The key assumptions concerning the future and other key sources

of estimation uncertainty at the reporting date, that have a

significant risk of causing a material adjustment to the carrying

amounts of assets and liabilities within the next financial year,

are discussed below. The Group based its assumptions and estimates

on parameters available when the financial statements were

prepared. However, existing circumstances and assumptions about

future developments may change due to market changes or

circumstances arising beyond the control of the Group. Such changes

are reflected in the assumptions when they occur.

Fair value of financial instruments

When the fair value of financial assets and financial

liabilities recorded in the statement of financial position cannot

be derived from active markets, their fair value is determined

using a variety of valuation techniques that include the use of

mathematical models. The inputs to these models are taken from

observable markets where possible, but where this is not feasible,

estimation is required in establishing fair values. The estimates

include considerations of liquidity and model inputs such as credit

risk (both own and counterparty's), correlation and volatility.

Changes in assumptions about these factors could affect the

reported fair value of financial instruments in the statement of

financial position and the level where the instruments are

disclosed in the fair value hierarchy.

AFRICA OPPORTUNITY FUND LIMITED

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE PERIOD 1 JANUARY 2013 THROUGH 30 JUNE 2013

4. SIGNIFICANT ACCOUNTING JUDGEMENTS, ESTIMATES AND ASSUMPTIONS

The models are calibrated regularly and tested for validity

using prices from any observable current market transactions in the

same instrument (without modification or repackaging) or based on

any available observable market data. IFRS 7 requires disclosures

relating to fair value measurements using a three-level fair value

hierarchy. The level within which the fair value measurement is

categorised in its entirety is determined on the basis of the

lowest level input that is significant to the fair value

measurement in its entirety.

Assessing the significance of a particular input requires

judgement, considering factors specific to the asset or liability.

To assess the significance of a particular input to the entire

measurement, the Group performs sensitivity analysis or stress

testing techniques.

5(a). FINANCIAL ASSETS AT FAIR VALUE THROUGH PROFIT OR LOSS

30 June 2013 30 June 2012

------------- -------------

USD USD

Designated at fair value through profit

or loss:

At start of year 42,159,300 42,449,714

Additions 16,106,663 5,093,528

Disposals (14,619,208) (7,521,595)

Net gain on financial assets at fair value

through profit or loss 7,391,461 (1,805,228)

51,038,216 38,216,419

============= ============

Analysis of portfolio:

- Listed equity securities 41,280,635 33,556,997

- Unlisted equity securities 606,249 2,305,499

- Listed debt securities 8,486,332 2,153,923

- Unlisted debt securities 665,000 200,000

-----------

51,038,216 38,216,419

=========== ===========

AFRICA OPPORTUNITY FUND LIMITED

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE PERIOD 1 JANUARY 2013 THROUGH 30 JUNE 2013

5(b). FINANCIAL LIABILITIES AT FAIR VALUE THROUGH PROFIT OR

LOSS

30 June 2013 30 June 2012

------------- -------------

USD USD

Written put option 1,126,915 481,090

Listed securities sold short 4,352,506 4,877,623

-------------

5,479,421 5,358,713

============= =============

6. TRADE AND OTHER RECEIVABLES

30 June 2013 30 June 2012

------------- -------------

USD USD

Interest receivable on bonds 434,663 209,254

Dividend receivable 725,375 631,905

Other receivables 533 315,983

1,160,571 1,157,142

============= =============

The receivables are neither past due nor impaired. Interests

receivable on bonds are due within six months.

7. SHARE CAPITAL

2013 2013 2012 2012

-------------- ----------- -------------- -----------

Number USD Number USD

Authorised share

capital

Ordinary shares with

a par value of USD

0.01 1,000,000,000 10,000,000 1,000,000,000 10,000,000

-------------- ----------- -------------- -----------

Share capital

At 1 January 42,630,327 426,303 42,630,327 426,303

-------------- ----------- -------------- -----------

At 30 June 42,630,327 426,303 42,630,327 426,303

-------------- ----------- -------------- -----------

The directors have the general authority to repurchase the

ordinary shares in issue subject to the Group having funds lawfully

available for the purpose. However, if the market price of the

ordinary shares falls to a discount to the Net Asset Value, the

directors will consult with the Investment Manager as to whether it

is appropriate to instigate a repurchase of ordinary shares.

AFRICA OPPORTUNITY FUND LIMITED

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE PERIOD 1 JANUARY 2013 THROUGH 30 JUNE 2013

8. TRADE AND OTHER PAYABLES

30 June 2013 30 June 2012

------------- -------------

USD USD

Performance fee 1,319,179 -

Accrued expenses 116,292 58,423

Dividend payable 85,261 110,839

Other payables - 40,669

---------- --------

1,520,732 209,931

========== ========

Other payables are non-interest bearing and are due on

demand.

9. EARNING PER SHARE

Earnings per share is calculated by dividing the profit

attributable to equity holders of the Company by the weighted

average number of ordinary shares in issue during the year

excluding ordinary shares purchased by the Company and held as

treasury shares.

The Company's diluted gain/ (loss) per share is the same as

basic gain/(loss) per share, since the Company has not issued any

instrument with dilutive potential.

30 June 2013 30 June 2012

-------------

USD USD

Earnings attributable to equity holders

of the Group USD 6,985,000 (1,090,783)

Weighted average number of ordinary

share in issue 42,630,327 42,630,327

Earnings per share USD 0.1639 (0.0256)

============= =============

10. TAXATION

Under the current laws of Cayman Islands, there is no income,

estate, transfer sales or other Cayman Islands taxes payable by the

Company. As a result, no provision for income taxes has been made

in the financial statements.

Dividend revenue is presented gross of any non-recoverable

withholding taxes, which are disclosed separately in the

consolidated statement of comprehensive income.

AFRICA OPPORTUNITY FUND LIMITED

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE PERIOD 1 JANUARY 2013 THROUGH 30 JUNE 2013

11. SEGMENT INFORMATION

For management purposes, the Group is organised in one main

operating segment, which invests in equity securities, debt

instruments and relative derivatives. All of the Group's activities

are interrelated, and each activity is dependent on the others.

Accordingly, all significant operating decisions are based upon

analysis of the Group as one segment. The financial results from

this segment are equivalent to the financial statements of the

Group as a whole.

12. PERSONNEL

The Group did not employ any personnel during the half year

period ended 30 June 2013 (2012: the same).

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR DELFLXKFBBBK

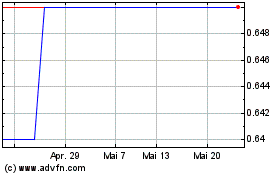

Africa Opportunity (LSE:AOF)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

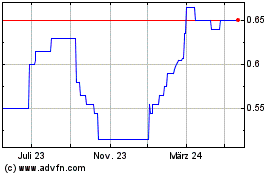

Africa Opportunity (LSE:AOF)

Historical Stock Chart

Von Jul 2023 bis Jul 2024