The Group recognises a financial asset or a financial liability

when, and only when, it becomes a party to the contractual

provisions of the instrument.

Purchases or sales of financial assets that require delivery of

assets within the time frame generally established by regulation or

convention in the market place are recognised directly on the trade

date, i.e., the date that the Group commits to purchase or sell the

asset.

(iii) Initial measurement

Financial assets and liabilities at fair value through profit or

loss are recorded in the statement of financial position at fair

value. All transaction costs for such instruments are recognised

directly in profit or loss.

Derivatives embedded in other financial instruments are treated

as separate derivatives and recorded at fair value if their

economic characteristics and risks are not closely related to those

of the host contract, and the host contract is not itself

classified as held for trading or designated at fair value though

profit or loss. Embedded derivatives separated from the host are

carried at fair value.

Loans and receivables and financial liabilities (other than

those classified as held for trading) are measured initially at

their fair value plus any directly attributable incremental costs

of acquisition or issue.

(iv) Subsequent measurement

After initial measurement, the Group measures financial

instruments which are classified as at fair value through profit or

loss at fair value. Subsequent changes in the fair value of those

financial instruments are recorded in 'Net gain or loss on

financial assets and liabilities at fair value through profit or

loss'. Interest earned and dividend revenue elements of such

instruments are recorded separately in 'Interest revenue' and

'Dividend revenue', respectively. Dividend expenses related to

short positions are recognised in 'Dividends on securities sold not

yet purchased'.

AFRICA OPPORTUNITY FUND LIMITED

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE PERIOD 1 JANUARY 2013 THROUGH 30 JUNE 2013

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

Financial assets (Continued)

(iv) Subsequent measurement (continued)

Loans and receivables are carried at amortised cost using the

effective interest method less any allowance for impairment. Gains

and losses are recognised in profit or loss when the loans and

receivables are derecognised or impaired, as well as through the

amortisation process.

Financial liabilities, other than those classified as at fair

value through profit or loss, are measured at amortised cost using

the effective interest method. Gains and losses are recognised in

profit or loss when the liabilities are derecognised, as well as

through the amortisation process.

The effective interest method is a method of calculating the

amortised cost of a financial asset or a financial liability and of

allocating the interest income or interest expense over the

relevant period. The effective interest rate is the rate that

exactly discounts estimated future cash payments or receipts

through the expected life of the financial instrument or, when

appropriate, a shorter period to the net carrying amount of the

financial asset or financial liability. When calculating the

effective interest rate, the Group estimates cash flows considering

all contractual terms of the financial instruments, but does not

consider future credit losses. The calculation includes all fees

paid or received between parties to the contract that are an

integral part of the effective interest rate, transaction costs and

all other premiums or discounts.

(v) Derecognition

A financial asset (or, where applicable, a part of a financial

asset or part of a group of similar financial assets) is

derecognised where:

-- The rights to receive cash flows from the asset have expired;

or

-- The Group has transferred its rights to receive cash flows

from the asset or has assumed an obligation to pay the received

cash flows in full without material delay to a third party under a

'pass-through' arrangement; and

-- Either (a) the Group has transferred substantially all the

risks and rewards of the asset, or (b) the Group has neither

transferred nor retained substantially all the risks and rewards of

the asset, but has transferred control of the asset.

When the Group has transferred its rights to receive cash flows

from an asset (or has entered into a pass-through arrangement), and

has neither transferred nor retained substantially all the risks

and rewards of the asset nor transferred control of the asset, the

asset is recognised to the extent of the Group's continuing

involvement in the asset.

The Group derecognises a financial liability when the obligation

under the liability is discharged, cancelled or expires.

AFRICA OPPORTUNITY FUND LIMITED

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE PERIOD 1 JANUARY 2013 THROUGH 30 JUNE 2013

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

Determination of fair value

Fair value is the amount for which an asset could be exchanged,

or a liability settled, between knowledgeable, willing parties in

an arm's length transaction.

The fair value for financial instruments traded in active

markets at the reporting date is based on their quoted price or

binding dealer price quotations, without any deduction for

transaction costs.

