TIDMAOF

RNS Number : 6878M

Africa Opportunity Fund Limited

19 September 2012

19 September 2012

Africa Opportunity Fund Limited (AOF.L)

Announcement of Unaudited Interim Results for the 6 month period

to 30 June 2012

Africa Opportunity Fund Limited ("AOF" or the "Company"), the

closed-ended investment company which aims to achieve capital

growth and income through investments in value, arbitrage, and

special opportunities derived from the continent of Africa

announces its unaudited results for the 6 month period to 30 June

2012.

Highlights:

-- AOF's net asset value per share of US$0.903 as at 30 June

2012 fell by 2.7% from the 31 December 2011 net asset value per

share of US$0.933; including dividends.

-- As at 30 June 2012, AOF's investment allocation was 74%

listed equities, 11% debt and 15% cash.

-- Dividends in the amount of $0.0026 per share were paid on 10 April 2012 and 13 July 2012.

-- AOF's net asset value per share as at 31 August 2012 was US$0.880.

Investment Manager's Statement

Market Conditions: AOF's NAV fell during the first half of 2012.

The NAV, including dividends, declined by 2.7%, and closed at

$0.903 on 30 June 2012. As a reference, in US dollar terms in the

first six months of 2012, the S&P rose 9.5%, South Africa

gained 6.0%, Egypt gained 25.5%, Kenya rose 20.9%, and Nigeria rose

6.6%.

Portfolio Highlights: AOF's portfolio fell broadly in sympathy

with declines in African and global bourses during Q2. Natural

resources suffered disproportionately as fear of a China slowdown

took hold in the minds of investors. As a fund, which has

maintained exposure to commodities almost since inception, AOF in

particular, and Africa in general, felt those disproportionate

losses. There were three identifiable reasons behind AOF's Q2

losses. First, most natural resource commodity companies, whether

producers, developers, or explorers, constituting one third of

AOF's portfolio, lost approximately 8% of their initial Q2 2012

market capitalization by the end of Q2. Admittedly, in a few of

those cases, as is all too common in the mining industry, the

primary reasons for market capitalization losses were idiosyncratic

cost overruns and scheduling delays in commencing commercial

production of a commodity. AOF's losses were somewhat tempered by

some hedges which ameliorated the impact of the resource sector

decline on our NAV. On a positive note, AOF tendered its shares of

Extract Resources, the owner of the Rossing South uranium deposit,

estimated to be the fifth largest such deposit in the world, to

China Guangdong Nuclear Power Holding Corp for a modest 11% gain.

Acquired 4 months before the occurrence of the Fukushima nuclear

tragedy, AOF's Extract shares lost 38% of their value in the wake

of that disaster. The positive outcome vindicated our conviction

that large and shallow mineral development deposits in Africa have

a calculable intrinsic value. We also reduced AOF's base metal

exposure during Q2. Second, the pattern of the Ghana Cedi

depreciating sharply in an election year, contrary to our

expectations based on Ghana's new oilfield proceeds, is repeating

itself in 2012, an election year. 6.8% of the Company's March 2012

portfolio was invested in equity securities listed on the Ghana

Stock Exchange. Their market value fell by 27.7% in Q2. Ghana's

financial authorities have attempted to maintain the external value

of the Cedi by raising interest rates sharply past the 20% level,

despite Ghana's 10% inflation rate. For example, the discount rate

for 182-day Ghana Government treasury bills on 30 March 2012 was

12.6% and 2 year fixed rate note bore an interest rate of 13.6%. By

29 June, those rates had risen respectively to 20.4% and 23% while

Ghana's inflation rate hovered around 10%. To quote from the IMF's

recent 13 July statement on Ghana: "reserve cover has fallen below

comfortable levels. Furthermore, spending overruns at the end of

2011, large public wage increases and re-emergence of energy

subsidies have created the need for corrective action to achieve

fiscal targets." Consequently, interest rate sensitive companies,

as a general proposition, suffered declines in market

capitalization. In the case of the Enterprise Group, price declines

were exacerbated by a poor set of financial results in Q1, as its

expenses grew at a rapid rate. Fortunately, Enterprise Group

continued to generate underwriting profits. Better still, with a

Price/Book ratio of 0.59X, a Price/Embedded Value ratio of 0.42X on

30 June, and the option of investing in risk-free Ghanaian debt at

a 10% real margin or yield, its valuation was a sparkling bargain.

Finally, the discount between the Lusaka Stock Exchange price of

Shoprite, where AOF holds its Shoprite shares, and its Johannesburg

Stock Exchange price widened from 28% at the beginning of 2012 to

42% by the end of Q2. As of 30 June, the book value of AOF's

financial liabilities at fair value was $5.36 million.

Portfolio Appraisal Value: As of 30 June, the Manager's

appraisal of the economic value of the portfolio was $1.22. The

market price of $0.786 on 30 June represents a 36% discount. Note

the Appraisal Value is intended to provide a measure of the

Manager's long-term view of the attractiveness of AOF's portfolio.

It is a subjective estimate, and does not tell when that value will

be realized, nor does it guarantee that any security will reach its

Appraisal Value.

Outlook: We believe that AOF's portfolio possesses deeply

undervalued companies. Given the challenges facing global markets

and in particular heavily indebted industrial economies, it is

difficult to predict when this value will express itself in AOF's

NAV, but we remain excited by the opportunities we are finding for

AOF.

