,

issuance and management.

Intercede's MyID is being used around the world by large corporations,

governments and banks to manage millions of identities for employees, citizens

and customers. Notable deployments in the US include 10 Federal Agencies, a

programme with Lockheed Martin and two major US financial institutions. In

Europe and the Middle East, Intercede's MyID is being deployed in support of

government identity, health and corporate employee ID security projects.

Intercede and MyID are registered trademarks or trademarks in the UK, US and/or

other countries. For more information visit http://www.intercede.com.

INTERCEDE GROUP plc

('Intercede', 'the Company' or 'the Group')

Preliminary Results for the Year Ended 31 March 2009

Chairman's Statement

Intercede is a leading international developer and supplier of software for

identity and credential management. This software is branded as the Intercede

MyID Identity and Credential Management System. MyID is a

commercial-off-the-shelf product that incorporates more than 200 man years of

continuous development and improvement. Intercede has licensed the use of MyID

to governments, public authorities and companies around the world to improve the

level of identity assurance of their citizens and employees.

Operational Highlights

During the year, Intercede's business model has been further proven and

significant progress has been made across many areas including:

1. Sales revenues have more than doubled from GBP2.8m to GBP5.7m.

2. Full year profitability reported at all levels for the first time since IPO

in 2001:

* Operating profit of GBP1.5m (2008: loss of GBP0.1m)

* Profit before tax of GBP1.4m (2008: loss of GBP0.2m)

* Profit for the year of GBP1.7m (2008: loss of GBP0.1m)

3. GBP2.6m of cash generated during the period (2008: GBP0.5m).

4. More than GBP1m of revenue secured in the period from major government

customers via Intercede's partnership with Thales.

5. A contract with a regional integrator to supply a system to support the

national ID card programme of a Middle Eastern country.

6. A contract to supply the management system to support the internal identity

badge of the world's largest defence contractor, Lockheed Martin.

7. The transfer of the contract for the support of the US Transportation Worker

Identity Credential (TWIC) from an Intercede distribution partner to Intercede.

As a result of this change, Intercede now holds a direct multi-year contract

with Lockheed Martin, the prime US government contractor for the TWIC project.

To date, in excess of 1 million TWIC cards have been issued to dock workers at

more than 100 ports across the US and overseas.

8. Intercede's VeriSign and SafeNet partners continue to sell MyID licences to

US Federal agencies, US state governments and US military bases.

9. The UK National Health Service programme has been transitioned from being a

contract between BT and an Intercede partner to Intercede having a direct

contract with BT, the NHS prime contractor.

10. The sale of MyID and associated services to support additional public

sector customers in the UK, Greece, Slovakia, Australia, the Netherlands and

Switzerland.

Results

+------------------+------------------+------------------+------------------+

| | Year ended 31 March |

+------------------+--------------------------------------------------------+

| GBP'000 | 2009 | 2008 | 2007 |

+------------------+------------------+------------------+------------------+

| Revenue | 5,701 | 2,805 | 2,620 |

+------------------+------------------+------------------+------------------+

| Gross profit | 5,660 | 2,775 | 2,546 |

+------------------+------------------+------------------+------------------+

| Operating | 1,487 | (102) | (349) |

| profit/(loss) | | | |

+------------------+------------------+------------------+------------------+

In the year ended 31 March 2009, sales revenues more than doubled from

GBP2,805,000 to GBP5,701,000 at a gross margin of 99%. During the period the

largest single project represented less than 25% of total revenue.

Geographically, Intercede's home market in the UK remains important and

contributes 44% of the Group's revenues. However, other markets are growing: the

US generated 37% of sales revenues with the remaining 19% being generated across

a wide range of European and Australasian customers. This diversity of customers

and territories provides resilience against macro-economic risk and currency

fluctuations.

Another major transition to occur this year has been the signing of a number of

direct contracts with large systems integrators and end-customers who had

previously been serviced by Intercede's OEM partners. This has already had the

benefit of increasing Intercede revenues. It also gives Intercede more control

of its most important accounts and strengthens the visibility of the Intercede

MyID brand.

Whilst costs have continued to be tightly controlled throughout the period, good

progress has been made organically growing the expertise within the Group to

handle the additional workload generated by the growth in sales revenues.

An operating profit of GBP1,487,000 has been achieved, reversing the prior year

operating loss of GBP102,000. The cash inflow from operating activities for the

year was GBP2,450,000 compared to a GBP207,000 outflow in the previous period.

As at 31 March 2009, the Group had cash balances of GBP3,711,000 (2008:

GBP1,153,000). Our cash position remains strong given that, as announced on 1

June 2009, all of the holders of the convertible notes elected to convert their

loan notes into equity instead of being repaid.

The Group has moved to a position of profitability over the last 5 years. The

trend line shows how Intercede has now 'crossed the chasm' resulting in a rapid

increase in profitability. This can be seen by clicking onto a pdf document of

the Preliminary Results announcement on the Group's website

(http://www.intercede.com/news/archives/2009/Intercede---Preliminary-Results-fo

-the-Year-Ended.aspx). The chart is on page 4 of the document.

