TIDMAOF

4 February 2009

NOT FOR PUBLICATION, DISTRIBUTION OR RELEASE IN OR INTO AUSTRALIA,

CANADA, JAPAN OR THE UNITED STATES

Africa Opportunity Fund Limited

Tender Offer

Africa Opportunity Fund Limited, a closed-end investment company

traded on the AIM Market of the London Stock Exchange and listed on

the Channel Islands Stock Exchange, is offering, conditional upon

Shareholder approval at an extraordinary general meeting, each

Shareholder the right to tender some or all of the Ordinary Shares

held by such Shareholder.

Notice of the Tender Offer EGM is set out in the Circular (a copy of

which will shortly be available from the Company's website

www.africaopportunityfund.com and will be posted to Shareholders

today). The Board consider that the Tender Offer is in the best

interests of Shareholders as a whole and unanimously recommends that

Shareholders vote in favour of the Tender Offer Resolution.

Summary of the proposal

* Proposed Tender Offer to allow Shareholders to realise

their investment in the Company. Price paid per Exit Share linked

to net asset amount realised from prorate share of Company's

investment portfolio.

* The Company's assets and liabilities will be split, so far

as possible, in accordance with the level of successful tenders

into a Tender Offer Pool and a Continuing Pool.

* The assets in the Tender Offer Pool will be realised and

net cash proceeds paid to Exiting Shareholders.

* Shareholders who do not tender their Ordinary Shares will

remain as Shareholders. The Continuing Pool will continue to be

invested in accordance with the Company's existing investment

objective and investment policy.

* Shareholders are not required to tender any Ordinary

Shares in the Tender Offer if they do not wish to.

* The Company's CISX listing will be cancelled whether or

not the Tender Offer is approved or implemented.

For further information please contact:

Africa Opportunity Fund Limited

Francis Daniels Tel: +2711 684 1528

Grant Thornton UK LLP (Nominated Adviser)

Philip Secrett Tel: +44 207 383

5100

INTRODUCTION

After discussions with major Shareholders, the Company and its

investment manager, Africa Opportunity Partners Limited, have

determined to implement the Tender Offer to allow all Shareholders an

opportunity to realise their investment in the Company.

The Company and the Investment Manager remain fully committed to the

Company's investment policy of seeking to achieve consistent capital

growth and income through investment in value, arbitrage and special

situations opportunities derived from the continent of Africa.

Current market conditions, while difficult and while producing

investment losses to date, at the same time have produced valuations

and investment opportunities that are, in the view of Directors,

exceptionally attractive. More than ever, the Directors believe that

the Company presents an attractive investment opportunity.

The Directors do not intend to tender in the Tender Offer any of the

10,775,827 Ordinary Shares (representing in aggregate approximately

9.33 per cent. of the existing issued share capital of the Company)

in which they are interested. The Directors and the Investment

Manager intend that the Company's securities will continue to be

admitted to trading on AIM, to the extent possible, following the

completion of the Tender Offer. However, regardless of the outcome of

the Tender Offer the Company intends to seek a delisting from the

CISX for reasons detailed below.

The price that will be paid to Shareholders who decide to tender

Ordinary Shares will be linked to the net amount actually realised

from a pro rata share of the Company's investment portfolio. This sum

may be different from the Company's announced Net Asset Value per

Ordinary Share.

In addition, to compensate the Investment Manager for the fact that,

relatively early in the life of the Company, it will be losing funds

under management on which it would otherwise have earned management

fees and to compensate Continuing Shareholders for the fact that they

will inevitably be bearing a higher proportion of fixed costs on an

ongoing basis, it is proposed that certain sums will be deducted from

the Tender Offer Pool to compensate the Investment Manager for the

accelerated loss of funds under management and the Continuing

Shareholders for the heavier burden of fixed costs they will carry in

the future. Further details of these arrangements are detailed in the

"Costs and Expenses" paragraph below.

