- Canal+ Group’s revenues up 6.5%, driven by all its

businesses

- Dynamic beginning of the year for Havas Group with revenues

up 11.3% on an organic basis

- Slight decline in Editis’ revenues after a record year in

2021

- Prisma Media’s1 revenues up 2.2%, driven by an increase of

more than 23% in the digital segment

- The other businesses are notably benefiting from the gradual

recovery of the live performance activities

Regulatory News:

Vivendi (Paris:VIV):

Revenues for the first

quarter (in millions of euros)

2022

2021

% Change year-on- year

% Change at constant currency

and perimeter1 year-on-year

Canal+ Group

1,446

1,357

+6.5%

+6.0%

Havas Group

591

502

+17.7%

+11.3%

Editis

160

163

-1.7%

-1.7%

Other businesses2

180

73

x2.5

+24.2%

Total Vivendi

2,377

2,095

+13.4%

+7.9%

This press release contains unaudited consolidated revenues,

established under IFRS and approved by the Management Board on

April 22, 2022. These revenues do not include those of Universal

Music Group (UMG), which, due to the distribution of 60% of its

share capital in September 2021, has been deconsolidated, leading

to the adjustment of previously reported figures.

For the first quarter of 2022, Vivendi’s revenues were

€2,377 million, compared to €2,095 million for the first quarter of

2021. This increase of 13.4% is mainly due to the growth of Canal+

Group (+€89 million), Havas Group (+€89 million) and Vivendi

Village (+€20 million). It also included the contribution of Prisma

Media (+€73 million), consolidated since June 1, 2021.

At constant currency and perimeter1, Vivendi’s revenues grew by

7.9% compared to the first quarter of 2021. This increase is mainly

due to the growth of Canal+ Group (+6.0%), as well as the strong

increase of Havas Group (+11.3%), Gameloft (+10.0%) and Vivendi

Village (x3.8).

Public tender offer on Lagardère

Vivendi's public tender offer for Lagardère's shares was opened

on April 14, 2022, for an initial period of 25 trading days, i.e.,

until May 20, 2022. On February 21, 2022, Vivendi's Management

Board approved the terms of its public tender offer and filed its

draft tender offer document with the French securities regulator

(Autorité des marchés financiers or “AMF”), which declared it

compliant on April 12, 2022.

Vivendi is proposing to Lagardère shareholders:

- Either on a principal basis: to sell their Lagardère shares at

a unit price of €25.50 (with dividend attached); or

- On a subsidiary basis: to benefit, for each Lagardère share

tendered to this subsidiary leg and held until the closing date

(inclusive) of the offer, which may be reopened, subject to a

proportional reduction (see below), from a right to sell such share

to Vivendi at a unit price of €24.10 until December 15, 2023

(inclusive).

If the number of shares tendered to the principal offer during

the first offer period is insufficient to reach the validity

threshold, Vivendi will acquire in cash at the price of the

principal offer the number of shares tendered to the subsidiary

offer necessary to reach 51% of the share capital of Lagardère at

the closing date of the first offer period.

If this offer is successful and the required regulatory

approvals are obtained, Vivendi would like Arnaud Lagardère to

remain as Chairman and Chief Executive Officer of Lagardère and

intends to continue to rely on the skills of its management

team.

Vivendi does not intend to apply to the AMF for a squeeze-out of

Lagardère's shares or to request the delisting of Lagardère's

shares from Euronext Paris.

Comments on the Businesses

Canal+ Group

For the first quarter of 2022, Canal+ Group's revenues amounted

to €1,446 million, up by 6.5% compared to the first quarter of 2021

(+6.0% at constant currency and perimeter). This increase is driven

by all the group's activities.

Television in mainland France recorded strong revenues growth,

with an increase of 6.5% at constant currency and perimeter

compared with the first quarter of 2021.

Revenue from international operations increased by 6.2% at

constant currency and perimeter compared to the first quarter of

2021, thanks again to a significant increase in the number of

subscribers.

