TIDMAIEA

RNS Number : 3372P

Airea PLC

24 March 2009

AIREA plc

Interim Results for the six months ended 31st December 2008.

Introduction

The six month period to 31st December 2008 has been one of difficult trading

conditions and considerable uncertainty. During this period we have undertaken a

fundamental review of our manufacturing operations in order to reduce costs and

simplify our business.

Sales declined in the period mainly due to the erosion of consumer confidence as

a consequence of growing economic uncertainty. Towards the end of the period

there was a similar, but less pronounced, decline in confidence in the

commercial sector as a result of the tightening in credit facilities.

As foreshadowed in the announcement in December 2008, the group has incurred an

operating loss in the period. Following a critical review of our asset base

these accounts include significant provisions for impairment of property, plant

and equipment, surplus inventories, onerous leases and impairment of goodwill.

During the period we have invested heavily in new product development,

particularly in the residential sector. By the end of the financial year the

vast majority of our product range will have been redesigned and relaunched into

the market.

The results

Within continuing operations, sales of floor covering products reduced by 9% to

GBP23.0m (2007: GBP25.4m) in the period, with maintained sales in commercial

products combined with a decline in sales of residential products. The operating

result was a loss of GBP9.0m (2007: operating profit GBP9.9m) but the period to

31st December 2008 includes exceptional operating costs of GBP4.1m (2007:

GBP0.3m) and a provision for impairment of goodwill of GBP4.0m (2007: GBPnil).

The period to 31st December 2007 included an exceptional profit on sale of

property of GBP9.6m. After excluding these items, the operating result from

continuing activities was a loss of GBP0.9m (2007: profit GBP0.6m).

After accounting for modest levels of finance income and finance costs, minor

costs in connection with discontinued activities and incorporating the

appropriate credit or charge for taxation, the result for the period was a loss

of GBP8.8m (2007: profit GBP4.7m). The loss per share was 18.99p (2007: earnings

per share 10.14p) and the adjusted loss per share, after excluding the effect of

the exceptional operating costs, the provision for impairment of goodwill this

year and the exceptional profit on sale of property, the related release of

deferred tax and the loss on sale of the specialist yarns business last year,

was 1.53p (2007: earnings per share 1.54p).

There was a cash outflow from operating activities of GBP2.9m (2007: GBP4.3m),

due to a combination of the operating loss, an increase in working capital, net

of provisions, and the continuing contributions to the defined benefit pension

scheme. There was a decrease in cash and cash equivalents of GBP2.9m (2007:

increase GBP7.8m). Total cash and cash equivalents at the end of the period

amounted to GBP3.2m down from GBP6.1m at the start of the period.

As we announced in December 2008, the board are not intending to pay an interim

dividend for the current financial year.

Management and personnel

Carolyn Tobin stepped down from the board on 31st December 2008 after several

years' service as a non-executive director. We are pleased to announce that

Martin Toogood will join the board on 1st April 2009 as a non-executive

director. Martin has considerable experience at executive and non-executive

level, most recently with ILVA in Scandinavia and the UK and with Carpetright in

the UK and Europe. He brings considerable knowledge of retail markets which will

be of great assistance in these difficult times.

Current trading and future prospects

Like-for-like sales in the early part of 2009 are around 23% below last year.

Although both segments are down, the effect is more significant within

residential carpets.

In the current challenging conditions, we are focussed on reducing the cost base

to position the business for the future. There has been a significant reduction

in headcount since the start of the financial year and numbers are expected to

fall further as the year progresses.

Our cost reduction programme has resulted in a much leaner manufacturing

operation, particularly in the residential sector. In recent months, we have

started to see the benefits of a streamlined manufacturing footprint and this

enables us to look forward with cautious optimism despite uncertainties in the

market place. We have been encouraged by the sales growth from new products and

have therefore accelerated our new product development plans.

In the meantime, we are looking to conserve cash and will be reducing both our

working capital and capital expenditure going forward. In view of this need to

conserve cash, the board do not expect to recommend the payment of a final

dividend for the current financial year.

Although there is considerable uncertainty about future market conditions, we

expect the commercial market to hold up reasonably well and the residential

market to start to flatten out. As a consequence of our reduced operational base

and an unprecedented level of new product development, we are well placed to

withstand the current challenges and enjoy the benefits of an improvement in

market conditions when this occurs.

Following a period of unsatisfactory results, our major priority has been to

stabilise the residential carpets business and then return it to profitability.

We are encouraged by the positive effects of our cost reduction programme and by

consumer reaction to our new product launches and as a result of these major

changes we believe that this return to profitability can be achieved in the near

future. However we remain realistic about the difficulties we are all

experiencing as a result of conditions in the global economy.

Enquiries:

Neil Rylance 01924 266561

Chief executive officer

Kevin Henry 01924 266561

Group finance director

Andrew Kitchingman 0845 270 8610

Managing Director - Corporate Finance

Brewin Dolphin

+------------------------------+------+--+-------------+--------------+--------------+

| Consolidated Income | | | | | |

| Statement | | | | | |

+------------------------------+------+--+-------------+--------------+--------------+

| 6 months ended 31st December | | | | | |

| 2008 | | | | | |

+------------------------------+------+--+-------------+--------------+--------------+

| | | | Unaudited | Unaudited | Audited |

+------------------------------+------+--+-------------+--------------+--------------+

| | | | 6 months | 6 months | year ended |

| | | | ended | ended | |

+------------------------------+------+--+-------------+--------------+--------------+

| | | | 31st | 31st | 30th June |

| | | | December | December | 2008 |

| | | | 2008 | 2007 | |

+------------------------------+------+--+-------------+--------------+--------------+

| | Note | | GBP000 | GBP000 | GBP000 |

+------------------------------+------+--+-------------+--------------+--------------+

| CONTINUING OPERATIONS | | | | | |

+------------------------------+------+--+-------------+--------------+--------------+

| Revenue | | | 23,040 | 25,378 | 48,713 |

+------------------------------+------+--+-------------+--------------+--------------+

| Operating costs | | | (28,018) | (25,073) | (48,648) |

+------------------------------+------+--+-------------+--------------+--------------+

| Impairment of goodwill | | | (4,000) | - | (8,012) |

+------------------------------+------+--+-------------+--------------+--------------+

| Exceptional profit on sale | | | - | 9,616 | 9,858 |

| of property | | | | | |

+------------------------------+------+--+-------------+--------------+--------------+