Product Development

Last year I reported that a major thrust of Intercede's product development

strategy was the repositioning of MyID from being a smart card management system

to a fully featured Identity and Credential Management System. I am pleased to

say this strategy has been vindicated with more than 30% of revenues in this

year being attributable to the new identity management functions within the MyID

v8 platform.

Intercede is continuing to design the MyID platform to take full advantage of

the latest industry standards. This maximises interoperability and future-proofs

the solutions we deliver to our customers. As evidence of this commitment,

Intercede became a full member of the smart card industry's GlobalPlatform

organisation in October 2008.

Intercede's participation in several large scale national identity programmes

during the year has given rise to a significant increase in the functionality

within the MyID platform, especially in the area of multi-application smart card

support. These project specific developments will be incorporated in the

standard MyID product for the benefit of all our partners and customers during

the next 12 months.

Finally, Intercede continues to invest in its integrators' toolkit. This is a

tool that accelerates Intercede's own project specific customisation activities

and provides integrators with a platform for rapid application development.

Strategy

In our statement last year, we highlighted that in the 2008/09 year the Group

would be focusing on executing its strategy to achieve profitability by:

* Adding to our current list of major projects wins;

* Refocusing our channel strategy to improve Intercede's margins on existing

business;

* Adding additional sales channels to attack new markets in different sectors and

regions;

* Becoming recognised as a major player in the Identity Registration and Enrolment

market space; and

* Expanding our professional service capabilities to better support our largest

customers and to provide enhanced feedback to our product management team.

After 12 months of further progress, and notwithstanding the impact of the

global financial recession, the Group's success in executing this strategy can

be summarised as follows:

* Contracts signed in support of two national ID card programmes, several public

sector projects and a large defence contractor;

* Lockheed Martin, BT and the US Environmental Protection Agency have all been

successfully transitioned from being customers of Intercede OEM partners to

being direct Intercede customers;

* New channel partners have been added in the Middle East and the US;

* Over 30% of revenues in the current year have been generated from Intercede's

expansion into the Identity Registration and Enrolment market; and

* Three additional technical consultants have been retained in the US along with a

further two UK based professional service and project management staff to better

support the growing revenue stream.

The success of this strategy is based upon product and service delivery

excellence. In both of these respects, Intercede has an impressive track record.

Furthermore, a programme of continuous product development and new innovation

continues to ensure that Intercede remains a leader amongst its global

competitors.

The Group's business plan in the coming year is to build on this year's success

by executing the following strategy:

* Continue to successfully deliver existing large projects that cross the

financial year end;

* Secure new large scale public sector projects from governments worldwide;

* Further expand our market penetration in the US;

* Capitalise on our new business in the Middle East and Australia to win

additional contracts in these regions; and

* Refocus Intercede's supply chain development efforts onto those partners who are

prepared to invest in product training and marketing. It is also critical that

they have the technical expertise to excel in project delivery and customer

care.

Outlook

After several years of early stage development, the identity and credential

management market has entered a more rapid growth phase. This has been the year

when Intercede has 'crossed the chasm', as the niche market in which the Group

operates transitions from being driven by innovators and early adopters to being

pulled along by the early majority of mainstream customers. As a result,

Intercede's revenues have more than doubled year on year and the sales pipeline

has continued to strengthen.

In spite of the global recession, the outlook within the identity industry is

exciting as an increasing number of large scale Government Public Sector

projects are being launched in the US, Europe and other regions. There is also

good growth potential in a number of industrial sectors, such as defence and

energy. Intercede is well positioned, through its market leading MyID products

and channel partner network, to exploit these emerging opportunities.

Against the background of billions of identity cards to be issued globally over

the next ten years, Intercede and its MyID platform is in an excellent position

to benefit from this burgeoning market.

At a time of macro-economic turmoil and global recession, Intercede has seen a

major upswing in its revenues and profitability. At the same time, the credit

squeeze means that any potential new market entrants are less likely to be able

to obtain development funding and more likely to buy external solutions than

invest in building their own. The Board therefore believes Intercede is very

well positioned to continue its growth notwithstanding these challenging times.

We look forward with confidence to reporting on our progress during the current

year and beyond.

9 June 2009

Richard Parris

Chairman & Chief Executive

Business and Finance Review

Introduction

Intercede has delivered a substantially improved financial performance in the

current financial year. This acceleration in growth reflects the continued

momentum from the Group's involvement in an increasing number of projects around

the world with a consequential increase in revenues from software licence sales,

associated support & maintenance and the delivery of ongoing professional

services assistance.

Business Development

It is the nature of new technology in an early stage market that the investment

is front end loaded. This is the case, both in respect of the extent to which

products have to be proven at proof of concept and pilot phases prior to

roll-out or, at the other end of the spectrum, the level of functionality

required to start to make repeat volume sales of the same product.

