RNS Number:3288O

Intercede Group PLC

7 December 2001

INTERCEDE GROUP plc

("Intercede" or "the Group")

Interim Results for the Six Months Ended 30 September 2001

Intercede (AIM: IGP), a leading developer of security management software,

today announces its interim results for the six months ended 30 September

2001.

KEY POINTS

- Turnover of #471,000 (H1 2000: #1,140,000 which included #664,000 from a

single major contract with Lloyds TSB)

- Loss before tax of #1,190,000 (H1 2000: #313,000)

- Technical resource focused exclusively on development of proprietary

edefice(TM) product for the smart card and PKI market

- Edefice(TM) version 6.0 successfully developed and launched on time and

within budget

- OEM agreement signed with Oberthur Card Systems in September 2001

- New OEM agreement with another major smart card industry player announced

today which includes a commitment to purchase an initial number of licences

worth US$800,000

- Edefice(TM) successfully installed with a major European bank

- Considerable scope to grow revenue streams through enlarged edefice(TM)

sales channel

Richard Parris, Chairman & CEO of Intercede, said today:

"Our transformation from a third party systems integrator into a proprietary

software developer is complete. Although this has had an inevitable impact on

revenues in the short term, we are now more strongly placed to enter the next

phase of our growth. The establishment of OEM agreements with market leaders,

in addition to our other sales channels, provides us with every reason to be

confident."

7 December 2001

ENQUIRIES:

Intercede Group plc Tel. 01455 558111

Richard Parris, Chairman & Chief Executive

Andrew Walker, Finance Director

College Hill Tel. 020 7457 2020

Archie Berens

Clare Warren

INTERCEDE GROUP plc

Interim Results for Six Months Ended 30 September 2001

CHAIRMAN'S STATEMENT

Introduction

Following our listing on the Alternative Investment Market at the start of

2001, Intercede has taken a number of significant steps towards achieving its

ambition of becoming a significant player in the global IT security management

market.

During the course of our development, we have made no secret of our intention

to transform ourselves from being a supplier and integrator of third party

security products to becoming a supplier and licensor of proprietary software.

I am pleased to report that, following the launch of the two latest versions

of our proprietary edefice(TM) product, this transformation is now complete.

Moreover, the development of our own product has been underpinned by important

agreements with two major smart card industry players, through which edefice(TM)

will be incorporated into those companies' core product lines thereby offering

considerable scope for the generation of significant future revenues.

Results

The overriding need to develop and release further versions of edefice(TM) and

to link up with key OEM's in the smart card management market has seen Intercede

focusing its technical resources almost entirely to this end. The Group has

neither sought nor undertaken new project work during the six months ended 30

September 2001. Revenues for the period therefore related primarily to the

servicing of existing customers through the resale of additional software

licences and associated third party hardware and maintenance services.

Revenues for the period were #471,000, compared with #1,140,000 for the six

months ended 30 September 2000. It should be noted that the previous period

benefited from a single large project with Lloyds TSB. Excluding this project,

revenue for the comparable period would have been #476,000. The loss before

tax for the period was #1,190,000 (2000: #313,000) resulting in a loss per

share of 7.3p (2000: 2.9p).

Business and Product Development

In the period following listing, the Group has taken steps to position itself

as a global business, able to earn long term revenues from its proprietary

product, edefice(TM). A great deal of time and resource has been devoted to this

purpose, culminating in the release of edefice(TM) 6.0, as announced on 16

October 2001.

Edefice(TM) 6.0 is a smart card and Public Key Infrastructure ("PKI") security

management solution for corporate enterprises and government customers. It is

designed to enable business managers to administer the life cycle of smart

cards and associated PKI credentials through a distributed web based

management system. Its competitive advantage lies in its product independence.

It can simultaneously support multiple smart card manufacturers and PKI

products within a single fully distributed network environment.

It was because of this technical superiority that edefice(TM) was selected by

Oberthur Card Systems, under a global OEM licence, as the smart card

management system for their AuthentIC family of security solutions. The

relationship with Oberthur provides the opportunity to earn license royalties

from the lucrative Identrus market. A further contract award, initially

resulting in a pilot installation, has also already been secured from a major

European bank.

Most recently, we have today announced the signing of an agreement with

another major industry player to embed elements of the edefice(TM) distributed

security management system across their range of products. As a global

provider of digital identity solutions, our new Partner has wide access to a

number of significant international channel partners including security

service companies, computer hardware manufacturers, operating systems

developers and systems integrators. Under the terms of the agreement, the

Partner has committed to purchase licences to the value of US$800,000 against

a series of development milestones which are scheduled for completion by March

2002.

