TIDMFEV

FIDELITY EUROPEAN VALUES PLC

Final Results for the year ended 31 December 2019

Financial Highlights:

* The Board of Fidelity European Values PLC (the "Company") recommends a

final dividend of 3.88 pence per share which together with the interim

dividend payment of 2.59 pence per share (totalling 6.47 pence) represents

an increase of 3% over the dividend of 6.28 pence per share paid in the

prior year

* The Company recorded a net asset value ("NAV") total return of +23.8% for

the year ended 31 December 2019, outperforming its Benchmark Index which

returned +20.4%.

* The discount to NAV narrowed from 10.7% to 6.2%, due to an impressive share

price total return of +30.6%.

* To better align the Company's name more closely to its objective, and to

avoid confusion with value investment products, the Board has decided to

change the Company's name from Fidelity European Values PLC to Fidelity

European Trust PLC with effect from 12 May 2020.

Contacts

For further information, please contact:

Bonita Guntrip

Senior Company Secretary

01737 837320

FIL Investments International

CHAIRMAN'S STATEMENT

Fidelity European Values PLC (the "Company") aims to be the cornerstone long

term investment of choice for those seeking European exposure across market

cycles.

The Company's portfolio is built on companies with well-formed, long-standing

foundations. Europe is home to the world's largest economy and some of the

strongest, most stable and resilient companies. These global household names

are famed for standing the test of time, even through periods of economic

uncertainty.

Using Fidelity's extensive research team, Portfolio Manager, Sam Morse, aims to

select well-established European companies with proven business models,

attractive valuations and the ability to grow dividends both now and in the

future. It's these leaders with market-beating potential that have helped the

Company outperform its Benchmark Index over the long term.

Company Name Change

In order to clarify the Company's investment proposition to investors and its

strategy to grow the Company, the Board has concluded that the word "values" in

the Company's name is no longer relevant to the objective of the Company.

Therefore, so as to align the Company's name more closely to its objective, and

to avoid confusion with value investment products, the Board has decided to

change the Company's name from Fidelity European Values PLC to Fidelity

European Trust PLC with effect from 12 May 2020. I should emphasise that there

will be no change to the way the investment portfolio is managed.

The change of name will take effect following the requisite statutory filings,

which are expected to be made to allow the change to take effect from 12 May

2020. The Company will, however, retain its existing ticker (FEV.L), SEDOL

(BK1PKQ9) and ISIN (GB00BK1PKQ95).

Performance

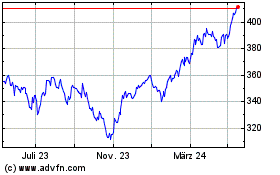

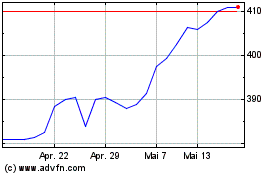

The net asset value ("NAV") of the Company increased by 23.8% for the year

ended 31 December 2019, outperforming the Benchmark Index, the FTSE World

Europe (ex UK) Index, which returned 20.4%. The share price return over this

period was a more impressive 30.6% (all performance data on a total return

basis). In what turned out to be a very strong year of absolute performance for

the Company, our Portfolio Manager's strong stock selection capabilities were

once again the primary drivers of outperformance versus the Benchmark Index

with several of his high-conviction holdings contributing significantly to

returns. In addition, the Company's NAV and share price total return

performance over three and five years remains well ahead of the Benchmark

Index, as can be seen from the chart on the Financial Highlights page in the

Annual Report.

European equity market performance during the year was broadly driven by the

accommodative monetary policy stance adopted by most major global central banks

and improving geopolitical conditions towards the end of the year. After the

sharp fall in equities in the fourth quarter of 2018, the first four months of

2019 witnessed a strong rebound. While weakening global economic data, Brexit

related uncertainty, FY19 corporate earnings downgrades and trade tensions

between the US and China did lead to some volatility mid-year, sentiment was

much improved towards the end of the reporting year. Positive policy signals

from the European Central Bank ("ECB"), the UK general election victory for the

ruling Conservative party and an apparent easing in US-China trade relations

were the key drivers of this shift in momentum.

Due Diligence Trip

In November 2019, the Board carried out its due diligence trip which started at

Fidelity's London office with analyst meetings, trading demonstrations, risk

management at Company and portfolio levels, research reviews and a market macro

update. The Board then travelled to Fidelity's Frankfurt office where it had

presentations on how Fidelity's analysts work, some of the funds managed and

specialist sector reviews. The Board also visited Deutsche Boerse. The due

diligence oriented exercise is important in providing the Board with useful

context about continental European markets in which the Company invests. It

also gives perspective on the Portfolio Manager's analysis and investment

approach.

Outlook

Investors are clearly very concerned about the likely effects of the

Coronavirus, COVID-19, on the world economy. At the end of his report below,

Sam Morse outlines his response in respect of the portfolio. As he implies,

things should sooner or later return to normal; it is just a matter of when.

Before the virus struck, my intention was to inform you that I was "cautiously

optimistic" about the prospects for the Company. Now, however, as one market

strategist wrote recently when observing the US bond market: "......the 10-year

bond doesn't have a medical degree....it is hard to define how growth will be

impacted." Nor do most equity market investors know.

The virus's behaviour is not yet fully understood. Like flu, it may well die

away during the warmer summer months of the northern hemisphere. It may also

reassert itself when winter returns. Investors should therefore be prepared for

market fluctuations to echo these vicissitudes, and it may well be that

sentiment will only fully recover once an immunising vaccine is widely

available. This could take up to another year or more to develop.

In these circumstances it is helpful to remember the timescale in which you

originally bought shares in this Company. If that was, say, a rolling three

years at a minimum - for most of our shareholders it is much longer - then

these events will in retrospect constitute a minor bump on the long road of

history. Even the great crash of 1987 looks just like that on the long term

graph.

While most industrial and commercial sectors are affected in the short term,

stronger companies, which Sam makes a point of holding, should usually be able

to ride out the challenges presented by falling demand or interrupted supply

chains. Though the portfolio is not immune, its constituents are typically

resilient and, like most human beings, likely to experience mild and temporary

symptoms at the hands of the virus. I hope that it will not be long before I

can write in a more optimistic vein based on more conventional economic and

market analysis.

Environmental, Social and Governance (ESG) Investment

Recent years have seen increasing concern about global warming, and the growth

of serious efforts to counter its effects. Businesses for their part are under

pressure to ensure that their activities are environmentally sustainable, as

well as demonstrating social responsibility and good corporate governance. In

his report, Sam Morse outlines Fidelity's approach to this important subject

and what this means for the Fidelity European Values investment portfolio.

OTHER MATTERS

Dividends

As reported in last year's Annual Report, and in order to smooth dividend

payments throughout the year, the Board decided that from the 2019 financial

year the Company would pay both an interim and a final dividend. As a result,

an interim dividend of 2.59 pence per ordinary share was paid on 1 November

2019.

The Board recommends a final dividend of 3.88 pence per ordinary share for the

year ended 31 December 2019 for approval by shareholders at the Annual General

Meeting ("AGM") on 12 May 2020. The dividend will be payable on 15 May 2020 to

those shareholders who appear on the share register at close of business on 27

March 2020 (ex-dividend date 26 March 2020). The interim and final dividends,

totalling 6.47 pence, represent a total increase of 3.0 per cent over the 6.28

pence per ordinary share paid for the year ended 31 December 2018.