In both respects, Intercede continues to make major progress.

In last year's Business and Finance Review, I stated that the momentum is

clearly building and the Directors are increasingly confident that this will be

reflected in the Group's future financial performance as more and more projects

move beyond the initial proof of concept and pilot phases. That has proven to be

the case over the past 12 months when, as outlined in the Chairman's Statement,

existing projects have continued to plan and new projects have continued to be

won.

It is also important to note that the nature of these projects, which are

infrastructure related, means that they can realistically be expected to deliver

revenues over many years. Intercede's MyID software manages the secure

registration, issuance and lifecycle of digital identities for a wide range of

uses. This requires the integration of multiple technologies and products from

many different vendors, including smart cards, biometrics, digital certificates,

Open Platform applets and physical access control systems. Requests for

professional services assistance are an ongoing feature of major projects in

addition to revenues from further licence sales and support & maintenance

renewals.

The past 12 months have also resulted in a further substantial strengthening and

broadening of the Group's historical card management offering. Following the

launch of MyID 8, contracts have been won to supply the Intercede MyID Identity

and Credential Management System in support of two national identity card

programmes. The work to date on these projects has resulted in a significant

increase in functionality which will be incorporated in the standard MyID

product, further strengthening our offering.

The combined effect of project wins and product strengthening continues to be

reflected in a growing level of interest in MyID from existing and potential new

industry partners. The nature and extent of project wins over the past 2-3 years

has established MyID as a market leader in its own right and an increasing

proportion of Intercede's industry partners are marketing and selling the

Group's technology under the MyID name. The consequential benefit from Intercede

receiving a greater share of the contract value has also contributed to the

Group's improved financial performance.

The Group enters 2009/10 with a stronger pipeline than ever before, both in

terms of the nature and scale of individual opportunities and in terms of the

probability of success. The current pipeline contains a high level of forecast

revenue from projects we have already won (ie additional revenues from existing

projects) quite apart from other projects that we are still bidding for.

Whilst experience tells us that project delays can and will happen for a variety

of reasons, we remain focused on the action we can take to ensure that we are

best placed to deal with any changes.

Financial Results

The financial results outlined below reflect the continued momentum from the

Group's involvement in an increasing number of projects around the world.

+---------------------+---------------------+---------------------+---------------------+

| | Year ended | Year ended | Change |

| | 31 March 2009 | 31 March 2008 | % |

| | GBP000 | GBP000 | |

+---------------------+---------------------+---------------------+---------------------+

| Revenue | 5,701 | 2,805 | 103.3 |

+---------------------+---------------------+---------------------+---------------------+

| Gross profit (%) | 5,660 (99%) | 2,775 (99%) | 104.0 |

+---------------------+---------------------+---------------------+---------------------+

| Operating costs | (4,173) | (2,877) | (45.0) |

+---------------------+---------------------+---------------------+---------------------+

| Operating | 1,487 | (102) | 1,557.8 |

| profit/(loss) | | | |

+---------------------+---------------------+---------------------+---------------------+

| Earnings/(loss) per | 4.7p | (0.2)p | N/A |

| share | | | |

+---------------------+---------------------+---------------------+---------------------+

Whilst sales revenues and gross profit have more than doubled year on year (with

gross profit margins remaining constant at 99%), the increase in costs has been

restricted to 45%. As a result, the larger part of revenues and gross profits

has dropped through to the bottom line thereby enabling the Group to deliver its

first full year profit since admission to AIM.

Staff costs continue to represent the main area of expense representing 76% of

the total operating costs (2008: 81%). The average number of employees increased

from 40 to 47 year on year.

The net finance cost for the year was GBP79,000 (2008: GBP75,000) and GBP61,000

was received from HM Revenue and Customs in respect of R&D tax credits (2008:

GBP90,000). GBP3,506,000 of prior year tax losses remain available for

utilisation against future year's profits (2008: GBP4,862,000). A further tax

credit totaling GBP280,000 reflects the recognition of a deferred tax asset in

respect of these prior year losses (2008: GBPnil).

A profit for the year of GBP1,749,000 resulted in a basic earnings per share of

4.7p (2008: 0.2p loss). Having regard for the convertible loan stock and share

options outstanding as at 31 March 2009, the fully diluted earnings per share is

3.6p (2008: 0.2p loss).

Funding

As at 31 March 2009, the Group had cash balances totaling GBP3,711,000 (2008:

GBP1,153,000) and convertible loan notes totaling GBP1,936,000 (2008:

GBP1,833,000). The increase in cash balances reflects a GBP2,478,000 inflow from

operating and investing activities (2008: GBP178,000 outflow) and GBP80,000

received from the issue of shares during the period (2008: GBP678,000).

As outlined in note 6, all of the convertible loan note holders have

subsequently elected to convert their loan notes into ordinary shares. The

conversion significantly strengthens the Company's Balance Sheet and leaves the

Group with a substantial cash balance to meet its future needs.