Africa Opportunity Partners

AFRICA OPPORTUNITY FUND LIMITED

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

FOR THE PERIOD 1 JANUARY 2012 THROUGH 30 JUNE 2012

For the For the Half

Half Year Year Ended

Note Ended 30 30 June 2011

June 2012

----------- --------------

USD USD

Revenue

Dividend revenue 1,885,893 813,018

Other income 2,119 66,345

Interest revenue 235,302 445,126

Net exchange gains on bank 100,690 26,096

Profit on financial assets at fair

value through profit or loss 5(a) - 2,202,126

------------

2,224,004 3,552,711

------------ ------------

Expenses

Losses on financial assets at fair

value through profit or loss 1,805,228 -

Losses on financial liabilities

at fair value through profit or

loss 442,561 181,018

Management fee 401,054 395,615

Custodian, secretarial and administration

fees 131,926 141,608

Dividend paid 114,980 22,474

Other operating expenses 102,526 28,416

Interest charges and other fees 98,089 27,823

Brokerage fees 96,537 50,496

Directors' fees 40,000 40,000

Audit fees 31,733 17,717

Tax incurred on dividend received 52,995 53,223

3,317,629 958,390

------------ ------------

(Loss)/ profit for the period (1,093,625) 2,594,321

Other comprehensive income - -

------------ ------------

Total comprehensive income for the

period (1,093,625) 2,594,321

============ ============

Attributable to:

Equity holders of the Company (1,090,783) 2,574,537

Non-controlling interest (2,842) 19,784

(1,093,625) 2,594,321

------------ ------------

Basic (loss)/ gain per share for

gain attributable to the equity

holders of the Company during the

period 9 (0.0256) 0.0604

The notes form an integral part of these financial

statements.

AFRICA OPPORTUNITY FUND LIMITED

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

AS AT 30 JUNE 2012

Notes As at As at

30 June 30 June

2012 2011

--------- ---------

USD USD

ASSETS

Financial assets at fair value

through profit or loss 5(a) 38,216,419 44,254,991

Trade and other receivables 6 1,157,142 566,819

Cash and cash equivalents 4,960,190 1,841,054

----------- -----------

Total assets 44,333,751 46,662,864

=========== ===========

EQUITY AND LIABILITIES

Liabilities

Financial liabilities at fair value

through profit or loss 5(b) 5,358,713 3,950,367

Trade and other payables 8 209,931 594,469

Total liabilities 5,568,644 4,544,836

----------- -----------

Equity

Share capital 7 426,303 426,303

Share premium 38,484,202 38,859,349

Retained losses (415,563) 2,552,322

----------- -----------

Equity attributable to equity holders

of the parent 38,494,942 41,837,974

Non controlling interest 270,165 280,054

Total equity 38,765,107 42,118,028

----------- -----------

Total equity and liabilities 44,333,751 46,662,864

=========== ===========

The notes form an integral part of these financial

statements.

AFRICA OPPORTUNITY FUND LIMITED

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE PERIOD 1 JANUARY 2012 THROUGH 30 JUNE 2012

ATTRIBUTABLE TO EQUITY HOLDERS OF THE PARENT

Issued Share Retained Non controlling Total

capital premium profit/(loss) Total interest equity

-------- ----------- -------------- -------------- ---------------- ------------

Notes USD USD USD USD USD USD

At 01 January 2011 426,303 39,012,818 (22,215) 39,416,906 260,270 39,677,176

Total Comprehensive

income for the period - - 697,435 697,435 12,737 710,172

Other comprehensive

income - - - - - -

Dividend (306,938) - (306,938) - (306,938)

At 31 December 2011 426,303 38,705,880 675,220 39,807,403 273,007 40,080,410

======== =========== ============== ============== ================ ============

At 01 January 2012 426,303 38,705,880 675,220 39,807,403 273,007 40,080,410

Total Comprehensive

income for the period - - (1,090,783) (1,090,783) (2,842) (1,093,625)

Other comprehensive

income - - - - - -

Dividend - (221,678) - (221,678) - (221,678)

At 30 June 2012 426,303 38,484,202 (415,563) 38,494,942 270,165 38,765,107

======== =========== ============== ============== ================ ============

The notes form an integral part of these financial

statements.

AFRICA OPPORTUNITY FUND LIMITED

CONSOLIDATED STATEMENT OF CASH FLOWS

FOR THE PERIOD 1 JANUARY 2012 THROUGH 30 JUNE 2012

Notes For the Period For the Period

Ended 30 Ended 30

June 2012 June 2011

--------------- ---------------

USD USD

Cash flows from operating activities

Comprehensive (loss)/ income for the

period (1,093,625) 2,594,321

Adjustment for:

Interest income (235,302) (445,126)

Dividend income (1,885,893) (759,795)

Loss/(gain) on financial assets at

fair value through profit or loss 1,805,228 (2,202,126)

Loss/(gain) on financial liabilities

at fair value through profit or loss 442,561 181,018

Tender offer pool adjustment - (1,094,591)

--------------

Operating losses before working capital

changes (967,031) (1,726,299)

Increase in other receivables and (138,256) -

prepayments

Decrease in other payables and accrued

expenses (54,673) (90,486)

------------ --------------

Net cash used in operating activities (1,159,960) (1,816,785)

------------ --------------

Interest received 169,690 635,162

Purchase of financial assets at fair

value through profit or loss (5,093,528) (5,035,141)

Disposal of financial assets at fair

value through profit or loss 7,521,595 4,305,977

Purchase of financial liabilities

at fair value through profit or loss - (3,047,258)

Disposal of financial liabilities

at fair value through profit or loss 1,503,412 765,206

Dividend received 1,456,706 695,248

--------------

Net cash generated from/ (used in)

investing activities 5,557,875 (1,680,806)

------------ --------------

Cash flows from financing activities

Dividend paid (221,678) (153,469)

--------------

Net cash flow used in financing activities (221,678) (153,469)

------------ --------------

Net increase/ (decrease) in cash and

cash equivalents 4,176,237 (3,651,060)

Cash and cash equivalents at the start

of the period 783,953 5,492,114

--------------

Cash and cash equivalents at the end

of the period 4,960,190 1,841,054

============ ==============

The notes form an integral part of these financial

statements.