While the Board has not sought to influence the Portfolio Manager by imposing

any income objective in any particular year - and this remains the case - the

investment focus on companies capable of growing their dividend has seen the

Company's dividend payments rise over time. Because the Board acknowledges that

both capital and income growth are components of performance, as reflected in

the change of investment objective approved by shareholders at the Annual

General Meeting in 2018, it considered that this was an appropriate time to

move to a more clearly defined progressive dividend practice.

The aim, therefore, as I stated in the last Annual Report, is to increase the

dividend each year. The unusual circumstances in which this may not prove

possible include, firstly, if sterling were to rise substantially against the

euro; secondly, if economic trends prove to be unusually adverse; and thirdly,

if the Portfolio Manager shifts the emphasis of companies held to ones with a

materially lower overall yield than hitherto.

In order to help realise its aim, the Board has decided gradually to augment

revenue reserves by retaining a minor proportion of earnings from year to year.

By law this proportion is not permitted to exceed 15 per cent. By way of

example, for the 2019 financial year the dividend of 6.47 pence is being paid

from earnings of 7.00 pence per share, a retention rate of about 7.5 per cent.

The Board expects that as revenue reserves build up they will assist, if

necessary, in smoothing dividend growth year on year, in the event of the sorts

of exceptional circumstances outlined above.

Discount Management and Treasury Shares

The Board operates an active discount management policy, the primary purpose of

which is to reduce discount volatility. Buying shares at a discount also

results in an enhancement to the NAV per share. As a consequence, the Board

seeks to maintain the discount in single digits in normal market conditions. In

order to assist in managing the discount, the Board has shareholder approval to

hold in Treasury ordinary shares repurchased by the Company, rather than

cancelling them. These shares are then available to re-issue at NAV per share

or at a premium to NAV per share, facilitating the management of and enhancing

liquidity in the Company's shares. The Board is seeking shareholder approval to

renew this authority at the forthcoming AGM.

As a result of discount management during the year, the Company repurchased

706,777 ordinary shares into Treasury. Since the end of the reporting year and

as at the date of this report, the Company has not repurchased any further

ordinary shares into Treasury or for cancellation.

Gearing

The Company continues to gear through the use of derivative instruments,

primarily contracts for difference ("CFDs"), and the Manager has flexibility to

gear within the parameters set by the Board. As at 31 December 2019, the

Company's gross gearing was 7.1% (2018: 10.1%) whilst net gearing was 4.7%

(2018: 6.1%). In the reporting year, gearing made a positive contribution to

performance, as can be seen from the attribution analysis table in the Annual

Report.

The Board monitors the level of gearing and the use of derivative instruments

carefully and has defined a risk control framework for this purpose which is

reviewed at each Board meeting.

Board of Directors

After serving on the Board for over ten years as a non-executive Director, Dr

Robin Niblett will step down from the Board at the conclusion of the AGM on 12

May 2020. Robin has made a unique and invaluable contribution to the Board and

the Company with the perspective of his Chief Executive role at Chatham House

(the Royal Institute of International Affairs) and as a member of the World

Economic Forum's Regional Future Council on Europe. I would like to take this

opportunity to thank him on behalf of the Board and all of the Company's

stakeholders for all that he has accomplished and for his unfailing dedication,

wisdom and good humour. He takes with us our very best wishes for the future.

As Robin's successor, I am pleased to welcome Sir Ivan Rogers as a

non-executive Director. He joined the Board on 1 January 2020. Sir Ivan is a

former British civil servant, formerly the Permanent Representative of the UK

to the European Union ("EU") for over three years until the beginning of 2017.

Before this, he was Principal Private Secretary to one British prime minister

and head of the Europe and Global Issues Secretariat for another. He was twice

the UK's G7/G8 Sherpa as well as the EU and G20 Sherpa. He has worked closely

with and for both the UK government and EU institutions for the majority of his

career. In addition to this, he spent five years in the private sector holding

senior public sector banking roles for Citigroup UK and Barclays Capital.

We continue to review Board composition and Directors' succession on a regular

basis to ensure that we have a Board with a mix of tenures and one which

provides diversity of perspective together with the range of appropriate skills

and experience for your Company. In accordance with the UK Corporate Governance

Code, and being a FTSE 350 Company, I together with Fleur Meijs, Marion Sears

and Paul Yates are subject to annual re-election at the AGM on 12 May 2020. Sir

Ivan Rogers, being newly appointed, is subject to election at the forthcoming

AGM. Biographical details of all the Directors standing for election and

re-election can be found in the Annual Report. The Directors, between them,

have a wide range of appropriate skills and experience to form a balanced Board

for the Company.

Annual General Meeting - Tuesday, 12 May 2020

In view of the emerging public health impact of the Coronavirus (COVID-19) and

in the interests of the wellbeing of our shareholders, the Board has decided to

change the format of the Annual General Meeting this year. We are actively

encouraging (and making it as easy as possible for) shareholders to vote by

proxy in advance of the meeting so that it is not necessary to attend in

person. A proxy form will be sent to shareholders on the main register.

The Portfolio Manager will not attend the meeting and his presentation will be

pre-recorded and made available on the website www.fidelityinvestmenttrusts.com

in advance of the meeting. Hard copies of the presentation will also be made

available by post on request to the Secretary, contact details for which can be

found in the Annual Report.

It is a legal requirement to hold the AGM and it will go ahead, unless advice

is received from the Government to the contrary. The meeting will be held at

midday on 12 May 2020 at Flat 2, Fidelity International, 130 Tonbridge Road,

Hildenborough, Tonbridge, Kent, TN11 9DZ with a reduced program. The AGM will

be restricted to the formal business of the meeting as set out in the Annual

Report and voting on the resolutions therein. On this occasion external guests

who are not shareholders, or proxies or representatives for shareholders, will

not be permitted to attend the meeting and no refreshments will be served.

If you hold shares through the Fidelity Platform, or through another platform

or nominee (and not directly in your own name) and you do wish to attend,

please ensure that you are validly appointed as a representative of the

relevant nominee and bring evidence of that appointment with you to the

meeting. Please contact the company that you hold your shares with should you

have any questions in relation to being appointed as a representative for the

AGM.

Investors should consult Government guidance and those who show any of the

symptoms associated with Coronavirus (however mild) or who have recently

travelled from a high-risk area are asked not to attend but to vote by proxy.

The AGM and proxy results will be announced and made available following the

AGM on the website www.fidelityinvestmenttrusts.com.

We sincerely hope to resume the meeting's usual format in future years.

VIVIAN BAZALGETTE

Chairman

18 March 2020

PORTFOLIO MANAGER'S REVIEW

Question

How has the Company performed in the year under review?

Answer

During 2019, the net asset value ("NAV") total return was +23.8% compared to a

total return of +20.4% for the FTSE World Europe (ex UK) Index which is the

Company's Benchmark Index. The share price total return was +30.6% benefiting

from a narrowing of the discount. The second half of the year saw positive

returns but was not as rewarding as the first half partly due to the strength

of UK sterling which dampened returns for UK sterling-based investors. It is

particularly pleasing that the Company outperformed in what was a very strong

year for absolute returns. This was partly due to gearing but mostly thanks to

the stock-picking efforts of the in-house Fidelity research team - a team of

forty or so analysts covering European companies, keeping on top of existing

investments and scouring the continental European markets for new opportunities

which fit the investment criteria of the Company.