Summary

After another challenging year, it is pleasing to be able to repeat what I said

last year. One year on, Intercede is better placed in terms of product

functionality, project wins, sales prospects and market position.

Furthermore, the Group is also considerably better placed in financial terms, as

evidenced by both the level of full year profitability and cash generation, and

the post year end elimination of all external debt following the convertible

loan note holders' decision to convert their loans into equity.

Andrew Walker

Finance Director

INTERCEDE GROUP plc

Consolidated Income Statement for the year ended 31 March 2009

+------------------------------------------------+-----------+-------------+------------+

| | Notes | 2009 | 2008 |

+------------------------------------------------+-----------+-------------+------------+

| | | GBP'000 | GBP'000 |

+------------------------------------------------+-----------+-------------+------------+

| Continuing operations | | | |

+------------------------------------------------+-----------+-------------+------------+

| Revenue | 2 | 5,701 | 2,805 |

+------------------------------------------------+-----------+-------------+------------+

| Cost of sales | | (41) | (30) |

+------------------------------------------------+-----------+-------------+------------+

| | | __________ | __________ |

+------------------------------------------------+-----------+-------------+------------+

| Gross profit | | 5,660 | 2,775 |

+------------------------------------------------+-----------+-------------+------------+

| Administrative expenses | | (4,173) | (2,877) |

+------------------------------------------------+-----------+-------------+------------+

| | | __________ | __________ |

+------------------------------------------------+-----------+-------------+------------+

| Operating profit/(loss) | | 1,487 | (102) |

+------------------------------------------------+-----------+-------------+------------+

| Finance income | | 68 | 61 |

+------------------------------------------------+-----------+-------------+------------+

| Finance costs | | (147) | (136) |

+------------------------------------------------+-----------+-------------+------------+

| | | __________ | __________ |

+------------------------------------------------+-----------+-------------+------------+

| Profit/(loss) before tax | | 1,408 | (177) |

+------------------------------------------------+-----------+-------------+------------+

| Taxation | 3 | 341 | 90 |

+------------------------------------------------+-----------+-------------+------------+

| | | __________ | __________ |

+------------------------------------------------+-----------+-------------+------------+

| Profit/(loss) for the year attributable to | | 1,749 | (87) |

| equity shareholders | | | |

+------------------------------------------------+-----------+-------------+------------+

| | | __________ | __________ |

+------------------------------------------------+-----------+-------------+------------+

| | | | |

+------------------------------------------------+-----------+-------------+------------+

| Earnings/(loss) per share (pence) | 4 | | |

+------------------------------------------------+-----------+-------------+------------+

| - basic | | 4.7p | (0.2)p |

+------------------------------------------------+-----------+-------------+------------+

| - diluted | | 3.6p | (0.2)p |

+------------------------------------------------+-----------+-------------+------------+

| | | __________ | __________ |

+------------------------------------------------+-----------+-------------+------------+

| | | | |

+------------------------------------------------+-----------+-------------+------------+

There are no recognised gains or losses in either year other than the profit or

loss for the year.

INTERCEDE GROUP plc

Consolidated Balance Sheet at 31 March 2009

+---------------------------------------------------+----------+------------+-------------+

| | Notes | 2009 | 2008 |

+---------------------------------------------------+----------+------------+-------------+

| | | GBP'000 | GBP'000 |

+---------------------------------------------------+----------+------------+-------------+

| Non-current assets | | | |

+---------------------------------------------------+----------+------------+-------------+

| Property, plant and equipment | | 67 | 52 |

+---------------------------------------------------+----------+------------+-------------+

| Deferred tax | | 280 | - |

+---------------------------------------------------+----------+------------+-------------+

| | | __________ | __________ |

+---------------------------------------------------+----------+------------+-------------+

| | | 347 | 52 |

+---------------------------------------------------+----------+------------+-------------+

| | | __________ | __________ |

+---------------------------------------------------+----------+------------+-------------+

| | | | |

+---------------------------------------------------+----------+------------+-------------+

| Current assets | | | |

+---------------------------------------------------+----------+------------+-------------+

| Trade and other receivables | | 902 | 419 |

+---------------------------------------------------+----------+------------+-------------+

| Cash and cash equivalents | 7 | 3,711 | 1,153 |

+---------------------------------------------------+----------+------------+-------------+

| | | __________ | __________ |

+---------------------------------------------------+----------+------------+-------------+

| | | 4,613 | 1,572 |

+---------------------------------------------------+----------+------------+-------------+

| | | __________ | __________ |

+---------------------------------------------------+----------+------------+-------------+

| | | | |

+---------------------------------------------------+----------+------------+-------------+

| Total assets | | 4,960 | 1,624 |

+---------------------------------------------------+----------+------------+-------------+

| | | __________ | __________ |

+---------------------------------------------------+----------+------------+-------------+