AFRICA OPPORTUNITY FUND LIMITED

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE PERIOD 1 JANUARY 2012 THROUGH 30 JUNE 2012

1. GENERAL INFORMATION

Africa Opportunity Fund Limited (the "Company") was launched

with a listing on the AIM market of the London Stock Exchange in

July 2007.

Africa Opportunity Fund Limited is a closed-ended fund

incorporated with limited liability and registered in Cayman

Islands under the Companies Law on 21 June 2007 and with registered

number MC-188243.

The Company aims to achieve capital growth and income through

investment in value, arbitrage, and special situations investments

in the continent of Africa. The Company therefore may invest in

securities issued by companies domiciled outside Africa which

conduct significant business activities within Africa. The Company

will have the ability to invest in a wide range of asset classes

including real estate interests, equity, quasi-equity or debt

instruments and debt issued by African sovereign states and

government entities.

The Company's investment activities are managed by Africa

Opportunity Partners Limited, a limited liability company

incorporated in the Cayman Islands and acting as the investment

manager pursuant to an Investment Management Agreement dated 18

July 2007.

To ensure that investments to be made by the Company, and the

returns generated on the realisation of investments, are both

effected in the most tax efficient manner, the Company has

established Africa Opportunity Fund L.P. as an exempted limited

partnership in the Cayman Islands. All investments made by the

Company will be made through the limited partnership. The limited

partners of the limited partnership are the Company and AOF CarryCo

Limited. The general partner of the limited partnership is Africa

Opportunity Fund (GP) Limited.

Presentation currency

The consolidated financial statements are presented in the

United States dollars ("USD").

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

The principal accounting policies applied in the preparation of

these consolidated financial statements are set out below. These

policies have been consistently applied from the prior year to the

current year for items which are considered material in relation to

the consolidated financial statements.

Statement of compliance

The financial statements are prepared in accordance with

International Financial Reporting Standards (IFRS) as issued by the

International Accounting Standards Board (IASB).

Basis of preparation

The consolidated financial statements have been prepared under

the historical cost convention except for the fair valuation of

financial assets and financial liabilities at fair value through

profit or loss.

The preparation of consolidated financial statements in

conformity with IFRS requires the use of certain critical

accounting estimates. It also requires the Board of Directors to

exercise its judgement in the process of applying the Company and

its subsidiaries' (referred to as the "Group") accounting policies.

The areas involving a higher degree of judgement or complexity, or

areas where assumptions and estimates are significant to the

consolidated financial statements, are disclosed in Note 4.

Basis of consolidation

The consolidated financial statements comprise the financial

statements of the Group as at 30 June 2012.

Subsidiaries are fully consolidated from the date of

acquisition, being the date on which the Group obtains control and

continued to be consolidated until the date that such control

ceases.

The financial statements of the subsidiaries are prepared for

the same reporting period as the parent company, using consistent

accounting policies.

All intra-group balances, income and expenses and unrealised

gains and losses resulting from intra-group transactions are

eliminated in full.

Non-controlling interests represent the portion of profit or

loss and net assets not held by the Group and are presented

separately in the statement of comprehensive income and within

equity in the Statement of Changes in Equity from parent

shareholders' equity.

Foreign currency translation

(a) Functional and presentation currency

The Group's consolidated financial statements are presented in

USD which is the Group's functional currency. That is the currency

of the primary economic environment in which the Company operates.

Each entity in the Group determines its own functional currency and

items included in the financial statements of each entity are

measured using that functional currency. The functional currency of

the entities within the Group is USD. The Group chose USD as the

presentation currency.

(b) Transactions and balances

Transactions in foreign currencies are initially recorded at the

functional currency rate prevailing at the date of transaction.

Monetary assets and liabilities denominated in foreign currencies

are retranslated at the functional currency spot rate of the

exchange ruling at the reporting date. All differences are taken to

profit or loss. Non-monetary items that are measured in terms of

historical cost in a foreign currency are translated using the

exchange rates as at the dates of the initial transactions.

Non-monetary items measured at fair value in a foreign currency are

translated using the exchange rates at the date when the fair value

is determined.

Financial instruments

(i) Classification

The Group classifies its financial assets and liabilities in

accordance with IAS 39.

Financial assets and liabilities at fair value through profit or

loss

The category of the financial assets and liabilities at fair

value through the profit or loss is subdivided into:

Financial assets and liabilities held for trading: financial

assets are classified as held for trading if they are acquired for

the purpose of selling and repurchasing in the near term. This

category includes equity securities, investments in managed funds

and debts instruments. These assets are acquired principally for

the purpose of generating a profit from short term fluctuation in

price. All derivatives and liabilities from the short sales of

financial instruments are classified as held for trading. The Group

policy is not to apply hedge accounting.

Financial instruments designated as at fair value through profit

or loss upon initial recognition: these include equity securities

and debt instruments that are not held for trading. These financial

assets are designated on the basis that they are part of a group of

financial assets which are managed and have their performance

evaluated on a fair value basis, in accordance with risk management

and investment strategies of the Group, as set out in the Group's

offering document. The financial information about the financial

assets is provided internally on that basis to the Investment

Manager and to the Board of Directors.

Options

Options are contractual agreements that convey the right, but

not the obligation, for the purchaser either to buy or sell a

specific amount of a financial instrument at a fixed price, either

at a fixed future date or at any time within a specified

period.

The Fund purchases and sells put and call options through

regulated exchanges and OTC markets. Options purchased by the Fund

provide the Fund with the opportunity to purchase (call options) or

sell (put options) the underlying asset at an agreed-upon value

either on or before the expiration of the option. The Fund is

exposed to credit risk on purchased options only to the extent of

their carrying amount, which is their fair value.

Options written by the Fund provide the purchaser the

opportunity to purchase from or sell to the Fund the underlying

asset at an agreed-upon value either on or before the expiration of

the option.

Options are generally settled on a net basis.