Question

And what about performance of the broader market environment?

Answer

2019 turned out to be something of a banner year for continental European

equities (a mirror image of the very disappointing 2018). In many ways, this

was surprising especially considering that aggregate earnings did not grow and

the US yield curve inverted (traditionally seen as a reliable forewarning of

global recession). Monetary easing and improving sentiment (not fundamentals)

have, however, been key drivers of improving equity prices (see the chart in

the Annual Report on 2019 return drivers). In the first half of the year,

investors remained wary and the market was initially led higher by bond proxies

thanks to the Federal Reserve's guidance on lower interest rates and monetary

easing. The second half of the year, however, saw the return of more 'animal

spirits', especially following the confirmation of a restart to the European

Central Bank's ("ECB") quantitative easing and some relief in trade tensions.

This led to a greater demand for economy-sensitive cyclicals and so-called

value stocks, particularly in September, as investors began to add risk to

their portfolios. The year ended on a positive note with the outcome of the UK

general election which was generally seen to be market friendly. We enter 2020,

therefore, almost at the other end of the spectrum versus 2019 in terms of

investor mood but it should not be forgotten that, in market terms, travelling

is often better than arriving!

Question

What have been the key contributors to performance? And detractors?

Answer

The performance of the Company was largely driven by stock-picking in 2019

although gearing contributed positively too. ASML, the manufacturer of

chip-making equipment (semiconductors not potatoes!), was the star of the year

with the company's shares almost doubling. Semiconductor shares generally

performed well as investors anticipated a recovery in demand for memory chips

and as trade tensions between the US and China began to ease. ASML got an

additional boost with strong demand from logic chip makers with the third

quarter results delivering its strongest ever order intake. LVMH Moët Hennessy

was another strong performer, continuing the trend commented on in the interim

report, as the spending power of the Chinese luxury consumer surprised

positively, despite the disturbances in Hong Kong, and as future earnings

prospects were further enhanced by the agreed acquisition of Tiffany's which

will complete this year. Detractors included ABN AMRO Bank, the Dutch banking

group, which suffered in the latter half of 2019 from growing worries about

possible negative impacts relating to a lack of robustness in its

anti-money-laundering processes. Telenor, the Norwegian multinational

telecommunications group also underperformed in the second half of the year,

especially following its failure to complete the mooted merger of some of its

Asian operations with a local competitor, Axiata.

Top 5 Stock Contributors (on a relative basis) %

ASML +1.2

LVMH Moët Hennessy +0.7

3i Group +0.6

Legrand +0.5

Telefonica +0.4

========

====

Top 5 Stock Detractors

(on a relative basis) %

ABN AMRO Bank -1.0

Telenor -0.7

Red Electrica -0.6

Sampo -0.5

Royal Dutch Shell -0.5

========

====

Question

Looking across the markets, European equities appear cheap versus bonds and

better value than US equities - would you agree?

Answer

Not really. One should be careful when comparing the aggregate valuation of

equities across different regions. Don't forget there are armies of analysts at

Fidelity and elsewhere whose job is to seek out valuation anomalies from market

to market. The rise of global funds, which can take advantage of these

anomalies, means that any inefficiencies in valuation are arbitraged away

rapidly. This is especially true of the larger companies in the Benchmark Index

which often have a number of global comparators. Remember too that these larger

companies represent the bulk of any index by value. So a lot of the 'cheapness'

of one region versus another will be down to mix differences or accounting

differences or other factors rather than differences in intrinsic value. The US

market's relative exposure to technology is an often-cited example of the mix

impact on aggregate valuation. And yes, European equities do "appear" cheap

versus bonds but does that mean European equities are cheap? Perhaps it simply

means that bonds are too expensive. This gap in valuation might, for instance,

be corrected with both asset classes falling, if or when the bond "bubble" is

pricked, rather than by equities outpacing bonds. As always, the Company will

focus on continental European companies that are not overly leveraged and which

will be able to deliver consistent dividend growth. We will also try to make

sure that we do not pay too much for these companies.

Question

In recent months European equities have been growing in popularity among asset

allocators. What has been the impetus behind this change in sentiment and will

it continue?

Answer

It could not have become much worse. European equities have been hugely

unpopular and have suffered large outflows for many years in favour of global

and US equity funds. This is understandable -- the earnings and dividend growth

of continental European companies have lagged their transatlantic peers for

many years. This may be a long term trend that continues but, as always, there

will be times when the pessimism is overdone and that can provide an

opportunity. When an asset class is out of fashion, as a result of years of

underperformance, then the canny asset allocator will take another look to see

if the 'baby has been thrown out with the bath water'. European equities may be

enjoying such a moment as asset allocators have generally become more

risk-seeking with some of the concerns that plagued markets in 2018 receding

during 2019. Continental European equities are often seen by asset allocators

as a high beta play on global growth -- if global economic growth picks up

again in 2020 thanks to central bank easing and a de-escalation of the trade

tensions then European equities may get a relative boost. A view on the

direction of the US dollar will, of course, also be very important and here

there is a healthy debate between those that think the US dollar is overvalued

on a purchase power parity basis and those that think it still provides a safe

haven with an attractive relative yield.

Question

What have been the major changes to the portfolio over the period?

Answer

We don't really do "major". There have been incremental changes but overall the

turnover in the portfolio will always be relatively low in keeping with the

Company's longer term investment horizon. No apologies for that. Low turnover

means that the transaction costs are low as well. So what has changed in 2019?

Two new investments were made in companies involved in the private equity

industry: Partners Group and EQT. The latter was an IPO which performed very

well but unfortunately the Company was not able to get a large allocation so it

remains, for the time being, a very small position. Partners Group, however, is

a more significant constituent in the Company's portfolio. It is a company that

fits the Company's criteria well: a 3% dividend yield and a long track record

of double-digit dividend growth (thanks to its robust cash generation). The

company enjoys high returns and a strong balance sheet with net cash. It is

largely an agency business with a long track record of successfully investing

clients' funds in the private sector (equity and debt) and in infrastructure

projects. It is a business where success breeds success and, as a result,

Partners Group is growing market share in an industry which is seeing a growing

share of asset allocators' wallets as the hunt for yield continues while

interest rates stay low. The opportunity to enter arose when the shares pulled

back on slightly disappointing results due to the increased levels of

investment required to prepare for the next stage of growth in assets under

management. The only disposal of the year was Flughafen Zurich which was sold

when it became evident that the upcoming regulatory review would be more

draconian than anticipated and was, therefore, likely to result in a reduced

dividend. As always, there have been a number of additions and reductions to

existing names which accounted for the majority of the turnover in the

portfolio. In general, the strategy here has been to trim stocks that have

risen to less reasonable levels of valuation and to add to those that have

experienced a temporary hiccup. A good example is EssilorLuxottica which

suffered while mired in a very public spat between the management of Essilor

and the majority owner of Luxottica shortly following the completion of their

merger. This provided an opportunity to add to holdings in what will, in the

long run, be a dominant powerhouse in the optical industry. The shares

recovered handsomely when senior management changes were agreed and the

combined group went on to announce an important (and very accretive)

acquisition of the spectacles retailer Grandvision.

Question

How has your derivative strategy performed in the period under review?

