Volta Finance Limited : Director/PDMR Shareholding

Volta Finance Limited

(VTA/VTAS)

Notification of transactions by

directors, persons discharging managerial

responsibilities and persons closely associated with

them

NOT FOR RELEASE, DISTRIBUTION OR PUBLICATION, IN WHOLE

OR IN PART, IN OR INTO THE UNITED STATES

***** Guernsey, 1 November 2023

Pursuant to the announcements made on 5 April

2019 and 26 June 2020 relating to changes to the payment of

directors fees, Volta Finance Limited (the “Company” or “Volta”)

has purchased 4,549 ordinary shares of no par value in the Company

(“Ordinary Shares”) at an average price of €5.09 per share.

Each director receives 30% of their Director’s

fees for any year in the form of shares, which they are required to

retain for a period of no less than one year from their respective

date of issue.

The shares will be issued to the Directors, who

for the purposes of Regulation (EU) No 596/2014 on Market Abuse

("MAR") are "persons discharging managerial

responsibilities" (a "PDMR").

- Dagmar Kershaw,

Chairman and a PDMR for the purposes of MAR, acquired 1,152

additional Ordinary Shares in the Company. Following the settlement

of this transaction, Ms Kershaw will have an interest in 9,605

Ordinary Shares, representing 0.03% of the issued shares of the

Company;

- Stephen Le

Page, Director and a PDMR for the purposes of MAR, acquired 979

additional Ordinary Shares in the Company. Following the settlement

of this transaction, Mr Le Page will have an interest in 47,970

Ordinary Shares, representing 0.13% of the issued shares of the

Company;

- Graham

Harrison, Director and a PDMR for the purposes of MAR, acquired 806

additional Ordinary Shares in the Company. Following the settlement

of this transaction, Mr Harrison will have an interest in 29,994

Ordinary Shares, representing 0.08% of the issued shares of the

Company;

- Yedau

Ogoundele, Director and a PDMR for the purposes of MAR acquired 806

additional Ordinary Shares in the Company. Following the settlement

of this transaction, Mrs Ogoundele will have an interest in 4,598

Ordinary Shares, representing 0.01% of the issued shares of the

Company; and

- Joanne

Peacegood, Director and a PDMR for the purposes of MAR acquired 806

additional Ordinary Shares in the Company. Following the settlement

of this transaction, Mrs Peacegood will have an interest in 1,085

Ordinary Shares, representing 0.01% of the issued shares of the

Company;

The notifications below, made in accordance with

the requirements of MAR, provide further detail in relation to the

above transactions:

- Details of the person discharging managerial

responsibilities / person closely associated

|

|

a) Dagmar KershawCHAIRMAN &

DIRECTOR |

b) Stephen Le PageDIRECTOR |

c) Graham Harrison DIRECTOR |

d) Yedau OgoundeleDIRECTOR |

e) Joanne PeacegoodDIRECTOR |

- Reason for the notification

|

|

a. Position/status |

Director |

|

b. Initial notification/Amendment |

Initial notification |

- Details of the issuer, emission allowance market

participant, auction platform, auctioneer or auction

monitor

|

|

a. Name |

Volta Finance Limited |

|

b. LEI |

2138004N6QDNAZ2V3W80 |

- Details of the transaction(s): section to be repeated

for (i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions have been

conducted

|

|

a. Description of financial instrument, type of instrument |

Ordinary Shares |

|

b. Identification code |

GG00B1GHHH78 |

|

c. Nature of the transaction |

Purchase and allocation of Ordinary Shares relation to the

part-payment of Directors' fees for the quarter ended 31 July

2023 |

|

d. Price(s) |

€5.09 per share |

|

e. Volume(s) |

Total: 4,549 |

|

f. Date of transaction |

1 November 2023 |

|

g. Place of transaction |

On-market – London |

- Aggregate Purchase Information

|

|

a) Dagmar KershawChairman and Director |

b)Steve Le PageDirector |

c) Graham Harrison Director |

d) Yedau Ogoundele Director |

e)Joanne PeacegoodDirector |

|

Aggr. Volume: 1,152 Price: €5.09 per share |

Aggr. Volume:979 Price:€5.09 per share |

Aggr. Volume: 806 Price:€5.09 per share |

Aggr. Volume: 806 Price: €5.09 per share |

Aggr. Volume: 806 Price: €5.09 per share |

CONTACTS

For the Investment ManagerAXA

Investment Managers ParisSerge Demayserge.demay@axa-im.com+33 (0) 1

44 45 84 47

Company Secretary and

AdministratorBNP Paribas S.A, Guernsey

Branchguernsey.bp2s.volta.cosec@bnpparibas.com +44 (0) 1481

750 853

Corporate BrokerCenkos Securities plcAndrew

WorneDaniel Balabanoff+44 (0) 20 7397 8900

***** ABOUT VOLTA FINANCE

LIMITED

Volta Finance Limited is incorporated in

Guernsey under the Companies (Guernsey) Law, 2008 (as amended) and

listed on Euronext Amsterdam and the London Stock Exchange's Main

Market for listed securities. Volta’s home member state for the

purposes of the EU Transparency Directive is the Netherlands. As

such, Volta is subject to regulation and supervision by the AFM,

being the regulator for financial markets in the Netherlands.

