European Car Makers Prep for Uncertainty After Strong Pricing in 1Q -- at a Glance

05 Mai 2023 - 3:44PM

Dow Jones News

By David Sachs

Now that the big European car makers have reported first-quarter

results, here is a look at how the manufacturers fared and where

they expect to go with pricing, a top-of-mind issue in light of

unclear economic conditions and fierce competition in China's

crowded electric-vehicle market.

--German auto making giant Volkswagen said improved price

positioning helped boost its group revenue. However, revenue fell

14.5% in China, where the price war is most acute due to intense

competition among battery-electric car makers. Chief Financial

Officer Arno Antlitz said pricing will remain strong, but the

company sees stiffer competition ahead. "We assume that competition

in the international automotive markets will intensify further,"

Volkswagen said in its earnings report. Average U.S. transaction

prices for Volkswagens are expected to have reached $49,000 in

April, up 9.8% on the year but down 0.5% month-on-month, RBC

Capital Markets analysts said.

--Netherlands-based Stellantis said pricing power contributed to

its first-quarter revenue gains and CFO Richard Palmer said this

week that pricing is "holding relatively stable compared to the

back end of 2022." However, the Jeep, Dodge and Peugeot maker's

pricing was 0.8% below the level anticipated by consensus,

according to Bernstein. Meanwhile, its inventory is higher than

peers' and price could be a lever to pull to get cars to customers

with future demand uncertain, RBC said. The analyst pegged

Stellantis's average U.S. transaction price at $57,000 in April, up

4.4% annually and 2.1% from March.

--French car maker Renault said revenue grew 30% in the quarter,

with robust pricing accounting for nearly a third of the increase.

Renault released first-quarter results in April amid Tesla's

industry-shaking price cuts, but CFO Thierry Pieton remained

resolute on holding prices steady. "The reality is, at the overall

group level, the plants are full," Mr. Pieton said. "We are at 100%

capacity generally speaking, so there is no big incentive to go cut

the prices and kill residuals and go in a spiral that some of the

competition is following." Renault's strategy is to use sticker

prices to offset costs and currency inflation, while tweaking them

with incentives such as financing discounts, it said.

--Premium car manufacturers Mercedes-Benz and BMW appear less

vulnerable to price cuts, Bernstein analysts said. Mercedes's

average sales price in the cars division rose 6% in the quarter to

76,000 euros ($83,940), a spokesman said, and the company raised

its margin target. BMW said it is enjoying strong pricing in the

new and used car markets. "However, we do expect the competitive

environment and pre-owned car markets to gradually normalize

through 2023," CFO Nicolas Peter said. Though uncertainty in China

is a factor, BMW has no plans to lower prices there, citing demand

evidenced by preliminary April figures, it said.

Write to David Sachs at david.sachs@wsj.com

(END) Dow Jones Newswires

May 05, 2023 09:29 ET (13:29 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

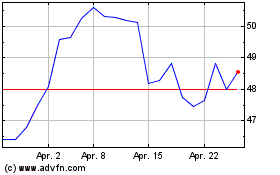

Renault (EU:RNO)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

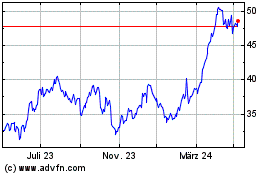

Renault (EU:RNO)

Historical Stock Chart

Von Dez 2023 bis Dez 2024