Studiocanal's revenues increased by 4.5% in one year, due in

particular to several cinema successes, such as Superwho?, Waiting

for Bojangles and Goliath, and the strong performances of the

catalogue.

During the first quarter of 2022, Canal+ Group strengthened its

content offerings and continued its international development.

On January 24, 2022, Canal+ signed the new media chronology.

Canal+ is now entitled to broadcast movies in France six months

after their theatrical release, compared to twelve months in

2018.

On February 15, 2022, Canal+ Group and ViacomCBS announced a

long-term strategic partnership based on two pillars:

- The distribution of Paramount+ by the end

of the year and nine ViacomCBS channels by Canal+ Group, in France

and Switzerland. Canal+ Group will be the only market player in

France able to integrate Paramount+ into its commercial offers (in

“hard bundle”); and - The acquisition of exclusive premium content

for Canal+ Group channels and services, covering more than 30

territories. Canal+ Group will notably air Paramount films in

exclusive premiere on Canal+ in France and Switzerland six months

after their theatrical release.

On March 15, 2022, Canal+ Group entered the Austrian market by

launching a streaming platform in partnership with A1 Telekom

Austria.

On March 17, 2022, Canal+ Group completed the acquisition of 70%

of SPI International, a global media group operating 42 television

channels and multiple digital products in more than 60

countries.

On March 29, 2022, the enhanced Arte.tv offer was added to the

Canal+ offer in France.

Finally, on April 6, 2022, Canal+ Group and Formula 1® announced

a new agreement for the exclusive broadcasting of the Formula 1®

World Championship on Canal+ until 2029, which completes the

motorsport offer with the MotoGP™ World Championship until 2029 and

the WRC (World Rally Championship) until 2030.

Havas Group

Havas Group made an excellent start to the year with

double-digit organic growth. For the first quarter of 2022,

revenues were €591 million, up by 17.7% compared to the first

quarter of 2021. Net revenues1 were €564 million, up by 18.0%

compared to the first quarter of 2021, broken down as follows:

organic growth of +11.4% (compared to organic growth of -0.8% in

the first quarter of 2021), a +4.4% currency effect and a +2.2%

contribution from acquisitions.

This excellent operating performance stems from the strong

commercial momentum achieved in recent quarters, boosted by the

launch of innovative new offerings (notably Havas CX and Havas

Market).

All the geographical regions reported strong organic growths,

with positive contributions from all divisions: Creative, Media and

Healthcare communication. Once again, Europe and North America were

the biggest contributors, with solid organic growth (+12.4% and

+9.0%, respectively). Both Asia-Pacific (+9.3%) and Latin America

(+22.3%) continued to report highly satisfactory performances.

During the first quarter of 2022, Havas Group accelerated its

acquisition of majority interests with five targeted operations:

Tinkle (Spain and Portugal), Inviqa (United Kingdom and Germany),

Search Laboratory (United Kingdom and United States), Frontier

Australia (Australia) and Front Networks (China).

Editis

For the first quarter of 2022, Editis’ revenues were €160

million, a decrease of 1.7% at constant currency and perimeter

compared to the same period in 2021. This change should be viewed

in the context of a market that is down by 1.0% compared to the

same period in 20212. This reversal of dynamics is to be put into

perspective with last year’s unprecedented growth; the 2022 market

increased by 19.3%4 compared to 2019.

At Editis, the Tourism and Comics segments outperformed the

market at the end of March 2022. In the Comics segment, Editis

created its 51st publishing house headed by the French businessman

Mourad Boudjellal, and its 52nd publishing house, Black River.

Moreover, in General Literature, Editis can be proud of the

success of several titles, including Joël Dicker’s new book

L’affaire Alaska Sanders, which ranked third in the GFK Top4, the

winner of the 2021 Prix Goncourt La plus secrète mémoire des hommes

by Mohamed Mbougar Sarr at Philippe Rey which continues to perform

well among the new 2022 titles, and Paris-Briançon by Philippe

Besson, which was among the Top 10 bestsellers at the end of March

20224.