| Operating (loss)/profit | | | (8,978) | 9,921 | 1,911 |

| after exceptional items | | | | | |

+------------------------------+------+--+-------------+--------------+--------------+

| Analysed between: | | | | | |

+------------------------------+------+--+-------------+--------------+--------------+

| Operating (loss)/profit | | | (901) | 555 | 484 |

| before exceptional items | | | | | |

+------------------------------+------+--+-------------+--------------+--------------+

| Exceptional operating costs | 2 | | (4,077) | (250) | (419) |

+------------------------------+------+--+-------------+--------------+--------------+

| Impairment of goodwill | | | (4,000) | - | (8,012) |

+------------------------------+------+--+-------------+--------------+--------------+

| Exceptional profit on sale | | | - | 9,616 | 9,858 |

| of property | | | | | |

+------------------------------+------+--+-------------+--------------+--------------+

| Finance income | | | 41 | - | 383 |

+------------------------------+------+--+-------------+--------------+--------------+

| Finance costs | | | (150) | (137) | (237) |

+------------------------------+------+--+-------------+--------------+--------------+

| (Loss)/profit before | | | (9,087) | 9,784 | 2,057 |

| taxation | | | | | |

+------------------------------+------+--+-------------+--------------+--------------+

| Taxation | | | 363 | (1,905) | (1,623) |

+------------------------------+------+--+-------------+--------------+--------------+

| (Loss)/profit from | | | (8,724) | 7,879 | 434 |

| continuing operations | | | | | |

+------------------------------+------+--+-------------+--------------+--------------+

| | | | | | |

+------------------------------+------+--+-------------+--------------+--------------+

| DISCONTINUED OPERATIONS | | | | | |

+------------------------------+------+--+-------------+--------------+--------------+

| Revenue | | | - | 6,097 | 6,329 |

+------------------------------+------+--+-------------+--------------+--------------+

| Operating costs | | | (57) | (5,780) | (6,570) |

+------------------------------+------+--+-------------+--------------+--------------+

| Impairment of goodwill | | | - | (845) | (845) |

+------------------------------+------+--+-------------+--------------+--------------+

| Loss on disposal of | | | - | (2,668) | (2,668) |

| discontinued operations | | | | | |

+------------------------------+------+--+-------------+--------------+--------------+

| Operating loss after | | | (57) | (3,196) | (3,754) |

| exceptional items | | | | | |

+------------------------------+------+--+-------------+--------------+--------------+

| Analysed between: | | | | | |

+------------------------------+------+--+-------------+--------------+--------------+

| Operating profit before | | | - | 317 | 245 |

| exceptional items | | | | | |

+------------------------------+------+--+-------------+--------------+--------------+

| Exceptional operating costs | 2 | | (57) | - | (486) |

+------------------------------+------+--+-------------+--------------+--------------+

| Impairment of goodwill | | | - | (845) | (845) |

+------------------------------+------+--+-------------+--------------+--------------+

| Loss on disposal of | | | - | (2,668) | (2,668) |

| discontinued operations | | | | | |

+------------------------------+------+--+-------------+--------------+--------------+

| Finance income | | | - | 168 | 188 |

+------------------------------+------+--+-------------+--------------+--------------+

| Loss before taxation | | | (57) | (3,028) | (3,566) |

+------------------------------+------+--+-------------+--------------+--------------+

| Taxation | | | - | (162) | (481) |

+------------------------------+------+--+-------------+--------------+--------------+

| Loss from discontinued | | | (57) | (3,190) | (4,047) |

| operations | | | | | |

+------------------------------+------+--+-------------+--------------+--------------+

| (Loss)/profit for the period | | | (8,781) | 4,689 | (3,613) |

+------------------------------+------+--+-------------+--------------+--------------+

| | | | | | |

+------------------------------+------+--+-------------+--------------+--------------+

| (Loss)/earnings per share | | | | | |

+------------------------------+------+--+-------------+--------------+--------------+

| (basic and diluted) | 4a | | (18.99)p | 10.14p | (7.81)p |

+------------------------------+------+--+-------------+--------------+--------------+

| (Loss)/earnings per share | | | | | |

| from continuing operations | | | | | |

+------------------------------+------+--+-------------+--------------+--------------+

| (basic and diluted) | 4b | | (18.87)p | 17.04p | 0.94p |

+------------------------------+------+--+-------------+--------------+--------------+

| Loss per share from | | | | | |

| discontinued operations | | | | | |

+------------------------------+------+--+-------------+--------------+--------------+

| (basic and diluted) | 4c | | (0.12)p | (6.90)p | (8.75)p |

+------------------------------+------+--+-------------+--------------+--------------+

| | | | | | |

+------------------------------+------+--+-------------+--------------+--------------+

| |

+------------------------------+------+--+-------------+--------------+--------------+

+------------------------------+------+--------------+--------------+--------------+

| Consolidated Balance Sheet | | | | |

+------------------------------+------+--------------+--------------+--------------+

| as at 31st December 2008 | | Unaudited | Unaudited | Audited |

+------------------------------+------+--------------+--------------+--------------+

| | | 31st | 31st | 30th June |

| | | December | December | 2008 |

| | | 2008 | 2007 | |

+------------------------------+------+--------------+--------------+--------------+

| | Note | GBP000 | GBP000 | GBP000 |

+------------------------------+------+--------------+--------------+--------------+

| Non-current assets | | | | |

+------------------------------+------+--------------+--------------+--------------+

| Property, plant and | | 7,809 | 9,828 | 8,865 |

| equipment | | | | |

+------------------------------+------+--------------+--------------+--------------+

| Goodwill | | - | 12,012 | 4,000 |

+------------------------------+------+--------------+--------------+--------------+

| Deferred tax asset | 5a | 1,260 | 1,780 | 1,540 |

+------------------------------+------+--------------+--------------+--------------+

| Loan notes | | 300 | 300 | 300 |

+------------------------------+------+--------------+--------------+--------------+

| | | 9,369 | 23,920 | 14,705 |

+------------------------------+------+--------------+--------------+--------------+

| Current assets | | | | |

+------------------------------+------+--------------+--------------+--------------+

| Inventories | | 8,249 | 10,084 | 10,970 |

+------------------------------+------+--------------+--------------+--------------+

| Trade and other receivables | | 7,198 | 8,569 | 8,793 |

+------------------------------+------+--------------+--------------+--------------+