Answer

Gearing, achieved through the use of contracts for difference ("CFDs"), has

added 1.3% to the performance of the Company during what has, of course, been a

very strong year for absolute returns. The Company's short portfolio, which is

very small in relation to the total net assets of the Company, has, however,

been a mixed bag and has neither added nor detracted from the overall

performance of the Company, relative to its Benchmark Index, during the period.

You may, therefore, be asking: why do it? Well, it is constantly under review

and it will remain a small part of the Company until we are convinced that it

can add value. Having said that, it is still early days and there are some soft

benefits associated with the practice (e.g. regular access to Fidelity's

shorting resource etc.). Be assured, if it were ever felt that the shorting

strategy was a distraction that diluted the overall performance of the Company,

there would be no hesitation in stopping it.

Question

How significant a concern is Brexit?

Answer

It is important to put the UK's significance in context. The UK represents, in

aggregate, less than 5% of the sales and profits of continental European

companies (see chart in the Annual Report). Some companies are, of course, more

exposed (think Spanish banks or German car companies) than others. Brexit,

technically speaking, has already happened but the process of leaving the

European Union is on-going: the UK's future relationship with its largest

trading partner is still to be decided. Given the timelines required, if the

Prime Minister sticks to his end of year pledge, then it is likely that only a

"barebones" agreement on the trade in goods will be in place by the deadline

with a lot still to agree on services, etc. For those names with a heightened

exposure to the UK, this may be a source of volatility during 2020 and in

future years. The health of the global economy, in contrast, will be much more

significant in general for continental European companies. In the long run

Brexit may be seen as a test case for the European Union project and it may

have a lasting impact on the latter's pace of integration and risk of

disintegration. Time will tell.

Question

There is a lot of press comment about Environmental, Social and Governance

("ESG") in connection with investing. What precisely is it about, what is the

Fidelity capability in this area, what is your approach as Portfolio Manager

and how does the investment portfolio measure up?

Answer

It is certainly true that much ink has been spilt on the subject of

Environmental, Social and Governance ("ESG") related investment matters in

recent times. As I see it, investing in companies which operate high standards

on corporate responsibility is more likely to protect and enhance investment

returns for shareholders. This is just good sense.

The best run companies are invariably those which consider their long term

value proposition and look after their stakeholders appropriately. Needless to

say, ESG matters affect different companies differently depending on their

business models and stakeholder groups. The 'Environmental' component alone is

multi-faceted, taking into account the depletion of resources, emissions,

biodiversity, waste and water management and of course carbon pollution.

In analysing each stock, I obtain a deep understanding of ESG issues at a

company level, aided by Fidelity's research analysts' team. We have responded

to our clients' demands in recent years by substantially developing our

in-house resources to scrutinise and map sustainability risks. Most recently,

this has resulted in the implementation of our proprietary ESG ratings system.

Fidelity's analysts are encouraged to explore any material differences between

their internal ratings of companies and the external ESG ratings provided by

third-party research agencies. For new or emerging securities, or support on

regional specifics, our dedicated Sustainable Investing Team will add

additional input where necessary.

As a house, Fidelity favours a positive engagement approach, discussing ESG

issues with the management of the companies in which we invest, or are

contemplating investing in, in the belief that this is the most effective way

to improve the attitude of businesses towards corporate responsibility.

Ultimately, ESG cannot be boiled down to a tick-box exercise. I am pleased to

say, however, that Fidelity European Values PLC is rated 'above average' in its

sustainability rating scoring by Morningstar. There is more detail on

Fidelity's approach to ESG in the Strategic Report in the Annual Report.

Question

Where should investors direct their attention in the months ahead?

Answer

As always, investors should pay attention to the companies in which they are

invested. As Peter Lynch, the respected American investor, famously said:

"Nobody can predict interest rates, the future direction of the economy, or the

stock market. Dismiss all such forecasts and concentrate on what's actually

happening to the companies in which you've invested". The Company will, as

always, stay fully invested and focus its attention on the prospects for its

constituent companies' dividend growth and will consider to what extent that

dividend growth is already discounted in the share price. Why does the Company

stay fully invested? Fidelity has published a lot of research which has shown

that trying to call the market is a mug's game: you may be able to call the top

but if you don't get back in near the bottom you will miss some of the

strongest days of return and leave a lot of money on the table. It is also

important to note that due to the Company's investment trust structure and the

low gearing, I will not need to liquidate any assets to meet any redemptions.

Much remains to be seen regarding the impact of COVID-19; notwithstanding the

human cost, there will likely be winners and losers. As always, there are a lot

of little devils hiding in the details. The bottom line for me is that I do not

try to time markets - I will stay fully invested. I will also stay focused on

companies with strong balance sheets. Companies with strong balance sheets can

take advantage in difficult times, like this, while companies with weak balance

sheets may be in peril. The cost of trading can also rise dramatically in times

of high volatility so my default setting will be to sit on my hands (unless I

have a very good reason for doing otherwise). I am investing in businesses that

I think are tough long term franchises and, as the saying goes, when the going

gets tough, the tough get going.

SAM MORSE

Portfolio Manager

18 March 2020

STRATEGIC REPORT

RISK FRAMEWORK

PRINCIPAL RISKS AND UNCERTAINTIES AND RISK MANAGEMENT

As required by provisions 28 and 29 of the 2018 UK Corporate Governance Code,

the Board has a robust ongoing process for identifying, evaluating and managing

the principal risks and uncertainties faced by the Company, including those

that would threaten its business model, future performance, solvency or

liquidity. The Board, with the assistance of the Alternative Investment Fund

Manager (FIL Investment Services (UK) Limited/ the "Manager"), has developed a

risk matrix which, as part of the risk management and internal controls

process, identifies the key existing and emerging risks that the Company faces.

The Audit Committee carried out a separate exercise in November 2019 to

identify any new emerging risks and take any action necessary to mitigate their

potential impact. The risks identified are placed on the Company's risk matrix

and graded appropriately. This process, together with the policies and

procedures for the mitigation of existing and emerging risks, is updated and

reviewed regularly in the form of comprehensive reports considered by the Audit

Committee. The Board determines the nature and extent of any risks it is

willing to take in order to achieve its strategic objectives.

The Manager also has responsibility for risk management for the Company. It

works with the Board to identify and manage the principal risks and

uncertainties and to ensure that the Board can continue to meet its UK

corporate governance obligations.

The Board considers the following as the principal risks and uncertainties

faced by the Company. There have been no changes to these since the prior

reporting year.

Principal Risks Description and Risk Mitigation

Market risk The Company's assets consist mainly of listed securities and the principal

risks are therefore market related such as market downturn, interest rate

movements, exchange rate movements and ESG investing, including climate risk.

The Portfolio Manager's success or failure to protect and increase the

Company's assets against this background is core to the Company's continued

success.

The risk of the likely effects of the Coronavirus (COVID-19) on the markets is

covered in the Chairman's Statement and Portfolio Manager's Review above. These

risks are somewhat mitigated by the investment trust structure which means no

forced sales will need to take place to deal with any redemptions. Therefore,

investments can be held over a longer time horizon.

Risks to which the Company is exposed in the market risk category are included

in Note 17 to the Financial Statements below together with summaries of the

policies for managing these risks.

