Vallourec progresses its holistic balance

sheet refinancing with successful pricing of its 2032 Senior Notes

offering

Meudon (France), April 18, 2024

– Vallourec S.A., (the “Company” and,

together with its subsidiaries, the “Group”), a

world leader in premium tubular solutions, announces today that it

has successfully priced an offering of Senior Notes due 2032 (the

“Notes”) in an aggregate principal amount of $820

million, which will be issued at par and will bear interest at a

rate of 7.500% per annum. The offering of the Notes is expected to

close on April 23, 2024, subject to customary closing

conditions.

Upon completion, the proceeds from the offering

of the Notes will be used, together with cash on hand, to (i) fund

the redemption of the Company’s €1,023.4 million in aggregate

principal amount of 8.5% senior notes due 2026 (the

“Existing Notes”) and pay accrued and unpaid

interest thereon, (ii) repay approximately €68 million outstanding

under the Company’s existing state-guaranteed loans (PGE, prêts

garantis par l’Etat) and pay accrued and unpaid interest thereon

and (iii) pay fees and expenses in connection with the foregoing

transactions, including fees and expenses incurred in connection

with the offering.

Following the completion of its refinancing,

Vallourec will have holistically reconfigured its balance sheet

via:

- Entry into a new

5-year €550 million multi-currency revolving credit facility (RCF)

with a substantially diversified, global banking group

- Entry into an

upsized and extended 5-year $350 million ABL facility in the United

States

- Issuance of the

aforementioned 8-year $820 million 7.500% Senior Notes and

redemption of its 8.5% Senior Notes due 2026

- Repayment of

approximately €68 million of its €262 million PGE during the

transaction and repayment of the remaining amount by December 31,

2024

Furthermore, Vallourec now maintains credit

ratings with all three of the major ratings agencies. Next to its

existing issuer rating with S&P, which has been upgraded once

again and now stands at BB+, Outlook stable, Vallourec is pleased

to welcome the addition of Moody’s and Fitch, which rate Vallourec

Ba2, Outlook positive and BB+, Outlook positive, respectively.

The pro forma effects of the transaction lead to

a reduction of net debt compared to the reported net debt of €570

million as of December 2023.

Philippe Guillemot, Chairman of the Board

of Directors, and Chief Executive Officer, declared: “I am

extremely pleased with the results of this transaction and our

overall balance sheet refinancing. This step further strengthens

Vallourec's financial position and sustainably improves its cash

flow generation. The completion of this transaction will give us

both greater visibility and financial flexibility over the coming

years.

The New Vallourec plan, initiated in May 2022,

resulted in an improvement of our operating results, and ultimately

enabled us to reduce net debt, extend our debt maturities, maintain

a very healthy liquidity profile and, importantly, improve

Vallourec’ ongoing cash generation”.

Cautionary Statements

This announcement constitutes a public

disclosure of inside information under Regulation (EU) 596/2014, as

amended.

This press release is for informational purposes

only and does not constitute an offer to sell or the solicitation

of an offer to buy the Notes, nor shall it constitute an offer,

solicitation or sale in any jurisdiction in which, or to any person

to whom, such offer, solicitation or sale would be unlawful. This

press release is not an offer of securities for sale in the United

States. The Notes and the guarantees thereof will not be registered

under the U.S. Securities Act of 1933, as amended (the “Securities

Act”), or the securities laws of any other jurisdiction, and may

not be offered or sold within the United States except pursuant to

an exemption from, or in a transaction not subject to, the

registration requirements of the Securities Act. In the United

States, the offering will be made only to “qualified institutional

buyers” (as defined in Rule 144A of the U.S. Securities Act) in

compliance with Rule 144A under the U.S. Securities Act (“Rule

144A”) and outside the United States to non-U.S. persons in

reliance on Regulation S under the Securities Act.

The offer and sale of the Notes will be made

only to qualified investors pursuant to an exemption under

Regulation EU 2017/1129, as amended (the "Prospectus Regulation")

from the requirement to produce a prospectus for offers of

securities. This announcement does not constitute a prospectus

within the meaning of the Prospectus Regulation or an offer to the

public.

The offer and sale of the Notes will be made

pursuant to an exemption under the Prospectus Regulation as it

forms part of domestic law by virtue of the European Union

(Withdrawal) Act 2018 (the “UK Prospectus Regulation”) from the

requirement to produce a prospectus for offers of securities. This

announcement does not constitute a prospectus within the meaning of

the UK Prospectus Regulation or an offer to the public.

The Notes are not intended to be offered, sold

or otherwise made available to and should not be offered, sold or

otherwise made available to any retail investor in the EEA. For

these purposes, a “retail investor” means a person who is one (or

more) of: (i) a retail client as defined in point (11) of Article

4(1) of Directive 2014/65/EU (as amended, “MiFID II”); (ii) a

customer within the meaning of Directive 2016/97/EU (as amended,

the “Insurance Distribution Directive”), where that customer would

not qualify as a professional client as defined in point (10) of

Article 4(1) of MiFID II; or (iii) not a “qualified investor” as

defined in the Prospectus Regulation. Consequently, no key

information document required by Regulation (EU) No 1286/2014 (as

amended, the “PRIIPs Regulation”) for offering or selling the Notes

or otherwise making them available to retail investors in the EEA

has been prepared and therefore offering or selling the Notes or

otherwise making them available to any retail investor in the EEA

may be unlawful under the PRIIPs Regulation.

