Canadian Dollar Climbs Against Majors

21 November 2024 - 3:30PM

RTTF2

The Canadian dollar advanced against its most major counterparts

in the New York session on Thursday amid higher oil prices, as

Russia-Ukraine tensions intensified and fuelled concerns about

disruption in oil supplies.

Ukraine's air force claimed that Russia has fired an

intercontinental ballistic missile at the country, although Russia

has refused to comment on the allegation.

The attack was in response to Ukraine's use of U.S. and U.K.

missiles into Russia.

Geopolitical concerns in eastern Europe eclipsed worries about

weak demand ignited by a higher-than-expected inventory build in

the U.S.

Data from U.S. Energy Information Administration showed that

crude oil inventories crept up by 0.5 million barrels last week,

after rising by 2.1 million barrels in the previous week. Markets

had anticipated a build of 0.4 million barrels.

The loonie rose to a 6-day high of 0.9073 against the aussie,

8-day high of 1.3931 against the greenback and near a 5-month high

of 1.4611 against the euro, off its early lows of 0.9114, 1.3978

and 1.4742, respectively. The currency is likely to locate

resistance around 0.89 against the aussie, 1.36 against the

greenback and 1.44 against the euro.

In contrast, the loonie fell to a 2-day low of 110.24 against

the yen. The currency is likely to locate support around the 106.00

level.

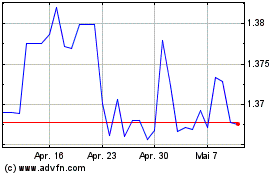

US Dollar vs CAD (FX:USDCAD)

Forex Chart

Von Nov 2024 bis Dez 2024

US Dollar vs CAD (FX:USDCAD)

Forex Chart

Von Dez 2023 bis Dez 2024