TIDMAOF

RNS Number : 2988Q

Africa Opportunity Fund Limited

29 August 2014

29 August 2014

AFRICA OPPORTUNITY FUND LIMITED

("AOF" or "the Company")

INTERIM RESULTS

The Board of Directors of Africa Opportunity Fund Limited is

pleased to announce its unaudited results for the 6 month period to

30 June 2014.

Highlights:

-- AOF's ordinary share net asset value per share of US$1.108 as

at 30 June 2014 decreased by 9% from the 31 December 2013 net asset

value per share of US$1.222.

-- AOF closed a share placing which raised US$29.2 million through the issue of C shares.

-- AOF's Ordinary Shares and the C Shares were admitted to

trading on the London Stock Exchange's Specialist Fund Market

("SFM") effective 17 April 2014. Concurrent with the listing on the

SFM, the Ordinary Shares were cancelled from admission to trading

on AIM.

-- As at 30 June 2014, AOF's investment allocation for its

Ordinary Shares was 73% equities, 27% debt.

-- AOF's Ordinary Shares net asset value per share as at 31 July 2014 was US$1.115.

-- AOF's C Share net asset value per share as at 31 July 2014 was US$0.972.

C Share Issue and Listing on the SFM: AOF closed a share placing

which raised $29.2 million through the issue of C Shares on 17

April. As part of the placing AOF moved to the Specialist Fund

Market ("SFM"), the London Stock Exchange's specialist market for

specialist investment funds.

Management Fee- Revised to be calculated as 2% on the first

US$50 million of Net Asset Value and 1% of the Net Asset Value in

excess of US$50 million. The Q3 effective rate (based on assets

under management as at 30 June 2014) was 1.66%.

Dividend Policy- Amended to pay out all earned income net of

fees and expenses annually, commencing in Q1 2015.

Life of Fund- There will be a continuation vote in 2019, with

the expectation that shareholders wishing to realize their

investment will be provided the opportunity to exit at or near

NAV.

Board of Directors - a new independent Chair of the Board was

appointed, Myma Belo-Osagie, along with two new independent

directors Vikram Mansharamani and Peter Mombaur.

Market Conditions: AOF's Ordinary Share NAV decreased 9% during

H1 2014. By comparison, in US dollar terms in H1 2014 the S&P

rose 7%, South Africa rose 9%, Egypt rose 16%, Kenya rose 8%, and

Nigeria rose 1%.

Portfolio Highlights: The H1 decline in AOF's Ordinary Share NAV

was precipitated primarily by the collapse of Ghana's Cedi. The

Cedi depreciated against the Dollar by 8% in May alone, 20% during

Q2, and 29% during H1. To compound the Cedi's depreciation over

that period, the share price of Enterprise Group declined 4%.

Ghanaians and foreigners alike have lost confidence in the Ghana

government's fiscal sobriety. AOF has resisted the urge to flee

Ghana for two reasons: most of its capital in Ghana is invested in

industry--leading financial service operators which over the long

term have unequivocal records of strong earnings growth and

dividends in US dollars. Standard Chartered Bank's H1 2014 profits,

for example, only declined from US$41.4 to US$40.7 million. The

interim results for the Enterprise Group however, disclosed that,

despite a decline in investment income from US$8.8 million to

US$8.4 million, overall net profits fell from US$10.6 million to

US$1.6 million due to a flat performance of its equity portfolio in

2014 versus strong results in 2013. Listed equities accounted for

24% of its portfolio at year--end and the Ghana stock market was

down 22% in US dollars at the end of Q2.

Elsewhere in the portfolio our largest holding Sonatel reported

pleasing H1 2014 numbers, with an EBITDA margin of 51%, return on

equity of 32%, and net profit margin of 25%. Subscriber numbers

rose 22% to 24 million, revenue rose 12%, year on year, and profits

rose 7%. The presence of Naspers, our fifth largest holding, with

its sky--high P/E ratio of 83 demands an explanation. It is part of

a paired trade in which AOF is short Tencent, its impressive

Chinese internet affiliate. We established this investment when

Naspers was trading at a discount to the value of its holding in

Tencent, meaning that synthetically we purchased the non--Tencent

business for free. What is this business? It is the dominant

African pay--TV franchise, with 8 million subscribers, which

generated US$1 billion in EBITDA and $420 million in net profit in

the last financial year. The fact that the South African market is

assigning no value to Naspers' pay--TV business is astonishing to

us.

Shoprite's Zambian listed shares declined by 14% as a result of

the weakening Kwacha, leaving the discount of Shoprite's Lusaka

share price to its JSE price at approximately 33% at the end of

June 2014. We continue to work towards obtaining confirmation of

AOF's title to its Shoprite shares and may potentially initiate

judicial proceedings in the second half of 2014.