Performance risk The achievement of the Company's performance objective relative to the market

requires the application of risk such as strategy, asset allocation and stock

selection and may lead to underperformance of the Benchmark Index. The Board

reviews the performance of the portfolio against the Company's Benchmark and

that of its competitors and the outlook for the market with the Portfolio

Manager at each Board meeting. The Portfolio Manager is responsible for

actively monitoring the portfolio selected in accordance with the asset

allocation parameters and seeks to ensure that individual stocks meet an

acceptable risk/reward profile. The emphasis is on long term performance as the

Company may experience volatility of performance in the shorter term.

Key person risk There is a risk that the Manager has an inadequate succession plan for key

individuals, particularly with investment trust expertise. The loss of the

Portfolio Manager or key individuals could lead to potential performance,

operational or regulatory issues. The Manager identifies key dependencies which

are then addressed through succession plans. Fidelity has succession plans in

place for portfolio managers and these are discussed regularly with the Board.

Economic and political The Company may be impacted by economic and political risks, including from the

risk UK's departure from the European Union and the outcome of future negotiations.

The Board is provided with a detailed investment review which covers material

economic, market and legislative changes at each Board meeting. The review also

covers risks relating to trade tensions, rising interest rates and political

unrest.

The Chairman's Statement and the Portfolio Manager's Review above provide more

detail.

Discount control risk The price of the Company's shares and its discount to NAV are factors which are

not within the Company's total control. The Board continues to adopt an active

discount management policy. Some short term influence over the discount may be

exercised by the use of share repurchases at acceptable prices within the

parameters set by the Board. The Company's share price, NAV and discount

volatility are monitored daily by the Manager and considered by the Board at

each of its meetings.

Gearing risk The Company has the option to invest up to the total of any loan facilities or

to use CFDs to invest in equities. The principal risk is that the Portfolio

Manager may fail to use gearing effectively, resulting in a failure to

outperform in a rising market or to underperform in a falling market. Other

risks are that the cost of gearing may be too high or that the term of the

gearing is inappropriate in relation to market conditions. The Company

currently has no bank loans and gears through the use of long CFDs which

provide greater flexibility and are significantly cheaper than bank loans. The

Board regularly considers the level of gearing and gearing risk and sets limits

within which the Manager must operate.

Derivatives risk Derivative instruments are used to provide both protection and enhancement of

investment returns. There is a risk that the use of derivatives may lead to a

higher volatility in the NAV and the share price than might otherwise be the

case. The Board has put in place policies and limits to control the Company's

use of derivatives and exposures. These are monitored on a daily basis by the

Manager's Compliance team and regular reports are provided to the Board.

Further details on derivatives risk is included in Note 17 to the Financial

Statements below.

Operational risks The operational risk from cybercrime is significant. Cybercrime threats evolve

rapidly and consequently the risk is regularly re-assessed and the Board

receives regular updates from the Manager in respect of the type and possible

scale of cyberattacks. The Manager's technology team has developed a number of

initiatives and controls in order to provide enhanced mitigating protection to

this ever increasing threat. The risk is frequently re-assessed by Fidelity's

information security and technology teams and has resulted in the

implementation of new tools and processes as well as improvements to existing

ones. Fidelity has also established a dedicated cybersecurity team which

provides regular awareness updates and best practices guidance.

Other significant operational risks, such as those currently arising from the

Coronavirus (COVID 19), following the Company's year end, are being managed by

Fidelity's Contagious Illness Response Team (CIRT) which is part of Fidelity's

overall Event Management Framework. There are contingency plans in place to

allow for the continuation of Fidelity's operations and to look after the

safety of their employees.

Other risks facing the Company include:

Tax and Regulatory Risks

There is a risk to the Company of not complying with tax and regulatory

requirements.

A breach of Section 1158 of the Corporation Tax Act 2010 could lead to a loss

of investment trust status, resulting in the Company being subject to tax on

capital gains.

There is a risk that outstanding withholding tax reclaims may not be

recoverable from some jurisdictions and may need to be written-off. The

Manager's tax team works closely with the Custodian to keep these under review

and the Board is kept updated on the recoverability of the withholding tax

reclaims.

The Board monitors tax and regulatory changes at each Board meeting and through

active engagement with regulators and trade bodies by the Manager.

Other Operational Risks

The Company relies on a number of third party service providers, principally

the Manager, Registrar, Custodian and Depositary. It is dependent on the

effective operation of the Manager's control systems and those of its service

providers with regard to the security of the Company's assets, dealing

procedures, accounting records and the maintenance of regulatory and legal

requirements. The Registrar, Custodian and Depositary are all subject to a

risk-based programme of internal audits by the Manager. In addition, service

providers' own internal control reports are received by the Board on an annual

basis and any concerns are investigated. Risks associated with these services

are generally rated as low, but the financial consequences could be serious,

including reputational damage to the Company.

CONTINUATION VOTE

A continuation vote takes place every two years. There is a risk that

shareholders do not vote in favour of the continuation of the Company during

periods when performance of the Company's NAV and share price is poor. At the

Company's AGM held on 13 May 2019, 100% of shareholders voted in favour of the

continuation of the Company. The next continuation vote will take place at the

AGM in 2021.

VIABILITY STATEMENT

In accordance with provision 31 of the 2018 UK Corporate Governance Code, the

Directors have assessed the prospects of the Company over a longer period than

the twelve month period required by the "Going Concern" basis. The Company is

an investment trust with the objective of achieving long term growth in both

capital and income. The Board considers long term to be at least five years,

and accordingly, the Directors believe that five years is an appropriate

investment horizon to assess the viability of the Company, although the life of

the Company is not intended to be limited to this or any other period.

In making an assessment on the viability of the Company, the Board has

considered the following:

· The ongoing relevance of the investment objective in prevailing market

conditions;

· The Company's NAV and share price performance;

· The principal risks and uncertainties facing the Company, as set out

above, and their potential impact;

· The future demand for the Company's shares;

· The Company's share price discount to the NAV;

· The liquidity of the Company's portfolio;

· The level of income generated by the Company; and

· Future income and expenditure forecasts.

The Company's performance has been strong for the five year reporting period to

31 December 2019, with a NAV total return of 77.7%, a share price total return

of 80.8% and a Benchmark Index total return of 61.6%. The Board regularly

reviews the Company's investment policy and considers whether it remains

appropriate. The Board has concluded that there is a reasonable expectation

that the Company will be able to continue in operation and meet its liabilities

as they fall due over the next five years based on the following

considerations:

· The Investment Manager's compliance with the Company's investment

objective and policy, its investment strategy and asset allocation;

· The portfolio mainly comprises readily realisable securities which can be

sold to meet funding requirements if necessary;

· The Board's discount management policy;

· The ongoing processes for monitoring operating costs and income which are

considered to be reasonable in comparison to the Company's total assets; and

* The Board's assessment of the risks arising from COVID-19 as set

out above.

In addition, the Directors' assessment of the Company's ability to operate in

the foreseeable future is included in the Going Concern Statement below.

PROMOTING THE SUCCESS OF THE COMPANY

Under Section 172(1) of the Companies Act, the Directors have a duty to promote

the success of the Company for the benefit of its stakeholders. This includes

having regard (amongst other matters) to the likely consequences of any

decision in the long term, fostering relationships with the Company's

stakeholders and the desirability of the Company maintaining a reputation for

high standards of business conduct.

