Vopak reports on Q3 2023 results

25 Oktober 2023 - 7:00AM

Vopak reports on Q3 2023 results

Rotterdam, the Netherlands, 25 October 2023

Vopak reports strong third quarter 2023 results

and increases its EBITDA outlook for FY

2023

Key highlights Q3 2023

Improve:

- EBITDA in Q3 2023 of EUR 241 million. FY 2023 EBITDA outlook

increased to around EUR 970 million.

- Reached an agreement on the sale of chemical terminals in

Rotterdam, the Netherlands.

Grow:

- Gate terminal

starts the construction of the 4th LNG tank at the port of

Rotterdam, the Netherlands.

- Solidifying our leading industrial terminal position in

Singapore with additional pipeline connections.

Accelerate:

- Collaborating for the development of a large-scale, low-carbon

ammonia production and export project on the Houston Ship

Channel.

- Commissioned repurposed infrastructure in the port of Los

Angeles, United States to store low-carbon fuels.

|

Q3 2023 |

Q2 2023 |

Q3 2022 |

|

in EUR millions |

YTD Q3 2023 |

YTD Q3 2022 |

|

352.0 |

359.0 |

349.6 |

|

Revenues |

1,072.8 |

1,011.7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Results -excluding exceptional items- |

|

|

|

240.5 |

245.2 |

226.9 |

|

Group operating profit / (loss) before depreciation and

amortization (EBITDA) |

734.7 |

659.4 |

|

158.2 |

163.5 |

140.3 |

|

Group operating profit / (loss) (EBIT) |

490.3 |

397.0 |

|

97.3 |

103.5 |

77.7 |

|

Net profit / (loss) attributable to holders of ordinary shares |

303.9 |

205.9 |

|

0.77 |

0.83 |

0.62 |

|

Earnings per ordinary share (in EUR) |

2.42 |

1.64 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Results -including exceptional items- |

|

|

|

286.5 |

291.4 |

229.7 |

|

Group operating profit / (loss) before depreciation and

amortization (EBITDA) |

826.9 |

197.8 |

|

204.2 |

209.7 |

143.1 |

|

Group operating profit / (loss) (EBIT) |

582.5 |

- 64.6 |

|

144.2 |

121.0 |

80.5 |

|

Net profit / (loss) attributable to holders of ordinary shares |

368.3 |

- 255.3 |

|

1.15 |

0.97 |

0.64 |

|

Earnings per ordinary share (in EUR) |

2.94 |

-2.04 |

|

|

|

|

|

|

|

|

|

240.2 |

220.2 |

197.9 |

|

Cash flows from operating activities (gross excluding

derivatives) |

680.1 |

581.0 |

|

245.6 |

250.8 |

191.3 |

|

Cash flows from operating activities (gross) |

723.4 |

530.9 |

|

-111.8 |

77.1 |

-117.9 |

|

Cash flows from investing activities (including derivatives) |

- 137.8 |

- 388.7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Additional performance measures |

|

|

|

285.4 |

292.2 |

277.4 |

|

Proportional EBITDA -excluding exceptional items- |

871.7 |

798.2 |

|

22.0 |

22.0 |

22.2 |

|

Proportional capacity end of period (in million cbm) |

22.0 |

22.2 |

|

92% |

91% |

89% |

|

Proportional occupancy rate |

91% |

87% |

|

36.4 |

36.4 |

36.6 |

|

Storage capacity end of period (in million cbm) |

36.4 |

36.6 |

|

91% |

91% |

88% |

|

Subsidiary occupancy rate |

91% |

86% |

|

|

|

|

|

|

|

|

|

14.1% |

13.7% |

11.2% |

|

Proportional operating cash return |

14.4% |

11.3% |

|

12.2% |

12.6% |

10.4% |

|

Return on capital employed (ROCE) |

12.5% |

9.6% |

|

5,068.5 |

5,095.9 |

5,344.3 |

|

Average capital employed |

5,128.9 |

5,443.4 |

|

2,698.8 |

2,852.8 |

3,278.7 |

|

Net interest-bearing debt |

2,698.8 |

3,278.7 |

|

2.09 |

2.27 |

2.82 |

|

Senior net debt : EBITDA |

2.09 |

2.82 |

|

2.27 |

2.46 |

3.02 |

|

Total net debt : EBITDA |

2.27 |

3.02 |

Royal Vopak Chief Executive Officer Dick Richelle,

said:

“The demand for our services remained strong, reflected by an

improved proportional occupancy of 92%. EBITDA increased by 12%

compared with last year, mainly driven by organic growth across

most of the business units. We continued to make good progress on

our strategy to improve our financial and

sustainability performance, to grow our base in

industrial and gas terminals, and to accelerate

towards new energies and sustainable feedstocks. Our well

diversified portfolio combined with our new streamlined

organizational structure, positions us well to continue executing

this strategy. We are pleased to increase the FY 2023 outlook, as

we remain focused on the long-term value creation through

disciplined and balanced capital allocation.”

Financial Highlights for YTD Q3 2023 -

excluding exceptional items -

- Revenue increased to EUR 1,073 million (YTD Q3

2022: EUR 1,012 million) despite a divestment impact of EUR 34

million and unfavorable currency translation effects of EUR 17

million. Compared to Q3 2023 (EUR 352 million) revenue was slightly

lower than Q2 2023 (EUR 359 million) mainly due to divestment

impact and unfavorable currency translation impact in a broadly

stable quarter on quarter business environment. In addition growth

projects contribution further supported revenue.

- Proportional revenue increased to EUR 1,448

million (YTD Q3 2022: EUR 1,366 million).

- During the first nine months of 2023 the oil markets were

dominated by volatility, rebalancing of trade flows and supply

security concerns which supported overall storage demand in the

main hub locations. Chemicals markets are characterized by

oversupply, suppressed China consumption as well as declining

margins and operating rates. The products from feedstock and energy

favored regions are being pushed into the global markets, as a

result the demand for storage is supported and remains stable.

Throughput levels in our global industrial terminals remain firm.

Gas markets (LNG) normalized in 2023 after the disruption caused by

the Russia - Ukraine war.

- Subsidiary occupancy rate at Q3 2023 was 91%

(Q2 2023: 91%).

- Proportional occupancy rate at Q3 2023

increased to 92% (Q2 2023: 91%) mainly due to improved occupancy in

Asia & Middle East and the Netherlands business units.

- Costs increased by EUR 7 million to EUR 529

million (YTD Q3 2022: EUR 522 million) mainly due to

increased personnel expenses and higher operating expenses,

including the cost of growth projects. The increase was partially

offset by a positive divestment impact, cost control measures and

favorable currency translation impact.

- Proportional costs increased by EUR 11 million

to EUR 669 million (YTD Q3 2022: EUR 658 million)

- EBITDA increased by EUR 76 million (12%

year-on-year) to EUR 735 million (YTD Q3 2022: EUR 659 million)

driven by organic growth partially offset by higher costs,

divestment impact (EUR 11 million) and negative currency

translation effects (EUR 15 million). Compared to Q2 2023 (EUR 245

million) EBITDA (Q3 2023: EUR 241 million) decreased due to

additional project development costs (EUR 4 million) and divestment

impact of Savannah terminal of EUR 3 million, offset by

positive business developments.

- Proportional EBITDA increased to EUR 872

million (YTD Q3 2022: EUR 798 million).

- Proportional EBITDA margin in YTD Q3 2023 was

at 57% (YTD Q3 2022: 55%) an improvement reflecting good business

conditions and our commercial ability to pass on inflationary

and exceptional energy costs during the year.

- EBIT of EUR 490 million (YTD Q3 2022:

EUR 397 million), increased by EUR 93 million mainly due to

EBITDA performance and lower depreciation compared to YTD Q3 2022

mainly as a result of impairment charges accounted for in HY1

2022.

- Growth investments in YTD Q3 2023 were EUR 188

million excluding any net cash received (YTD Q3 2022: EUR 270

million). Growth investments in 2022 included Vopak investment in

Aegis-Vopak partnership in India. Proportional growth investments

in YTD Q3 2023 were EUR 245 million (YTD Q3 2022: EUR 299

million).