| | | | |

+---------------------------------------------------+----------+------------+-------------+

| Equity | | | |

+---------------------------------------------------+----------+------------+-------------+

| Called up share capital | 6 | 4,305 | 4,292 |

+---------------------------------------------------+----------+------------+-------------+

| Share premium account | | 2,875 | 2,764 |

+---------------------------------------------------+----------+------------+-------------+

| Other reserves | | 1,508 | 1,508 |

+---------------------------------------------------+----------+------------+-------------+

| Equity reserve | | 109 | 109 |

+---------------------------------------------------+----------+------------+-------------+

| Retained earnings | | (8,102) | (9,851) |

+---------------------------------------------------+----------+------------+-------------+

| | | __________ | __________ |

+---------------------------------------------------+----------+------------+-------------+

| Total equity | | 695 | (1,178) |

+---------------------------------------------------+----------+------------+-------------+

| | | __________ | __________ |

+---------------------------------------------------+----------+------------+-------------+

| | | | |

+---------------------------------------------------+----------+------------+-------------+

| Current liabilities | | | |

+---------------------------------------------------+----------+------------+-------------+

| Trade and other payables | | 1,156 | 350 |

+---------------------------------------------------+----------+------------+-------------+

| Deferred revenue | | 1,173 | 619 |

+---------------------------------------------------+----------+------------+-------------+

| Convertible loan notes | 7 | 1,936 | - |

+---------------------------------------------------+----------+------------+-------------+

| | | __________ | __________ |

+---------------------------------------------------+----------+------------+-------------+

| | | 4,265 | 969 |

+---------------------------------------------------+----------+------------+-------------+

| | | __________ | __________ |

+---------------------------------------------------+----------+------------+-------------+

| | | | |

+---------------------------------------------------+----------+------------+-------------+

| Non-current liabilities | | | |

+---------------------------------------------------+----------+------------+-------------+

| Convertible loan notes | 7 | - | 1,833 |

+---------------------------------------------------+----------+------------+-------------+

| | | __________ | __________ |

+---------------------------------------------------+----------+------------+-------------+

| | | | |

+---------------------------------------------------+----------+------------+-------------+

| Total equity and liabilities | | 4,960 | 1,624 |

+---------------------------------------------------+----------+------------+-------------+

| | | __________ | __________ |

+---------------------------------------------------+----------+------------+-------------+

Attention is drawn to a significant event which took place subsequent to 31

March 2009. On 29 May 2009, as outlined in note 6, the convertible loan notes

included above within current liabilities were all converted into equity.

INTERCEDE GROUP plc

Consolidated Statement of Changes in Equity for the year ended 31 March 2009

+---------------------------------+------------+----------+----------+---------+----------+----------+

| | Share | Share | Other | Equity | Retained | Total |

| | | | | | | |

+---------------------------------+------------+----------+----------+---------+----------+----------+

| | capital | premium | reserves | reserve | earnings | |

+---------------------------------+------------+----------+----------+---------+----------+----------+

| | | account | | | | |

+---------------------------------+------------+----------+----------+---------+----------+----------+

| | GBP'000 | GBP'000 | GBP'000 | GBP'000 | GBP'000 | GBP'000 |

+---------------------------------+------------+----------+----------+---------+----------+----------+

| | | | | | | |

+---------------------------------+------------+----------+----------+---------+----------+----------+

| At 31 March 2007 | 4,271 | 2,107 | 1,508 | 109 | (9,764) | (1,769) |

+---------------------------------+------------+----------+----------+---------+----------+----------+

| Issue of shares, net of costs | 21 | 657 | - | - | - | 678 |

+---------------------------------+------------+----------+----------+---------+----------+----------+

| Loss for the year | - | - | - | - | (87) | (87) |

+---------------------------------+------------+----------+----------+---------+----------+----------+

| | ________ | ________ | ________ | _______ | ________ | _______ |

+---------------------------------+------------+----------+----------+---------+----------+----------+

| At 31 March 2008 | 4,292 | 2,764 | 1,508 | 109 | (9,851) | (1,178) |

+---------------------------------+------------+----------+----------+---------+----------+----------+

| Issue of shares, net of costs | 13 | 111 | - | - | - | 124 |

| (see note 6) | | | | | | |

+---------------------------------+------------+----------+----------+---------+----------+----------+

| Profit for the year | - | - | - | - | 1,749 | 1, 749 |

+---------------------------------+------------+----------+----------+---------+----------+----------+

| | ________ | ________ | ________ | _______ | _______ | ________ |

+---------------------------------+------------+----------+----------+---------+----------+----------+

| At 31 March 2009 | 4,305 | 2,875 | 1,508 | 109 | (8,102) | 695 |

+---------------------------------+------------+----------+----------+---------+----------+----------+

| | ________ | ________ | ________ | _______ | ________ | ________ |

+---------------------------------+------------+----------+----------+---------+----------+----------+

