The Company aims to achieve capital growth and income through

investment in value, arbitrage, and special situations investments

in the continent of Africa. The Company therefore may invest in

securities issued by companies domiciled outside Africa which

conduct significant business activities within Africa. The Company

will have the ability to invest in a wide range of asset classes

including real estate interests, equity, quasi-equity or debt

instruments and debt issued by African sovereign states and

government entities.

The Company's investment activities are managed by Africa

Opportunity Partners Limited, a limited liability company

incorporated in the Cayman Islands and acting as the investment

manager pursuant to an Investment Management Agreement dated 18

July 2007.

To ensure that investments to be made by the Company, and the

returns generated on the realisation of investments are both

effected in the most tax efficient manner, the Company has

established Africa Opportunity Fund L.P. as an exempted limited

partnership in the Cayman Islands. All investments made by the

Company are made through the limited partnership. The limited

partners of the limited partnership are the Company and AOF CarryCo

Limited. The general partner of the limited partnership is Africa

Opportunity Fund (GP) Limited.

Presentation currency

The consolidated financial statements are presented in the

United States dollars ("USD").

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

The principal accounting policies applied in the preparation of

these consolidated financial statements are set out below. These

policies have been consistently applied from the prior year to the

current year for items which are considered material in relation to

the consolidated financial statements.

Statement of compliance

The financial statements are prepared in accordance with

International Financial Reporting Standards (IFRS) as issued by the

International Accounting Standards Board (IASB).

Basis of preparation

The consolidated financial statements have been prepared under

the historical cost convention except for financial assets and

financial liabilities at fair value through profit or loss that

have been measured at fair value.

The preparation of consolidated financial statements in

conformity with IFRS requires the use of certain critical

accounting estimates. It also requires the Board of Directors to

exercise its judgement in the process of applying the Company's and

its subsidiaries' (referred to as the "Group")accounting policies.

The areas involving a higher degree of judgement or complexity, or

areas where assumptions and estimates are significant to the

consolidated financial statements are disclosed in Note 4.

Basis of consolidation

The consolidated financial statements comprise the financial

statements of the Group as at 30 June 2014.

Subsidiaries are fully consolidated from the date of

acquisition, being the date on which the Group obtains control and

continued to be consolidated until the date that such control

ceases.

The financial statements of the subsidiaries are prepared for

the same reporting period as the parent company, using consistent

accounting policies.

All intra-group balances, income and expenses and unrealised

gains and losses resulting from intra-group transactions are

eliminated in full.

Non-controlling interests represent the portion of profit or

loss and net assets not held by the Group and are presented

separately in the statement of comprehensive income and within

equity in the Statement of Changes in Equity from parent

shareholders' equity.

Foreign currency translation

(a) Functional and presentation currency

The Group's consolidated financial statements are presented in

USD which is the Group's functional currency. That is the currency

of the primary economic environment in which the Group operates.

Each entity in the Group determines its own functional currency and

items included in the financial statements of each entity are

measured using that functional currency. The functional currency of

the entities within the Group is USD. The Group chose USD as the

presentation currency.

(b) Transactions and balances

Transactions in foreign currencies are initially recorded at the

functional currency rate prevailing at the date of transaction.

Monetary assets and liabilities denominated in foreign currencies

are retranslated at the functional currency spot rate of the

exchange ruling at the reporting date. All differences are taken to

profit or loss. Non-monetary items that are measured in terms of

historical cost in a foreign currency are translated using the

exchange rates as at the dates of the initial transactions.

Non-monetary items measured at fair value in a foreign currency are

translated using the exchange rates at the date when the fair value

is determined.

Financial instruments

(i) Classification

The Group classifies its financial assets and liabilities in

accordance with IAS 39.

