TIDMGUS

RNS Number : 0699B

Gusbourne PLC

29 September 2022

29 September 2022

Gusbourne Plc

("Gusbourne" or the "Company")

Interim Results to 30 June 2022

Gusbourne Plc, the English sparkling wine producer, is pleased

to announce its unaudited interim results for the six months ended

30 June 2022.

Continuing strong growth in net revenue in the first half with

net revenue up 108% at GBP3.014m, and Adjusted EBITDA loss narrowed

to GBP0.697m.

H1 2022 H1 2021 Change FY 2021

GBP'000 GBP'000 % GBP'000

NET REVENUE AND ADJUSTED EBITDA

Net revenue (1) 3,014 1,448 108% 4,191

Gross profit 1,806 829 118% 2,344

Adjusted EBITDA (2) (697) (945) (1,452)

Gross profit % 60% 57% 56%

STATUTORY RESULTS

Net revenue (1) 3,014 1,448 108% 4,191

Gross profit 1,806 829 118% 2,344

Fair value movement in biological

produce (216) (217) (704)

Sales and marketing expenses (1,801) (1,153) (2,460)

Administrative expenses (702) (621) (1,336)

Depreciation (293) (310) (600)

Profit/(loss) on disposal 28 - -

Total Administrative expenses (2,768) (2,084) (4,396)

Operating profit/(loss) (1,178) (1,472) (2,756)

RECONCILIATION OF OPERATING

PROFIT/(LOSS)

TO ADJUSTED EBITDA

Operating profit/(Loss) (1,178) (1,472) (2,756)

Add back;

Depreciation 293 310 600

Profit/(loss) on disposal (28) - -

Fair value movement in biological

produce/asset 216 217 704

Adjusted EBITDA (2) (697) (945) (1,452)

(1) Net revenue is revenue reported by the Company after excise

duties payable

(2) Adjusted EBITDA means profit/(loss)from operations before

fair value movement in biological produce, interest, tax,

depreciation and amortisation.

Highlights

-- Net revenue (1) up by 108% to GBP3.014m (30 June 2021: GBP1.448m)

-- Gross profit up by 118% to GBP1.806m (30 June 2021: GBP0.829m)

-- Adjusted EBITDA (2) loss narrowed to GBP0.697m (H1 2021:

GBP0.945m loss). Includes increased investment in sales and

marketing to support sales growth but demonstrates a 26% reduction

in the loss compared to the prior period, as the Company

increasingly works towards a positive Adjusted EBITDA.

-- UK Trade sales up by 126% at GBP1.346m (H1 2021 GBP0.596m) as

UK Trade continued to recover from the prior year effects of

COVID-19.

-- Direct to consumer (DTC) wine sales, together with tour,

tasting events and related income increased to GBP0.833m a 66%

increase from the prior year (H1 2021: GBP0.502m) driven by online

sales and cellar door operations in Kent.

-- International sales at GBP0.798m (H1 2021: GBP0.309m) were up

by 158% with Norway, USA and Japan constituting our largest

overseas markets

-- 2022 has been our most successful awards season to date in

both international and UK wine competitions, with a total of 53

medals awarded, including seventeen gold medals and six trophies.

Particular highlights include winning the Judges Selection trophy

at the prestigious Texsom awards in the United States in May for

the third consecutive year and trophies for 'Best Chardonnay',

'Best Pinot Noir' and back-to-back 'Winery of the Year' at the

WineGB awards in September for the second year running.

-- Our new prestige cuvee, Fifty One Degrees North, was launched

in September 2022. Gusbourne's most exclusive offering, this wine

has been designed to represent the definitive expression of modern

English winemaking. This exciting new release is a seminal moment

in the ongoing development and elevation of the Gusbourne brand and

has been widely met with critical acclaim.

Charlie Holland, Chief Winemaker and Chief Executive Officer,

commented :

"I am delighted to report strong sales growth for the first six

months of 2022, with net revenue more than double the same period

in 2021. We continue to enjoy strong demand for Gusbourne wines

driven by the continued expansion of our customer base, both in the

UK and internationally. It also reflects the luxury appeal and

reputation of the Gusbourne brand, the dynamic growth of the

English wine sector and the increasing demand for English

wines.