THE TENDER OFFER

The Company is seeking to address the needs of Shareholders who would

like to achieve some liquidity by offering to each Shareholder the

right to tender some or all of the Ordinary Shares held by such

Shareholder on the Record Date for immediate repurchase and

cancellation by the Company for the right to receive payments over

time of a price based on a proportionate share of the aggregate

Tender Consideration, being the aggregate amount of the net proceeds

actually received by the Company in USD on the full disposition of

each investment in the Tender Offer Pool less applicable costs and

expenses allocated to the Tender Offer Pool.

The Tender Offer will close at 5.00 p.m. (Coordinated Universal Time)

on 18 February 2009 and the results of the Tender Offer are expected

to be announced following completion of the EGM on 26 February 2009.

The division of the Company's assets and liabilities into the Tender

Offer Pool and the Continuing Pool will take place on the Calculation

Date which is currently anticipated to be 27 February 2009. Ordinary

Shares successfully tendered will be treated as purchased and

cancelled on the Calculation Date with applicable Tender

Consideration left outstanding as a deferred liability of the

Company. Following the Calculation Date, Exiting Shareholders will

cease to have any rights as Shareholders but will become unsecured

creditors of the Company (each with a proportionate right to the

Tender Consideration) until the payment of the Tender Consideration

has been completed. Thereafter the Tender Consideration will be paid

to Exiting Shareholders (in one or more payments) as and when the

Company is able to realise the investments in the Tender Offer

Portfolio.

Shareholders do not have to tender any Ordinary Shares in the Tender

Offer if they do not wish to do so.

The Tender Offer is conditional upon Shareholders passing the Tender

Offer Resolution to approve its implementation.

Tender Offer Pool

Save as set out below, all of the Company's assets and liabilities

will, on the Calculation Date, so far as possible, be split in

accordance with the level of successful tenders into a Tender Offer

Pool and a Continuing Pool. As the Company will continue to undertake

investment activity in the ordinary course of business the assets and

liabilities of the Company as at the Calculation Date may differ from

the assets and liabilities existing at the date of the Circular. The

assets in the Tender Offer Pool will be realised and the net cash

proceeds (after deductions of the costs and expenses outlined below)

will be paid as Tender Consideration to Exiting Shareholders who

successfully tendered their Ordinary Shares.

Notwithstanding the foregoing, since the DiamondCorp PLC bond is a

private loan which cannot, therefore, be divided or sold in portions,

and the loan will, at the option of the Investment Manager either (i)

be retained by the Continuing Pool, with a cash payment made to the

Tender Offer Pool according to the loan's fair value, or (ii) sold in

its entirety and the cash consideration allocated pro rata to the

Tender Offer Pool and the Continuing Pool.

For the avoidance of doubt, following the Calculation Date, Exiting

Shareholders will have no interest in, or entitlement to, the

Continuing Pool.

Costs and Expenses

The costs and expenses of implementing the Tender Offer will together

be borne by Exiting Shareholders and Continuing Shareholders. The

costs and expenses of realising the assets in the Tender Offer Pool

(to include selling commissions and any other applicable fees and

expenses) will be borne by the Tender Offer Pool.

In order to compensate the Investment Manager for the fact that,

relatively early in the life of a Company, it will be losing funds

under management on which it would otherwise have earned management

fees and to compensate Continuing Shareholders for the fact that they

will inevitably be bearing a higher proportion of fixed costs on an

ongoing basis it has been agreed that the following additional

deductions will be made from the net amounts realised from the

Tender Offer Pool:

On realisations of investments in the 10 per cent. of the net

Tender Offer Pool where the applicable amounts realised.

settlement date is on or prior to 30 June

2009:

On realisations of investments in the 5 per cent. of the net

Tender Offer Pool where the applicable amounts realised.

settlement date is after 30 June 2009:

In each case the deductions made will be split equally between the

Investment Manager and for the benefit of the Continuing Pool. The

amounts reallocated to the Continuing Pool will be available for

reinvestment.

The Independent Directors, having consulted with the Company's

nominated adviser, believe the proposed payment of the distribution

fees relating to the Investment Manager are fair and reasonable

insofar as Shareholders are concerned.