For all other financial instruments not traded in an active

market, the fair value is determined by using appropriate valuation

techniques. Valuation techniques include: using recent arm's length

market transactions; reference to the current market value of

another instrument that is substantially the same; discounted cash

flow analysis and option pricing models making as much use of

available and supportable market data as possible.

Impairment of financial assets

The Group assesses at each reporting date whether a financial

asset or group of financial assets classified as loans and

receivables is impaired. Evidence of impairment may include

indications that the debtor, or a group of debtors, is experiencing

significant financial difficulty, default or delinquency in

interest or principal payments, the probability that they will

enter bankruptcy or other financial reorganisation and, where

observable data indicate that there is a measurable decrease in the

estimated future cash flows, such as changes in arrears or economic

conditions that correlate with defaults.

If there is objective evidence that an impairment loss has been

incurred, the amount of the loss is measured as the difference

between the asset's carrying amount and the present value of

estimated future cash flows (excluding future expected credit

losses that have not yet been incurred) discounted using the

asset's original effective interest rate. The carrying amount of

the asset is reduced through the use of an allowance account and

the amount of the loss is recognised in profit or loss.

Impaired debts, together with the associated allowance, are

written off when there is no realistic prospect of future recovery

and all collateral has been realised or has been transferred to the

Group. If, in a subsequent period, the amount of the estimated

impairment loss increases or decreases because of an event

occurring after the impairment was recognised, the previously

recognised impairment loss is increased or reduced by adjusting the

allowance account. If a previous write-off is later recovered, the

recovery is credited to profit or loss.

Interest revenue on impaired financial assets is recognised

using the rate of interest used to discount the future cash flows

for the purpose of measuring the impairment loss.

AFRICA OPPORTUNITY FUND LIMITED

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE PERIOD 1 JANUARY 2013 THROUGH 30 JUNE 2013

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

Performance fee

The Special Limited Partners, under the terms of the Partnership

Agreement, are entitled to an aggregate annual carried interest

("Performance Allocation") from the Limited Partnership equivalent

to 20 per cent, of the excess of the Net Asset Value (as at 31

December in each year) after deducting the sum of (i) the annual

management fee for that year and (ii) a non compounding annual

hurdle amount equal to the Net Asset Value as at 31 December in the

previous year, as increased by the one year US Dollar LIBOR rate

(as derived from Bloomberg) calculated at the same date. The

Performance Allocation is subject to a "catch up" and a "high

watermark" requirement.

Offsetting financial instruments

Financial assets and financial liabilities are offset and the

net amount reported in the statement of financial position if, and

only if, there is a currently enforceable legal right to offset the

recognised amounts and there is an intention to settle on a net

basis, or to realise the asset and settle the liability

simultaneously.

Net gain or loss on financial assets and liabilities at fair

value through profit or loss

This item includes changes in the fair value of financial assets

and liabilities held for trading or designated upon initial

recognition as 'at fair value through profit or loss' and excludes

interest and dividend income and expenses.

Unrealised gains and losses comprise changes in the fair value

of financial instruments for the period and from reversal of prior

period's unrealised gains and losses for financial instruments

which were realised in the reporting period.

Realised gains and losses on disposals of financial instruments

classified as 'at fair value through profit or loss' are calculated

using the Average Cost (AVCO) method. They represent the difference

between an instrument's initial carrying amount and disposal

amount, or cash payments or receipts made on derivative contracts

(excluding payments or receipts on collateral margin accounts for

such instruments).

Due to and due from brokers

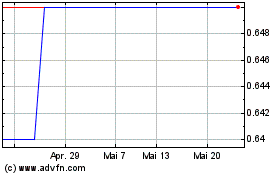

Africa Opportunity (LSE:AOF)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

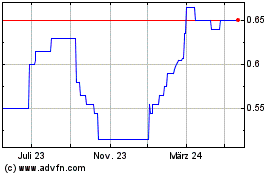

Africa Opportunity (LSE:AOF)

Historical Stock Chart

Von Jul 2023 bis Jul 2024