I am also delighted to report the increase of GBP6m in our

asset-based financing facilities from PNC which will provide

combined lending facilities of GBP16.5m for a further 5 years and

provide valued long term support for the Company's further growth

plans.

I am very pleased the Company has been able to acquire the

additional freehold land in Kent, which, will form a key part of

our production expansion plans over the coming years".

Enquiries:

Gusbourne Plc

Charlie Holland +44 (0)12 3375 8666

Panmure Gordon (UK) Limited (Nomad and Sole Broker)

Oliver Cardigan + 44 (0)20 7886 2500

Hugh Rich

Note: This and other press releases are available at the

Company's website: www.gusbourneplc.com

Note to Editors

Gusbourne produces and distributes a range of high quality and

award winning vintage English sparkling wines from grapes grown in

its own vineyards in Kent and West Sussex.

The Gusbourne business was founded by Andrew Weeber in 2004 with

the first vineyard plantings at Appledore in Kent. The first wines

were released in 2010 to critical acclaim. Following additional

vineyard plantings in 2013 and 2015 in both Kent and West Sussex,

Gusbourne now has 231 acres of mature vineyards. The NEST visitor

centre was opened next to the winery in Appledore in 2017,

providing tours, tastings and a direct outlet for our wines.

Right from the beginning, Gusbourne's intention has always been

to produce the finest English sparkling wines. Starting with

carefully chosen sites, we use best practice in establishing and

maintaining the vineyards and conduct green harvests to ensure we

achieve the highest quality grapes for each vintage. A quest for

excellence is at the heart of everything we do. We blind taste

hundreds of samples before finalising our blends and even after the

wines are bottled, they spend extended time on their lees to add

depth and flavour. Once disgorged, extra cork ageing further

enhances complexity. Our winemaking process remains traditional,

but one that is open to innovation where appropriate. It takes four

years to bring a vineyard into full production and a further four

years to transform those grapes into Gusbourne's premium sparkling

wine.

We are one of England's most awarded wine producers. Highlights

include:

-- Three times winner of the International Wine & Spirits

Challenge (IWSC) English Wine Producer of the Year, having won the

award in 2013, 2015 and 2017- a unique achievement

-- Back-to-back winner of 'Winery of the Year' at the WineGB Competition in 2021 and 2022

-- Trophies for 'Best English Still Red Wine', 'Best English

Still White Wine' and 'Best English Still Wine' at Wine GB awards

2022

-- Trophy for 'Best Vintage English Sparkling Wine' at the 2022 International Wine Challenge

-- Shortlisted for 'Best Sparkling Wine Producer' at the 2022

International Wine and Spirits Competition

-- Awarded 'Judges Selection' trophy at the Texsom 2020-2022

Gusbourne's luxury brand enjoys premium price positioning and is

distributed in the finest establishments both in the UK and abroad.

Our wines can be found in leading luxury retailers, restaurants,

hotels and stockists, always being aware that where we are says a

lot about who we are .

OPERATIONS AND FINANCIAL REVIEW

Results

Net revenue for the period amounted to GBP3.014m (H1 2021:

GBP1.448m), an increase of 108% on the corresponding period last

year.

Net revenue by distribution channel is shown in the table

below.

NET REVENUE BY DISTRIBUTION

CHANNEL

H1 2022 H1 2021 Change FY 2021

GBP'000 GBP'000 % GBP'000

Direct to Consumer (DTC Wine

Sales) 536 381 41% 1,080

UK Trade 1,346 596 126% 1,934

International 798 309 158% 781

Net wine sales 2,680 1,286 108% 3,795

Other income * 334 162 106% 396

Total net revenue 3,014 1,448 108% 4,191

*Other income

Tour, tasting events and related

income 297 121 145% 309

Other 37 41 (10%) 87

Total other income 334 162 106% 396

DTC wine sales together with

tour,

tasting events and related

income (DTC

net revenue) 833 502 66% 1,389

PERCENTAGES OF NET REVENUE

Direct to Consumer (DTC) 27.6% 34.7% 33.1%

UK Trade 44.7% 41.2% 46.2%

International 26.5% 21.3% 18.6%

Other 1.2% 2.8% 2.1%

100.0% 100.0% 100.0%

Operating expenses for the six months, excluding depreciation,

amounted to GBP2.503m (H1 2021: GBP1.774m), included planned

increased expenditure on sales and marketing costs of GBP1.801m (H1

2021: GBP1.153m) reflecting continuing investment in the growth of

the business and its sales beyond the current financial period.