As an Investment Trust the Company has no employees or physical assets, the

Manager is our predominant supplier and our customers are our shareholders. The

Board, with the Portfolio Manager, sets an overall investment strategy and

reviews this at an annual strategy day which is separate from the regular cycle

of board meetings. In order to ensure good governance of the Company, the Board

has set various limits on the investments in the portfolio, whether in the

maximum size of individual holdings, the use of derivatives, the level of

gearing and others. These limits and guidelines are regularly monitored.

It is one of the Board's long term intentions that the share price should trade

at a level close to the underlying net asset value of the shares. In order to

achieve this, the Board has an active discount policy in order to reduce

discount volatility and will execute share repurchases (in normal market

conditions) in order to keep the discount in single figures.

The Board is mindful that investors expect their funds to be managed for a

competitive fee. The Board last renegotiated the fee payable to the Manager in

2018 and details can be found in the Director's Report section of the Annual

report. The tiered structure of the fee will mean that as assets grow over

time, the benefits of scale will be passed on to shareholders.

It is important that shareholders have access to both the Portfolio Manager and

the Board. The Portfolio Manager meets with major shareholders, stock market

analysts, journalists and other commentators during the year. The Chairman,

Senior Independent Director and the other Directors are also available to meet

shareholders.

As long term investors, we look to the future - the Portfolio Manager in

constructing the portfolio and the Board in governing the Company. The

performance of the Company and its reputation for transparency and good

governance are paramount to its long term success for the benefit of all its

stakeholders.

GOING CONCERN STATEMENT

The Directors have considered the Company's investment objective, risk

management policies, liquidity risk, credit risk, capital management policies

and procedures, the nature of its portfolio (being mainly securities which are

readily realisable) and its expenditure and cash flow projections and have

concluded that the Company has adequate resources to continue to adopt the

going concern basis for at least twelve months from the date of this Annual

Report. This conclusion also takes into account the Board's assessment of the

risks arising from COVID-19 as set out above. The prospects of the Company over

a period longer than twelve months can be found in the Viability Statement

above.

STATEMENT OF DIRECTORS' RESPONSIBILITIES

The Directors are responsible for preparing the Annual Report and Financial

Statements in accordance with applicable law and regulations.

Company law requires the Directors to prepare financial statements for each

financial period. Under that law they have elected to prepare the Financial

Statements in accordance with UK Generally Accepted Accounting Practice,

including FRS 102: The Financial Reporting Standard applicable in the UK and

Republic of Ireland. The Financial Statements are required by law to give a

true and fair view of the state of affairs of the Company and of the profit or

loss for the reporting period.

In preparing these Financial Statements, the Directors are required to:

· select suitable accounting policies and then apply them

consistently;

· make judgements and estimates that are reasonable and prudent;

· state whether applicable UK Accounting Standards have been

followed, subject to any material departures disclosed and explained in the

Financial Statements; and

· prepare the Financial Statements on the going concern basis unless

it is inappropriate to presume that the Company will continue in business.

The Directors are responsible for ensuring that adequate accounting records are

kept which disclose with reasonable accuracy at any time the financial position

of the Company and to enable them to ensure that the Financial Statements

comply with the Companies Act 2006. They are also responsible for safeguarding

the assets of the Company and hence for taking reasonable steps for the

prevention and detection of fraud and other irregularities.

Under applicable law and regulations the Directors are also responsible for

preparing a Strategic Report, a Directors' Report, a Corporate Governance

Statement and a Directors' Remuneration Report that comply with that law and

those regulations.

The Directors have delegated responsibility for the maintenance and integrity

of the corporate and financial information included on the Company's pages of

the Manager's website at: www.fidelityinvestmenttrusts.com to the Manager.

Visitors to the website need to be aware that legislation in the UK governing

the preparation and dissemination of the Financial Statements may differ from

legislation in their own jurisdictions.

The Directors confirm that to the best of their knowledge:

· The Financial Statements, prepared in accordance with FRS 102, give

a true and fair view of the assets, liabilities, financial position and profit

of the Company; and

· The Annual Report includes a fair review of the development and

performance of the business and the position of the Company, together with a

description of the principal risks and uncertainties it faces.

The Directors consider that the Annual Report and Financial Statements, taken

as a whole, are fair, balanced and understandable and provide the information

necessary for shareholders to assess the Company's performance, business model

and strategy.

Approved by the Board on 18 March 2020 and signed on its behalf by:

VIVIAN BAZALGETTE

Chairman

Income Statement for the year ended 31 December 2019

Year ended 31 December 2019 Year ended 31 December 2018

Notes

revenue capital total revenue capital total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Gains/(losses) on 10 - 183,944 183,944 - (64,871) (64,871)

investments

Gains/(losses) on 11 - 17,516 17,516 - (6,143) (6,143)

derivative instruments

Income 3 34,201 - 34,201 33,763 - 33,763

Investment management 4 (2,119) (6,357) (8,476) (2,030) (6,090) (8,120)

fees

Other expenses 5 (857) - (857) (846) - (846)

Foreign exchange gains/ - 199 199 - (17) (17)

(losses)

------------------- ------------------- ------------------- ------------------- ------------------- -------------------

Net return/(loss) on 31,225 195,302 226,527 30,887 (77,121) (46,234)

ordinary activities before

finance costs and

taxation

Finance costs 6 (254) (760) (1,014) (448) (1,345) (1,793)

------------------- ------------------- ------------------- ------------------- ------------------- -------------------

Net return/(loss) on 30,971 194,542 225,513 30,439 (78,466) (48,027)

ordinary activities before

taxation

Taxation on return/(loss) 7 (2,155) - (2,155) (1,706) - (1,706)

on ordinary activities

------------------- ------------------- ------------------- ------------------- ------------------- -------------------

Net return/(loss) on 28,816 194,542 223,358 28,733 (78,466) (49,733)

ordinary activities after

taxation for the year

=========== =========== =========== =========== =========== ===========

Return/(loss) per ordinary 8 7.00p 47.26p 54.26p 6.94p (18.96p) (12.02p)

share

------------------- ------------------- ------------------- ------------------- ------------------- -------------------

The Company does not have any other comprehensive income. Accordingly the net

return/(loss) on ordinary activities after taxation for the year is also the

total comprehensive income for the year and no separate Statement of

Comprehensive Income has been presented.

The total column of this statement represents the Income Statement of the

Company. The revenue and capital columns are supplementary and presented for

information purposes as recommended by the Statement of Recommended Practice

issued by the AIC.

No operations were acquired or discontinued in the year and all items in the

above statement derive from continuing operations.

The Notes below form an integral part of these Financial Statements.

Statement of Changes in Equity for the year ended 31 December 2019

share capital total

share premium redemption capital revenue shareholders'

capital account reserve reserve reserve funds

Notes GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Total shareholders' funds 10,411 58,615 5,414 844,043 36,828 955,311

at 31 December 2018

Net return on ordinary - - - 194,542 28,816 223,358

activities after taxation

for the year

Repurchase of ordinary 14 - - - (1,578) - (1,578)

shares

Dividends paid to 9 - - - - (36,529) (36,529)

shareholders

------------------- ------------------- ------------------- ------------------- ------------------- -------------------

Total shareholders' funds 10,411 58,615 5,414 1,037,007 29,115 1,140,562

at 31 December 2019

=========== =========== =========== =========== =========== ===========

Total shareholders' funds 10,411 58,615 5,414 929,452 26,156 1,030,048

at 31 December 2017

Net (loss)/return on - - - (78,466) 28,733 (49,733)

ordinary activities after

taxation for the year

Repurchase of ordinary 14 - - - (6,943) - (6,943)

shares

Dividend paid to 9 - - - - (18,061) (18,061)

shareholders

------------------- ------------------- ------------------- ------------------- ------------------- -------------------

Total shareholders' funds 10,411 58,615 5,414 844,043 36,828 955,311

at 31 December 2018

=========== =========== =========== =========== =========== ===========

The Notes on pages below form an integral part of these Financial Statements.