Financial instruments designated as at fair value through profit

or loss upon initial recognition: these include equity securities

and debt instruments that are not held for trading. These financial

assets are designated on the basis that they are part of a group of

financial assets which are managed and have their performance

evaluated on a fair value basis, in accordance with risk management

and investment strategies of the Group, as set out in the Group's

offering document. The financial information about the financial

assets is provided internally on that basis to the Investment

Manager and to the Board of Directors.

The vast majority of the financial assets are expected to be

realised within the 12 months of the reporting date.

Loans and receivables

Loans and receivables are non-derivatives financial assets with

fixed or determinable payments that are not quoted in an active

market. They are included in current assets, except for maturities

greater than 12 months after the reporting date. These are

classified as non-current assets. The Group's loans and receivables

comprise 'trade and other receivables' and 'cash and cash

equivalents' in the statement of financial position.

Other financial liabilities

This category includes all financial liabilities, other than

those classified as at fair value through profit or loss. The Group

includes in this category amounts relating to other short term

payables.

(ii) Recognition

The Group recognises a financial asset or a financial liability

when, and only when, it becomes a party to the contractual

provisions of the instrument.

Purchases or sales of financial assets that require delivery of

assets within the time frame generally established by regulation or

convention in the market place are recognised directly on the trade

date, i.e., the date that the Group commits to purchase or sell the

asset.

(iii) Initial measurement

Financial assets and liabilities at fair value through profit or

loss are recorded in the statement of financial position at fair

value. All transaction costs for such instruments are recognised

directly in profit or loss.

Derivatives embedded in other financial instruments are treated

as separate derivatives and recorded at fair value if their

economic characteristics and risks are not closely related to those

of the host contract, and the host contract is not itself

classified as held for trading or designated at fair value though

profit or loss. Embedded derivatives separated from the host are

carried at fair value with changes in fair value recognised in

profit or loss.

Loans and receivables and financial liabilities (other than

those classified as held for trading) are measured initially at

their fair value plus any directly attributable incremental costs

of acquisition or issue.

(iv) Subsequent measurement

After initial measurement, the Group measures financial

instruments which are classified as at fair value through profit or

loss at fair value. Subsequent changes in the fair value of those

financial instruments are recorded in 'Net gain or loss on

financial assets and liabilities at fair value through profit or

loss'. Interest earned and dividend revenue elements of such

instruments are recorded separately in 'Interest revenue' and

'Dividend revenue', respectively. Dividend expenses related to

short positions are recognised in 'Dividends on securities sold not

yet purchased'.

Loans and receivables are carried at amortised cost using the

effective interest method less any allowance for impairment. Gains

and losses are recognised in profit or loss when the loans and

receivables are derecognised or impaired, as well as through the

amortisation process.

Financial liabilities, other than those classified as at fair

value through profit or loss, are measured at amortised cost using

the effective interest method. Gains and losses are recognised in

profit or loss when the liabilities are derecognised, as well as

through the amortisation process.

The effective interest method is a method of calculating the

amortised cost of a financial asset or a financial liability and of

allocating the interest income or interest expense over the

relevant period. The effective interest rate is the rate that

exactly discounts estimated future cash payments or receipts

through the expected life of the financial instrument or, when

appropriate, a shorter period to the net carrying amount of the

financial asset or financial liability. When calculating the

effective interest rate, the Group estimates cash flows considering

all contractual terms of the financial instruments, but does not

consider future credit losses. The calculation includes all fees

paid or received between parties to the contract that are an

integral part of the effective interest rate, transaction costs and

all other premiums or discounts.

v) Derecognition

A financial asset (or, where applicable, a part of a financial

asset or part of a group of similar financial assets) is

derecognised where:

-- The rights to receive cash flows from the asset have expired;

or

-- The Group has transferred its rights to receive cash flows

from the asset or has assumed an obligation to pay the received

cash flows in full without material delay to a third party under a

'pass-through' arrangement; and

-- Either (a) the Group has transferred substantially all the

risks and rewards of the asset, or (b) the Group has neither

transferred nor retained substantially all the risks and rewards of

the asset, but has transferred control of the asset.

When the Group has transferred its rights to receive cash flows

from an asset (or has entered into a pass-through arrangement), and

has neither transferred nor retained substantially all the risks

and rewards of the asset nor transferred control of the asset, the

asset is recognised to the extent of the Group's continuing

involvement in the asset.

The Group derecognises a financial liability when the obligation

under the liability is discharged, cancelled or expires.

Determination of fair value

Fair value is the amount for which an asset could be exchanged,

or a liability settled, between knowledgeable, willing parties in

an arm's length transaction.

The fair value for financial instruments traded in active

markets at the reporting date is based on their quoted price or

binding dealer price quotations, without any deduction for

transaction costs.

For all other financial instruments not traded in an active

market, the fair value is determined by using appropriate valuation

techniques. Valuation techniques include: using recent arm's length

market transactions; reference to the current market value of

another instrument that is substantially the same; discounted cash

flow analysis and option pricing models making as much use of

available and supportable market data as possible.

Impairment of financial assets

The Group assesses at each reporting date whether a financial

asset or group of financial assets classified as loans and

receivables is impaired. Evidence of impairment may include

indications that the debtor, or a group of debtors, is experiencing

significant financial difficulty, default or delinquency in

interest or principal payments, the probability that they will

enter bankruptcy or other financial reorganisation and, where

observable data indicate that there is a measurable decrease in the

estimated future cash flows, such as changes in arrears or economic

conditions that correlate with defaults.

If there is objective evidence that an impairment loss has been

incurred, the amount of the loss is measured as the difference

between the asset's carrying amount and the present value of

estimated future cash flows (excluding future expected credit

losses that have not yet been incurred) discounted using the

asset's original effective interest rate. The carrying amount of

the asset is reduced through the use of an allowance account and

the amount of the loss is recognised in profit or loss.