Financial assets and liabilities at fair value through profit or

loss

The category of the financial assets and liabilities at fair

value through the profit or loss is subdivided into:

Financial assets and liabilities held for trading

Financial assets are classified as held for trading if they are

acquired for the purpose of selling and repurchasing in the near

term. This category includes equity securities, investments in

managed funds and debts instruments. These assets are acquired

principally for the purpose of generating a profit from short term

fluctuation in price. All derivatives and liabilities from the

short sales of financial instruments are classified as held for

trading.

Options

Options are contractual agreements that convey the right, but

not the obligation, for the purchaser either to buy or sell a

specific amount of a financial instrument at a fixed price, either

at a fixed future date or at any time within a specified

period.

The Group purchases and sells put and call options through

regulated exchanges and OTC markets. Options purchased by the Group

provide the Group with the opportunity to purchase (call options)

or sell (put options) the underlying asset at an agreed-upon value

either on or before the expiration of the option. The Group is

exposed to credit risk on purchased options only to the extent of

their carrying amount, which is their fair value.

Options written by the Group provide the purchaser the

opportunity to purchase from or sell to the Group the underlying

asset at an agreed-upon value either on or before the expiration of

the option.

Options are generally settled on a net basis.

Financial instruments designated as at fair value through profit

or loss upon initial recognition

These include equity securities and debt instruments that are

not held for trading. These financial assets are designated on the

basis that they are part of a group of financial assets which are

managed and have their performance evaluated on a fair value basis,

in accordance with risk management and investment strategies of the

Group, as set out in the Group's offering document. The financial

information about the financial assets is provided internally on

that basis to the Investment Manager and to the Board of Directors

of the Company.

Loans and receivables

Loans and receivables are non-derivatives financial assets with

fixed or determinable payments that are not quoted in an active

market. They are included in current assets, except for maturities

greater than 12 months after the reporting date. These are

classified as non-current assets. The Group's loans and receivables

comprise 'trade and other receivables' and 'cash and cash

equivalents' in the statement of financial position.

Other financial liabilities

This category includes all financial liabilities, other than

those classified as at fair value through profit or loss. The Group

includes in this category amounts relating to other short term

payables.

(ii) Recognition

The Group recognises a financial asset or a financial liability

when, and only when, it becomes a party to the contractual

provisions of the instrument.

Purchases or sales of financial assets that require delivery of

assets within the time frame generally established by regulation or

convention in the market place are recognised directly on the trade

date, i.e., the date that the Group commits to purchase or sell the

asset.

(iii) Initial measurement

Financial assets and liabilities at fair value through profit or

loss are recorded in the statement of financial position at fair

value. All transaction costs for such instruments are recognised

directly in profit or loss.

Derivatives embedded in other financial instruments are treated

as separate derivatives and recorded at fair value if their

economic characteristics and risks are not closely related to those

of the host contract, and the host contract is not itself

classified as held for trading or designated at fair value though

profit or loss. Embedded derivatives separated from the host are

carried at fair value with changes in fair value recognised in

profit or loss.

Loans and receivables and financial liabilities (other than

those classified as held for trading) are measured initially at

their fair value plus any directly attributable incremental costs

of acquisition or issue.

(iv) Subsequent measurement

After initial measurement, the Group measures financial

instruments which are classified as at fair value through profit or

loss at fair value. Subsequent changes in the fair value of those

financial instruments are recorded in 'Net profit or loss on

financial assets and liabilities at fair value through profit or

loss'. Interest earned and dividend revenue elements of such

instruments are recorded separately in 'Interest income' and

'Dividend income', respectively. Dividend expenses related to short

positions are recognised in 'Dividends paid'.

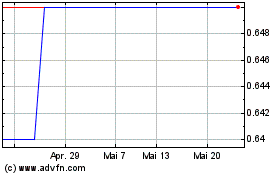

Africa Opportunity (LSE:AOF)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

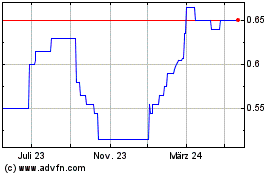

Africa Opportunity (LSE:AOF)

Historical Stock Chart

Von Jul 2023 bis Jul 2024