Volta’s Investment objectives are to preserve

its capital across the credit cycle and to provide a stable stream

of income to its Shareholders through dividends that it expects to

distribute on a quarterly basis. The Company currently seeks to

achieve its investment objectives by pursuing exposure

predominantly to CLO’s and similar asset classes. A more

diversified investment strategy across structured finance assets

may be pursued opportunistically. The Company has appointed AXA

Investment Managers Paris an investment management company with a

division specialised in structured credit, for the investment

management of all its assets.

*****

ABOUT AXA INVESTMENT

MANAGERSAXA Investment Managers (AXA IM) is a multi-expert

asset management company within the AXA Group, a global leader in

financial protection and wealth management. AXA IM is one of the

largest European-based asset managers with 2,600 professionals and

€824 billion in assets under management as of the end of December

2022.

*****

This press release is published by AXA

Investment Managers Paris (“AXA IM”), in its capacity as

alternative investment fund manager (within the meaning of

Directive 2011/61/EU, the “AIFM Directive”) of Volta Finance

Limited (the "Volta Finance") whose portfolio is managed by AXA

IM.

This press release is for information

only and does not constitute an invitation or inducement to acquire

shares in Volta Finance. Its circulation may be prohibited in

certain jurisdictions and no recipient may circulate copies of this

document in breach of such limitations or restrictions. This

document is not an offer for sale of the securities referred to

herein in the United States or to persons who are “U.S. persons”

for purposes of Regulation S under the U.S. Securities Act of 1933,

as amended (the “Securities Act”), or otherwise in circumstances

where such offer would be restricted by applicable law. Such

securities may not be sold in the United States absent registration

or an exemption from registration from the Securities Act. Volta

Finance does not intend to register any portion of the offer of

such securities in the United States or to conduct a public

offering of such securities in the United States.

*****

This communication is only being

distributed to and is only directed at (i) persons who are outside

the United Kingdom or (ii) investment professionals falling within

Article 19(5) of the Financial Services and Markets Act 2000

(Financial Promotion) Order 2005 (the “Order”) or (iii) high net

worth companies, and other persons to whom it may lawfully be

communicated, falling within Article 49(2)(a) to (d) of the Order

(all such persons together being referred to as “relevant

persons”). The securities referred to herein are only available to,

and any invitation, offer or agreement to subscribe, purchase or

otherwise acquire such securities will be engaged in only with,

relevant persons. Any person who is not a relevant person should

not act or rely on this document or any of its contents. Past

performance cannot be relied on as a guide to future

performance.

*****This press release

contains statements that are, or may deemed to be, "forward-looking

statements". These forward-looking statements can be identified by

the use of forward-looking terminology, including the terms

"believes", "anticipated", "expects", "intends", "is/are expected",

"may", "will" or "should". They include the statements regarding

the level of the dividend, the current market context and its

impact on the long-term return of Volta Finance's investments. By

their nature, forward-looking statements involve risks and

uncertainties and readers are cautioned that any such

forward-looking statements are not guarantees of future

performance. Volta Finance's actual results, portfolio composition

and performance may differ materially from the impression created

by the forward-looking statements. AXA IM does not undertake any

obligation to publicly update or revise forward-looking

statements.

Any target information is based on

certain assumptions as to future events which may not prove to be

realised. Due to the uncertainty surrounding these future events,

the targets are not intended to be and should not be regarded as

profits or earnings or any other type of forecasts. There can be no

assurance that any of these targets will be achieved. In addition,

no assurance can be given that the investment objective will be

achieved.

The figures provided that relate to past

months or years and past performance cannot be relied on as a guide

to future performance or construed as a reliable indicator as to

future performance. Throughout this review, the citation of

specific trades or strategies is intended to illustrate some of the

investment methodologies and philosophies of Volta Finance, as

implemented by AXA IM. The historical success or AXA IM’s belief in

the future success, of any of these trades or strategies is not

indicative of, and has no bearing on, future results.

The valuation of financial assets can

vary significantly from the prices that the AXA IM could obtain if

it sought to liquidate the positions on behalf of the Volta Finance

due to market conditions and general economic environment. Such

valuations do not constitute a fairness or similar opinion and

should not be regarded as such.

Editor: AXA INVESTMENT MANAGERS PARIS, a

company incorporated under the laws of France, having its

registered office located at Tour Majunga, 6, Place de la Pyramide

- 92800 Puteaux. AXA IMP is authorized by the

Autorité des Marchés Financiers under

registration number GP92008 as an alternative investment fund

manager within the meaning of the AIFM Directive.

*****

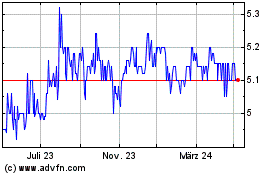

Volta Finance (EU:VTA)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

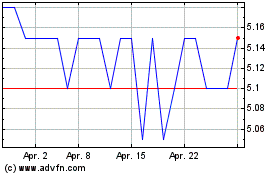

Volta Finance (EU:VTA)

Historical Stock Chart

Von Dez 2023 bis Dez 2024