For the purposes of these consolidated financial statements,

parties are considered to be related to the Group if they have the

ability, directly or indirectly, to control the Group or exercise

significant influence over the Group in making financial and

operating decisions, or vice versa, or where the Group is subject

to common control or common significant influence. Related parties

may be individuals or other entities.

3. CHANGES IN ACCOUNTING POLICY AND DISCLOSURES

New and amended standards and interpretations

The accounting policies adopted in the current year are

consistent with those of the previous year, except that the Group

has adopted some of the following new and revised accounting

standards:

-- IAS 1 Presentation of Financial Statements

-- IFRS 10 Consolidated Financial Statements

-- IFRS 12 Disclosure of Interest in Other Entities

-- IFRS 13 Fair Value Measurement

-- Disclosures - Offsetting Financial Assets and Financial Liabilities (Amendments to IFRS 7)

The adoption of the above standards is described below:

IAS 1 Presentation of Financial Statements

Presentation of Items of Other Comprehensive Income - Amendments

to IAS 1

The amendments to IAS 1 change the grouping of items presented

in 'other comprehensive income'. Items that could be reclassified

(or recycled) to profit or loss at a future point in time (for

example, upon derecognition or settlement) would be presented

separately from items that will not be reclassified. The amendment

has not impacted the Group's accounts as the Group has no other

comprehensive income.

IAS 1 Clarification of the requirement for comparative

information (Amendment)

These amendments clarify the difference between voluntary

additional comparative information and the minimum required

comparative information. This standard has not impacted the

financial statements of the Group.

IFRS 7 Financial instruments - Disclosures

This standard amends the disclosure requirements in IFRS 7

Financial Instruments: Disclosures to require information about all

recognised financial instruments that are set off in accordance

with paragraph 42 of IAS 32 Financial Instruments:

Presentation.

The amendments also require disclosure of information about

recognised financial instruments subject to enforceable master

netting arrangements and similar agreements even if they are not

set off under IAS 32. The IASB believes that these disclosures will

allow financial statement users to evaluate the effect or potential

effect of netting arrangements, including rights of set-off

associated with an entity's recognised financial assets and

recognised financial liabilities, on the entity's financial

position. The amendment has not impacted the Group's accounts.

IFRS 10 Consolidated Financial Statements

IFRS 10 Consolidated Financial Statements requires a parent to

present consolidated financial statements as those of a single

economic entity, replacing the requirements previously contained in

IAS 27 Consolidated and Separate Financial Statements and SIC-12

Consolidation - Special Purpose Entities.

The Standard identifies the principles of control, determines

how to identify whether an investor controls an investee and

therefore must consolidate the investee, and sets out the

principles for the preparation of consolidated financial

statements.

The Standard introduces a single consolidation model for all

entities based on control, irrespective of the nature of the

investee (i.e. whether an entity is controlled through voting

rights of investors or through other contractual arrangements as is

common in 'special purpose entities'). Under IFRS 10, control is

based on whether an investor has:

-- Power over the investee

-- Exposure, or rights, to variable returns from its involvement with the investee, and

-- The ability to use its power over the investee to affect the amount of the returns.

The amendment has not impacted the Group's account.

IFRS 12 Disclosure of Interests in Other Entities

This standard requires the extensive disclosure of information

that enables users of financial statements to evaluate the nature

of, and risks associated with, interests in other entities and the

effects of those interests on its financial position, financial

performance and cash flows.

In high-level terms, the required disclosures are grouped into

the following broad categories:

-- Significant judgements and assumptions - such as how control,

joint control, significant influence has been determined;

-- Interests in subsidiaries - including details of the

structure of the group, risks associated with structured entities,

changes in control, and so on;

-- Interests in joint arrangements and associates - the nature,

extent and financial effects of interests in joint arrangements and

associates (including names, details and summarised financial

information); and

-- Interests in unconsolidated structured entities - information

to allow an understanding of the nature and extent of interests in

unconsolidated structured entities and to evaluate the nature of,

and changes in, the risks associated with its interests in

unconsolidated structured entities.