Other businesses

Prisma Media

For the first quarter of 2022, Prisma Media’s revenues were €73

million, up by 2.2% compared to the same period in 2021 (pro

forma3). Digital revenues reached a record, up by more than 23%

compared to the same period in 2021 and representing more than 30%

of Prisma Media’s revenues.

Gala celebrated its 1,500th publication in March 2022 with an

exclusive interview with Mylène Farmer; the issue reached a record

circulation of nearly 140,000 copies sold. Télé-Loisirs

strengthened its SVoD offering with the goal of becoming the

reference website on the topic. The Télé 2 semaines brand

accelerated its digital development with editorial content focused

on popular TV shows (such as Koh Lanta, Mask Singer, The Voice and

L’Amour est dans le pré) on its TV program website.

Prisma Media brands retained their leading positions in terms of

digital audiences: Télé-Loisirs is No. 1 in the Entertainment

segment with an average monthly 22.5 million unique visitors (UVs)

and Capital is No. 1 in the Economic segment with 10.2 million

UVs.

Prisma Media’s social media audiences continued to grow compared

to the first quarter of 2021, with the number of followers

increasing by 11%. The Gala brand remains the European media leader

on Tiktok, with the number of followers up by more than 32%

compared to 2021.

Gameloft

For the first quarter of 2022, Gameloft’s revenues reached €61

million, up by 10.8% compared to the same period in 2021 (+10.0% at

constant currency and perimeter). The gross margin4 reached €44

million, up by 19.1% compared to the same period in 2021.

This strong growth was mainly driven by the success of Apple

Arcade games, the excellent performance of Gameloft for brands

(advertising platforms) up by 40.7% and the strong rebound of

Gameloft Business Solutions (telecom operator and handset

manufacturer platforms) with an increase of 20.3%.

Asphalt 9: Legends, Disney Magic Kingdoms, Dragon Mania Legends,

March of Empires, and Sniper Champions generated 47% of Gameloft’s

total revenues and were the five-best-selling-games in the first

quarter of 2022.

Vivendi Village

For the first quarter of 2022, Vivendi Village’s revenues were

€27 million compared to €7 million for the first quarter of 2021

and, more comparatively, to €22 million for the first quarter of

2020.

This growth was mainly driven by the ticketing activities united

under the See Tickets brand, which were particularly dynamic in the

United Kingdom and the United States during the period, as well as

in Spain, which enjoyed a record month of March. Ticket sales for

summer festivals in France and the United Kingdom continued to be

very satisfactory and L'Olympia is back on track with 55

performances in the first quarter of 2022.

New Initiatives

For the first quarter of 2022, New Initiatives, which brings

together Dailymotion and the GVA entities, recorded revenues of €25

million, an increase of 41.1% at constant currency and

perimeter.

This significant increase results both from the increase of

Dailymotion's audience and consequently of its advertising revenues

and from the growth of GVA's fiber subscriber base in Africa, which

now covers seven countries.

Shareholder’s Annual General Meeting

The Combined General Shareholder’s Annual Meeting is being held

today at the Olympia in Paris at 10:00 am. It will be broadcast

live on the group's website.

About Vivendi

Since 2014, Vivendi has built a world-class content, media and

communications group. The Group owns leading, strongly

complementary assets in television and movies (Canal+ Group),

communications (Havas Group), publishing (Editis), magazines

(Prisma Media), video games (Gameloft), live entertainment and

ticketing (Vivendi Village). It also owns a global digital content

distribution platform (Dailymotion). Vivendi’s various businesses

cohesively work together as an integrated industrial group to

create greater value. Vivendi is committed to the environment and

has set the goal of contributing to net zero carbon worldwide by

adopting an approach in line with the Paris Agreements. In

addition, the Group is helping to build more open, inclusive and

responsible societies by supporting diverse and inventive creative

works, promoting broader access to culture, education and its

businesses, and by increasing awareness of 21st-century challenges

and opportunities. www.vivendi.com.