Impaired debts, together with the associated allowance, are

written off when there is no realistic prospect of future recovery

and all collateral has been realised or has been transferred to the

Group. If, in a subsequent period, the amount of the estimated

impairment loss increases or decreases because of an event

occurring after the impairment was recognised, the previously

recognised impairment loss is increased or reduced by adjusting the

allowance account. If a previous write-off is later recovered, the

recovery is credited to profit or loss.

Interest revenue on impaired financial assets is recognised

using the rate of interest used to discount the future cash flows

for the purpose of measuring the impairment loss.

Offsetting financial instruments

Financial assets and financial liabilities are offset and the

net amount reported in the statement of financial position if, and

only if, there is a currently enforceable legal right to offset the

recognised amounts and there is an intention to settle on a net

basis, or to realise the asset and settle the liability

simultaneously.

Net gain or loss on financial assets and liabilities at fair

value through profit or loss

This item includes changes in the fair value of financial assets

and liabilities held for trading or designated upon initial

recognition as 'at fair value through profit or loss' and excludes

interest and dividend income and expenses.

Unrealised gains and losses comprise changes in the fair value

of financial instruments for the period and from reversal of prior

period's unrealised gains and losses for financial instruments

which were realised in the reporting period.

Realised gains and losses on disposals of financial instruments

classified as 'at fair value through profit or loss' are calculated

using the Average Cost (AVCO) method. They represent the difference

between an instrument's initial carrying amount and disposal

amount, or cash payments or receipts made on derivative contracts

(excluding payments or receipts on collateral margin accounts for

such instruments).

Due to and due from brokers

Amounts due to brokers are payables for securities purchased (in

a regular way transaction) that have been contracted for but not

yet delivered on the reporting date. Refer to the accounting policy

for 'financial liabilities, other than those classified as at fair

value through profit or loss' for recognition and measurement.

Amounts due from brokers include margin accounts and receivables

for securities sold (in a regular way transaction) that have been

contracted for but not yet delivered on the reporting date. Refer

to accounting policy for 'loans and receivables' for recognition

and measurement.

Margin accounts represent cash deposits held with brokers as

collateral against open futures contracts.

Interest revenue and expense

Interest revenue and expense are recognised in the statement of

comprehensive income for all interest-bearing financial instruments

using the effective interest method.

Dividend revenue and expense

Dividend revenue is recognised when the Group's right to receive

the payment is established. Dividend revenue is presented gross of

any non-recoverable withholding taxes, which are disclosed

separately in the statement of comprehensive income. Dividend

expense relating to equity securities sold short is recognised when

the shareholders' right to receive the payment is established.

Stated capital

Ordinary shares are classified as equity.

Provision

A provision is recognised when and only when there is a present

obligation (legal or constructive) as a result of a past event, and

it is probable that an outflow embodying economic benefits will be

required to settle that obligation and a reliable estimate can be

made of the amount of the obligation. Provisions are reviewed at

each reporting date and adjusted to reflect the current best

estimate.

Cash and cash equivalents

Cash and cash equivalents comprise cash at bank. Cash

equivalents are short term, highly liquid investments that are

readily convertible to known amounts of cash and which are subject

to an insignificant risk of change in value.

Related parties

For the purposes of these consolidated financial statements,

parties are considered to be related to the Group if they have the

ability, directly or indirectly, to control the Group or exercise

significant influence over the Group in making financial and

operating decisions, or vice versa, or where the Group is subject

to common control or common significant influence. Related parties

may be individuals or other entities.

3. CHANGES IN ACCOUNTING POLICY AND DISCLOSURES

New and amended standards and interpretations

The accounting policies adopted are consistent with those of the

previous financial year, except for the following new and amended

IFRS and IFRIC interpretations effective as of 1 January 2011:

-- IAS 24 Related Party Disclosures (amendment) effective 1 January 2011

-- IAS 32 Financial Instruments: Presentation (amendment) effective 1 February 2010

-- IFRA 1 First-time Adoption of International Financial

Reporting Standards - Limited Exemption from Comparative IRFS 7

Disclosures for First-time Adopters effective 1 July 2010

-- IFRIC 14 Prepayments of a Minimum Funding Requirement (amendment) effective 1 January 2011

-- IFRIC 19 Extinguishing Financial Liabilities with Equity Instruments effective 1 July 2010

-- Improvements to IFRSs (May 2010) effective either 1 July 2010 or 1 January 2011.

The adoption of the standards or interpretations is described

below:

IAS 24 Related Party Transactions (Amendment)

The IASB issued an amendment to IAS 24 that clarifies the

definitions of a related party. The new definitions emphasise a

symmetrical view of related party relationships and clarifies the

circumstances in which persons and key management personnel affect

the related party relationships of an entity. In addition, the

amendment introduces an exemption from the general related party

disclosure requirements for transactions with government and

entities that are controlled, jointly controlled or significantly

influenced by the same government as the reporting entity. The

adoption of the amendment did not have any impact on the financial

position or performance of the Group.

IAS 32 Financial Instruments: Presentation (Amendment)

The IASB issued an amendment that alters the definition of a

financial liability in IAS 32 to enable entities to classify rights

issues and certain options or warrants as equity instruments. The

amendment is applicable if the rights are given pro rata to all of

the existing owners of the same class of an entity's non-derivative

equity instruments, to acquire a fixed number of the entity's own

equity instruments for a fixed amount in any currency. The

amendment has had no effect on the financial position or

performance of the Fund because the Fund does not have these types

of instruments.

IFRS 1 First-time Adoption of International Financial Reporting

Standards - Limited Exemption from Comparative IFRS 7 Disclosure

for First-time Adopters

The Standard has been amended to allow first-time adopters to

utilise the transitional provisions of IFRS 7 Financial

Instruments: Disclosures. The amendments provide relief to

first-time adopters, by reducing the costs and resources required

to provide certain comparative disclosures. The amendments may be

applied earlier than the effective date.