Ordinary Share Portfolio Appraisal Value: As of 30 June 2014,

the Manager's appraisal of the economic value of the Ordinary Share

portfolio was US$1.37 per share. The Ordinary Share market price of

US$1.14 per share at 30 June 2014 represents a 16% discount. The

Appraisal Value is intended to provide a measure of the Manager's

long--term view of the attractiveness of AOF's Ordinary Share

portfolio. It is a subjective estimate, and does not tell when that

value will be realized, nor does it guarantee that any security

will reach its Appraisal Value.

C Shares: The NAV of the C Shares declined 3% to the end of June

2014. We have begun to invest this new capital separately from the

capital underpinning AOF's ordinary shares. As of the end of June

2014, 25% of that capital had been invested, with 19% in debt, and

6% in equity. Nigeria, South Africa, Zambia, and Zimbabwe have

received the majority of the C Share's invested capital in sectors

like insurance, real estate, industrial mineral and oil and

gas.

Outlook: Ghana's macro-economic challenges and the economic,

social and health consequences of the Ebola virus in West Africa

may harm the business environment for West African companies in

AOF's portfolio in the second half of this year. The rise of

Ghana's producer price inflation data from 33% in June to 47% in

July, juxtaposed with consumer price inflation of 15.3% in July

could be a harbinger of severe margin compression for the Ghanaian

business sector, slowing economic activity and a growing danger of

non-performing loans. The spread of the Ebola virus is not only a

human tragedy for countries at its epicentre like Guinea, but also

a source of lower GDP growth in West Africa because of quarantines

imposed for preventive or curative medical reasons.

We believe that AOF's portfolio possesses undervalued companies.

The Ordinary Shares top 10 holdings (including the Naspers paired

trade) combined offer a weighted average dividend yield of 5.8%, a

P/E ratio of 13.5X, a return on assets of 5.2% and a return on

equity of 11.3%. Despite the difficult period experienced by the

portfolio during the first half of 2014, we are excited by these

attractive valuation metrics and remain optimistic about AOF's

prospects.

Responsibility Statements:

The Board of Directors confirm that, to the best of their

knowledge:

a. The financial statements, prepared in accordance with

International Financial Reporting Standards, give a true and fair

view of the assets, liabilities, financial position and profit or

loss of the Company.

b. The Interim Investment Manager Report, and Condensed Notes to

the Financial Statements include:

i. a fair review of the information required by DTR 4.2.7R

(indication of important events that have occurred during the first

six months and their impact on the financial statements, and a

description of principal risks and uncertainties for the remaining

six months of the year); and

ii. a fair review of the information required by DTR 4.2.8R

(confirmation that no related party transactions have taken place

in the first six months of the year that have materially affected

the financial position or performance of the Company during that

period).

Per Order of the Board

29 August 2014

AFRICA OPPORTUNITY FUND LIMITED

CONSOLIDATED STATEMENT OF PROFIT OR LOSS

AND OTHER COMPREHENSIVE INCOME

FOR THE PERIOD FROM 1 JANUARY 2014 TO 30 JUNE 2014

For the period For the period

ended 30 ended 30

Note June 2014 June 2013

--------------- ---------------

USD USD

Revenue

Dividend income 995,397 932,097

Interest income 722,152 337,420

Net exchange gains on bank - 486,340

Profit on financial assets at fair

value through profit or loss 5(a) - 7,391,461

Profit on financial liabilities at

fair value through profit or loss 5(b) 71,392 246,236

Other income 331,193 -

2,120,134 9,393,554

------------ ----------

Expenses

Losses on financial assets at fair 5,068,917 -

value through profit or loss

Placing and admission fees 1,075,141 -

Management fee 573,403 435,441

Net exchange losses on bank 290,869 -

Custodian, secretarial and administration

fees 136,917 120,976

Interest charges and other fees 145,103 102,569

Dividend paid 86,475 20,754

Operating expenses 86,111 44,072

Brokerage fees 64,156 239,871

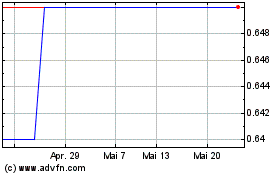

Africa Opportunity (LSE:AOF)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

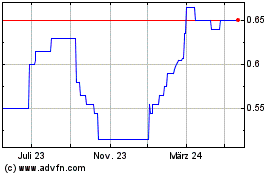

Africa Opportunity (LSE:AOF)

Historical Stock Chart

Von Jul 2023 bis Jul 2024