Sales and marketing costs, which are largely discretionary,

continue to represent a relatively high proportion of net revenues

during this planned growth phase of the business but are now

declining as a percentage of net revenue from a peak of 84% in FY

2019 to 59% in FY 2021. Sales and marketing costs represented 59.8%

of H1 2022 net revenue (H1 2021 79.6%).

Adjusted EBITDA for the six months was a loss of GBP0.697m (H1

2021: GBP0.945m). The operating loss for the period after

depreciation and amortisation was GBP1.178m (H1 2021: GBP1.472m

loss). The loss before tax was GBP1.374m (H1 2021: GBP1.922m loss)

after net finance costs of GBP0.196m (H1 2021: GBP0.450m). Finance

costs have reduced in 2022 following the restructuring of the

balance sheet in 2021. These adjusted EBITDA losses continue to be

in line with expectations and the long-term growth strategy of the

Group is intended for adjusted EBITDA to become positive within the

coming years.

Balance Sheet

The Group's balance sheet reflects the long-term nature of the

sparkling wine industry. The production of premium quality wine

from new vineyards is, by its very nature, a long-term project of

at least ten years. It takes around two years to select and prepare

optimal vineyard sites and order the appropriate vines for

planting. It takes a further four years from planting to bring a

vineyard into full production and a further four years to transform

these grapes into Gusbourne's premium sparkling wine. This requires

capital expenditure on vineyards and related property, plant and

equipment as well as significant working capital to support

inventories over the long production cycle.

The total assets employed in the business at 30 June 2022 was

GBP26.893m (H1 2021: GBP23.586m) represented by:

-- 362 acres of Freehold land and buildings of GBP6.178m (H1

2021: GBP6.199m) - with buildings at cost less depreciation.

-- 231 acres of mature vineyards of GBP2.785m (H1 2021:

GBP2.931m) - at cost less depreciation

-- Plant, machinery and other equipment of GBP1.481m (H1 2021:

GBP1.411m) - at cost less depreciation

-- Right of use assets (under IFRS 16) of GBP1.953m (H1 2021: GBP1.999m).

-- Biological assets of GBP0.756m (H1 2021: GBP0.541m).

-- Inventories at 31 December 2021 at the lower of cost and net

realisable value amounted to GBP10.423m (H1 2021: GBP9.533m). These

inventories represent wine in its various stages of production from

wine in tank from the last harvest to the finished products which

take around four years to produce from the time of harvest. These

additional four years reflect the time it takes to transform our

high-quality grapes into Gusbourne's premium sparkling wine. An

important point to note is that these wine inventories already

include the wine (at its various stages of production) to support

sales planned for the next four years. The anticipated underlying

surplus of net realisable value over the cost of these wine

inventories, which is not reflected in these accounts, will become

an increasingly significant factor of the Group's asset base as

these inventories continue to grow.

-- Other working capital (representing trade and other

receivables less trade and other payables) of GBP0.542m (H1 2021:

negative GBP0.225m)

-- Cash of GBP1.768m (H1 2021: GBP0.190m)

-- Intangible assets of GBP1.007m (H1 2021: GBP1.007m) arose on

the acquisition of the Gusbourne Estate business on 27 September

2013. Intangible assets, which includes the Gusbourne brand itself,

remain unimpaired at their historical amount and in accordance with

the relevant accounting standards. No account has been taken with

regards to any potential fair value uplift that may be

appropriate.

Financing

At 30 June 2022 the Group's total assets of GBP26.893m (H1 2021:

GBP23.586m) were financed by:

-- Shareholder's equity of GBP14.529m (H1 2021: GBP7.209m)

-- Long term secured debt from PNC of GBP10.294m (H1 2021:

GBP8.305m). As at 30 June 2022 the PNC facilities were provided on

a revolving basis over a minimum period of 5 years from June 2020

and allowed flexible drawdown and repayments in line with the

Company's working capital requirements. The interest rate was at

the annual rate of 2.75 per cent (H1 2021: 2.75 per cent) over the

Bank of England Base Rate.