In addition to the opportunities for growth afforded by the OEM agreements

outlined above, Intercede has a number of other important channel

relationships. This currently includes, amongst others, Compaq and ICL in the

UK and, more recently, the development of new channel opportunities overseas.

Each of these channels are already engaged on at least one major prospect

for edefice(TM), giving us good grounds to be optimistic of revenue generation

during the next six to nine months and beyond.

Finance

As at 30 September 2001, the Group had cash balances totalling #1,071,000

remaining out of the #2,185,000 raised at the time of the listing. The cash

position has been consistently higher than budgeted throughout the year to

date reflecting the Group's commitment to strong financial control.

On 6 December 2001, the Group obtained further funding totalling #981,629 in

the form of a 5% convertible unsecured loan, which is convertible at a price

of 60p per share (up to a maximum of 1,636,048 shares) on or prior to the

fifth anniversary of the drawdown of the funds. To the extent that the loan

has not been converted, it shall be repaid on such fifth anniversary.

The loan, which was arranged by Credo Corporate Finance Limited, the Group's

corporate finance advisers, will provide the Group with additional flexibility

to make the most of the opportunities provided by both current and potential

future channel partner relationships. Associated costs total #50,000. In

addition Credo Corporate Finance Limited have been granted a warrant, subject

to shareholder approval, to subscribe for 0.5% of the fully diluted share

capital at a subscription price of 60p per share. The warrant must be

exercised by 7 December 2004.

Current Trading and Outlook

Although the downturn in the world economy has created difficult trading

conditions for the IT sector, we nevertheless anticipate an acceleration in

smart card related business for the second half of the current financial year

and beyond. The unfortunate events of 11 September 2001 can only increase the

likelihood that growing volumes of smart cards will need to be deployed for

security purposes. Our business goal is to earn a license fee on each card

issued and managed. Given our success to date in bringing edeficeO to market

and the agreements we have entered into, we believe that we are in an

excellent position to capitalize on the undoubted opportunities that exist in

this area.

Richard Parris

Chairman & Chief Executive

7 December 2001

INTERCEDE GROUP plc

Consolidated Profit and Loss Account

6 months 6 months Year

ended ended ended

30 30 31

September September March

2001 2000 2001

#'000 #'000 #'000

Turnover 471 1,140 2,014

Cost of sales (260) (542) (945)

Gross profit 211 598 1,069

Other operating expenses (1,419) (894) (2,188)

Operating loss (1,208) (296) (1,119)

Interest receivable and similar income 41 7 48

Interest payable and similar charges (23) (24) (54)

Loss on ordinary activities before taxation, (1,190) (313) (1,125)

being retained loss on ordinary activities

after taxation and for the period

Basic and diluted loss per ordinary share (7.3)p (2.9)p (8.8)p

INTERCEDE GROUP plc

Consolidated Balance Sheet

As at As at As at

30 30 31

September September March

2001 2000 2001

#'000 #'000 #'000

Fixed assets

Tangible assets 128 110 119

Current Assets

Stocks 5 17 8

Debtors 184 1,427 663

Cash at bank and in hand 1,071 688 2,042

1,260 2,132 2,713

Creditors: Amounts falling due within one (1,110) (1,658) (1,341)

year

Net current assets 150 474 1,372

Total assets less current liabilities 278 584 1,491

Creditors: Amounts falling due after more (36) (525) (59)

than one year

Net Assets 242 59 1,432

Capital and reserves

Called-up share capital 4,090 2,916 4,090

Share premium account 1,011 - 1,011

Other reserves 1,508 1,508 1,508

Profit and loss account (6,367) (4,365) (5,177)

Shareholders' funds - all equity 242 59 1,432

INTERCEDE GROUP plc

Consolidated Cash Flow Statement

6 months 6 months Year

ended ended ended

30 30 31

September September March

2001 2000 2001

#'000 #'000 #'000

Net cash outflow from operating activities (940) (715) (1,093)

Returns on investments and servicing of finance

Interest received 44 7 42

Interest paid (18) (4) (27)

Interest element of finance lease rentals (5) (5) (12)

Net cash inflow/(outflow) from returns on 21 (2) 3

investments and servicing of finance

Capital expenditure

Purchase of tangible fixed assets (32) (60) (80)

Sale of tangible fixed assets - 1 1

Net cash outflow on capital expenditure (32) (59) (79)

Cash outflow before financing (951) (776) (1,169)