| Income tax receivable | | 813 | 348 | 448 |

+------------------------------+------+--------------+--------------+--------------+

| Cash and cash equivalents | | 3,171 | 6,272 | 6,063 |

+------------------------------+------+--------------+--------------+--------------+

| | | 19,431 | 25,273 | 26,274 |

+------------------------------+------+--------------+--------------+--------------+

| Non-current assets held for | | - | 140 | 452 |

| sale | | | | |

+------------------------------+------+--------------+--------------+--------------+

| Total assets | | 28,800 | 49,333 | 41,431 |

+------------------------------+------+--------------+--------------+--------------+

| Current liabilities | | | | |

+------------------------------+------+--------------+--------------+--------------+

| Trade and other payables | | (7,107) | (8,682) | (10,891) |

+------------------------------+------+--------------+--------------+--------------+

| Non-current liabilities | | | | |

+------------------------------+------+--------------+--------------+--------------+

| Trade and other payables | | (1,715) | - | - |

+------------------------------+------+--------------+--------------+--------------+

| Pension deficit | | (4,500) | (5,930) | (5,500) |

+------------------------------+------+--------------+--------------+--------------+

| Deferred tax | 5c | (211) | (617) | (252) |

+------------------------------+------+--------------+--------------+--------------+

| | | (6,426) | (6,547) | (5,752) |

+------------------------------+------+--------------+--------------+--------------+

| Total liabilities | | (13,533) | (15,229) | (16,643) |

+------------------------------+------+--------------+--------------+--------------+

| | | 15,267 | 34,104 | 24,788 |

+------------------------------+------+--------------+--------------+--------------+

| Equity | | | | |

+------------------------------+------+--------------+--------------+--------------+

| Called up share capital | | 11,561 | 11,561 | 11,561 |

+------------------------------+------+--------------+--------------+--------------+

| Share premium account | | 504 | 504 | 504 |

+------------------------------+------+--------------+--------------+--------------+

| Capital redemption reserve | | 2,395 | 2,395 | 2,395 |

+------------------------------+------+--------------+--------------+--------------+

| Retained earnings | 6 | 807 | 19,644 | 10,328 |

+------------------------------+------+--------------+--------------+--------------+

| | | 15,267 | 34,104 | 24,788 |

+------------------------------+------+--------------+--------------+--------------+

| | | | | |

+------------------------------+------+--------------+--------------+--------------+

+------------------------------+------+--------------+--------------+--------------+

| Consolidated Cash Flow | | | | |

| Statement | | | | |

+------------------------------+------+--------------+--------------+--------------+

| 6 months ended 31st December | | Unaudited | Unaudited | Audited |

| 2008 | | | | |

+------------------------------+------+--------------+--------------+--------------+

| | | 6 months | 6 months | year ended |

| | | ended | ended | |

+------------------------------+------+--------------+--------------+--------------+

| | | 31st | 31st | 30th June |

| | | December | December | 2008 |

| | | 2008 | 2007 | |

+------------------------------+------+--------------+--------------+--------------+

| | Note | GBP000 | GBP000 | GBP000 |

+------------------------------+------+--------------+--------------+--------------+

| Operating activities | | | | |

+------------------------------+------+--------------+--------------+--------------+

| Cash used in operations | 8 | (2,856) | (4,342) | (4,148) |

+------------------------------+------+--------------+--------------+--------------+

| Interest received | | 19 | 37 | 187 |

+------------------------------+------+--------------+--------------+--------------+

| Income tax received/(paid) | | 238 | (9) | 5 |

+------------------------------+------+--------------+--------------+--------------+

| | | (2,599) | (4,314) | (3,956) |

+------------------------------+------+--------------+--------------+--------------+

| Investing activities | | | | |

+------------------------------+------+--------------+--------------+--------------+

| Purchase of property, plant | | (191) | (1,603) | (2,323) |

| and equipment | | | | |

+------------------------------+------+--------------+--------------+--------------+

| Proceeds on disposal of | | 638 | 15,738 | 16,261 |

| property, plant and | | | | |

| equipment | | | | |

+------------------------------+------+--------------+--------------+--------------+

| Disposal of subsidiary | | - | 2,409 | 2,409 |

| undertaking | | | | |

+------------------------------+------+--------------+--------------+--------------+

| | | 447 | 16,544 | 16,347 |

+------------------------------+------+--------------+--------------+--------------+

| Financing activities | | | | |

+------------------------------+------+--------------+--------------+--------------+

| Equity dividends paid | 3 | (740) | (740) | (1,110) |

+------------------------------+------+--------------+--------------+--------------+

| Redemption of loan notes | | - | (88) | (88) |

+------------------------------+------+--------------+--------------+--------------+

| Repayment of bank loans | | - | (3,652) | (3,652) |

+------------------------------+------+--------------+--------------+--------------+

| | | (740) | (4,480) | (4,850) |

+------------------------------+------+--------------+--------------+--------------+

| Net (decrease)/increase in | | (2,892) | 7,750 | 7,541 |

| cash and cash equivalents | | | | |

+------------------------------+------+--------------+--------------+--------------+

| Cash and cash equivalents at | | 6,063 | (1,478) | (1,478) |

| start of period | | | | |

+------------------------------+------+--------------+--------------+--------------+

| Cash and cash equivalents at | | 3,171 | 6,272 | 6,063 |

| end of period | | | | |

+------------------------------+------+--------------+--------------+--------------+

| | | | | |

+------------------------------+------+--------------+--------------+--------------+

| | | | | |

+------------------------------+------+--------------+--------------+--------------+

| Statement of Recognised Income and Expense | | |

+----------------------------------------------------+--------------+--------------+

| 6 months ended 31st December | | | | |

| 2008 | | | | |

+------------------------------+------+--------------+--------------+--------------+

| | | Unaudited | Unaudited | Audited |

+------------------------------+------+--------------+--------------+--------------+

| | | 6 months | 6 months | year ended |

| | | ended | ended | |

+------------------------------+------+--------------+--------------+--------------+

| | | 31st | 31st | 30th June |

| | | December | December | 2008 |

| | | 2008 | 2007 | |

+------------------------------+------+--------------+--------------+--------------+

| | | GBP000 | GBP000 | GBP000 |

+------------------------------+------+--------------+--------------+--------------+

| (Loss)/profit attributable | | (8,781) | 4,689 | (3,613) |

| to shareholders of the group | | | | |

+------------------------------+------+--------------+--------------+--------------+

| Actuarial losses recognised | | - | - | (644) |

| in the pension scheme | | | | |

+------------------------------+------+--------------+--------------+--------------+

| Total recognised income and | (8,781) | 4,689 | (4,257) |

| expense relating to the period | | | |

+-------------------------------------+--------------+--------------+--------------+

| | | | | |

+------------------------------+------+--------------+--------------+--------------+