- Operating capex, which includes sustaining and

IT capex, YTD Q3 2023 was EUR 186 million (YTD Q3 2022: EUR 196

million) in line with Vopak’s projections to have a spend of

maximum EUR 280 million in FY 2023. Proportional operating capex

was EUR 210 million (YTD Q3 2022: EUR 211 million)

- Cash flow from operating activities increased

by EUR 192 million to EUR 723 million compared to YTD Q3 2022 EUR

531 million (36% year-on-year). The increase was related

mainly to positive business performance (EUR 60 million), working

capital movements (EUR 62 million) and settlement of derivatives

(EUR 93 million). This was partially offset by lower dividend

receipts from joint ventures and associates (EUR 23 million).

- Proportional operating cash flow in YTD Q3

2023 increased by EUR 101 million (20% year-on-year) to EUR 615

million (YTD Q3 2022 EUR 514 million) driven mainly by improved

proportional EBITDA performance and partly offset by a negative

currency translation impact of EUR 11 million. Proportional

operating cash return in YTD Q3 2023 was 14.4% compared to 11.3% in

YTD Q3 2022. The increase was due to lessor accounting (0.7%),

higher EBITDA contribution and lower average capital employed

compared to last year. Proportional operating cash return in Q3

2023 was at 14.1% compared to Q2 2023 at 13.7% mainly due to lower

operating capex in YTD 2023.

- Net profit attributable to holders of ordinary

shares -excluding exceptional items- was EUR 304 million

(YTD Q3 2022: EUR 206 million). Q3 2023 Earnings per

share -excluding exceptional items- continued to improve, Q3 2023

EPS was EUR 2.42 (47% year-on-year) compared to EUR 1.64 in Q3

2022.

- The total net debt : EBITDA ratio is 2.27x at

the end of Q3 2023 compared to Q3 2022: 3.02x and Q2 2023: 2.46x

below our ambition to keep net debt to EBITDA in the range of

around 2.5-3.0x.

Exceptional items in YTD Q3

2023 consist of:

- Partial reversal of impairment charges recorded in 2022,

related to the chemical terminal assets in Rotterdam, for an amount

of EUR 54.2 million, immediately before classification of these

assets as held for sale.

- Organizational restructuring charges of EUR 10.7 million YTD Q3

2023 (YTD Q2 2023: EUR 2.5 million) for changes in management

structure in line with Vopak’s strategic goals mainly include

employee termination benefits and advisor costs.

- A gain of EUR 49.7 million with a tax charge of EUR 28.7

million recognized in Q2 upon completion of the divestment of 100%

shareholding in Vopak Terminals Savannah Inc.

- Adjustment of receivable for Vopak Terminal Hamburg divestment

(2019) resulting in a charge of EUR 1.0 million in Q2.

For more information please

contact:

Vopak Press: Liesbeth Lans -

Manager External Communication,e-mail:

global.communication@vopak.comVopak Analysts and

Investors: Fatjona Topciu - Head of Investor

Relations, e-mail: investor.relations@vopak.com

The analysts’ presentation will be given via an

on-demand audio webcast on Vopak’s corporate website, starting at

9:30 AM CEST on 25 October 2023.

This press release contains inside information

as meant in clause 7 of the Market Abuse Regulation. The content of

this report has not been audited or reviewed by an external

auditor.

For Vopak's full press release, please refer to the

attached document.

- Vopak reports on Q3 2023 results

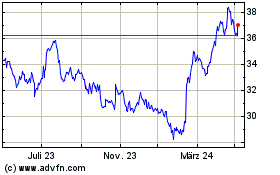

Koninklijke Vopak (EU:VPK)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

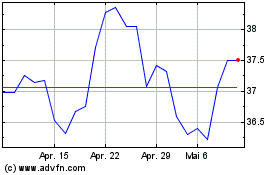

Koninklijke Vopak (EU:VPK)

Historical Stock Chart

Von Dez 2023 bis Dez 2024