Balance Sheet as at 31 December 2019 Company number 2638812

2019 2018

Notes GBP'000 GBP'000

Fixed assets

Investments 10 1,108,702 938,826

Current assets

Derivative instruments 11 16,576 2,391

Debtors 12 5,134 6,405

Amounts held at futures clearing houses and brokers 2,029 4,279

Fidelity Institutional Liquidity Fund 46 1,847

Cash at bank 9,444 4,427

------------------ ------------------

33,229 19,349

========== ==========

Creditors

Derivative instruments 11 (457) (2,024)

Other creditors 13 (912) (840)

------------------ ------------------

(1,369) (2,864)

------------------ ------------------

Net current assets 31,860 16,485

------------------ ------------------

Net assets 1,140,562 955,311

========== ==========

Capital and reserves

Share capital 14 10,411 10,411

Share premium account 15 58,615 58,615

Capital redemption reserve 15 5,414 5,414

Capital reserve 15 1,037,007 844,043

Revenue reserve 15 29,115 36,828

------------------ ------------------

Total shareholders' funds 1,140,562 955,311

========== ==========

Net asset value per ordinary share 16 277.19p 231.77p

------------------ ------------------

The Financial Statements above and below were approved by the Board of

Directors on 18 March 2020 and were signed on its behalf by:

Vivian Bazalgette

Chairman

The Notes on pages below form an integral part of these Financial Statements.

Notes to the Financial Statements

1 PRINCIPAL ACTIVITY

Fidelity European Values PLC is an Investment Company incorporated in England

and Wales with a premium listing on the London Stock Exchange. The Company's

registration number is 2638812, and its registered office is Beech Gate,

Millfield Lane, Lower Kingswood, Tadworth, Surrey, KT20 6RP. The Company has

been approved by HM Revenue & Customs as an Investment Trust under Section 1158

of the Corporation Tax Act 2010 and intends to conduct its affairs so as to

continue to be approved.

2 ACCOUNTING POLICIES

The Company has prepared its Financial Statements in accordance with UK

Generally Accepted Accounting Practice ("UK GAAP"), including FRS 102 "The

Financial Reporting Standard applicable in the UK and Republic of Ireland",

issued by the Financial Reporting Council ("FRC"). The Financial Statements

have also been prepared in accordance with the Statement of Recommended

Practice: Financial Statements of Investment Trust Companies and Venture

Capital Trusts ("SORP") issued by the Association of Investment Companies

("AIC"), in November 2014 and updated in October 2019 with consequential

amendments. The Company is exempt from presenting a Cash Flow Statement as a

Statement of Changes in Equity is presented and substantially all of the

Company's investments are highly liquid and are carried at market value.

a) Basis of accounting - The Financial Statements have been prepared on a going

concern basis and under the historical cost convention, except for the

measurement at fair value of investments and derivative instruments.

b) Significant accounting estimates and judgements - The Directors make

judgements and estimates concerning the future. Estimates and judgements are

continually evaluated and are based on historical experience and other factors,

such as expectations of future events, and are believed to be reasonable under

the circumstances. Actual results may differ from these estimates.

c) Segmental reporting - The Company is engaged in a single segment business

and, therefore, no segmental reporting is provided.

d) Presentation of the Income Statement - In order to reflect better the

activities of an investment company and in accordance with guidance issued by

the AIC, supplementary information which analyses the Income Statement between

items of a revenue and capital nature has been prepared alongside the Income

Statement. The net revenue return after taxation for the year is the measure

the Directors believe appropriate in assessing the Company's compliance with

certain requirements set out in Section 1159 of the Corporation Tax Act 2010.

e) Income - Income from equity investments is accounted for on the date on

which the right to receive the payment is established, normally the ex-dividend

date. Overseas dividends are accounted for gross of any tax deducted at source.

Amounts are credited to the revenue column of the Income Statement. Where the

Company has elected to receive its dividends in the form of additional shares

rather than cash, the amount of the cash dividend foregone is recognised in the

revenue column of the Income Statement. Any excess in the value of the shares

received over the amount of the cash dividend is recognised in the capital

column of the Income Statement. Special dividends are treated as a revenue

receipt or a capital receipt depending on the facts and circumstances of each

particular case.

Derivative instrument income received from dividends on long contracts for

difference ("CFDs") is accounted for on the date on which the right to receive

the payment is established, normally the ex-dividend date. The amount net of

tax is credited to the revenue column of the Income Statement.

Interest received on CFDs, bank deposits and money market funds are accounted

for on an accruals basis and credited to the revenue column of the Income

Statement.

f) Investment management fees and other expenses - Investment management fees

and other expenses are accounted for on an accruals basis and are charged as

follows:

· The investment management fee is allocated 25% to revenue and 75% to

capital; and

· All other expenses are allocated in full to revenue with the exception of

those directly attributable to share issues or other capital events.

g) Functional currency and foreign exchange - The functional and reporting

currency of the Company is UK sterling, which is the currency of the primary

economic environment in which the Company operates. Transactions denominated in

foreign currencies are reported in UK sterling at the rate of exchange ruling

at the date of the transaction. Assets and liabilities in foreign currencies

are translated in the rates of exchange ruling at the Balance Sheet date.

Foreign exchange gains and losses arising on the translation are recognised in

the Income Statement as a revenue or a capital item depending on the nature of

the underlying item to which they relate.

h) Finance costs - Finance costs comprise interest on deposits and interest

paid on CFDs, which are accounted for on an accruals basis, and dividends paid

on short CFDs, which are accounted for on the date on which the obligation to

incur the cost is established, normally the ex-dividend date. Finance costs are

allocated 25% to revenue and 75% to capital.

i) Taxation - The taxation charge represents the sum of current taxation and

deferred taxation.

Current taxation is taxation suffered at source on overseas income less amounts

recoverable under taxation treaties. Taxation is charged or credited to the

revenue column of the Income Statement, except where it relates to items of a

capital nature, in which case it is charged or credited to the capital column

of the Income Statement. Where expenses are allocated between revenue and

capital any tax relief in respect of the expenses is allocated between revenue

and capital returns on the marginal basis using the Company's effective rate of

corporation tax for the accounting period. The Company is an approved

Investment Trust under Section 1158 of the Corporation Tax Act 2010 and is not

liable for UK taxation on capital gains.

Deferred taxation is the taxation expected to be payable or recoverable on

timing differences between the treatment of certain items for accounting

purposes and their treatment for the purposes of computing taxable profits.

Deferred taxation is based on tax rates that have been enacted or substantively

enacted when the taxation is expected to be payable or recoverable. Deferred

tax assets are only recognised if it is considered more likely than not that

there will be sufficient future taxable profits to utilise them.

j) Dividend paid - Dividends payable to equity shareholders are recognised when

the Company's obligation to make payment is established.

k) Investments - The Company's business is investing in financial instruments

with a view to profiting from their total return in the form of income and

capital growth. This portfolio of investments is managed and its performance

evaluated on a fair value basis, in accordance with a documented investment

strategy, and information about the portfolio is provided on that basis to the

Company's Board of Directors. Investments are measured at fair value with

changes in fair value recognised in profit or loss, in accordance with the

provisions of both Section 11 and Section 12 of FRS 102. The fair value of

investments is initially taken to be their cost and is subsequently measured as

follows:

· Listed investments are valued at bid prices, or last market prices,

depending on the convention of the exchange on which they are listed.