+----+---------------------------------+------------+-------------+----------+----------+

| Notes | | | | |

+--------------------------------------+------------+-------------+----------+----------+

| 1 | SEGMENTAL INFORMATION | | | | |

+----+---------------------------------+------------+-------------+----------+----------+

| | |

| | For management purposes the group is organised into three business |

| | segments. These comprise the commercial carpet operation carried out by |

| | Burmatex Limited, the residential carpet operation carried out by Ryalux |

| | Carpets Limited and a group cost centre. |

| | |

+----+----------------------------------------------------------------------------------+

| | | Commercial | Residential | Group | Total |

| | | carpets | carpets | cost | |

| | | | | centre | |

+----+---------------------------------+------------+-------------+----------+----------+

| | 6 months ended 31st December | GBP000 | GBP000 | GBP000 | GBP000 |

| | 2008 | | | | |

+----+---------------------------------+------------+-------------+----------+----------+

| | Revenue | 10,786 | 12,254 | - | 23,040 |

+----+---------------------------------+------------+-------------+----------+----------+

| | Operating costs | (9,876) | (17,768) | (374) | (28,018) |

+----+---------------------------------+------------+-------------+----------+----------+

| | Impairment of goodwill | - | (4,000) | - | (4,000) |

+----+---------------------------------+------------+-------------+----------+----------+

| | Operating profit/(loss) after | 910 | (9,514) | (374) | (8,978) |

| | exceptional items | | | | |

+----+---------------------------------+------------+-------------+----------+----------+

| | Analysed between | | | | |

+----+---------------------------------+------------+-------------+----------+----------+

| | Operating profit/(loss) before | 999 | (1,554) | (346) | (901) |

| | exceptional items | | | | |

+----+---------------------------------+------------+-------------+----------+----------+

| | Exceptional operating costs | (89) | (3,960) | (28) | (4,077) |

+----+---------------------------------+------------+-------------+----------+----------+

| | Impairment of goodwill | - | (4,000) | - | (4,000) |

+----+---------------------------------+------------+-------------+----------+----------+

| | Finance income | 15 | 26 | - | 41 |

+----+---------------------------------+------------+-------------+----------+----------+

| | Finance costs | (138) | - | (12) | (150) |

+----+---------------------------------+------------+-------------+----------+----------+

| | Profit/(loss) before taxation | 787 | (9,488) | (386) | (9,087) |

+----+---------------------------------+------------+-------------+----------+----------+

| | Depreciation charge | 215 | 308 | - | 523 |

+----+---------------------------------+------------+-------------+----------+----------+

| | Capital expenditure | 69 | 122 | | 191 |

+----+---------------------------------+------------+-------------+----------+----------+

| | Segment assets/(liabilities) | 9,069 | 8,038 | (1,408) | 15,699 |

+----+---------------------------------+------------+-------------+----------+----------+

| | 6 months ended 31st December | GBP000 | GBP000 | GBP000 | GBP000 |

| | 2007 | | | | |

+----+---------------------------------+------------+-------------+----------+----------+

| | Revenue | 10,822 | 14,556 | - | 25,378 |

+----+---------------------------------+------------+-------------+----------+----------+

| | Operating costs | (9,546) | (15,158) | (369) | (25,073) |

+----+---------------------------------+------------+-------------+----------+----------+

| | Exceptional profit on sale of | - | - | 9,616 | 9,616 |

| | property | | | | |

+----+---------------------------------+------------+-------------+----------+----------+

| | Operating profit/(loss) after | 1,276 | (602) | 9,247 | 9,921 |

| | exceptional items | | | | |

+----+---------------------------------+------------+-------------+----------+----------+

| | Analysed between | | | | |

+----+---------------------------------+------------+-------------+----------+----------+

| | Operating profit/(loss) before | 1,299 | (413) | (331) | 555 |

| | exceptional items | | | | |

+----+---------------------------------+------------+-------------+----------+----------+

| | Exceptional operating costs | (23) | (189) | (38) | (250) |

+----+---------------------------------+------------+-------------+----------+----------+

| | Exceptional profit on sale of | - | - | 9,616 | 9,616 |

| | property | | | | |

+----+---------------------------------+------------+-------------+----------+----------+

| | Finance costs | - | - | (137) | (137) |

+----+---------------------------------+------------+-------------+----------+----------+

| | Profit/(loss) before taxation | 1,276 | (602) | 9,110 | 9,784 |

+----+---------------------------------+------------+-------------+----------+----------+

| | Depreciation charge | 255 | 346 | - | 601 |

+----+---------------------------------+------------+-------------+----------+----------+

| | Capital expenditure | 153 | 1,163 | - | 1,316 |

+----+---------------------------------+------------+-------------+----------+----------+

| | Segment assets/(liabilities) | 10,580 | 21,249 | (361) | 31,468 |

+----+---------------------------------+------------+-------------+----------+----------+

| | Year ended 30th June 2008 | GBP000 | GBP000 | GBP000 | GBP000 |

+----+---------------------------------+------------+-------------+----------+----------+

| | Revenue | 21,119 | 27,594 | - | 48,713 |

+----+---------------------------------+------------+-------------+----------+----------+

| | Operating costs | (18,703) | (29,124) | (821) | (48,648) |

+----+---------------------------------+------------+-------------+----------+----------+

| | Impairment of goodwill | - | (8,012) | - | (8,012) |

+----+---------------------------------+------------+-------------+----------+----------+

| | Exceptional profit on sale of | - | - | 9,858 | 9,858 |

| | property | | | | |

+----+---------------------------------+------------+-------------+----------+----------+

| | Operating profit/(loss) after | 2,416 | (9,542) | 9,037 | 1,911 |

| | exceptional items | | | | |

+----+---------------------------------+------------+-------------+----------+----------+

| | Analysed between | | | | |

+----+---------------------------------+------------+-------------+----------+----------+