Important Disclaimers

Cautionary Note Regarding Forward-Looking Statements. This press

release contains forward-looking statements with respect to

Vivendi’s financial condition, results of operations, business,

strategy, plans and outlook, including the impact of certain

transactions and the payment of dividends and distributions, as

well as share repurchases. Although Vivendi believes that such

forward-looking statements are based on reasonable assumptions,

such statements are not guarantees of future performance. Actual

results may differ materially from the forward-looking statements

as a result of a number of risks and uncertainties, many of which

are outside our control, including, but not limited to, the risks

related to antitrust and other regulatory approvals as well as any

other approvals which may be required in connection with certain

transactions and the risks described in the documents of the Group

filed by Vivendi with the Autorité des Marchés Financiers (the

French securities regulator), which are also available in English

on Vivendi's website (www.vivendi.com). Investors and security

holders may obtain a free copy of documents filed by Vivendi with

the Autorité des Marchés Financiers at www.amf-france.org, or

directly from Vivendi. Accordingly, we caution readers against

relying on such forward-looking statements. These forward-looking

statements are made as of the date of this press release. Vivendi

disclaims any intention or obligation to provide, update or revise

any forward-looking statements, whether as a result of new

information, future events or otherwise.

Unsponsored ADRs. Vivendi does not sponsor an American

Depositary Receipt (ADR) facility in respect of its shares. Any ADR

facility currently in existence is “unsponsored” and has no ties

whatsoever to Vivendi. Vivendi disclaims any liability in respect

of any such facility.

In 2021, notwithstanding the uncertainties created by the

COVID-19 pandemic and although its impacts were more significant in

certain countries or on certain businesses than others, Vivendi

showed resilience in adapting its business activities to continue

to best serve and entertain its customers, while reducing costs to

preserve its margins. The business activities showed good

resilience, in particular pay television services, as well as Havas

Group and Editis. However, as expected, the pandemic’s effects

continued to slow down certain businesses such as Vivendi Village

(in particular live entertainment).

Vivendi continually monitors the current and potential

consequences of the health crisis. To date, it is difficult to

determine how it will impact Vivendi’s results in 2022.

Nevertheless, the Group remains confident in the resilience of its

main businesses. It continues to make every effort to ensure the

continuity of its business activities, as well as to best serve and

entertain its customers and audiences while complying with the

health guidelines of authorities in each country where it

operates.

Russia's invasion of Ukraine in February 2022 is having a

significant impact on the financial markets and the prices of

certain commodities and will have repercussions on the entire world

economy. Vivendi is mainly present in Ukraine through Gameloft,

which is doing everything possible to support its teams in the

country and limit the impact of the events on the delivery of its

content. The Group also has communications activities in Ukraine

through companies affiliated with Havas Group and is fully

mobilized to help them as much as possible. At this time, it is not

possible for Vivendi to assess the indirect consequences that the

Ukraine crisis could have on its business activities.

APPENDIX I

VIVENDI

REVENUES BY BUSINESS

SEGMENT

(IFRS, unaudited)

Three months ended March 31,

(in millions of euros)

2022

2021

% Change

% Change at constant currency

% Change at constant currency and

perimeter (a)

Revenues

Canal+ Group

1,446

1,357

+6.5%

+6.4%

+6.0%

Havas Group

591

502

+17.7%

+13.4%

+11.3%

Editis

160

163

-1.7%

-1.7%

-1.7%

Prisma Media

73

na

na

na

+2.2%

Gameloft

61

55

+10.8%

+10.0%

+10.0%

Vivendi Village

27

7

x 3.8

x 3.8

x 3.8

New Initiatives

25

17

+41.1%

+41.1%

+41.1%

Other (b)

(6

)

(6

)

-

-

-

Total Vivendi

2,377

2,095

+13.4%

+12.3%

+7.9%

na: not applicable.

