Pound Weakens As Investors Await U.S Jobs Report

03 September 2024 - 2:54PM

RTTF2

The pound fell against its major counterparts in the New York

session on Tuesday, as investors awaited key U.S. economic data,

including Friday's non-farm payrolls report for August to gauge the

size of the Federal Reserve's rate cut later this month.

Friday's U.S. jobs report is crucial as an apparently cooling

labor market might reignite recession fears and fuel speculation of

a 50-basis point rate cut in mid-September.

Economists expect employment to climb by 165,000 jobs in August

after rising by 114,000 jobs in July.

The unemployment rate is expected to edge down to 4.2 percent in

August from 4.3 percent in July.

Data from the British Retail Consortium showed that UK retail

sales increased in August driven by food sales.

Total retail sales grew 1.0 percent year-on-year in August but

slower than the 4.1 percent increase posted in the same period last

year.

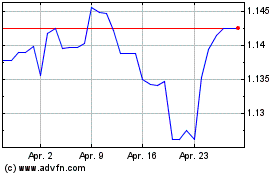

The pound dropped to 5-day lows of 190.32 against the yen and

1.1118 against the franc, off its early highs of 193.36 and 1.1209,

respectively. The pound is likely to challenge support around

185.00 against the yen and 1.09 against the franc.

The pound declined to near a 2-week low of 1.3088 against the

greenback and a 5-day low of 0.8434 against the euro, from an early

high of 1.3148 and a 4-day high of 0.8406, respectively. The pound

is seen finding support around 1.27 against the greenback and 0.86

against the euro.

Sterling vs CHF (FX:GBPCHF)

Forex Chart

Von Dez 2024 bis Dez 2024

Sterling vs CHF (FX:GBPCHF)

Forex Chart

Von Dez 2023 bis Dez 2024