IFRIC 14 Prepayments of a Minimum Funding Requirement

(Amendment)

The amendment removes an unintended consequence when an entity

is subject to minimum funding requirements and makes an early

payment of contributions to cover such requirements. The amendment

permits a prepayment of future service costs by the entity to be

recognised as a pension asset. The amendment has had no effect on

the financial position or performance of the Group because the

Group does not have employee benefit schemes.

IFRIC 19 Extinguishing Financial Liabilities with Equity

Instruments

In November 2009, the IASB issued IFRIC 19 Extinguishing

Financial Liabilities with Equity. The interpretation clarifies

that equity instruments issued to a creditor to extinguish a

financial liability qualify as consideration paid. The equity

instruments issued are measured at their fair value. In cases that

this cannot be reliably measured, the instruments are measured at

the fair value of the liability extinguished. Any gain or loss is

recognised immediately in profit or loss. The adoption of this

interpretation had no effect on the financial statements of the

Group and will only affect such future transactions.

Improvements to IFRSs

In May 2010, the IASB issued its third omnibus of amendments to

its standards, primarily with a view to removing inconsistencies

and clarifying wording. There are separate transitional provisions

for each standard. The adoption of the following amendments

resulted in changes to presentation and disclosure and to

accounting policies but had no impact on the financial position or

performance of the Group.

IFRS 7 Financial Instruments - Disclosures: The amendment was

intended to simplify the disclosures provided, by reducing the

volume of disclosures around collateral held and improving

disclosures by requiring qualitative information to put the

quantitative information in context. The Group reflects the revised

disclosure requirements in Note 16.

Other amendments resulting from Improvements to IFRSs to the

following standards and interpretations did not have any impact on

the accounting policies, financial position or performance of the

Group:

-- IAS 1 Presentation of Financial Statements (Presentation of

an analysis of each component of other comprehensive income)

-- IFRS 1 First-time Adoption of International Financial Reporting Standards

-- IFRS 3 Business Combinations (Contingent consideration

arising from business combination prior to adoption of IFRS 3 (as

revised in 2008))

-- IFRS 3 Business Combinations (Un-replaced and voluntarily

replaced share-based payment awards)

-- IAS 27 Consolidated and Separate Financial Statements

-- IAS 34 Interim Financial Statement

-- IFRIC 13 Customer Loyalty Programmes (determining the fair value of award credits)

Standards issued but not yet effective

Standards issued but not yet effective up to the date of

issuance of the Company's financial statements are listed below.

The Group intends to adopt applicable standards when they become

effective.

IAS 1 Financial Statement Presentation - Presentation of Items

of Other Comprehensive Income

The amendments to IAS 1 change the grouping of items presented

in OCI. Items that could be reclassified (or 'recycled') to profit

or loss at a future point in time (for example, upon derecognition

or settlement) would be presented separately from items that will

never be reclassified. The amendment affects presentation only and

has no impact on the Company's financial position or performance.

The amendment becomes effective for annual periods beginning on or

after 1 July 2012.

IAS 12 Income Taxes (Amendments) - Deferred Taxes: Recovery of

Underlying Assets

The Standard introduces a rebuttable presumption that deferred

tax on investment properties measured at fair value will be

recognised on a sale basis, unless the entity has a business model

that would indicate the investment property will be consumed in the

business, in which case, a use basis will be adopted. The

amendments also introduce the requirement that deferred tax on

non-depreciable assets measured using the revaluation model in IAS

16 should always be measured on a sale basis. The amendment becomes

effective for annual periods beginning on or after 1 January 2012.

The amendment has no impact on the company's financial position or

performance as the Company is not subject to income or any other

Cayman Island taxes.

IAS 19 Employee Benefits (Amendment)

The IASB has issued numerous amendments to IAS 19. These range

from fundamental changes such as removing the corridor mechanism

and the concept of expected returns on plan assets to simple

clarifications and re-wording. The amendment becomes effective for

annual periods beginning on or after 1 January 2013.

The Group has no employee benefits which would be affected by

these amendments.

IAS 27 Separate Financial Statements (as revised in 2011)

As a consequence of the new IFRS 10 and IFRS 12, what remains in

IAS 27 is limited to accounting for subsidiaries, jointly

controlled entities, and associates in separate financial

statements. The amendment becomes effective for annual periods

beginning on or after 1 January 2013.

IAS 28 Investments in Associates and Joint Ventures (as revised

in 2011)

As a consequence of the new IFRS 11 and IFRS 12, IAS 28 has been

renamed IAS 28 Investments in Associates and Joint Ventures, and

describes the application of the equity method to investments in

joint ventures in addition to associates. As the Group has no

associates or joint venture investments, this amendment has no

impact on the Group's financial position or performance. The

amendment becomes effective for annual periods beginning on or

after 1 January 2013.

IAS 32 Financial Instruments: Presentation - Offsetting

Financial Assets and Financial Liabilities

The amendments clarify the meaning of 'currently has a legally

enforceable right of set-off'; and that some gross settlement

systems may be considered equivalent to net settlement. The

amendments are effective for annual periods beginning on or after 1

January 2014 and are required to be applied retrospectively.

IFRS 1 First-time Adoption of International Financial Reporting

Standards (Amendment) - Severe Hyperinflation and Removal of Fixed

Dates for First-time Adopters

The amendment provides that, when an entity's date of transition

to IFRS is on, or after, the date its functional currency ceases to

be subject to hyperinflation, the entity may elect to measure all

assets and liabilities held before the functional currency

normalisation date that were subject to severe hyperinflation, at

fair value, on the date of transition to IFRS. This fair value may

be deemed cost of those assets and liabilities in the opening IFRS

statement of financial position.

A further amendment to the Standard is the removal of the legacy

fixed dates in IFRS 1 relating to derecognition and day one gain or

loss transactions have also been removed. The standard now has

these dates coinciding with the date of transition to IFRS.

The amendments may be applied earlier than the effective

date.