On 15 August 2022 Gusbourne announced that its wholly owned

subsidiary, Gusbourne Estate Limited, had entered into an amended

and restated agreement with PNC Financial Services UK Limited

("PNC") to increase its existing GBP10.5 million 5-year asset-based

lending facilities by an additional GBP6 million to provide the

Company with a total GBP16.5 million asset-based lending facilities

at a competitive rate (the "New PNC Facilities"). The New PNC

facilities have been made available to the Company for a minimum

period of 5 years to 12 August 2027. The interest rate will be at

the annual rate of 2.50 per cent over the Bank of England Base

Rate. Further details are shown in notes 8 and 10.

-- Lease liabilities under IFRS 16 of GBP2.070m (H1 2021: GBP2.101m).

-- Short term secured debt of GBPnil (H1 2021: GBP5.971m). On 29

October 2021 the Company's short-term debt was repaid or converted

into equity. Further details of this are shown in note 8.

Current trading and outlook

Current trading continues to reflect year on year net revenue

growth although at lower growth rates than H1, with H1 performance

having benefited from a strong recovery from the prior year adverse

effects of COVID-19 on trading.

We look forward to significant further business development and

growth in the coming years based on our luxury market positioning,

an increasing new product range, further development of our DTC

cellar door operations and increased supply over the longer term

with planned new plantings.

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

For the six months ended 30 June 2022

Unaudited Unaudited Audited

Six months Six months Year ended

to to

30 June 30 June 31 December

Notes 2022 2021 2021

GBP'000 GBP'000 GBP'000

Revenue 2 3,290 1,598 4,613

Excise duties (276) (150) (422)

Net revenue 3,014 1,448 4,191

Cost of sales (1,208) (619) (1,847)

Gross profit 1,806 829 2,344

Fair value movement in biological

assets 6 (216) (217) -

Fair movement in biological

produce 6 - - (704)

Administrative expenses (2,768) (2,084) (4,396)

Loss from operations (1,178) (1,472) (2,756)

Finance expense 4 (196) (450) (817)

Loss before tax (1,374) (1,922) (3,573)

Tax expense - - -

Loss and total comprehensive

loss for the period attributable

to

period attributable to owners

of the parent (1,374) (1,922) (3,573)

Loss per share attributable

to

the ordinary equity holders

of the parent:

Basic and diluted (2.26p)) (4.14p) (7.29p)

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

At 30 June 2022

Unaudited Unaudited Audited

30 June 30 June 31 December

Notes 2022 2021 2021

Assets GBP'000 GBP'000 GBP'000

Non-current assets

Intangibles 1,007 1,007 1,007

Property, plant and equipment 5 12,397 12,540 12,343

Other receivables 25 35 32

13,429 13,582 13,382

--------- --------- -----------

Current assets

Biological assets 6 756 541 -

Inventories 7 10,423 9,533 10,638

Trade and other receivables 1,826 1,095 1,275

Cash and cash equivalents 1,768 190 3,128

--------- --------- -----------

14,773 11,359 15,041

--------- --------- -----------

Total assets 28,202 24,941 28,423

--------- --------- -----------

Liabilities

Current liabilities

Trade and other payables (1,309) (1,355) (1,118)

Loans and borrowings 8 - (5,971) -

Lease liabilities (100) (100) (89)

(1,409) (7,426) (1,207)

--------- --------- -----------

Non-current liabilities

Loans and borrowings 8 (10,294) (8,305) (9,326)

Lease liabilities (1,970) (2,001) (2,005)

(12,264) (10,306) (11,331)

Total liabilities (13,673) (17,732) (12,538)

NET ASSETS 14,529 7,209 15,885

--------- --------- -----------

CONSOLIDATED STATEMENT OF FINANCIAL POSITION (continued)

