Euro Falls Amid Growth Concerns

24 März 2023 - 9:42AM

RTTF2

The euro depreciated against its major counterparts in the

European session on Friday, as European shares fell on renewed

concerns about the health of the banking sector despite assurances

from U.S. regulators.

Treasury Secretary Janet Yellen's pledge to safeguard all

deposits without congressional approval failed to reassure

investors.

Flash survey results from S&P Global showed that Eurozone

and German manufacturing PMIs fell more-than-expected in March.

Eurozone manufacturing PMI dropped to a 4-month low of 47.1 in

March from 48.5 last month. The reading was forecast to fall to

49.

German manufacturing PMI fell to 44.4 in March from 46.3 in

February. This was the lowest reading since May 2020.

The U.K.'s FTSE 100 dropped 1.9 percent, while France's CAC 40

and Germany's DAX fell 2.2 percent each.

The euro dropped to 3-day lows of 1.0712 against the greenback

and 1.7272 against the kiwi, from its prior highs of 1.0838 and

1.7376, respectively. The next likely support for the euro is seen

around 1.05 against the greenback and 1.70 against the kiwi.

The euro weakened to a 2-day low of 0.8777 against the pound and

a 1-week low of 0.9848 against the franc, after rising to 0.8826

and 0.9939, respectively in early deals. The currency may find

support around 0.86 against the pound and 0.97 against the franc,

should it drops again.

The euro fell to 2-day lows of 1.6138 against the aussie and

1.4766 against the loonie, retreating from its early highs of

1.6251 and 1.4870, respectively. The euro is poised to challenge

support around 1.58 against the aussie and 1.46 against the

loonie.

The euro was down against the yen, at a 4-day low of 139.06. On

the downside, 135.00 is possibly seen as its next support

level.

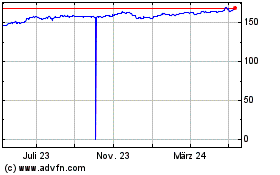

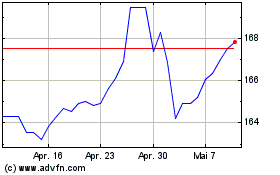

Euro vs Yen (FX:EURJPY)

Forex Chart

Von Nov 2024 bis Dez 2024

Euro vs Yen (FX:EURJPY)

Forex Chart

Von Dez 2023 bis Dez 2024