In accordance with the AIC SORP, the Company includes transaction costs,

incidental to the purchase or sale of investments, within gains/(losses) on

investments in the capital column of the Income Statement and has disclosed

these costs in Note 10 below.

l) Derivative instruments - When appropriate, permitted transactions in

derivative instruments are used. Derivative transactions into which the Company

may enter include long and short CFDs and futures. Derivatives are classified

as other financial instruments and are initially accounted and measured at fair

value on the date the derivative contract is entered into and subsequently

measured at fair value as follows:

· Long and short CFDs - the difference between the strike price and the

value of the underlying shares in the contract; and

· Futures - the difference between the contract price and the quoted trade

price.

Where transactions are used to protect or enhance income, if the circumstances

support this, the income and expenses derived are included in net income in the

revenue column of the Income Statement. Where such transactions are used to

protect or enhance capital, if the circumstances support this, the income and

expenses derived are included in gains/(losses) on derivative instruments in

the capital column of the Income Statement. Any positions on such transactions

open at the year end are reflected on the Balance Sheet at their fair value

within current assets or creditors.

m) Debtors - Debtors include accrued income, taxation recoverable and other

debtors incurred in the ordinary course of business. If collection is expected

in one year or less (or in the normal operating cycle of the business, if

longer) they are classified as current assets. If not, they are presented as

non-current assets. They are recognised initially at fair value and, where

applicable, subsequently measured at amortised cost using the effective

interest rate method.

n) Amounts held at futures clearing houses and brokers - These are amounts held

in segregated accounts as collateral on behalf of brokers and are subject to an

insignificant risk of changes in value.

o) Other creditors - Other creditors include investment management fees and

other creditors and expenses accrued in the ordinary course of business. If

payment is due within one year or less (or in the normal operating cycle of the

business, if longer) they are classified as current liabilities. If not, they

are presented as non-current liabilities. They are recognised initially at fair

value and, where applicable, subsequently measured at amortised cost using the

effective interest rate method.

p) Fidelity Institutional Liquidity Fund plc - The Company holds an investment

in the Fidelity Institutional Liquidity Fund plc, a short term money market

fund investing in a diversified range of short term instruments. It is readily

convertible to cash and is considered a cash equivalent.

q) Capital reserve - The following are accounted for in the capital reserve:

· Gains and losses on the disposal of investments and derivative

instruments;

· Changes in the fair value of investments and derivative instruments held

at the year end;

· Foreign exchange gains and losses of a capital nature;

· 75% of investment management fees and finance costs;

· Dividends receivable which are capital in nature; and

· Costs of repurchasing ordinary shares.

As a result of technical guidance issued by the Institute of Chartered

Accountants in England and Wales in TECH 02/17BL: Guidance on the determination

of realised profits and losses in the context of distributions under the

Companies Act 2006, changes in the fair value of investments which are readily

convertible to cash, without accepting adverse terms at the Balance Sheet date,

can be treated as realised. Capital reserves realised and unrealised are shown

in aggregate as capital reserve in the Statement of Changes in Equity and the

Balance Sheet. At the Balance Sheet date, the portfolio of the Company

consisted of: investments listed on a recognised stock exchange and derivative

instruments, contracted with counterparties having an adequate credit rating,

and the portfolio was considered to be readily convertible to cash.

3 INCOME

Year ended Year ended

31.12.19 31.12.18

GBP'000 GBP'000

Investment income

Overseas dividends 29,019 26,394

Overseas scrip dividends 795 1,685

UK dividends 2,058 2,005

------------------ ------------------

31,872 30,084

========== ==========

Derivative income

Income recognised from futures contracts 567 2,591

Dividends received on long CFDs 1,658 985

Interest received on long CFDs* 45 11

------------------ ------------------

2,270 3,587

------------------ ------------------

Investment and derivative income 34,142 33,671

========== ==========

Other interest

Interest received on deposits and money market funds 48 92

Interest received on tax reclaims 11 -

------------------ ------------------

59 92

========== ==========

Total income 34,201 33,763

========== ==========

* Due to negative interest rates during the reporting year, the Company

received interest on its long CFDs.

No special dividends have been recognised in capital during the reporting year

(2018: GBP671,000).

4 INVESTMENT MANAGEMENT FEES

Year ended 31 December Year ended 31 December

2019 2018

revenue capital total revenue capital total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Investment management fees 2,119 6,357 8,476 2,030 6,090 8,120

======== ======== ======== ======== ======== ========

== == == == == ==

FIL Investment Services (UK) Limited is the Company's Alternative Investment

Fund Manager and has delegated portfolio management to FIL Investments

International ("FII"). Both companies are Fidelity group companies.

From 1 April 2018, FII charges investment management fees at an annual rate of

0.85% of net assets up to GBP400 million and 0.75% of net assets in excess of GBP

400 million. Prior to this date the investment management fees were charged at

a rate of 0.85% of net assets. Fees are payable monthly in arrears and are

calculated on a daily basis.

5 OTHER EXPENSES

Year ended Year ended

31.12.19 31.12.18

GBP'000 GBP'000

AIC fees 22 21

Custody fees 112 113

Depositary fees 75 77

Directors' fees1 151 161

Legal and professional fees 55 101

Marketing expenses 189 146

Printing and publication expenses 126 112

Registrars' fees 75 67

Fees payable to the Company's Independent Auditor for the audit of the 29 25

Financial Statements2

Other expenses 23 23

------------------ ------------------

857 846

========== ==========

1 Details of the breakdown of Directors' fees are disclosed in the Directors'

Remuneration Report in the Annual Report.

2 The VAT payable on audit fees is included in other expenses.

6 FINANCE COSTS

Year ended 31 December 2019 Year ended 31 December 2018

revenue capital total revenue capital total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Interest paid on deposits 30 89 119 1 3 4

Interest paid on short CFDs1 27 81 108 64 193 257

Dividends paid on short CFDs 197 590 787 383 1,149 1,532

------------------ ------------------ ------------------ ------------------ ------------------ ------------------

254 760 1,014 448 1,345 1,793

========== ========== ========== ========== ========== ==========

1 Due to negative interest rates during the year, the Company has paid

interest on its short CFDs and deposits.

7 TAXATION ON RETURN/(LOSS) ON ORDINARY ACTIVITIES

Year ended 31 December 2019 Year ended 31 December 2018

revenue capital total revenue capital total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

a) Analysis of the taxation charge

for the year

Overseas taxation 2,155 - 2,155 1,706 - 1,706

------------------ ------------------ ------------------ ------------------ ------------------ ------------------

Total taxation charge for the year 2,155 - 2,155 1,706 - 1,706

(see Note 7b)

========== ========== ========== ========== ========== ==========

b) Factors affecting the taxation charge for the year

The taxation charge for the year is lower than the standard rate of UK

corporation tax for an investment trust company of 19.00% (2018: 19.00%). A

reconciliation of the standard rate of UK corporation tax to the taxation