At 30 June 2022

Issued capital and reserves attributable

to

owners of the parent

Share capital 9 12,190 12,048 12,190

Share premium 21,121 10,918 21,103

Merger reserve (13) (13) (13)

Retained earnings (18,769) (15,744) (17,395)

-------- -------- --------

TOTAL EQUITY 14,529 7,209 15,885

-------- -------- --------

CONSOLIDATED STATEMENT OF CASH FLOWS

For the six months ended 30 June 2022

Unaudited Unaudited Audited

Six months to months to Six months to Year ended

30 June 30 June 31 December

2022 2021 2021

GBP'000 GBP'000 GBP'000

Cashflows from operating

activities

Loss for the year/period before tax (1,374) (1,922) (3,573)

Adjustments for:

Depreciation of property, plant and

equipment 293 310 599

Finance expense 196 450 817

Profit on disposal of fixed assets (28) - -

Fair value movement in biological

asset 216 217 -

Fair value movement in biological

produce - - 704

----------------------- ------------- ----------

Operating cash flow before changes

in working capital (697) (945) (1,453)

(Increase) in trade and other

receivables (544) (223) (318)

(Increase)/decrease in inventories 257 (178) . (1,886)

(Increase) in biological assets (972) (758) -

Increase in trade and other payables 191 586 349

----------------------- ------------- ----------

Cash outflow from operations (1,765) (1,518) (3,308)

Investing activities

Purchases of property, plant and

equipment,

excluding vineyard establishment (348) (57) (195)

Sale of property, plant and equipment 28 - -

Net cash from investing activities (320) (57) (195)

----------------------- ------------- ----------

Financing activities

Capital loan repayments (2,235) - (2,944)

New loans issued 3,182 1,689 5,584

Loan issue costs - (20) (20)

Repayment of lease liabilities (66) (50) (99)

Interest paid (174) (119) (289)

Issue of ordinary shares 18 3 5,715

Share issue expense - - (359)

Repayment of deep discount bonds - - (1,219)

Net cash from financing activities 725 1,503 6,369

----------------------- ------------- ----------

CONSOLIDATED STATEMENT OF CASH FLOWS (continued)

For the six months ended 30 June 2022

Unaudited Unaudited Audited

Six months to Six months to Six months to Period to

30 June 30 June 31 December

2022 2021 2021

GBP'000 GBP'000 GBP'000

Net increase/(decrease) in cash and cash

equivalents (1,360) (72) 2,866

Cash and cash equivalents at beginning of

period 3,128 262 262

--------------------------- ------------- ------------

Cash and cash equivalents at end of period 1,768 190 3,128

=========================== ============= ============

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

For the six months ended 30 June 2022

Total

attributable

to equity

holders

Share Share Merger Retained of

Audited: capital premium reserve earnings parent

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

31 December

2020 12,048 10,915 (13) (13,822) 9,128

Share issue - 3 - - 3

Comprehensive

loss for the

period - - - (1,922) (1,922)

______ ______ ______ _____ ______

30 June 2021 12,048 10,918 (13) (15,744) 7,209

______ ______ ______ ______ ______

Share issue 142 10,544 - - 10,686

Share issue

expenses - (359) - - (359)

Comprehensive

loss for the

period - - - (1,651) (1,651)

______ ______ ______ _____ ______

31 December

2021 12,190 21,103 (13) (17,395) 15,885

Unaudited:

Share issue - 18 - - 18

Share issue - - - -

expenses

Comprehensive

loss for

the period - - - (1,374) (1,374)

______ ______ ______ _____ ______

30 June

2022 12,190 21,121 (13) (18,769) 14,529

______ ______ ______ ______ ______

NOTES TO THE INTERIM FINANCIAL STATEMENTS

1 Basis of preparation

Statement of compliance

The interim financial statements in this report have been

prepared in accordance with UK adopted international accounting

standards that were applied in the preparation of the Company's

published consolidated financial statements for the year ended 31

December 2021 and are consistent with the accounting policies

expected to apply in its financial statements for the year ended 31

December 2022. As permitted, this interim report has been prepared

in accordance with the AIM Rules for Companies and does not seek to

comply with IAS 34 "Interim Financial Reporting".