Financing

Issue of ordinary share capital

- By Intercede Limited - 750 990

- By Intercede Group plc in connection with - - 2,185

admission to AIM

Repayment of secured loan (5) (5) (10)

Repayment of directors' loans - (8) (8)

Capital element of finance lease rentals (15) (11) (24)

Receipts from sale and lease back of assets - 26 26

Income from invoice discounting - 660 -

Net cash (outflow)/inflow from financing (20) 1,412 3,159

(Decrease)/increase in cash in the period (971) 636 1,990

INTERCEDE GROUP plc

Notes to the Accounts

1. Preparation of the interim financial statements

The interim financial statements have been prepared on the basis of the

accounting policies set out in the Group's 2001 statutory accounts.

The interim financial statements are unaudited and do not constitute statutory

accounts as defined in Section 240 of the Companies Act 1985. The figures for

the year ended 31 March 2001 are an abridged version of the Group's statutory

accounts for that year which have been filed with the Registrar of Companies.

The audit opinion on those statutory accounts was unqualified and did not

include a statement under Section 237(2) or (3) of the Companies Act 1985.

The interim report will be mailed to shareholders. Copies will be available on

the website (www.intercedegroup.com) and at the registered office: Intercede

Group plc, Lutterworth Hall, St Mary's Road, Lutterworth, Leicestershire, LE17

4PS.

2. Basic and diluted loss per ordinary share

The calculations of loss per ordinary share are based on the loss for the

period and the weighted average number of ordinary shares in issue during each

period.

6 months 6 months Year

ended ended ended

30 30 31

September September March

2001 2000 2001

#'000 #'000 #'000

Loss for the period (1,190) (313) (1,125)

Number Number Number

Weighted average number of shares 16,360,485 10,868,550 12,771,716

Pence Pence Pence

Basic and diluted loss per ordinary (7.3) (2.9) (8.8)

share

3. Reconciliation of movement in 6 months 6 months Year

shareholders' funds ended ended ended

30 30 31 March

September September

2001 2000 2001

#'000 #'000 #'000

Opening shareholders' funds 1,432 372 372

Loss for the period (1,190) (313) (1,125)

Issue of shares - - 2,185

Closing shareholders' funds 242 59 1,432

4. Reconciliation of operating loss to 6 months 6 months Year

operating cash flow ended ended ended

30 30 31 March

September September

2001 2000 2001

#'000 #'000 #'000

Operating loss (1,208) (296) (1,119)

Depreciation charge 23 14 34

Profit on sale of tangible fixed assets - 1 -

Decrease/(increase) in stock 3 (9) -

Decrease/(increase) in debtors 477 (1,079) (549)

(Decrease)/increase in creditors (235) 654 541

Net cash outflow from operating activities (940) (715) (1,093)

As at As at

5. Analysis and reconciliation of net debt

31 March 30

September

2001 Cash Flow 2001

#'000 #'000 #'000

Cash at bank and in hand 2,042 (971) 1,071

Debt due within one year (460) - (460)

Debt due after one year (22) 5 (17)

Finance leases (68) 15 (53)

(550) 20 (530)

Net cash 1,492 (951) 541

The reconciliation of net cash flow to the movement in

net debt is as follows:

6 months 6 months Year

ended ended ended

30 30 31

September September March

2001 2000 2001

#'000 #'000 #'000

(Decrease)/increase in cash in the period (971) 636 1,990

Cash outflow/(inflow) from decrease/ 20 (668) 17

(increase) in debt and lease financing

Change in net debt resulting from cash flows (951) (32) 2,007

New finance leases - - (14)

Movement in net debt in the period (951) (32) 1,993

Net cash/(debt) at the beginning of the 1,492 (501) (501)

period

Net cash/(debt) at the end of the period 541 (533) 1,492

6. Creditors: Amounts falling due within one year

Creditors falling due within one year includes 7% convertible unsecured loan

stock totalling #450,000. This loan stock is convertible at the option of the

holder into fully paid ordinary shares of the Company at 41.4p per ordinary

share (up to 1,086,800) at any time prior to 31 March 2002. Unless previously

redeemed or converted, the debt will be redeemed at par on 31 March 2002.

7. Dividend

The Directors do not recommend the payment of a dividend.

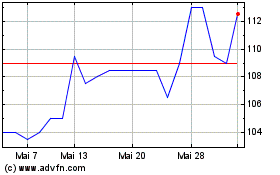

Intercede (LSE:IGP)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Intercede (LSE:IGP)

Historical Stock Chart

Von Jul 2023 bis Jul 2024