TIDMAOF

RNS Number : 9270O

Africa Opportunity Fund Limited

26 September 2013

26 September 2013

Africa Opportunity Fund Limited

("AOF" or "the Company")

Interim Results

The Board of Africa Opportunity Fund Limited ("AOF", "the

Company" or "the Fund") is pleased to announce its unaudited

results for the 6 month period to 30 June 2013.

Highlights:

-- AOF's net asset value per share of US$1.123 as at 30 June

2013 increased by 17.1% from the 31 December 2012 net asset value

per share of US$0.963.

-- As at 30 June 2013, AOF's investment allocation was 76% equities, 18% debt and 6% cash.

-- Dividends declared in the 6 month period in the amount of

$0.002 per share were paid on 12 April 2013 and 12 July 2013

respectively.

-- AOF's net asset value per share as at 31 August 2013 was US$1.178.

A copy of the unaudited interim financial statement is available

on the Company's website: www.africaopportunityfund.com.

For further information please contact:

Africa Opportunity Fund Limited

Francis Daniels Tel: +2711 684 1528

Grant Thornton UK LLP (Nominated Adviser)

Philip Secrett/David Hignell/Jamie Barklem Tel: +44 207 383 5100

LCF Edmond de Rothschild Securities Limited (Nominated

Broker)

Hiroshi Funaki Tel: +44 020 7845 5960

Investment Manager's Statement

Market Conditions: AOF's NAV increased approximately 4.3% during

Q2 2013. As a reference, in US terms in Q2 2013, the S&P rose

2.9%, South Africa fell 7.3%, Egypt fell 11.4%, Kenya fell

marginally - 0.3%, and Nigeria rose 7.7%.

Portfolio Highlights: The major contribution to AOF's

respectable performance in Q2 2013 was continued appreciation of a

few holdings in Ghana and Nigeria. In US Dollar terms, Enterprise

Group's share price rose by 52% in Q2 while Okomu Oil's rose by

29%. Their respective trailing 12 month P/E ratios at the end of Q2

stood at 3.9X, and 16.8X. AOF sold 78% of its Okomu Oil holdings in

April and May because its share price appreciated well above our 31

March, 2013 appraisal value. It took 7 months to acquire our entire

Okomu position in 2011 and 5 weeks to complete our sales. Clearly,

even the more illiquid of African listed companies enjoy breezes of

liquidity from time to time. This outcome illustrates that

illiquidity is often part of the challenge in acquiring

misunderstood or overlooked shares. As prices recover very often

liquidity recovers too. Happily, Okomu has generated a total US

Dollar return of 434% over 2 years.

Q2 provided challenges and disappointment too. African Bank

Investment Limited l ("ABL") lost half of its value. We considered

it one of our safe investments and its share price collapse is

humbling, to say the least. ABL announced in early May that its

interim profits would be 30% lower because of high non-performing

loans, especially among some of its Ellerines furniture retailing

customers. ABL responded by cutting its dividend 71% and reducing

its dividend payout ratio from 50% to 20%. It continues to face

serious challenges such as the possibility of a credit downgrade by

Moody's as well as the danger of South Africa's own sovereign

credit rating being downgraded in the next year. But, a crucial

ameliorating feature was that ABL continued to generate more

after-tax cash from its advances book than net income. In the long

run, net cold cash from advances is what builds a bank; not

accruing profits. African Bank remains very strong on that measure.

Undoubtedly, it will take a few years for its share price to leave

the recovery ward. Nevertheless, in the here and now, we have

increased substantially our investment in it. The other

disappointment during Q2 was the accelerated decline in the price

of gold miners like Anglogold Ashanti. They suffered grievously

from the sharp downturn in the gold price combined with the

prospect of tough wage negotiations and bitter strikes in South

Africa.

Finally, as discussed previously, we expected the Shoprite

litigation to commence in Q3. This litigation did in fact commence

in July. See our announcement which was released to the market on

29 July 2013 and available on the AOF website for more information.

We continue to remain confident that AOF holds clear title to its

shares. AOF will update the market accordingly with regards to

future developments.

Portfolio Appraisal Value: As of 30 June, the Manager's

appraisal of the economic value of the portfolio was $ 1.35. The

market price of $0.979 at 30 June represents a 27% discount. Note

the Appraisal Value is intended to provide a measure of the

Manager's long-term view of the attractiveness of AOF's portfolio.

It is a subjective estimate, and does not tell when that value will

be realized, nor does it guarantee that any security will reach its

Appraisal Value.

Outlook: We believe that AOF's portfolio possesses undervalued

companies. Its top 10 holdings combined offer a weighted average

P/E ratio of 7X, a dividend yield of 5.6%, a return on assets of

8.6% and a return on equity of 21.7%. We are excited by these

attractive valuation metrics and remain optimistic about AOF's

prospects.

AFRICA OPPORTUNITY FUND LIMITED

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

FOR THE PERIOD 1 JANUARY 2013 THROUGH 30 JUNE 2013

For the period For the period

ended 30 ended 30

Note June 2013 June 2012

--------------- -----------------

USD USD

Revenue

Dividend income 932,097 1,885,893

Interest income 337,420 235,302

Net exchange gains on bank 486,340 100,690

Profit on financial assets at fair value

through profit or loss 5(a) 7,391,461 -

Profit on financial liabilities at fair

value through profit or loss 5(b) 246,236 -

Other income - 2,119

9,393,554 2,224,004

---------------- ----------------

Expenses

Performance fees 1,319,179 -

Management fees 435,441 401,054

Brokerage fees 239,871 96,537

Custodian, secretarial and administration

fees 120,976 131,926

Interest charges and other fees 102,569 98,089

Other operating expenses 44,072 102,526

Directors' fees 40,000 40,000

Audit fees 20,251 31,733

Dividend paid 20,754 114,980

Losses on financial assets at fair value

through profit or loss - 1,805,228

Losses on financial liabilities at fair

value through profit or loss - 442,561

2,343,113 3,264,634

---------------- ----------------

Profit/(loss) before tax 7,050,441 (1,040,630)

Withholding tax 663 52,995

Profit after tax 7,049,778 (1,093,625)

Other comprehensive income - -

---------------- ----------------

Total comprehensive income for the period 7,049,778 (1,093,625)

================ ================

Attributable to:

Equity holders of the Company 6,985,000 (1,090,783))

Non-controlling interest 64,778 (2,842)

7,049,778 (1,093,625)

---------------- ----------------

Basic and diluted earnings per share

for gain attributable to the equity

holders of the Company during the period 9 0.1639 (0.0256)

AFRICA OPPORTUNITY FUND LIMITED

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

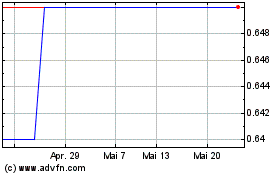

Africa Opportunity (LSE:AOF)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

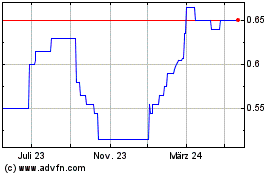

Africa Opportunity (LSE:AOF)

Historical Stock Chart

Von Jul 2023 bis Jul 2024