Statutory information

The financial information for the six months ended 30 June 2022

has not been subject to an audit nor a review in accordance with

International Standard on Review Engagements 2410, Review of

Interim Financial Information Performed by the Independent Auditor

of the Entity, issued by the Auditing Practices Board. The

comparative financial information presented herein for the year

ended 31 December 2021 does not constitute full statutory accounts

within the meaning of Section 434 of the Companies Act 2006. The

Group's annual report and accounts for the year ended 31 December

2021 have been delivered to the Registrar of Companies. The Group's

independent auditor's report was unqualified and did not contain a

statement under section 498(2) or 498(3) of the Companies Act

2006.

The consolidated financial statements have been prepared on a

going concern basis in accordance with UK adopted international

accounting standards.

The Board of the Company continually assesses and monitors the

key risks of the business. The Board continues to consider the

Group's profit and cash flow plans for at least the next 12 months

and run forecasts and downside "stress test" scenarios. These risks

have not significantly changed from those set out in the Company's

Annual Report for the period ended 31 December 2021. In addition,

these stress test scenarios do not show a requirement in excess of

the Group's undrawn facilities nor do they show the Group breaching

any of its key covenant tests.

The stress test scenarios also include certain cost mitigation

actions, including but not limited to, operating cost reductions

and reduced capital expenditure.

Under the significant stress test scenarios, we have run, the

Group could withstand a material and prolonged adverse impact on

revenues and continue to operate within the available lending

facilities. Accordingly, the Group and the Company continues to

adopt the going concern basis in preparing its Financial

Statements.

2 Revenue

Unaudited Unaudited Audited

30 June 30 June 31 December

2022 2021 2021

GBP'000 GBP'000 GBP'000

Wine sales 2,680 1,286 3,795

Other income 334 162 396

Net revenue 3,014 1,448 4,191

--------- --------- -----------

Excise duties 276 150 422

Total Revenue 3,290 1,598 4,613

--------- --------- -----------

3 Loss from operations

Loss from operations has been arrived at after charging:

Unaudited Unaudited Audited

30 June 30 June 31 December

2022 2021 2021

GBP'000 GBP'000 GBP'000

Depreciation of property, plant

and equipment 293 310 600

Profit/loss on disposal (28) - -

Staff costs expensed to consolidated

statement of income 893 695 1,310

Furlough grant income - (31) (45)

4 Finance expense

Unaudited Unaudited Audited

30 June 30 June 31 December

2022 2021 2021

GBP'000 GBP'000 GBP'000

Finance expense

Interest payable on borrowings 174 157 325

Amortisation of bank transaction

costs 22 21 42

Interest on lease liabilities - 13 -

Discount expense on deep discount

bonds - 259 450

Total finance expense 196 450 817

--------- --------- -----------

5 Property, plant and equipment

Unaudited Unaudited Audited

30 June 30 June 31 December

2022 2021 2021

GBP'000 GBP'000 GBP'000

Freehold land and buildings 6,178 6,199 6,134

Plant, machinery and motor vehicles 1,447 1,381 1,342

Mature vineyards 2,785 2,931 2,858

Computer equipment 34 30 33

Right of use assets 1,953 1,999 1,976

12,397 12,540 12,343

--------- --------- -----------

Right of use assets

Right of use assets comprise land leases on which vines have

been planted and property leases from which vineyard operations are

carried out. These assets have been created under IFRS 16 -

Leases.

6 Biological assets

Biological assets represent grapes growing on the Group's vines.

Once the grapes are harvested, they are deemed to be biological

produce and transferred to inventories.

Unaudited Unaudited Audited

30 June 30 June 31 December

2022 2021 2021

GBP'000 GBP'000 GBP'000

Crop growing costs 972 758 1,609

Fair value of grapes harvested and

transferred

to inventories - - (905)

Fair value movement in biological

assets (216) (217) -

Fair value movement in biological

produce - - (704)

--------- --------- -----------

Fair value of biological assets

at the reporting date 756 541 -

--------- --------- -----------

The fair value of biological assets at the reporting date is

determined by reference to estimated market prices less costs to

sell. The estimated market price for grapes used in respect of 2022

is GBP2,500 (2021: GBP2,500) per tonne. The fair value is subject

to a discount factor of 55% (2021: 55%) due to the grapes, as at

the reporting date, being approximately 3 months away from being

ready for harvest.