IFRS 7 Financial Instruments: Disclosures - Enhanced

Derecognition Disclosure Requirements

The amendment requires additional disclosure about financial

assets that have been transferred but not derecognised to enable

the user of the financial statements to understand the relationship

with those assets that have not been derecognised and their

associated liabilities. In addition, the amendment requires

disclosures about continuing involvement in derecognised assets to

enable the user to evaluate the nature of, and risks associated

with, the entity's continuing involvement in those derecognised

assets. The amendment becomes effective for annual periods

beginning on or after 1 July 2011. The amendment affects disclosure

only and has no impact on the Group's financial position or

performance.

IFRS 7 Financial Instruments: Disclosures

Common disclosure requirements were issued that are intended to

help investors and other users to better assess the effect or

potential effect of offsetting arrangements on a company's

financial position. The new requirements are set out in

Disclosures-Offsetting Financial Assets and Financial Liabilities

(Amendments to IFRS 7). As part of that project the IASB also

clarified aspects of IAS 32 Financial Instruments: Presentation.

The amendments address consistencies in current practice when

applying the requirements.

IFRS 9 Financial Instruments

The Standard covers the classification and measurement of

financial assets, as the first part of its project to replace IAS

39. It is effective as from 1 January 2013.

IFRS 9 Financial Instruments - Classification and measurement of

financial assets, Accounting for financial liabilities and

derecognition

The mandatory effective date of IFRS 9 has been deferred to 1

January 2015. The amendments also provide relief from restating

comparative information and require disclosures (in IFRS 7) to

enable users of financial statements to understand the effect of

beginning to apply IFRS 9.

IFRS 9 Financial Instruments: Classification and Measurement

IFRS 9 as issued reflects the first phase of the IASB's work on

the replacement of IAS 39 and applies to classification and

measurement of financial assets and financial liabilities as

defined in IAS 39. The standard is effective for annual periods

beginning on or after 1 January 2013. In subsequent phases, the

IASB will address hedge accounting and impairment of financial

assets. The completion of this project is expected over the course

of 2011 or the first half of 2012. The adoption of the first phase

of IFRS 9 will have an effect on the classification and measurement

of the Group's financial assets but will potentially have no impact

on classification and measurements of financial liabilities. The

Group will quantify the effect in conjunction with the other

phases, when issued, to present a comprehensive picture.

IFRS 10 Consolidated Financial Statements

IFRS 10 replaces the portion of IAS 27 Consolidated and Separate

Financial Statements that addresses the accounting for consolidated

financial statements. It also replaces SIC-12 Consolidation -

Special Purpose Entities. IFRS 10 establishes a single control

model that applies to all entities including 'special purpose

entities'.

The changes introduced by IFRS 10 will require management to

exercise significant judgement to determine which entities are

controlled, and therefore required to be consolidated by a parent,

compared with the requirements that were in IAS 27. This standard

becomes effective for annual periods beginning on or after 1

January 2013. This amendment will have an impact as the Company

prepares consolidated Financial Statements.

IFRS 11 Joint Arrangements

IFRS 11 replaces IAS 31 Interests in Joint Ventures and SIC-13

Jointly-controlled Entities - Non-monetary Contributions by

Venturers. IFRS 11 removes the option to account for jointly

controlled entities (JCEs) using proportionate consolidation.

Instead, JCEs that meet the definition of a joint venture must be

accounted for using the equity method. The application of this new

standard will not impact the financial position and performance of

the Group.

This standard becomes effective for annual periods beginning on

or after 1 January 2013.

IFRS 12 Disclosure of Involvement with Other Entities

IFRS 12 includes all of the disclosures that were previously in

IAS 27 related to consolidated financial statements, as well as all

of the disclosures that were previously included in IAS 31 and IAS

28. These disclosures relate to an entity's interests in

subsidiaries, joint arrangements, associates and structured

entities.

A number of new disclosures are also required. This standard

becomes effective for annual periods beginning on or after 1

January 2013.

IFRS 13 Fair Value Measurement

IFRS 13 establishes a single source of guidance under IFRS for

all fair value measurements. IFRS 13 does not change when an entity

is required to use fair value, but rather provides guidance on how

to measure fair value under IFRS when fair value is required or

permitted. The Group is currently assessing the impact that this

standard will have on the financial position and performance. This

standard becomes effective for annual periods beginning on or after

1 January 2013.

4. SIGNIFICANT ACCOUNTING JUDGEMENTS, ESTIMATES AND ASSUMPTIONS

The preparation of the Group's financial statements requires

management to make judgements, estimates and assumptions that

affect the reported amounts recognised in the financial statements

and disclosure of contingent liabilities. However, uncertainty

about these assumptions and estimates could result in outcomes that

could require a material adjustment to the carrying amount of the

asset or liability affected in future periods.

Judgements

In the process of applying the Group's accounting policies,

management has made the following judgements, which have the most

significant effect on the amounts recognised in the financial

statements:

Going Concern

The Group's management has made an assessment of the Group's

ability to continue as a going concern and is satisfied that the

Company has the resources to continue in business for the

foreseeable future. Furthermore, management is not aware of any

material uncertainties that may cast significant doubt upon the

Company's ability to continue as a going concern. Therefore, the

financial statements continue to be prepared on the going concern

basis.

Determination of functional currency

The determination of the functional currency of the Group is

critical since recording of transactions and exchange differences

arising thereon are dependent on the functional currency selected.

As described in Note 2, the directors have considered those factors

therein and have determined that the functional currency of the

Company is the United States Dollar.

Estimates and assumptions

The key assumptions concerning the future and other key sources

of estimation uncertainty at the reporting date, that have a

significant risk of causing a material adjustment to the carrying

amounts of assets and liabilities within the next financial year,

are discussed below. The Group based its assumptions and estimates

on parameters available when the financial statements were

prepared. However, existing circumstances and assumptions about

future developments may change due to market changes or

circumstances arising beyond the control of the Group. Such changes

are reflected in the assumptions when they occur.