INTERCEDE GROUP plc

Consolidated Cash Flow Statement for the year ended 31 March 2009

+---------------------------------------------------+----------+------------+-------------+

| | Notes | 2009 | 2008 |

+---------------------------------------------------+----------+------------+-------------+

| | | GBP'000 | GBP'000 |

+---------------------------------------------------+----------+------------+-------------+

| | | | |

+---------------------------------------------------+----------+------------+-------------+

| Cash flows from operating activities | | | |

+---------------------------------------------------+----------+------------+-------------+

| Operating profit/(loss) | | 1,487 | (102) |

+---------------------------------------------------+----------+------------+-------------+

| Depreciation | | 25 | 18 |

+---------------------------------------------------+----------+------------+-------------+

| (Increase) in trade and other receivables | | (483) | (184) |

+---------------------------------------------------+----------+------------+-------------+

| Increase/(decrease) in trade and other payables | | 1,360 | (29) |

+---------------------------------------------------+----------+------------+-------------+

| | | __________ | __________ |

+---------------------------------------------------+----------+------------+-------------+

| Cash generated from/(used in) operations | | 2,389 | (297) |

+---------------------------------------------------+----------+------------+-------------+

| Taxation received | | 61 | 90 |

+---------------------------------------------------+----------+------------+-------------+

| | | __________ | __________ |

+---------------------------------------------------+----------+------------+-------------+

| Net cash generated from/(used in) operating | | 2,450 | (207) |

| activities | | | |

+---------------------------------------------------+----------+------------+-------------+

| | | __________ | __________ |

+---------------------------------------------------+----------+------------+-------------+

| | | | |

+---------------------------------------------------+----------+------------+-------------+

| Investing activities | | | |

+---------------------------------------------------+----------+------------+-------------+

| Interest received | | 68 | 61 |

+---------------------------------------------------+----------+------------+-------------+

| Purchases of property, plant and equipment | | (40) | (32) |

+---------------------------------------------------+----------+------------+-------------+

| | | __________ | __________ |

+---------------------------------------------------+----------+------------+-------------+

| Net cash from investing activities | | 28 | 29 |

+---------------------------------------------------+----------+------------+-------------+

| | | __________ | __________ |

+---------------------------------------------------+----------+------------+-------------+

| | | | |

+---------------------------------------------------+----------+------------+-------------+

| Financing activities | | | |

+---------------------------------------------------+----------+------------+-------------+

| Proceeds on issue of shares | | 80 | 678 |

+---------------------------------------------------+----------+------------+-------------+

| | | __________ | __________ |

+---------------------------------------------------+----------+------------+-------------+

| | | | |

+---------------------------------------------------+----------+------------+-------------+

| Net increase in cash and cash equivalents | 7 | 2,558 | 500 |

+---------------------------------------------------+----------+------------+-------------+

| Cash and cash equivalents at the beginning of the | 7 | 1,153 | 653 |

| year | | | |

+---------------------------------------------------+----------+------------+-------------+

| | | __________ | __________ |

+---------------------------------------------------+----------+------------+-------------+

| Cash and cash equivalents at the end of the year | 7 | 3,711 | 1,153 |

+---------------------------------------------------+----------+------------+-------------+

| | | __________ | __________ |

+---------------------------------------------------+----------+------------+-------------+

INTERCEDE GROUP plc

Preliminary Results for the Year Ended 31 March 2009

NOTES

1.The financial information set out in this announcement does not constitute the

Group's Statutory Accounts for the years ended 31 March 2008 or 2009, but is

derived from those accounts. Statutory Accounts for 2008 have been delivered to

the Registrar of Companies and those for 2009, which have been approved by the

Board of Directors, will be delivered following the Group's Annual General

Meeting. The Company's auditors have reported on those accounts; their reports

were unqualified and did not contain statements under Section 237(2) or (3) of

the Companies Act 1985.

The Annual General Meeting of the Company will be held at 11.00 am on Wednesday

16 September 2009 at Lutterworth Hall. Copies of the full Statutory Accounts

will be despatched to shareholders in due course. Copies will also be available

on the website (www.intercede.com) and from the registered office of the

Company: Lutterworth Hall, St. Mary's Road, Lutterworth, Leicestershire, LE17

4PS.

2.SEGMENTAL REPORTING

All of the Group's revenue, operating profits and net assets originate from

operations in the United Kingdom. The Directors consider that the activity of

the Group constitutes a single business segment.

