Crown Place VCT PLC Crown Place Vct Plc : Annual -11-

02 Oktober 2014 - 6:08PM

UK Regulatory

offer

price

Recent investment price to Cost (reviewed for 62 More

impairment) relevant

valuation

methodology

The valuation method used will be the most appropriate valuation

methodology for an investment within its market, with regard to the

financial health of the investment and the IPEVCV Guidelines. The

Directors believe that, within these parameters, there are no other

possible methods of valuation which would be reasonable as at 30 June

2014.

10. Significant interests

The principal activity of the Group is to select and hold a portfolio of

investments in unquoted securities. Although the Company, through the

Manager, will, in some cases, be represented on the board of the

portfolio company, it will not take a controlling interest or become

involved in the management of a portfolio company. The size and

structure of the companies with unquoted securities may result in

certain holdings in the portfolio representing a participating interest

without there being any partnership, joint venture or management

consortium agreement.

The Company has interests of greater than 20 per cent. of the nominal

value of any class of the allotted shares in the portfolio companies as

at 30 June 2014 as described below:

% total

Country of % class and voting

Company incorporation Principal activity share type rights

ELE Advanced Manufacturer of precision engineering components for

Technologies the industrial gas turbine, aerospace and automotive 74.3% B

Limited Great Britain markets Ordinary 41.9%

House of

Dorchester 33.0% B

Limited Great Britain Chocolate manufacturer Ordinary 22.2%

56.7% B

Ordinary/A

Preference

and B

Uctal Limited Great Britain TV production company Preference 24.2%

The investments listed above are held as part of an investment portfolio

and therefore, as permitted by IAS 28 and FRS 9, they are measured at

fair value and not accounted for using the equity method.

11. Investments in subsidiary undertakings

30 June 2014

CP1 VCT PLC CP2 VCT PLC Total

GBP'000 GBP'000 GBP'000

Carrying value as at 1 July 2013 7,299 9,281 16,580

Movement in subsidiary net assets (677) (808) (1,485)

Carrying value as at 30 June 2014 6,622 8,473 15,095

30 June 2013

CP1 VCT PLC CP2 VCT PLC Total

GBP'000 GBP'000 GBP'000

Carrying value as at 1 July 2012 6,820 8,740 15,560

Movement in subsidiary net assets 479 541 1,020

Carrying value as at 30 June 2013 7,299 9,281 16,580

The subsidiary companies currently hold cash and intercompany balances.

Both CP1 VCT PLC and CP2 VCT PLC are wholly owned by Crown Place VCT PLC

as follows:

30 June 2014

CP1 VCT PLC CP2 VCT PLC

Nominal value of shares held GBP6,382,746 GBP8,219,350

Percentage of total voting rights held 100% 100%

30 June 2013

CP1 VCT PLC CP2 VCT PLC

Nominal value of shares held GBP6,382,746 GBP8,219,350

Percentage of total voting rights held 100% 100%

12. Trade and other receivables/debtors and current asset investments

30 June 2014 30 June 2013

Group Company Group Company

GBP'000 GBP'000 GBP'000 GBP'000

Trade and other receivables/debtors less than one

year 74 74 17 17

30 June 2014 30 June 2013

Group Company Group Company

GBP'000 GBP'000 GBP'000 GBP'000

Contingent future receipts on disposal of fixed asset

investments 42 42 21 21

The fair value hierarchy applied to contingent future receipts on

disposal of fixed asset investments is Level 3. The only movement in the

contingent future receipts is an unrealised increase in the fair value.

13. Trade and other payables/creditors

30 June 2014 30 June 2013

Group Company Group Company

GBP'000 GBP'000 GBP'000 GBP'000

Amounts falling due within one year:

Amounts due to subsidiary undertakings - 15,039 - 16,523

Other payables 21 21 28 28

Accruals 200 200 191 191

221 15,260 219 16,742

Interest is chargeable on intercompany balances at a rate of 12 per

cent. per annum. Intercompany balances are payable on demand. The

subsidiaries' current business is to hold cash and intercompany

balances.

14. Ordinary share capital

30 June 2014 30 June 2013

GBP'000 GBP'000

Allotted, called up and fully paid

100,057,224 Ordinary shares of 10p each (2013:

92,999,904) 10,006 9,300

Voting rights

90,680,814 Ordinary shares of 10p each (2013:

84,205,494)

The Company purchased 1,317,000 Ordinary shares for cancellation (2013:

1,407,000) during the year at a total cost of GBP395,000 (2013:

GBP416,000).

The Company purchased 582,000 Ordinary shares for treasury (2013:

728,000) during the year at a total cost of GBP174,000 (2013:

GBP206,000). The Company did not cancel any Ordinary shares from

treasury during the year (2013: 769,500).

The total number of shares held in treasury as at 30 June 2014 was

9,376,410 (2013: 8,794,410) representing 9.4 per cent. of the shares in

issue as at 30 June 2014.

Under the terms of the Dividend Reinvestment Scheme Circular dated 26

February 2009, the following Ordinary shares of nominal value 10 pence

were allotted during the year:

Number

of

Allotment shares Aggregate nominal value of shares Issue price Net consideration received Opening market price on allotment

date allotted (GBP'000) (pence per share) (GBP'000) (pence per share)

29

November

2013 257,201 26 31.01 77 30.00

31 March

2014 294,674 29 30.91 89 30.00

551,875 55 166

Under the terms of the Albion VCTs Top Up Offers 2013/2014, the

following Ordinary shares of nominal value 10 pence were issued during

the year:

Number of

Allotment shares Aggregate nominal value of shares Issue price Net consideration received Opening market price on allotment

date allotted (GBP'000) (pence per share) (GBP'000) (pence per share)

31 January

2014 1,597,074 160 32.60 506 30.00

31 January

2014 1,063,942 106 32.40 339 30.00

31 January

2014 46,728 5 32.10 15 30.00

5 April

2014 1,294,447 129 31.90 401 30.00

5 April

2014 39,411 4 31.60 12 30.00

5 April

2014 42,765 4 31.70 13 30.00

4,084,367 408 1,286

Albion Crown Vct (LSE:CRWN)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

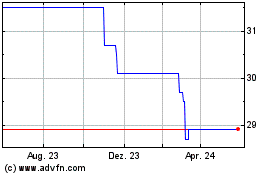

Albion Crown Vct (LSE:CRWN)

Historical Stock Chart

Von Jul 2023 bis Jul 2024