-- IFRS 12 lists specific examples and additional disclosures

which further expand upon each of these disclosure objectives, and

includes other guidance on the extensive disclosures required. The

amendment has not impacted the Group's account.

IFRS 13 Fair Value Measurement

-- IFRS 13 establishes a single source of guidance under IFRS

for all fair value measurements. IFRS 13 does not change when an

entity is required to use fair value, but rather provides guidance

on how to measure fair value under IFRS. IFRS 13 defines fair value

as an exit price. As a result of the guidance in IFRS 13, the Group

reassessed its policies for measuring fair values, in particular,

its valuation inputs such as non-performance risk for fair value

measurement of liabilities. IFRS 13 also requires additional

disclosures.

-- Additional disclosures where required, are provided in the

individual notes related to the assets and liabilities whose fair

values were determined. Fair value hierarchy is provided in Note

7.

Amendments to standards issued but not yet effective

-- Standards issued but not yet effective up to the date of

issuance of the Group's financial statements are listed below. The

Group intends to adopt applicable standards when they become

effective.

-- The following standards, amendments to existing standards and

interpretations were in issue but not yet effective. They are

mandatory for accounting periods beginning on the specified dates,

but the Group has not early adopted them:

Amendments to standards issued but not yet effective

(continued)

New or revised standards and interpretations:

Effective

for accounting

period beginning

on or after

- IFRS 9 Financial Instruments - Classification and Not yet confirmed

measurement of financial assets, Accounting for financial

liabilities and derecognition

- IAS 32 Financial Instruments: Presentation - Offsetting 1 January

Financial Assets and Financial Liabilities 2014

- Investment Entities (Amendments to IFRS 10, IFRS 12 1 January

and IAS 27) 2014

- Recoverable Amount Disclosures for Non-Financial Assets 1 January

(Amendments to IAS 36) - effective 1 January 2014 2014

- Novation of Derivatives and Continuation of Hedge 1 January

Accounting (Amendments to IAS 39) 2014

- Defined Benefit Plans: Employee Contributions (Amendments 1 July 2014

to IAS 19)

- Annual Improvements 2010-2012 Cycle 1 July 2014

- Annual Improvements 2011-2013 Cycle 1 July 2014

- IFRIC 21 Levies 1 January

2014

- IFRS 14 Regulatory Deferral Accounts 1 January

2016

IFRS 9 Financial Instruments - Classification and measurement of

financial assets, Accounting for financial liabilities and

derecognition

IFRS 9 Financial Instruments - no stated effective date

IFRS 9 introduces new requirements for classifying and measuring

financial assets, as follows:

Amendments in 2009

-- Debt instruments meeting both a 'business model' test and a

'cash flow characteristics' test are measured at amortised cost

(the use of fair value is optional in some limited

circumstances)

-- Investments in equity instruments can be designated as 'fair

value through other comprehensive income' with only dividends being

recognised in profit or loss

-- All other instruments (including all derivatives) are

measured at fair value with changes recognised in the profit or

loss

-- The concept of 'embedded derivatives' does not apply to

financial assets within the scope of the Standard and the entire

instrument must be classified and measured in accordance with the

above guidelines.

Amendments in 2010

-- A revised version of IFRS 9 incorporating revised

requirements for the classification and measurement of financial

liabilities, and carrying over the existing derecognition

requirements from IAS 39 Financial Instruments: Recognition and

Measurement.

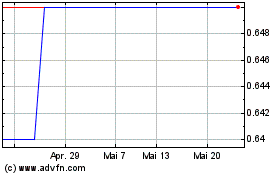

Africa Opportunity (LSE:AOF)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

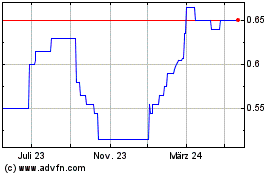

Africa Opportunity (LSE:AOF)

Historical Stock Chart

Von Jul 2023 bis Jul 2024