| | Operating profit/(loss) before | 2,527 | (1,341) | (702) | 484 |

| | exceptional items | | | | |

+----+---------------------------------+------------+-------------+----------+----------+

| | Exceptional operating costs | (111) | (189) | (119) | (419) |

+----+---------------------------------+------------+-------------+----------+----------+

| | Impairment of goodwill | - | (8,012) | - | (8,012) |

+----+---------------------------------+------------+-------------+----------+----------+

| | Exceptional profit on sale of | - | - | 9,858 | 9,858 |

| | property | | | | |

+----+---------------------------------+------------+-------------+----------+----------+

| | Finance income | 88 | - | 295 | 383 |

+----+---------------------------------+------------+-------------+----------+----------+

| | Finance costs | (17) | - | (220) | (237) |

+----+---------------------------------+------------+-------------+----------+----------+

| | Profit/(loss) before taxation | 2,487 | (9,542) | 9,112 | 2,057 |

+----+---------------------------------+------------+-------------+----------+----------+

| | Depreciation charge | 434 | 657 | - | 1,091 |

+----+---------------------------------+------------+-------------+----------+----------+

| | Capital expenditure | 308 | 1,603 | - | 1,911 |

+----+---------------------------------+------------+-------------+----------+----------+

| | Segment assets/(liabilities) | 8,814 | 14,391 | (1,155) | 22,050 |

+----+---------------------------------+------------+-------------+----------+----------+

| | | | | | |

+----+---------------------------------+------------+-------------+----------+----------+

+----+---------------------------------+---+--+------------+-------------+--+------------+

| | | | | | |

+----+---------------------------------+------+------------+-------------+---------------+

| 2 | EXCEPTIONAL OPERATING COSTS | | | | |

+----+---------------------------------+------+------------+-------------+---------------+

| | | | 6 months | 6 months | Year ended |

| | | | ended | ended | |

+----+---------------------------------+------+------------+-------------+---------------+

| | | | 31st | 31st | 30th June |

| | | | December | December | |

+----+---------------------------------+------+------------+-------------+---------------+

| | | | 2008 | 2007 | 2008 |

+----+---------------------------------+------+------------+-------------+---------------+

| | | | GBP000 | GBP000 | GBP000 |

+----+---------------------------------+------+------------+-------------+---------------+

| | Impairment of property, plant | | 588 | - | 276 |

| | and equipment | | | | |

+----+---------------------------------+------+------------+-------------+---------------+

| | Provision against inventories | | 1,071 | - | 10 |

+----+---------------------------------+------+------------+-------------+---------------+

| | Provision for onerous leases | | 2,124 | - | - |

| | and related costs | | | | |

+----+---------------------------------+------+------------+-------------+---------------+

| | Severance payments and | | 252 | 215 | 459 |

| | incentives | | | | |

+----+---------------------------------+------+------------+-------------+---------------+

| | Relocation costs | | 26 | 12 | 101 |

+----+---------------------------------+------+------------+-------------+---------------+

| | Provision for bad debts | | 37 | - | 24 |

+----+---------------------------------+------+------------+-------------+---------------+

| | Legal and professional expenses | | 36 | 23 | 35 |

+----+---------------------------------+------+------------+-------------+---------------+

| | | | 4,134 | 250 | 905 |

+----+---------------------------------+------+------------+-------------+---------------+

| | | | | | |

+----+---------------------------------+------+------------+-------------+---------------+

| | The impairment of property, plant and equipment, the provision against |

| | inventories, the provision for onerous leases and related costs and part of the |

| | severance payments and incentives relate to the ongoing reorganisation of the |

| | residential carpets business. The remainder of the severance payments and |

| | incentives and part of the relocation costs relate to the commercial carpets |

| | business. The remainder of the relocation costs and the provision for bad debts |

| | relate to the discontinuation of the yarn dyeing operation. The legal and |

| | professional expenses relate to the streamlining of the group structure. |

| | |

+----+-----------------------------------------------------------------------------------+

| | GBP4,077,000 (31st December 2007: GBP250,000, 30th June 2008: GBP419,000) of the |

| | exceptional operating costs related to continuing operations and GBP57,000 (31st |

| | December 2007: GBPnil, 30th June 2008: GBP486,000) related to discontinued |

| | operations. |

+----+-----------------------------------------------------------------------------------+

| | | | | | |

+----+---------------------------------+---+---------------+----------------+------------+

| 3 | DIVIDENDS | | | | |

+----+---------------------------------+---+---------------+----------------+------------+

| | | | 6 months | 6 months ended | Year ended |

| | | | ended | | |

+----+---------------------------------+---+---------------+----------------+------------+

| | | | 31st December | 31st December | 30th June |

+----+---------------------------------+---+---------------+----------------+------------+

| | | | 2008 | 2007 | 2008 |

+----+---------------------------------+---+---------------+----------------+------------+

| | | | GBP000 | GBP000 | GBP000 |

+----+---------------------------------+---+---------------+----------------+------------+

| | Paid during the period: | | | | |

+----+---------------------------------+---+---------------+----------------+------------+

| | Final dividend for the year | | | | |

| | ended 30th June 2008 | | | | |

+----+---------------------------------+---+---------------+----------------+------------+

| | - 1.60p per share | | 740 | - | - |

+----+---------------------------------+---+---------------+----------------+------------+

| | Interim dividend for the year | | | | |

| | ended 30th June 2008 | | | | |

+----+---------------------------------+---+---------------+----------------+------------+

| | - 0.80p per share | | - | - | 370 |

+----+---------------------------------+---+---------------+----------------+------------+

| | Final dividend for the year | | | | |

| | ended 30th June 2007 | | | | |

+----+---------------------------------+---+---------------+----------------+------------+

| | - 1.60p per share | | - | 740 | 740 |

+----+---------------------------------+---+---------------+----------------+------------+

| | | | 740 | 740 | 1,110 |

+----+---------------------------------+---+---------------+----------------+------------+

| | Proposed after the period end | | | | |

| | (not recognised as a | | | | |

| | liability): | | | | |

+----+---------------------------------+---+---------------+----------------+------------+

| | Final dividend for the year | | | | |

| | ended 30th June 2008 | | | | |

+----+---------------------------------+---+---------------+----------------+------------+

| | - 1.60p per share | | - | - | 740 |

+----+---------------------------------+---+---------------+----------------+------------+

| | Interim dividend for the year | | | | |

| | ended 30th June 2008 | | | | |

+----+---------------------------------+---+---------------+----------------+------------+

| | - 0.80p per share | | - | 370 | - |

+----+---------------------------------+---+---------------+----------------+------------+

| | | | - | 370 | 740 |

+----+---------------------------------+---+---------------+----------------+------------+

| | | | | | |

+----+---------------------------------+---+--+------------+-------------+--+------------+