Calculation of the Tender Consideration

On the Calculation Date the assets and liabilities of the Company

will, subject as set out below, be allocated on a pro rata basis in

accordance with the successful tenders, between a Tender Pool and a

Continuing Pool. In effecting the allocation:

* subject to the paragraph below, all liabilities recognised

in the Company's accounting records and all debtors and other

receivables will be allocated pro rata between the Tender Offer

Pool and the Continuing Pool by reference to the respective values

of each pool;

* a pro rata proportion (representing the period from 1

January 2009 to and including the Calculation Date) of the

instalment of the annual management fee for the quarter commencing

1 January 2009 (the "Q1 Management Fee") shall be allocated pro

rata between the Tender Offer Pool and the Continuing Pool by

reference to the respective values of each pool. The remaining

amount of the Q1 Management Fee shall be allocated to and payable

by the Continuing Pool;

* any investment whose listing has been suspended and any

other assets which the Directors consider it would be inappropriate

to transfer to the Tender Offer Pool (e.g. stocks subject to

corporate action) will be allocated to the Continuing Pool at the

value reflected in the accounting records (which will reflect the

Director's assessment of fair value);

* all quoted investments, other than those mentioned in the

above bullet point, will be allocated pro rata between the Tender

Offer Pool and the Continuing Pool by reference to the respective

values of each pool. For such purposes the calculations will be

rounded down to the nearest whole number of securities for each

security;

* the loans related to the DiamondCorp PLC transaction will,

at the option of the Investment Manager, either (i) be allocated in

full to the Continuing Pool with the proportion of the loans

related to the DiamondCorp PLC transaction otherwise attributable

to the Tender Offer Pool being purchased (at fair value) for cash

by the Continuing Pool, or (ii) sold in their entirety and the cash

consideration allocated pro rata to the Tender Offer Pool and the

Continuing Pool; and

* all cash and near cash assets, other than as set out in

the paragraph above, will be allocated pro rata between the Tender

Offer Pool and the Continuing Pool by reference to the respective

values of each pool.

In allocating and/or valuing assets and liabilities pursuant to the

bullet points above the Directors, after consultation with the Expert

(as defined below), shall be entitled (in any case where the proper

allocation of an asset or liability in accordance with any of the

above provisions is, in the opinion of the Directors, incorrect or

unfair) to adopt an alternative basis of allocation or method of

valuation (as the case may be).

The Investment Manager will prepare or procure the preparation of the

calculation necessary to determine the Tender Offer Pool and the

Continuing Pool. Such calculation will be reviewed by the Expert.

The "Expert" shall be either the Company's administrator, a reputable

firm of accountants or investment bank or other similar financial

services organisation selected by agreement between the Company and

the Investment Manager. Such Expert will act as expert and not as an

arbitrator.

Settlement and calculation formula of tender offer price

Unless terminated in accordance with the provisions as detailed in

this announcement, the Tender Offer will close at 5.00 p.m.

(Coordinated Universal Time) on 18 February 2009 and it is expected

that on 26 February 2009 the Company will make a public announcement

of the EGM results and (if the Tender Offer Resolution is passed) the

total number of Ordinary Shares tendered pursuant to the Tender

Offer.

Ordinary Shares successfully tendered will be treated as purchased

and cancelled on the Calculation Date which it is currently expected

will be 27 February 2009 at the Formula Tender Price per Ordinary

Share.

The Formula Tender Price per Ordinary Share shall be an amount

(rounded down to the nearest whole US cent) equal to ((A - B) divided

by C) where:

A = the aggregate amount of the net proceeds actually received by the

Company in USD on the full disposition of each investment in the

Tender Offer Pool (and including any allocated free USD cash);

B = the costs and deductions chargeable to the Tender Offer Pool; and

C = the total number of Exit Shares.

The Formula Tender Price per Ordinary Share will be payable by the

Company to the Exiting Shareholders in applicable tranches ("Payment

Tranches") in USD following the full or partial disposition of each

investment in the Tender Offer Pool which shall take place from time

to time in accordance with the Company's ordinary course of business.

