U.S. Dollar Higher After Fed Minutes

09 Oktober 2024 - 6:12PM

RTTF2

The U.S. dollar was higher against its major counterparts in the

New York session on Wednesday, after the minutes of the Federal

Reserve's latest policy meeting showed a split among policymakers

for lowering the policy rate by 50 basis points at the meeting.

In light of the progress on inflation and the balance of risks,

all participants agreed that it was appropriate to ease the stance

of monetary policy, the minutes from the September 17-18 meeting

showed.

A substantial majority of participants supported lowering the

target range for the federal funds rate by 50 basis points

observing that this adjustment in monetary policy would help align

it more closely with recent inflation and labour market

indicators.

Some participants noted that there had been a plausible case for

a 25 basis point rate cut at the previous meeting and that data

over the intermeeting period had provided further evidence that

inflation was on a sustainable path toward 2 percent while the

labor market continued to cool.

Fed officials noted that if the data came in about as expected,

with inflation moving down sustainably to 2 percent and the economy

near maximum employment, it would likely be appropriate to move

toward a more neutral stance of policy over time.

The greenback climbed to near 2-month highs of 1.0935 against

the euro, 0.8609 against the franc, 149.35 against the yen and

1.3710 against the loonie, off its early lows of 1.0980, 0.8565,

148.00 and 1.3643, respectively. The currency is seen finding

resistance around 1.08 against the euro, 0.89 against the franc,

150.00 against the yen and 1.38 against the loonie.

The greenback appreciated to more than a 3-week high of 0.6707

against the aussie and near a 2-month high of 0.6052 against the

kiwi, from its early lows of 0.6761 and 0.6143, respectively. The

currency is poised to challenge resistance around 0.65 against the

aussie and 0.58 against the kiwi.

The greenback rebounded to 1.3061 against the pound. This may be

compared to an early nearly 4-week high of 1.3055. The currency is

poised to challenge resistance around the 1.29 level.

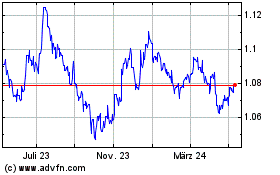

Euro vs US Dollar (FX:EURUSD)

Forex Chart

Von Nov 2024 bis Dez 2024

Euro vs US Dollar (FX:EURUSD)

Forex Chart

Von Dez 2023 bis Dez 2024