+----+----------------------------+---------+----+----+----+----+----+----+----+----+----+----+

| 4 | EARNINGS PER SHARE | | | | | | |

+----+----------------------------+--------------+---------+---------+---------+---------+----+

| | (a) Group results | | | | | | |

+----+----------------------------+--------------+---------+---------+---------+---------+----+

| | The calculation of basic earnings per share is based on a loss of GBP8,781,000 (31st |

| | December 2007: earnings GBP4,869,000, 30th June 2008: loss GBP3,613,000) and on |

| | 46,242,455 (31st December 2007: 46,242,455, 30th June 2008: 46,242,455) ordinary |

| | shares, being the number in issue during the period. |

+----+ +

| | |

+----+----------------------------------------------------------------------------------------+

| | |

| | Adjusted earnings per share is calculated after excluding exceptional operating |

| | costs, impairment of goodwill, the exceptional profit on sale of property, the |

| | related movements on deferred tax and the loss on disposal of discontinued operations |

| | as set out below. |

| | |

+----+ +

| | |

+----+----------------------------------------------------------------------------------------+

| | | 6 months | 6 months ended | Year |

| | | ended | | ended |

+----+----------------------------+-------------------+-------------------+-------------------+

| | | 31st December | 31st December | 30th June |

| | | 2008 | 2007 | 2008 |

+----+----------------------------+-------------------+-------------------+-------------------+

| | | GBP000 | pence | GBP000 | pence | GBP000 | pence |

+----+----------------------------+---------+---------+---------+---------+---------+---------+

| | (Loss)/earnings and basic | (8,781) | (18.99) | 4,689 | 10.14 | (3,613) | (7.81) |

| | (loss)/earnings per share | | | | | | |

+----+----------------------------+---------+---------+---------+---------+---------+---------+

| | Exceptional operating | 4,073 | 8.81 | 175 | 0.38 | 634 | 1.37 |

| | costs (net of tax) | | | | | | |

+----+----------------------------+---------+---------+---------+---------+---------+---------+

| | Impairment of goodwill | 4,000 | 8.65 | 845 | 1.82 | 8,857 | 19.15 |

+----+----------------------------+---------+---------+---------+---------+---------+---------+

| | Exceptional profit on sale | - | - | (8,982) | (19.42) | (9,158) | (19.81) |

| | of property (net of tax) | | | | | | |

+----+----------------------------+---------+---------+---------+---------+---------+---------+

| | Deferred tax movements on | - | - | 1,316 | 2.85 | 1,316 | 2.85 |

| | sale of property | | | | | | |

+----+----------------------------+---------+---------+---------+---------+---------+---------+

| | Loss on disposal of | - | - | 2,668 | 5.77 | 2,668 | 5.77 |

| | discontinued operations | | | | | | |

+----+----------------------------+---------+---------+---------+---------+---------+---------+

| | Adjusted (loss)/earnings | (708) | (1.53) | 711 | 1.54 | 704 | 1.52 |

| | and basic (loss)/earnings | | | | | | |

| | per share | | | | | | |

+----+----------------------------+---------+---------+---------+---------+---------+---------+

| | | | | | | | |

+----+----------------------------+---------+---------+---------+---------+---------+---------+

| | (b) Continuing operations | | | | | | |

+----+----------------------------+---------+---------+---------+---------+---------+---------+

| | The calculation of basic earnings per share from continuing operations is based on a |

| | loss of GBP8,724,000 (31st December 2007: earnings GBP7,879,000, 30th June 2008: |

| | earnings GBP434,000) and on 46,242,455 (31st December 2007: 46,242,455, 30th June |

| | 2008: 46,242,455) ordinary shares. |

+----+ +

| | |

+----+----------------------------------------------------------------------------------------+

| | |

| | Adjusted earnings per share from continuing operations is calculated after excluding |

| | exceptional operating costs, impairment of goodwill, the exceptional profit on sale |

| | of property and the related movements on deferred tax as set out below. |

+----+ +

| | |

+----+----------------------------------------------------------------------------------------+

| | | 6 months | 6 months ended | Year |

| | | ended | | ended |

+----+----------------------------+-------------------+-------------------+-------------------+

| | | 31st December | 31st December | 30th June |

| | | 2008 | 2007 | 2008 |

+----+----------------------------+-------------------+-------------------+-------------------+

| | | GBP000 | pence | GBP000 | pence | GBP000 | pence |

+----+----------------------------+---------+---------+---------+---------+---------+---------+

| | (Loss)/earnings and basic | (8,724) | (18.87) | 7,879 | 17.04 | 434 | 0.94 |

| | (loss)/earnings per share | | | | | | |

+----+----------------------------+---------+---------+---------+---------+---------+---------+

| | Exceptional operating | 4,016 | 8.69 | 175 | 0.38 | 293 | 0.63 |

| | costs (net of tax) | | | | | | |

+----+----------------------------+---------+---------+---------+---------+---------+---------+

| | Impairment of goodwill | 4,000 | 8.65 | - | - | 8,012 | 17.33 |

+----+----------------------------+---------+---------+---------+---------+---------+---------+

| | Exceptional profit on sale | - | - | (8,982) | (19.42) | (9,158) | (19.81) |

| | of property (net of tax) | | | | | | |

+----+----------------------------+---------+---------+---------+---------+---------+---------+

| | Deferred tax movements on | - | - | 1,316 | 2.85 | 1,316 | 2.85 |

| | sale of property | | | | | | |

+----+----------------------------+---------+---------+---------+---------+---------+---------+

| | Adjusted (loss)/earnings | (708) | (1.53) | 388 | 0.85 | 897 | 1.94 |

| | and basic (loss)/earnings | | | | | | |

| | per share | | | | | | |

+----+----------------------------+---------+---------+---------+---------+---------+---------+

| | | | | | | | |

+----+----------------------------+---------+---------+---------+---------+---------+---------+

| | (c) Discontinued | | | | | | |

| | operations | | | | | | |

+----+----------------------------+---------+---------+---------+---------+---------+---------+