- Constant perimeter notably reflects the impacts of Prisma Media

consolidated since June 1, 2021.

- As from January 1, 2022, this new operating segment includes

the Elimination of intersegment transactions and CanalOlympia,

previously part of Vivendi Village (2021 data has been

restated).

APPENDIX II

VIVENDI

DETAIL OF REVENUES BY BUSINESS

SEGMENT

(IFRS, unaudited)

Canal+ Group

Three months ended March 31,

(in millions of euros)

2022

2021

% Change

% Change at constant currency and

perimeter

TV - International

574

537

+6.9%

+6.2%

TV – Mainland France (a)

788

739

+6.5%

+6.5%

Studiocanal

84

81

+4.5%

-

Revenues

1,446

1,357

+6.5%

+6.0%

a. Relates to pay-TV services and free-to-air channels (C8,

CStar et CNews) in Mainland France.

Groupe Havas

Three months ended March 31,

(in millions of euros)

2022

2021

% Change

% Change at constant currency and

perimeter

Revenues

591

502

+17.7%

+11.3%

Net revenues (a)

564

478

+18.0%

+11.4%

Net revenues by

geographic area

Europe

276

234

+18.0%

+12.4%

North America

218

186

+16.9%

+9.0%

Asia-Pacific and Africa

45

37

+22.7%

+9.3%

Latin America

25

21

+21.2%

+22.3%

564

478

+18.0%

+11.4%

a. Net revenues, a non-GAAP measure, correspond to revenues less

pass-through costs rebilled to customers.

Editis

Three months ended March 31,

(in millions of euros)

2022

2021

% Change

% Change at constant currency and

perimeter

Literature

75

74

+1.8%

+1.8%

Education and Reference

22

22

+0.8%

+0.8%

Diffusion and Distribution

63

67

-6.3%

-6.3%

Revenues

160

163

-1.7%

-1.7%

APPENDIX III

VIVENDI

SCOPE OF CONSOLIDATION AND

CURRENCY IMPACTS

Q1 2021

Q1 2022

Δ organic

+1,5%

+7,9%

Consolidation scope impact

+0,4pt

+4,4pts

Δ at constant currency rate

+1,9%

+12,3%

FX impact

-2,3pts

+1,1pt

Δ actual

-0,4%

+13,4%

Changes in currencies

Average rate over the period

Q1 2021

Q1 2022

Δ YoY

USD:

1,217

1,134

-6,8%

EUR vs.

GBP:

0,886

0,839

-5,3%

PLN:

4,486

4,559

+1,6%

1 Constant perimeter notably reflects the impact of Prisma Media

consolidated since June 1, 2021. 2 Including the elimination of

inter-segment transactions. 3 Net revenues correspond to Havas

Group revenues after deduction of costs rebilled to clients. 4

Source: GFK data, as of March 27, 2022, based on revenues. 5

Vivendi has fully consolidated Prisma Media since June 1, 2021. 6

Gross margin corresponds to Gameloft’s revenues after deduction of

costs of sales.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220424005137/en/

Media Jean-Louis Erneux +33 (0)1 71 71 15 84 Solange

Maulini +33 (0) 1 71 71 11 73

Investor Relations Xavier Le Roy +33 (0) 1 71 71 18 77

Nathalie Pellet +33(0)1 71 71 11 24 Delphine Maillet +33 (0)1 71 71

17 20

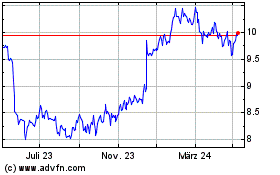

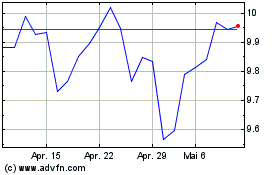

Vivendi (EU:VIV)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Vivendi (EU:VIV)

Historical Stock Chart

Von Dez 2023 bis Dez 2024