This press release has been prepared on the

basis that any offer of in any Member State of the EEA will be made

pursuant to an exemption under the Prospectus Regulation from the

requirement to produce a prospectus for offers of the Notes.

The Notes are not intended to be offered, sold

or otherwise made available to and should not be offered, sold or

otherwise made available to any retail investor in the United

Kingdom (the “UK”). For these purposes, a retail investor means a

person who is one (or more) of: (i) a retail client, as defined in

point (8) of Article 2 of Regulation (EU) No 2017/565 as it forms

part of domestic law by virtue of the EUWA; (ii) a customer within

the meaning of the provisions of the FSMA and any rules or

regulations made under the FSMA to implement Directive (EU)

2016/97, where that customer would not qualify as a professional

client, as defined in point (8) of Article 2(1) of Regulation (EU)

No 600/2014 as it forms part of domestic law by virtue of the EUWA;

or (iii) not a qualified investor as defined in Article 2 of

Regulation (EU) 2017/1129 as it forms part of domestic law by

virtue of the EUWA. Consequently, no key information document

required by Regulation (EU) No 1286/2014 as it forms part of

domestic law by virtue of the EUWA (the “UK PRIIPs Regulation”) for

offering or selling the Notes or otherwise making them available to

retail investors in the UK has been prepared and, therefore,

offering or selling the Notes or otherwise making them available to

any retail investor in the UK may be unlawful under the UK PRIIPs

Regulation.

This press release has been prepared on the

basis that any offer of the Notes in the UK will be made pursuant

to an exemption under the UK Prospectus Regulation from a

requirement to publish a prospectus for offers of Notes.

This press release is being distributed only to

persons who (i) have professional experience in matters relating to

investments and are investment professionals falling within Article

19(5) of the Financial Services and Markets Act 2000 (Financial

Promotion) Order 2005, as amended (the “Order”), (ii) are high net

worth companies, and other persons to whom it may lawfully be

communicated, falling within Article 49(2)(a) to (d) of the Order,

(iii) are outside the United Kingdom, or (iv) are persons to whom

an invitation or inducement to engage in investment activity within

the meaning of Section 21 of the Financial Services and Markets Act

2000 (the “FSMA”) in connection with the issue or sale of any

securities may otherwise lawfully be communicated or caused to be

communicated (all such persons together being referred to as

“relevant persons”). This press release is directed only at

relevant persons and must not be acted on or relied on by persons

who are not relevant persons. Any investment or investment activity

to which this press release relates is available only to relevant

persons and will be engaged in only with relevant persons.

No money, securities or other consideration is

being solicited, and, if sent in response to the information

contained herein, will not be accepted.

This press release includes forward-looking

statements within the meaning of the applicable securities law. All

statements other than statements of historical fact included herein

are forward-looking statements. These statements may include,

without limitation, any statements preceded by, followed by or

including words such as “aim”, “anticipate”, “believe”, “can have”,

“could”, “estimate”, “expect”, “intend”, “may”, “plan”, “seek”,

“should”, “will” “would” and other words and terms of similar

meaning or the negative thereof. By their nature, forward-looking

statements involve risks and uncertainties because they relate to

events and depend on circumstances that may or may not occur in the

future. Such forward-looking statements are based on numerous

assumptions regarding the Group’s present and future business

strategies and the environment in which it will operate in the

future. The Group therefore cautions against relying on any of

these forward-looking statements. The forward-looking statements

and information contained in this press release are made as of the

date hereof, and the Group undertakes no obligation to update

publicly or revise any forward-looking statements or information,

whether as a result of new information, future events or otherwise,

unless so required by applicable securities laws.

About Vallourec

Vallourec is a world leader in premium tubular

solutions for the energy markets and for demanding industrial

applications such as oil & gas wells in harsh environments, new

generation power plants, challenging architectural projects, and

high-performance mechanical equipment. Vallourec’s pioneering

spirit and cutting edge R&D open new technological frontiers.

With close to 15,000 dedicated and passionate employees in more

than 20 countries, Vallourec works hand-in-hand with its customers

to offer more than just tubes: Vallourec delivers innovative, safe,

competitive and smart tubular solutions, to make every project

possible.

Listed on Euronext in Paris (ISIN code:

FR0013506730, Ticker VK), Vallourec is part of the CAC Mid 60, SBF

120 and Next 150 indices and is eligible for Deferred Settlement

Service.

In the United States, Vallourec has established

a sponsored Level 1 American Depositary Receipt (ADR) program (ISIN

code: US92023R4074, Ticker: VLOWY). Parity between ADR and a

Vallourec ordinary share has been set at 5:1.

For further information, please contact:

|

Investor relations Connor LynaghTel: +1 (713)

409-7842connor.lynagh@vallourec.com |

Press relations Héloïse Rothenbühler Tel: +33 (0)1

41 03 77

50 heloise.rothenbuhler@vallourec.com |

|

Individual shareholdersToll Free Number (from

France): 0 805 65 10 10 actionnaires@vallourec.com |

|

- Vallourec Senior Notes Pricing Press Release

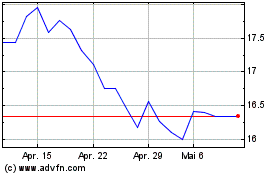

Vallourec (EU:VK)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Vallourec (EU:VK)

Historical Stock Chart

Von Dez 2023 bis Dez 2024