The split of revenue by geographical destination of the end customer can be

analysed as follows:

+-------------------------------------------------+-------+------------+-------+-------+

| | 2009 | 2008 |

+---------------------------------------------------------+------------+---------------+

| | GBP'000 | GBP'000 |

+---------------------------------------------------------+------------+---------------+

| United Kingdom | 2,488 | 1,378 |

+---------------------------------------------------------+------------+---------------+

| Rest of Europe | 846 | 298 |

+---------------------------------------------------------+------------+---------------+

| USA | 2,104 | 1,085 |

+---------------------------------------------------------+------------+---------------+

| Rest of World | 263 | 44 |

+---------------------------------------------------------+------------+---------------+

| | __________ | _________ |

+---------------------------------------------------------+------------+---------------+

| | 5,701 | 2,805 |

+---------------------------------------------------------+------------+---------------+

| | __________ | _________ |

+---------------------------------------------------------+------------+---------------+

| | |

+-------------------------------------------------+-------+------------+-------+-------+

3. TAX ON LOSS ON ORDINARY ACTIVITIES

The tax credit comprises:

+-------------------------------------------------------+----+-----------+----+------+----+

| | 2009 | 2008 |

+------------------------------------------------------------+-----------+-----------+

| | GBP'000 | GBP'000 |

+------------------------------------------------------------+-----------+-----------+

| | | |

+------------------------------------------------------------+-----------+-----------+

| Current year - UK corporation | - | - |

| tax | | |

+------------------------------------------------------------+-----------+-----------+

| Research and development tax | 61 | 90 |

| credits relating to prior | | |

| periods | | |

+------------------------------------------------------------+-----------+-----------+

| Recognition of deferred tax | 280 | - |

| asset arising from prior | | |

| period losses | | |

+------------------------------------------------------------+-----------+-----------+

| | __________ | _________ |

+-------------------------------------------------------+---------------------+-----------+

| | 341 | 90 |

+------------------------------------------------------------+-----------+-----------+

| | __________ | _________ |

+-------------------------------------------------------+---------------------+-----------+

| | | |

+-------------------------------------------------------+----+-----------+----+------+----+

There is no charge in respect of corporation tax in either year due to the

availability of losses. An adjustment has been made in respect of the prior year

for research and development claims which have been agreed by HMRC and received

in cash during the year.

The Group has unrecognised deferred tax assets of GBP702,000 (2008:

GBP1,361,000) and unused tax losses of GBP3,506,000 (2008: GBP4,862,000).

4. BASIC AND DILUTED EARNINGS/(LOSS) PER ORDINARY SHARE

The calculations of earnings/(loss) per ordinary share are based on the profit

or loss for the financial year and the weighted average number of ordinary

shares in issue during each year. Basic and diluted loss per share are the same

for the year ended 31 March 2008 as potential dilution cannot be applied to a

loss making period.

+----------------------------------------------------+-------+----+------------+-------+----+

| | 2009 | 2008 |

+----------------------------------------------------+------------+------------+

| | GBP'000 | GBP'000 |

+----------------------------------------------------+------------+------------+

| | | |

+----------------------------------------------------+------------+------------+

| | | |

+----------------------------------------------------+------------+------------+

| Profit/(loss) for the | 1,749 | (87) |

| year | | |

+----------------------------------------------------+------------+------------+

| | __________ | __________ |

+-----------------------------------------------------------------+------------+------------+

| | | |

+----------------------------------------------------+------------+------------+

| | Number | Number |

+----------------------------------------------------+------------+------------+

| | | |

+----------------------------------------------------+------------+------------+

| Weighted average | 37,011,460 | 35,831,101 |

| number of shares - | | |

| basic | | |

+----------------------------------------------------+------------+------------+

| - diluted | 48,735,005 | 48,735,005 |

+----------------------------------------------------+------------+------------+

| | __________ | __________ |

+-----------------------------------------------------------------+------------+------------+

| | | |

+----------------------------------------------------+------------+------------+

| | Pence | Pence |

+----------------------------------------------------+------------+------------+

| | | |

+----------------------------------------------------+------------+------------+

| Earnings/(loss) per | 4.7 | (0.2) |

| share - basic | | |

+----------------------------------------------------+------------+------------+

| - diluted | 3.6 | (0.2) |

+----------------------------------------------------+------------+------------+

| | __________ | __________ |

+-----------------------------------------------------------------+------------+------------+

| | | |

+----------------------------------------------------+-------+----+------------+-------+----+

5.DIVIDEND

The Directors do not recommend the payment of a dividend.