Fair value of financial instruments

When the fair value of financial assets and financial

liabilities recorded in the statement of financial position cannot

be derived from active markets, their fair value is determined

using a variety of valuation techniques that include the use of

mathematical models. The inputs to these models are taken from

observable markets where possible, but where this is not feasible,

estimation is required in establishing fair values. The estimates

include considerations of liquidity and model inputs such as credit

risk (both own and counterparty's), correlation and volatility.

Changes in assumptions about these factors could affect the

reported fair value of financial instruments in the statement of

financial position and the level where the instruments are

disclosed in the fair value hierarchy. The models are calibrated

regularly and tested for validity using prices from any observable

current market transactions in the same instrument (without

modification or repackaging) or based on any available observable

market data. IFRS 7 requires disclosures relating to fair value

measurements using a three-level fair value hierarchy. The level

within which the fair value measurement is categorised in its

entirety is determined on the basis of the lowest level input that

is significant to the fair value measurement in its entirety.

Assessing the significance of a particular input requires

judgement, considering factors specific to the asset or liability.

To assess the significance of a particular input to the entire

measurement, the Group performs sensitivity analysis or stress

testing techniques.

5(a). FINANCIAL ASSETS AT FAIR VALUE THROUGH PROFIT OR LOSS

30 June 2012 30 June 2011

------------- -------------

USD USD

Designated at fair value through profit

or loss:

At start of year 42,449,714 41,323,702

Additions 5,093,528 5,035,140

Disposals (7,521,595) (4,305,977)

Net gain on financial assets at fair value

through profit or loss (1,805,228) 2,202,126

38,216,419 44,254,991

============= ============

Analysis of portfolio:

- Listed equity securities 33,556,997 32,795,193

- Unlisted equity securities 2,305,499 46,469

- Listed debt securities 2,153,923 10,418,386

- Unlisted debt securities 200,000 994,943

-----------

38,216,419 44,254,991

=========== ===========

5(b). FINANCIAL LIABILITIES AT FAIR VALUE THROUGH PROFIT OR LOSS

30 June 2012 30 June 2011

USD USD

Written put option 481,090 98,750

Written call option and short position - 3,851,617

Listed securities sold short 4,877,623 -

-------------

5,358,713 3,950,367

============= =============

6. TRADE AND OTHER RECEIVABLES

30 June 2012 30 June 2011

------------- -------------

USD USD

Interest receivable on bonds 209,254 481,634

Dividend receivable 631,905 85,185

Other receivables 315,983 -

1,157,142 566,819

============= =============

The receivables are neither past due nor impaired. Interests

receivable on bonds are due within six months.

7. SHARE CAPITAL

2012 2012 2011 2011

-------------- ----------- -------------- -----------

Number USD Number USD

Authorised share

capital

Ordinary shares with

a par value of USD

0.01 1,000,000,000 10,000,000 1,000,000,000 10,000,000

Share capital

At 1 January 42,630,327 426,303 42,630,327 426,303

At 31 December 42,630,327 426,303 42,630,327 426,303

=========== ======== =========== ========

The directors have the general authority to repurchase the

ordinary shares in issue subject to the Company having funds

lawfully available for the purpose. However, if the market price of

the ordinary shares falls to a discount to the Net Asset Value, the

directors will consult with the Investment Manager as to whether it

is appropriate to instigate a repurchase of ordinary shares.

8. TRADE AND OTHER PAYABLES

30 June 2012 30 June 2011

------------- -------------

USD USD

Accrued expenses 58,423 50,480

Dividend payable 110,839 76,735

Other payables 40,669 467,254

-------- --------

209,931 594,469

======== ========

Other payables are non-interest bearing and are due on

demand.

9. GAIN/ (LOSS) PER SHARE

Basic gain/ (loss) per share is calculated by dividing the gain/

(loss) attributable to equity holders by the weighted average

number of ordinary shares in issue during the period excluding

ordinary shares purchased by the Company (including those

repurchased in accordance with the Tender Offer) and held as

treasury shares.

The Company's diluted gain/ (loss) per share is the same as

basic gain/ (loss) per share, since the Company has not issued any

instrument with dilutive potential.

2012 2011

------------ -----------

Gain/(loss) attributable to equity

holders of the Company USD (1,090,783) 2,574,537

Weighted average number of ordinary

share in issue 42,630,327 42,630,327

Basic (loss)/ gain per share USD (0.0256) 0.0604

============ ===========

10. TAXATION

Under the current laws of Cayman Islands, there is no income,

estate, transfer sales or other Cayman Islands taxes payable by the

Fund. As a result, no provision for income taxes has been made in

the financial statements.

11. SEGMENT INFORMATION

For management purposes, the Group is organised in one main

operating segment, which invests in equity securities, debt

instruments and relative derivatives. All of the Group's activities

are interrelated, and each activity is dependent on the others.

Accordingly, all significant operating decisions are based upon

analysis of the Group as one segment. The financial results from

this segment are equivalent to the financial statements of the

Group as a whole.

12. PERSONNEL

The Group did not employ any personnel during the half year

period ended 30 June 2012 (2011: the same).

Website: www.africaopportunityfund.com

For further information please contact:

Africa Opportunity Fund Limited

Francis Daniels Tel: +2711 684 1528

Grant Thornton UK LLP (Nominated Adviser)

Philip Secrett/David Hignell Tel: +44 207 383 5100

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR QKLFFLKFXBBZ

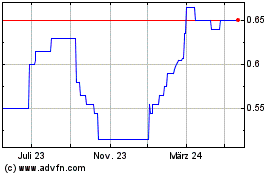

Africa Opportunity (LSE:AOF)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Africa Opportunity (LSE:AOF)

Historical Stock Chart

Von Jul 2023 bis Jul 2024