The Formula Tender Price per Ordinary Share will be satisfied in full

following the complete disposition of the last investment in the

Tender Offer Pool and the settlement of the final Payment Tranche

relating to such investment (the "Payment Satisfaction Date"). On and

following the Payment Satisfaction Date the Exiting Shareholders

shall have no further right to receive further Payment Tranches from

the Company.

Realisation of the Tender Offer Pool

Given the nature of the assets in the Company's portfolio which

mainly comprise securities listed or quoted on the stock exchanges of

various emerging markets, together with certain unquoted securities,

it may be difficult and time consuming to realise the assets in the

Tender Offer Pool. Distributions of tranches of the Tender

Consideration will, therefore, be made as and when the Investment

Manager believes it to be appropriate given the amounts realised.

None of the assets in the Tender Offer Pool will be disposed of to a

Related Party (as such term is defined in the AIM Rules) without the

prior approval of the Board and subject always to the provisions of

the AIM Rules.

TERMINATION OF THE TENDER OFFER

If the Company (acting through the Directors) is of the opinion that:

* in its absolute discretion, the Tender Offer would no

longer be in the best interests of the Company and/or the

Shareholders as a whole; or

* as a result of any change in national or international

financial, economic, political or market conditions, the Tender

Offer or the cost of realisation of assets to fund the Tender Offer

has become significantly more expensive since the date of the

Circular; or

* in its reasonable opinion the completion of the purchase

of Ordinary Shares in the Tender Offer could have unexpected

adverse fiscal or other consequences (whether by reason of a change

in legislation or practice or otherwise) for the Company or its

Shareholders if the Tender Offer were to proceed,

the Company shall be entitled at its complete discretion by a public

announcement and subsequent written notice to Shareholders to

withdraw the Tender Offer and in such event the Tender Offer shall

cease and terminate absolutely.

RESTRICTED SHAREHOLDERS AND SHAREHOLDERS GENERALLY

The attention of shareholders who are not citizens or nationals of,

or resident in, the United Kingdom is drawn to paragraph 3 of Part I

of the Circular.

TAXATION

Shareholders who sell Ordinary Shares in the Tender Offer may,

depending on their individual circumstances, incur a tax liability.

Following the proposed delisting of the Company from the CISX (please

see below) Ordinary Shares will no longer be eligible to be held in

the stocks and shares component of an UK Individual Savings Account

(ISA) or an UK Self Invested Personal Pension (SIPP).

Shareholders who are in doubt as to their tax position should consult

an appropriate professional adviser.

RISK FACTORS

The attention of Shareholders is drawn to the Risk Factors set out in

Part II of the Circular.

CANCELLATION OF CISX LISTING

Shortly after the Company's admission to AIM, application was also

made and granted for the issued share capital of the Company to be

dual listed on the CISX. It was anticipated that a CISX listing would

broaden the appeal of the Company particularly as it would enable UK

retail investors to invest in the Company via certain individual tax

efficient investment accounts. Unfortunately these benefits have

failed to materialise to the extent anticipated and accordingly,

whether or not the Tender Offer is approved and implemented, the

Company has concluded that the expense of maintaining the CISX

listing is no longer justified. Consequently, with effect from 4

March 2009 the admission of the Ordinary Shares to trading on the

CISX will be cancelled.

INVESTMENT OBJECTIVE AND POLICY

The Board confirms that the assets in the Continuing Pool will

continue to be invested in accordance with the Company's existing

investment objective and investment policy of providing Shareholders

with consistent capital growth and income through value, arbitrage

and special situation investments in the Continent of Africa.

Portfolio investments will include equity, debt and other interests

in both listed and unlisted assets.

CURRENT FINANCIAL POSITION

For information on the Company's Net Asset Value position please see

the most recent Net Asset Value announcement on the Company's website

www.africaopportunityfund.com. A further updated Net Asset Value

announcement will be made in accordance with the Company's Net Asset

Value reporting policy during the period of the Tender Offer.