A 10% increase in the estimated market price of grapes to

GBP2,750 per tonne would result in an increase of GBP76,000 in the

fair value of biological assets at the reporting date. A 10%

decrease in the estimated market price of grapes to GBP2,250 per

tonne would result in a decrease of GBP75,000 in the fair value of

biological assets at the reporting date.

7 Inventories

Unaudited Unaudited Audited

30 June 30 June 31 December

2022 2021 2021

GBP'000 GBP'000 GBP'000

Finished goods 998 88 985

Work in progress 9,425 9,445 9,653

10,423 9,533 10,638

--------- --------- -----------

8 Loans and borrowings

Unaudited Unaudited Audited

30 June 30 June 31 December

2022 2021 2021

GBP'000 GBP'000 GBP'000

Current liabilities

Bank loans - - -

Other loans - 580 -

Deep Discount Bonds - 5,391 -

- 5,971 -

--------- --------- -----------

Non-current liabilities

Bank loans 10,415 8,468 9,468

Unamortised bank transaction costs (121) (163) (142)

Other loans - - -

Deep Discount Bonds - - -

--------- --------- -----------

Total loans and borrowings 10,294 8,305 9,326

--------- --------- -----------

The bank loans of GBP10,294,000 with PNC Financial Services UK

Limited ("PNC") shown above is net of transaction costs of

GBP121,000 which are being amortised over the life of the loan.

On 15 August 2022 Gusbourne announced that its wholly owned

subsidiary, Gusbourne Estate Limited, had entered into an amended

and restated agreement with PNC to increase its existing GBP10.5

million 5-year asset-based lending facilities by an additional GBP6

million to provide the Company with a total GBP16.5 million

asset-based lending facilities at a competitive rate (the "New PNC

Facilities"). The New PNC facilities have been made available to

the Company for a minimum period of 5 years to 12 August 2027.

The New PNC Facilities are being provided on a revolving basis

and will be used to provide further working capital for the Company

covering inventory and accounts receivables, to support its growth

plans and allow flexible drawdown and repayments in line with the

Company's working capital requirements. The interest rate will be

at the annual rate of 2.50 per cent (2021: 2.75 per cent) over the

Bank of England Base Rate. The facilities will be secured by way of

first priority charges over the Company's inventory, receivables

and freehold property as well as an all-assets debenture and

contain financial and general covenants and customary events of

default. The financial covenants include cash burn, fixed charge

cover, capital expenditure restrictions and minimum headroom

levels, and are tested monthly.

On 29 October 2021 Belize Finance Limited ("BFL") converted its

interest in the company's Deep Discount Bonds into Ordinary Shares

at 75p per Ordinary Share. BFL has converted its DDBs into

2,838,765 Ordinary Shares at 75p per Ordinary Share in respect of

money owed for the 2020 DDB, amounting to GBP2,129,074, and

2,306,314 Ordinary Shares at 75p per Ordinary Share in respect of

money owed for the 2016 DDB, amounting to GBP1,729,735.

On 29 October 2021 the sole holder of the short-term loan

Franove, a related party of Paul Bentham, a director of the

Company, converted its short-term loan amounting to GBP610,445 into

813,926 Ordinary Shares at 75p per Ordinary Share on 29 October

2021.

On 29 October 2021, following an invitation to all other holders

of DDBs to convert amounts owed to them by the Company via the DDBs

into Ordinary Shares, other holders of DDBs amounting to GBP373,177

converted their DDBs into 497,568 Ordinary Shares at 75p per

Ordinary Share and used GBP131,250 of DDB proceeds to exercise

175,000 Warrants. The remaining DDBs amounting to GBP1,218,573 have

been repaid, and all short-term debt on the Company's balance sheet

has therefore now been eliminated.

The total Ordinary Shares issued pursuant to the BFL Conversion,

the Franove Conversion and the Other DDBs Conversion amounts to

6,456,573 Ordinary Shares.

The Company did not receive any cash proceeds from the DDBs and

Franove Conversion.