6. CALLED-UP SHARE CAPITAL

+----------------------------------------------------+------------+------------+

| | 2009 | 2008 |

+----------------------------------------------------+------------+------------+

| | GBP'000 | GBP'000 |

+----------------------------------------------------+------------+------------+

| Authorised | | |

+----------------------------------------------------+------------+------------+

| 481,861,616 (2008: 481,861,616) ordinary shares of | 4,819 | 4,819 |

| 1p each | | |

+----------------------------------------------------+------------+------------+

| 393,138,384 (2008: 393,138,384) deferred shares of | 3,931 | 3,931 |

| 1p each | | |

+----------------------------------------------------+------------+------------+

| | __________ | __________ |

+----------------------------------------------------+------------+------------+

| | 8,750 | 8,750 |

+----------------------------------------------------+------------+------------+

| | __________ | __________ |

+----------------------------------------------------+------------+------------+

| Issued and fully-paid | | |

+----------------------------------------------------+------------+------------+

| 37,403,756 (2008: 36,093,741) ordinary shares of | 374 | 361 |

| 1p each | | |

+----------------------------------------------------+------------+------------+

| 393,138,384 (2008: 393,138,384) deferred shares of | 3,931 | 3,931 |

| 1p each | | |

+----------------------------------------------------+------------+------------+

| | __________ | __________ |

+----------------------------------------------------+------------+------------+

| | 4,305 | 4,292 |

+----------------------------------------------------+------------+------------+

| | __________ | __________ |

+----------------------------------------------------+------------+------------+

The increase in issued and fully-paid ordinary shares of 1p each reflects

the exercise of warrants and convertible loan stock during the year.

On 13 May 2008, Credo Corporate Finance exercised the warrants which were

granted in connection with the July 2003 placing. This resulted in the issue of

1,017,100 ordinary shares at the July 2003 placing price of 7.8p per ordinary

share.

On 10 March 2009, a further 292,915 ordinary shares were issued at a price of

15p per ordinary share following notification from Champel Inc. that they had

agreed to convert their loan note together with associated interest for the

period to 31 May 2009.

On 29 May 2009, notification was received from the remaining holders of the

convertible loan notes issued by the Company on 31 March 2000 and 6 December

2001 that they had elected to convert their loan notes together with associated

interest for the period to 31 May 2009 into ordinary shares of 1p each in the

Company. This resulted in the issue of 3,877,166 ordinary shares at a price of

15p per share and 6,897,083 ordinary shares at a price of 20p per Ordinary

Share. Following the conversion, the total issued share capital of the Company

is 48,178,005 ordinary shares of 1p each.

The deferred shares which were created as a result of the July 2003 placing have

minimal rights attaching to them and are effectively worthless.

7. ANALYSIS AND RECONCILIATION OF NET DEBT

+---------------------+----------+-------------+------------------+------------+------------+

| | 2008 | Cash flow | Reclassification | Non-cash | 2009 |

| | | | | movement | |

+---------------------+----------+-------------+------------------+------------+------------+

| | GBP'000 | GBP'000 | GBP'000 | GBP'000 | GBP'000 |

+---------------------+----------+-------------+------------------+------------+------------+

| Cash at bank and in | 1,153 | 2,558 | - | - | 3,711 |

| hand | | | | | |

+---------------------+----------+-------------+------------------+------------+------------+

| Debt due within one | - | - | (1,833) | (103) | (1,936) |

| year | | | | | |

+---------------------+----------+-------------+------------------+------------+------------+

| Debt due after one | (1,833) | - | 1,833 | - | - |

| year | | | | | |

+---------------------+----------+-------------+------------------+------------+------------+

| | ________ | __________ | __________ | __________ | _________ |

+---------------------+----------+-------------+------------------+------------+------------+

| Net debt | (680) | 2,558 | - | (103) | 1,775 |

+---------------------+----------+-------------+------------------+------------+------------+

| | ________ | __________ | __________ | __________ | __________ |

+---------------------+----------+-------------+------------------+------------+------------+

The non-cash movement represents the net effect of interest payable on the

convertible loan notes (GBP147,000) less loan note conversions during the year

(GBP44,000).

On 29 May 2009, as outlined in note 6, the debt due within one year disappeared

since the remaining convertible loan note holders elected to convert their loan

notes into ordinary shares rather than to request repayment.

8. PATENT INFRINGEMENT LAWSUIT

On 1 October 2008, ActivIdentity Corporation ("ActivIdentity") filed a lawsuit

against Intercede Group plc and Intercede Ltd. ("Intercede") in the United

States District Court for the Northern District of California (Case No.

C08-4577) alleging that Intercede's MyID line of products infringes a patent

owned by ActivIdentity.

In response, on 26 March 2009, Intercede filed an answer and counterclaims

against ActivIdentity alleging violations of United States antitrust law, fraud,

and unfair competition. Intercede alleges that, as a member of the Global

Platform standard-setting organization, ActivIdentity had a duty to disclose any

patents relating to Global Platform's smart card specifications, but failed to

do so. In addition to these counterclaims, Intercede's answer and counterclaims

deny that its products infringe ActivIdentity's patent and allege further that

this patent is invalid and unenforceable. Intercede plans to vigorously defend

itself in this matter and fully pursue its counterclaims against ActivIdentity.

No provision has been made as at 31 March 2009 in respect of the original

ActivIdentity lawsuit or contingent asset disclosed in respect of Intercede's

counterclaims.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR CKCKDOBKDKAK

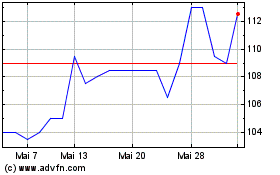

Intercede (LSE:IGP)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Intercede (LSE:IGP)

Historical Stock Chart

Von Jul 2023 bis Jul 2024