| | The calculation of basic earnings per share from discontinued operations is based on |

| | a loss of GBP57,000 (31st December 2007: loss GBP3,190,000, 30th June 2008: loss |

| | GBP4,047,000) and on 46,242,455 (31st December 2007: 46,242,455, 30th June 2008: |

| | 46,242,455) ordinary shares. |

+----+ +

| | |

+----+----------------------------------------------------------------------------------------+

| | Adjusted earnings per share from discontinued operations is calculated after |

| | excluding exceptional operating costs, impairment of goodwill and the loss on |

| | disposal of discontinued operations as set out below. |

+----+ +

| | |

+----+----------------------------------------------------------------------------------------+

| | | 6 months | 6 months ended | Year |

| | | ended | | ended |

+----+----------------------------+-------------------+-------------------+-------------------+

| | | 31st December | 31st December | 30th June |

| | | 2008 | 2007 | 2008 |

+----+----------------------------+-------------------+-------------------+-------------------+

| | | GBP000 | pence | GBP000 | pence | GBP000 | pence |

+----+----------------------------+---------+---------+---------+---------+---------+---------+

| | (Loss)/earnings and basic | (57) | (0.12) | (3,190) | (6.90) | (4,047) | (8.75) |

| | (loss)/earnings per share | | | | | | |

+----+----------------------------+---------+---------+---------+---------+---------+---------+

| | Exceptional operating | 57 | 0.12 | - | - | 341 | 0.74 |

| | costs (net of tax) | | | | | | |

+----+----------------------------+---------+---------+---------+---------+---------+---------+

| | Impairment of goodwill | - | - | 845 | 1.82 | 845 | 1.82 |

+----+----------------------------+---------+---------+---------+---------+---------+---------+

| | Loss on disposal of | - | - | 2,668 | 5.77 | 2,668 | 5.77 |

| | discontinued operations | | | | | | |

+----+----------------------------+---------+---------+---------+---------+---------+---------+

| | Adjusted earnings/(loss) | - | - | 323 | 0.69 | (193) | (0.42) |

| | and basic earnings/(loss) | | | | | | |

| | per share | | | | | | |

+----+----------------------------+---------+---------+---------+---------+---------+---------+

| | | | | | | | |

+----+----------------------------+---------+----+----+----+----+----+----+----+----+----+----+

+----+---------------------------------+---+-------+----+------+------------+------------+

| 5 | DEFERRED TAX | | | | |

+----+---------------------------------+---+-------------------+------------+------------+

| | | | 31st December | 31st | 30th June |

| | | | | December | |

+----+---------------------------------+---+-------------------+------------+------------+

| | | | 2008 | 2007 | 2008 |

+----+---------------------------------+---+-------------------+------------+------------+

| | | | GBP000 | GBP000 | GBP000 |

+----+---------------------------------+---+-------------------+------------+------------+

| | (a) Deferred tax non-current | | | | |

| | asset | | | | |

+----+---------------------------------+---+-------------------+------------+------------+

| | Brought forward | | 1,540 | 2,520 | 2,520 |

+----+---------------------------------+---+-------------------+------------+------------+

| | Movement during the period | | (280) | (740) | (980) |

+----+---------------------------------+---+-------------------+------------+------------+

| | Carried forward | | 1,260 | 1,780 | 1,540 |

+----+---------------------------------+---+-------------------+------------+------------+

| | The above amounts are in respect of the deferred tax asset relating to the gross |

| | pension deficit. |

+----+-----------------------------------------------------------------------------------+

| | (b) Deferred tax current asset | | | | |

+----+---------------------------------+---+-------------------+------------+------------+

| | Brought forward | | - | 1,260 | 1,260 |

+----+---------------------------------+---+-------------------+------------+------------+

| | Movement during the period | | - | (1,260) | (1,260) |

+----+---------------------------------+---+-------------------+------------+------------+

| | Carried forward | | - | - | - |

+----+---------------------------------+---+-------------------+------------+------------+

| | The above amounts are in respect of the deferred tax asset relating to the assets |

| | previously held for sale. |

+----+-----------------------------------------------------------------------------------+

| | (c) Deferred tax current | | | | |

| | liability | | | | |

+----+---------------------------------+---+-------------------+------------+------------+

| | Brought forward | | 252 | 738 | 738 |

+----+---------------------------------+---+-------------------+------------+------------+

| | Movement during the period | | (41) | (121) | (386) |

+----+---------------------------------+---+-------------------+------------+------------+

| | Disposal of subsidiary | | - | - | (100) |

| | undertaking | | | | |

+----+---------------------------------+---+-------------------+------------+------------+

| | Carried forward | | 211 | 617 | 252 |

+----+---------------------------------+---+-------------------+------------+------------+

| | The above amounts are in respect of accelerated capital allowances and other |

| | timing differences. |

+----+-----------------------------------------------------------------------------------+

| | RETAINED EARNINGS | | | | |

| | | | | | |

| 6 | | | | | |

+----+---------------------------------+---+-------------------+------------+------------+

| | | | 31st December | 31st | 30th June |

| | | | | December | |

+----+---------------------------------+---+-------------------+------------+------------+

| | | | 2008 | 2007 | 2008 |

+----+---------------------------------+---+-------------------+------------+------------+

| | | | GBP000 | GBP000 | GBP000 |

+----+---------------------------------+---+-------------------+------------+------------+

| | Brought forward | | 10,328 | 15,695 | 15,695 |

+----+---------------------------------+---+-------------------+------------+------------+

| | (Loss)/profit for the period | | (8,781) | 4,689 | (3,613) |

+----+---------------------------------+---+-------------------+------------+------------+

| | Other recognised losses | | - | - | (644) |

+----+---------------------------------+---+-------------------+------------+------------+

| | Equity dividends paid | | (740) | (740) | (1,110) |

+----+---------------------------------+---+-------------------+------------+------------+

| | Carried forward | | 807 | 19,644 | 10,328 |

+----+---------------------------------+---+-------------------+------------+------------+

| | | | | | |

+----+---------------------------------+---+-------------------+------------+------------+

| 7 | STATEMENT OF CHANGES IN TOTAL EQUITY | | | | |

+----+---------------------------------------------+----+------+------------+------------+

| | | | 31st December | 31st | 30th June |

| | | | | December | |

+----+---------------------------------+---+-------------------+------------+------------+

| | | | 2008 | 2007 | 2008 |

+----+---------------------------------+---+-------------------+------------+------------+

| | | | GBP000 | GBP000 | GBP000 |

+----+---------------------------------+---+-------------------+------------+------------+

| | Brought forward | | 24,788 | 30,155 | 30,155 |

+----+---------------------------------+---+-------------------+------------+------------+

| | (Loss)/profit for the period | | (8,781) | 4,689 | (3,613) |

+----+---------------------------------+---+-------------------+------------+------------+

| | Other recognised losses | | - | - | (644) |

+----+---------------------------------+---+-------------------+------------+------------+

| | Equity dividends paid | | (740) | (740) | (1,110) |

+----+---------------------------------+---+-------------------+------------+------------+

| | Carried forward | | 15,267 | 34,104 | 24,788 |

+----+---------------------------------+---+-------------------+------------+------------+

| | | | | | |

+----+---------------------------------+---+-------+----+------+------------+------------+

