Africa Opportunity Fund Limited Amendments to the Company's structure and policies (6758B)

06 März 2014 - 9:53AM

UK Regulatory

TIDMAOF

RNS Number : 6758B

Africa Opportunity Fund Limited

06 March 2014

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION IN WHOLE OR IN PART

IN OR INTO AUSTRALIA, CANADA, SOUTH AFRICA OR JAPAN OR THE UNITED

STATES OF AMERICA OR TO US PERSONS.

This announcement is an advertisement and not a prospectus and

investors should not subscribe for or purchase any securities

except on the basis of information in the prospectus to be

published by the Company in due course in connection with the

admission of the existing ordinary shares and C shares to trading

on the Specialist Fund Market of the London Stock Exchange (the

"Prospectus"). Copies of the Prospectus will, following

publication, be available from the offices of Lawrence Graham

LLP.

6 March 2014

Africa Opportunity Fund Limited (the "Company")

Amendments to the Company's structure and policies

The Company announced on 16 January 2014 that it is proposing to

raise up to US$100 million by way of a placing of C shares ("C

Shares") at a placing price of US$1.00 per C Share (the "Placing").

It is envisaged that the C Shares will be admitted to trading on

the Specialist Fund Market of the London Stock Exchange ("SFM")

and, simultaneously, the Company's ordinary shares ("Ordinary

Shares") will be transferred to the SFM from AIM (the

"Admission").

The Company has decided to implement a number of changes to its

structure and management arrangements which will be effective from

admission of the C Shares to the SFM.

Discount control mechanism

In addition to the Company's existing share buyback powers and

the continuation vote scheduled for 2019, the Company will provide

shareholders, without first requiring a shareholder vote to

implement this policy, with an opportunity to realise all or part

of their shareholding in the Company for a net realised pro rata

share of the Company's investment portfolio.

Carried interest

The Board and the Company's investment manager (the "Investment

Manager") have agreed to change the hurdle on the carried interest

received by the principals of the Investment Manager from the

current 12 month US Dollar LIBOR to 5 per cent. (no catch up).

C Share conversion ratio

The Board has resolved to exercise its discretion to apply a 5

per cent. discount to the net assets attributable to the Ordinary

Shares on conversion of the C Shares.

Dividend Policy

The Company has resolved to conduct its affairs so that,

following admission of the C Shares to the SFM, it will apply for

Reporting Fund status for the purposes of the United Kingdom's

offshore fund rules. Accordingly, the Company will amend its

dividend policy and will pay a dividend each year equivalent to the

Company's income (excluding realised and unrealised capital gains)

less reasonable expenses.

The Placing and Admission are subject, inter alia, to market

conditions and the Company expects, upon approval by the UK Listing

Authority, to publish the Prospectus in due course. For further

information, please contact:

Africa Opportunity Fund Limited

Francis Daniels Tel: +27 11 684 1528

Robert Knapp Tel: +1 617 449 3127

Edmond de Rothschild Securities (UK) Limited, Placing Agent

& FinancialAdviser

William Marle Tel: +44 (0)20 7845 5950

Andrew Davies (Sales) Tel: +44 (0)20 7845 5960

Hiroshi Funaki Tel: +44 (0)20 7845 5960

funds@lcfr.co.uk

Grant Thornton UK LLP, Nominated Adviser

Philip Secrett Tel: +44 (0)20 7383 5100

David Hignell Tel: +44 (0)20 7383 5100

philip.j.secrett@uk.gt.com

This announcement has been prepared by the Company for

information purposes only and does not constitute an offer to sell,

or the solicitation of an offer to acquire or subscribe for, the C

Shares in any jurisdiction. Any offer and/or sale of C Shares will

not be registered under the applicable securities laws of the

United States, Australia, Canada, South Africa or Japan. Subject to

certain exceptions, the C Shares may not be offered or sold within

the United States, Australia, Canada, South Africa or Japan or to

any national, resident or citizen of the United States, Australia,

Canada, South Africa or Japan. This announcement does not

constitute any form of financial opinion or recommendation on the

part of the Company or any of its affiliates or advisers and is not

intended to be an offer, or the solicitation of any offer, to buy

or sell any securities in any jurisdiction.

Neither the U.S. Securities and Exchange Commission (the "SEC")

nor any state securities commission has approved or disapproved of

the securities referred to in this announcement or passed upon the

adequacy or accuracy of this announcement. Any representation to

the contrary is a criminal offence in the United States.

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCJFMPTMBAMMBI

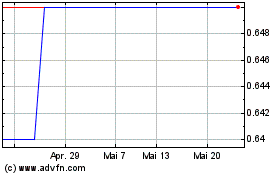

Africa Opportunity (LSE:AOF)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

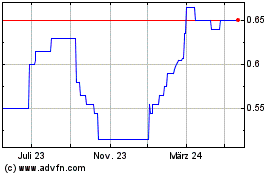

Africa Opportunity (LSE:AOF)

Historical Stock Chart

Von Jul 2023 bis Jul 2024