EXTRAORDINARY GENERAL MEETING

The Company is convening an Extraordinary General Meeting for 1.00

p.m. (Coordinated Universal Time) on 26 February 2009 to consider

and, if thought fit, pass the Proposals (further details of which are

set out in the Circular).

RECOMMENDATION

The Board considers that the Tender Offer is in the best interests

of Shareholders as a whole. Accordingly, the Board recommends

unanimously that Shareholders vote in favour of the Tender Offer

Resolution as they intend to do so in respect of their beneficial

holdings of Ordinary Shares which, in aggregate amount to 10,775,827

Ordinary Shares representing approximately 9.33 per cent. of the

issued share capital of the Company.

The Directors continue to have faith in, and remain fully committed

to, the Investment Manager. Current market conditions, while

difficult and while producing investment losses to date, at the same

time have produced valuations and investment opportunities that are,

in the view of the Directors, exceptionally attractive. More than

ever, the Directors believe that the Company presents an attractive

investment opportunity. Accordingly, none of the Directors intend to

tender any of their beneficial holdings of Ordinary Shares.

The Directors make no recommendation in terms of whether or not

Shareholders should tender Ordinary Shares in the Tender Offer.

Shareholders should make their own decision in light of their own

individual circumstances and investment objectives both with respect

to their individual investments in the Company and in light of their

investment portfolios as a whole.

EXPECTED TIMETABLE*

Record Date for the Tender Offer 8.00 a.m. (Coordinated Universal

Time) on 5 February 2009

Closing Date: latest time and date 5.00 p.m. (Coordinated Universal

for receipt of Tender Forms Time) on 18 February 2009

Latest time and date for receipt of 1.00 p.m. (Coordinated Universal

Proxy Forms Time) on 24 February 2009

Extraordinary General Meeting 1.00 p.m. (Coordinated Universal

Time) on 26 February 2009

Results of the EGM and the Tender 26 February 2009

Offer announced on

Calculation Date 27 February 2009

Date of cancellation of CISX listing 4 March 2009

*The above times and/or dates may be subject to change and, in the

event of such change, the revised times and/or dates will be notified

to Shareholders by an announcement through a Regulatory Information

Service of the London Stock Exchange and to the CISX.

DEFINITIONS

The following definitions apply throughout this announcement unless

the context otherwise requires:

"Admission Document" the Company's AIM admission document

dated 18 July 2007;

"AIM" the market of that name operated by the

London Stock Exchange;

"AIM Rules" the AIM Rules for Companies, as

published by the London Stock Exchange

from time to time;

"Articles of Association" the articles of association of the

Company;

"Board" or "Directors" the directors of the Company;

"Business Day" any day other than a Saturday, Sunday or

public holiday in London;

"Calculation Date" the date on which the Company will

create (and/or procure the creation of )

the Tender Offer Pool and the Continuing

Pool and formally purchase and cancel

Ordinary Shares validly tendered and

accepted pursuant to the Tender Offer in

accordance with the terms and conditions

of the Tender Offer currently expected

to be 27 February 2009;

"certificated" or "in not in uncertificated form;

certificated form"

"Circular" the circular sent to shareholders on 4

February 2009;

"CISX" or "Channel Islands the Channel Islands Stock Exchange, LBG;

Stock Exchange"

"Clearstream" the system of paperless settlement of

trades and the holdings of shares

without share certificates administered

by Clearstream Banking SA;

"Closing Date" 5.00 p.m. (Coordinated Universal Time)

on 18 February 2009;

"Companies Law" the Companies Law (2007 Revision) of the

Cayman Islands (as amended);

"Company" Africa Opportunity Fund Limited (and,

for the purposes of this announcement,

references to the assets and liabilities

and investment portfolio of the Company

shall together include the assets and

liabilities and investment portfolio of

the Company, the Limited Partnership and

Africa Opportunity Fund (GP) Limited);

"Conditions" the Conditions to the Tender Offer as

defined in paragraph 2.1 of Part III of

the Circular;

"Continuing Pool" the pool of securities, cash and assets

to be created in accordance with the

Tender Offer for the benefit of the

Continuing Shareholders;

"Continuing Shareholders" Shareholders who retain Ordinary Shares

after the Calculation Date;

"EGM" the extraordinary general meeting of the

Company convened for 1.00 p.m.