+----+--------------------------------+---+------+------+------+--+------+------+------+----+

| | | | | | |

+----+--------------------------------+---+-----------------------+-------------+-----------+

| 8 | RECONCILIATION OF (LOSS)/PROFIT | | | |

| | FOR THE PERIOD | | | |

+----+---------------------------------------------------------+--+-------------+-----------+

| | TO NET CASH USED IN OPERATIONS | | | | |

+----+--------------------------------+---+-----------------------+-------------+-----------+

| | | | 6 months ended | 6 months | Year |

| | | | | ended | ended |

+----+--------------------------------+---+-----------------------+-------------+-----------+

| | | | 31st December | 31st | 30th June |

| | | | | December | |

+----+--------------------------------+---+-----------------------+-------------+-----------+

| | | | 2008 | 2007 | 2008 |

+----+--------------------------------+---+-----------------------+-------------+-----------+

| | | | GBP000 | GBP000 | GBP000 |

+----+--------------------------------+---+-----------------------+-------------+-----------+

| | (Loss)/profit for the period | | (8,781) | 4,689 | (3,613) |

+----+--------------------------------+---+-----------------------+-------------+-----------+

| | Tax (credited)/charged | | (363) | 2,067 | 2,104 |

+----+--------------------------------+---+-----------------------+-------------+-----------+

| | Finance costs/(income) | | 109 | (31) | (334) |

+----+--------------------------------+---+-----------------------+-------------+-----------+

| | Impairment of property, plant | | 588 | - | 276 |

| | and equipment | | | | |

+----+--------------------------------+---+-----------------------+-------------+-----------+

| | Exceptional profit on sale of | | - | (9,616) | (9,858) |

| | property | | | | |

+----+--------------------------------+---+-----------------------+-------------+-----------+

| | Impairment of goodwill | | 4,000 | 845 | 8,857 |

+----+--------------------------------+---+-----------------------+-------------+-----------+

| | Loss on disposal of | | - | 2,668 | 2,668 |

| | discontinued operations | | | | |

+----+--------------------------------+---+-----------------------+-------------+-----------+

| | Depreciation | | 523 | 749 | 1,245 |

+----+--------------------------------+---+-----------------------+-------------+-----------+

| | (Profit)/loss on disposal of | (49) | (16) | 38 |

| | property, plant and equipment | | | |

+----+------------------------------------+-----------------------+-------------+-----------+

| | Current service pension cost | | - | 130 | - |

+----+--------------------------------+---+-----------------------+-------------+-----------+

| | Decrease/(increase) in | | 2,721 | 153 | (733) |

| | inventories | | | | |

+----+--------------------------------+---+-----------------------+-------------+-----------+

| | Decrease/(increase) in | | 1,553 | (2,289) | (2,747) |

| | receivables | | | | |

+----+--------------------------------+---+-----------------------+-------------+-----------+

| | (Decrease)/increase in | | (2,007) | (1,091) | 1,609 |

| | payables | | | | |

+----+--------------------------------+---+-----------------------+-------------+-----------+

| | Contributions to defined | | (1,150) | (2,600) | (3,660) |

| | benefit pension scheme | | | | |

+----+--------------------------------+---+-----------------------+-------------+-----------+

| | Net cash used in operations | | (2,856) | (4,342) | (4,148) |

+----+--------------------------------+---+-----------------------+-------------+-----------+

| | | | | | |

+----+--------------------------------+---+-----------------------+-------------+-----------+

| 9 | BASIS OF PREPARATION AND ACCOUNTING POLICIES | | | |

+----+--------------------------------------------------+---------+-------------+-----------+

| | |

| | The financial information for the six months ended 31st December 2008 and the six |

| | months ended 31st December 2007 is unreviewed and unaudited. The comparative figures |

| | for the financial year ended 30th June 2008 are not the statutory financial |

| | statements of AIREA plc for that financial year. Those financial statements have |

| | been reported on by the Company's auditors and delivered to the registrar of |

| | companies. The report of the auditors was unqualified and did not contain statements |

| | under section 237(2) or (3) of the Companies Act 1985. |

| | |

+----+--------------------------------------------------------------------------------------+

| | These interim financial statements have been prepared using the recognition and |

| | measurement principles of International Financial Reporting Standards as adopted by |

| | the European Union ("IFRS"). The accounting policies used are the same as those used |

| | in preparing the financial statements for the year ended 30th June 2008. These |

| | policies are set out in the annual report and accounts for the year ended 30th June |

| | 2008 which is available on the Company's website at www.aireaplc.co.uk. |

| | |

+----+--------------------------------------------------------------------------------------+

| | Further copies of this report are available from the Company Secretary at the |

| | registered office at Victoria Mills, The Green, Ossett, Wakefield, West Yorkshire |

| | WF5 0AN. |

+----+--------------------------------------------------------------------------------------+

| | | | | | |

+----+--------------------------------+---+------+------+------+--+------+------+------+----+

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR KGGZFNFKGLZM

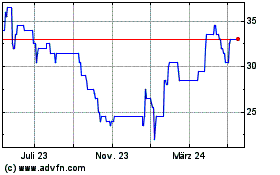

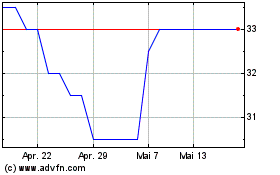

Airea (LSE:AIEA)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Airea (LSE:AIEA)

Historical Stock Chart

Von Jul 2023 bis Jul 2024