9 Share capital

Deferred Ordinary

shares of shares

49p each of 1p each

Number Number GBP'000

Issued and fully paid

At 1 January 2021 23,639,762 46,478,619 12,048

------------------------ ----------- ------------ --------

Issued in the year - 14,253,086 142

------------------------ ----------- ------------ --------

At 31 December 2021 23,639,762 60,731,705 12,190

------------------------ ----------- ------------ --------

Issued in the period - 24,615 -

----------------------- ----------- ------------ --------

At 30 June 2022 23,639,762 60,756,320 12,190

------------------------ ----------- ------------ --------

On 2 March 2022 the Company issued 23,970 new ordinary shares of

1p each pursuant to an exercise of Warrants. All Warrants were

exercised at 75p per share.

On 29 March 2022 the Company issued 226 new ordinary shares of

1p each pursuant to an exercise of Warrants. All Warrants were

exercised at 75p per share.

On 3 May 2022 the Company issued 419 new ordinary shares of 1p

each pursuant to an exercise of Warrants. All Warrants were

exercised at 75p per share.

Unexercised Warrants as at 30 June 2022 amount to 3,977,644

Ordinary Shares of 1 pence each. These Warrants are excisable at a

price of 75 pence per share and have a final exercise date of 16

December 2022.

10 Post balance sheet events

Increase of GBP6m in existing PNC asset-based lending

facilities

On 15 August 2022 Gusbourne announced that its wholly owned

subsidiary, Gusbourne Estate Limited, had entered into an amended

and restated agreement with PNC Financial Services UK Limited

("PNC") to increase its existing GBP10.5 million 5-year asset-based

lending facilities by an additional GBP6 million to provide the

Company with a total GBP16.5 million asset-based lending facilities

at a competitive rate (the "New PNC Facilities"). The New PNC

facilities have been made available to the Company for a minimum

period of 5 years to 12 August 2027.

The New PNC Facilities are being provided on a revolving basis

and will be used to provide further working capital for the Company

covering inventory and accounts receivables, to support its growth

plans and allow flexible drawdown and repayments in line with the

Company's working capital requirements. The interest rate will be

at the annual rate of 2.50 per cent over the Bank of England Base

Rate. The facilities will be secured by way of first priority

charges over the Company's inventory, receivables and freehold

property as well as an all-assets debenture and contain financial

and general covenants and customary events of default. The

financial covenants include cash burn, fixed charge cover, capital

expenditure restrictions and minimum headroom levels, and are

tested monthly.

Purchase of Additional Freehold Land in Kent from a Related

Party

On 15 August 2022 Gusbourne announced that it had exchanged

contracts with Andrew Weeber, Non-Executive Director and a

shareholder of the Company, and his spouse, to purchase 137 acres

of freehold agricultural land located in Appledore, Ashford in Kent

(the "Land Purchase"). The Land Purchase completed on 24 August

2022. The property is adjacent to and contiguous with the Company's

existing freehold estate in Kent, where the majority of the

Company's existing mature vineyards are planted.

This will bring the total freehold acreage of land in Kent owned

by the Company to 489 acres. The purchase price for the Land

Purchase is GBP1.6 million in cash from existing cash resources

plus related acquisition costs. There are no profits attributable

to the land being acquired.

The Company has previously established the suitability of this

additional land for vines and intends to plant the majority of this

acreage with vines in May 2024, which will provide the required

lead time to order the appropriate vines and prepare the land for

planting. The additional wine production from grapes grown on these

new vineyards will help support the longer-term growth plans of the

Company.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FLFIDADITFIF

(END) Dow Jones Newswires

September 29, 2022 02:00 ET (06:00 GMT)

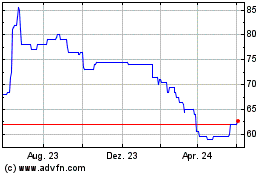

Gusbourne (LSE:GUS)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

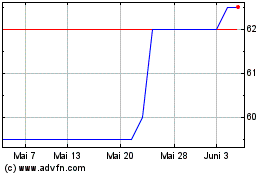

Gusbourne (LSE:GUS)

Historical Stock Chart

Von Jul 2023 bis Jul 2024