The Group's management has made an assessment of the Group's

ability to continue as a going concern and is satisfied that the

Company has the resources to continue in business for the

foreseeable future. Furthermore, management is not aware of any

material uncertainties that may cast significant doubt upon the

Group's ability to continue as a going concern. Therefore, the

financial statements continue to be prepared on the going concern

basis.

Determination of functional currency

The determination of the functional currency of the Group is

critical since recording of transactions and exchange differences

arising thereon are dependent on the functional currency selected.

As described in Note 2, the directors have considered those factors

therein and have determined that the functional currency of the

Company is the United States Dollar.

Estimates and assumptions

The key assumptions concerning the future and other key sources

of estimation uncertainty at the reporting date, that have a

significant risk of causing a material adjustment to the carrying

amounts of assets and liabilities within the next financial year,

are discussed below. The Group based its assumptions and estimates

on parameters available when the financial statements were

prepared. However, existing circumstances and assumptions about

future developments may change due to market changes or

circumstances arising beyond the control of the Group. Such changes

are reflected in the assumptions when they occur.

Fair value of financial instruments

When the fair value of financial assets and financial

liabilities recorded in the statement of financial position cannot

be derived from active markets, their fair value is determined

using a variety of valuation techniques that include the use of

mathematical models. The inputs to these models are taken from

observable markets where possible, but where this is not feasible,

estimation is required in establishing fair values. The estimates

include considerations of liquidity and model inputs such as credit

risk (both own and counterparty's), correlation and volatility.

Changes in assumptions about these factors could affect the

reported fair value of financial instruments in the statement of

financial position and the level where the instruments are

disclosed in the fair value hierarchy. The models are calibrated

regularly and tested for validity using prices from any observable

current market transactions in the same instrument (without

modification or repackaging) or based on any available observable

market data. IFRS 7 requires disclosures relating to fair value

measurements using a three-level fair value hierarchy. The level

within which the fair value measurement is categorised in its

entirety is determined on the basis of the lowest level input that

is significant to the fair value measurement in its entirety.

Assessing the significance of a particular input requires

judgement, considering factors specific to the asset or liability.

To assess the significance of a particular input to the entire

measurement, the Group performs sensitivity analysis or stress

testing techniques.

Investment in Shoprite Holdings (SHP ZL)

The Group (through its subsidiary Africa Opportunity Fund L.P.)

has 9.0 per cent of its net assets (14.4 per cent of the net assets

of the Ordinary shares) in Shoprite Holdings (SHPZL) ("Shoprite")

on the Zambian Register. The value of the investment as at 30 June

2014 amounted to USD 6,786,064 (2013: USD 7,800,572) and the

original cost of the investment was USD 3,639,685 (2013: USD

3,639,685). Shoprite has conveyed its intention to seek to reverse

certain trades made on the Lusaka Stock Exchange which includes

543,743 or 80.06 per cent of the shares held by Africa Opportunity

Fund L.P. To date, the filing to the courts made by Shoprite

against the Company (through the custodian as nominee on behalf of

the fund) has been dismissed as an abuse of Process of Court on

account of multiplicity of action with costs awarded to the

defendants. The multiplicity of action refers to an existing case

in a separate jurisdiction that has been filed by Shoprite against

its agent and transfer agent Messrs Lewis Nathan Advocates.

Shoprite has to date not appealed the decision, and no further

filing has been made. Management has fair valued the investment in

Shoprite at the price prevailing on the Lusaka Stock Exchange.

Additionally, Shoprite has been placing dividend payments into

escrow rather than distributing these amounts to shareholders.

These dividends are reflected as a receivable amounting to USD

428,473 (2013: USD 334,163) in the Group's assets.

Management has assessed these facts and consulted with their

legal advisors, who consider such action by Shoprite to be devoid

of merit. Therefore, management believes that the correct judgement

is to continue to account for the investment at fair value and

accrue for the dividends on this investment.

The C shares have no direct holdings in Shoprite shares as at 30

June 2014.

5. FINANCIAL ASSETS AND LIABILITIES AT FAIR VALUE THROUGH PROFIT OR LOSS

5 (a) FINANCIAL ASSETS AT FAIR VALUE THROUGH PROFIT OR LOSS

30 June 2014 30 June 2013

------------- -------------

USD USD

Designated at fair value through profit

or loss:

At start of year 55,473,931 42,159,300

Additions 16,679,578 16,106,663

Disposals (1,415,107) (14,619,208)

Net (losses)/ gains on financial assets

at fair value through profit or loss (5,068,917) 7,391,461

65,669,485 51,038,216

============ =============

Analysis of portfolio:

- Listed equity securities 46,818,244 41,280,635

- Unlisted equity securities - 606,249

- Listed debt securities 17,901,241 8,486,332

- Unlisted debt securities 950,000 665,000

-----------

65,669,485 51,038,216

=========== ===========

Net gains/(losses) on fair value of financial assets at fair

value through profit or loss

30 June 2014 30 June 2013

------------- -------------

USD USD

Realised (500,903) 6,808,459

Unrealised (4,568,014) 583,002

-------------

Net gains/(losses) (5,068,917) 7,391,461

============= =============

5 (b) FINANCIAL LIABILITIES AT FAIR VALUE THROUGH PROFIT OR

LOSS

30 June 2014 30 June 2013

------------- -------------

USD USD

Written put option 66,713 1,126,915

Listed securities sold short 11,617,976 4,352,506

-------------

11,684,689 5,479,421

============= =============

30 June 2014 30 June 2013

------------- -------------

USD USD

Realised 284,315 357,457

Unrealised (212,923) (111,221)

-------------

Net gains/ (losses) 71,392 246.236

============= =============

5 (c) Fair value hierarchy

The Group uses the following hierarchy for determining and

disclosing the fair value of the financial instruments by valuation

technique:

Level 1: quoted (unadjusted) market prices in active markets for

identical assets and liabilities.

Level 2: Valuation techniques for which the lowest level input

that is significant to the fair value measurement is directly or

indirectly observable.

Level 3: Valuation techniques for which the lowest level input

that is significant to the fair value measurement is

unobservable.

Recurring fair value measurement of assets and liabilities -

2014

30 June Level 1 Level 2 Level 3

2014

-------- -------- -------- --------

USD USD USD USD

Financial assets at fair value through profit or loss:

Equities 46,818,244 40,032,180 6,786,064 -

Debt securities 18,851,241 - 17,901,241 950,000

------------- ------------- ----------- --------

65,669,485 40,032,180 24,687,305 950,000

============= ============= =========== ========

Financial liabilities

at fair value through

profit or loss 11,684,689 11,684,689 - -

============= ============= =========== ========

Recurring fair value measurement of assets and liabilities -

2013

30 June Level 1 Level 2 Level 3

2013

---------- ---------- ---------- ----------

USD USD USD USD

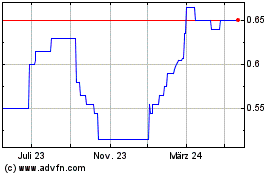

Africa Opportunity (LSE:AOF)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Africa Opportunity (LSE:AOF)

Historical Stock Chart

Von Jul 2023 bis Jul 2024