(Coordinated Universal Time) on 26

February 2009;

"Euroclear" the system of paperless settlement of

trades and the holding of shares without

share certificates administered by

Euroclear Bank SA;

"Exiting Shareholders" those Shareholders who successfully

tender Ordinary Shares for purchase

pursuant to the Tender Offer;

"Exit Share" an Ordinary Share which has been

successfully tendered for purchase

pursuant to the Tender Offer;

"Formula Tender Price per has the meaning defined in paragraph 5.3

Ordinary Share" of Part III of the circular;

"Independent Directors" the Board excluding Robert Knapp and

Francis Daniels;

"Investment Manager" Africa Opportunity Partners Limited;

"Limited Partnership" Africa Opportunity Fund L.P., a Cayman

Islands registered exempted limited

partnership;

"London Stock Exchange" London Stock Exchange plc;

"Net Asset Value" or the total value of all of the assets of

"NAV" the Company less its liabilities as

determined by the Board and calculated

in accordance with the Company's

accounting policies;

"Net Asset Value per the Net Asset Value divided by the

Ordinary Share" number of Ordinary Shares then in issue;

"Ordinary Shares" ordinary shares of USD 0.01 each in the

capital of the Company;

"Overseas Shareholders" Shareholders who are resident in, or

citizens of, territories outside the

United Kingdom and not resident in, or

citizens of, any of the Restricted

Territories;

"Proxy Form" the proxy form for use in connection

with the EGM, and which accompanies the

Circular;

"Record Date" 8.00 a.m. (Coordinated Universal Time)

on 5 February 2009;

"Register" the Company's register of Shareholders;

"Restricted Shareholders" Shareholders who are resident in, or

citizens of, a Restricted Territory;

"Restricted Territories" any of the following territories:

Australia, Canada, Japan and the United

States;

"Shareholders" holders of Ordinary Shares (or, where

the context so requires, where Ordinary

Shares are held in Euroclear and/or

Clearstream, the persons otherwise

beneficially entitled to such Ordinary

Shares);

"Tender Consideration" the aggregate amount to be paid by the

Company to the Exiting Shareholders as

calculated and paid in accordance with

Part III of the Circular;

"Tender Form" the tender form for use in connection

with the Tender Offer and which

accompanies the Circular;

"Tender Offer" or "Offer" the conditional invitation by the

Company to Shareholders (other than

Restricted Shareholders) to tender

Ordinary Shares for purchase and

cancellation by the Company on the terms

and subject to the conditions set out in

this announcement, the Circular and in

the Tender Form;

"Tender Offer Pool" the pool of securities, cash and assets

to be created in accordance with the

Tender Offer for the benefit of the

Exiting Shareholders;

"Tender Offer Resolution" the special resolution to approve the

Tender Offer to be proposed at the EGM

notice of which is set out on page 28 of

the Circular;

"uncertificated" or "in an Ordinary Share recorded on the

uncertificated form" Register as being held in Euroclear or

Clearstream by the relevant nominee on

behalf of a Shareholder and the

beneficial title to which may be

transferred by means of Euroclear or

Clearstream (as appropriate);

"United Kingdom" or "UK" the United Kingdom of Great Britain; and

"$", "US Dollar" or "USD" United States dollars, the legal

currency of the United States.

=--END OF MESSAGE---

This announcement was originally distributed by Hugin. The issuer is

solely responsible for the content of this announcement.

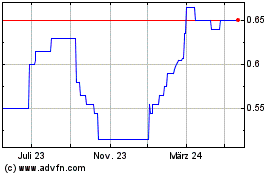

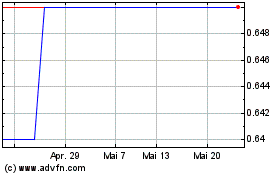

Africa Opportunity (LSE:AOF)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Africa Opportunity (LSE:AOF)

Historical Stock Chart

Von Jul 2023 bis Jul 2024