Regulatory News:

NHOA S.A. (Paris:NHOA):

Not for publication, dissemination or

distribution, directly or indirectly, in the United States of

America or any other jurisdiction in which the distribution or

dissemination of this Press Release is unlawful. This Press

Release does not constitute an offer to purchase any

securities.

PRESS RELEASE DATED NOVEMBER 25,

2024

RELATING TO THE IMPLEMENTATION OF THE

SQUEEZE-OUT

for the shares of the company NHOA

S.A.

following the simplified tender offer

initiated by

Taiwan Cement Europe Holdings B.V.,

a subsidiary of

TCC GROUP HOLDINGS

AMOUNT

OF COMPENSATION: EUR 1.25 per NHOA share

CONDITIONAL PRICE SUPPLEMENT: Only if certain

conditions materialize, as further detailed in Section 2.2 of

Taiwan Cement Europe Holdings B.V.’s offer document (note

d’information) approved (visa) by the AMF on November 5, 2024 under

number 24-461 (the “Offer Document”), shareholders whose

NHOA shares are transferred to the offeror as part of the

squeeze-out will be entitled to a conditional price supplement

(complément de prix conditionnel) of EUR 0.65 per NHOA share (the

“Conditional Price Supplement”)

AMF | AUTORITÉ DES MARCHÉS

FINANCIERS

This press release was prepared and issued

by Taiwan Cement Europe Holdings B.V. in accordance with the

provisions of Article 237-3 III of the general regulation (the

“AMF General Regulation”) of the French Autorité des marchés

financiers (the “AMF”) and Article 9 of the AMF instruction

no. 2006-07 relating to tender offers (the “Press

Release”).

Target company: NHOA S.A., a société anonyme à conseil

d’administration, with a share capital of EUR 55,080,483.40, having

its registered office at 93 boulevard Haussmann, 75008 Paris,

France, registered with the Trade and Companies Register of Paris

under number 808 631 691 (“NHOA” or the “Company”),

having its shares admitted to trading on Compartment B of the

regulated market of Euronext Paris (“Euronext Paris”) under

ISIN Code FR0012650166, ticker symbol “NHOA.PA”.

Offeror: Taiwan Cement Europe Holdings B.V., a private

company with limited liability (besloten vennootschap met beperkte

aansprakelijkheid) organized under the laws of the Netherlands,

having its registered office at Strawinskylaan 3051, 1077 ZX,

Amsterdam, the Netherlands, and registered with the trade register

of the Dutch Chamber of Commerce under number 82637970

(“TCEH” or the “Offeror”). The Offeror is an indirect

subsidiary of TCC Group Holdings Co., Ltd (formerly known as Taiwan

Cement Corporation), a company organized under the laws of the

Republic of China (Taiwan), whose registered office is at No. 113,

Section 2, Zhongshan North Road, Taipei City 104, Taiwan

(“TCC”).

Terms of the squeeze-out: Following the simplified tender

offer (the “Offer”) relating to the shares of the Company

(the “Shares”), which received a clearance (conformité)

decision from the AMF on November 5, 2024,1 and which was carried

out from November 7, 2024 to November 20, 2024 (inclusive),2 the

Offeror holds 273,137,654 Shares representing 273,137,654

theoretical voting rights of the Company,3 i.e., 99.18% of the

Company’s share capital and theoretical voting rights.4

Taking into account the 25,043 Shares assimilated to the Shares

held by the Offeror pursuant to Article L. 233-9, I, 4° of the

French Code de commerce5 (the “Blocked Shares”), the Offeror

holds 273,162,697 Shares representing 273,162,697 theoretical

voting rights of the Company,3 i.e., 99.19% of the Company’s share

capital and theoretical voting rights.4

The conditions required by Article L. 433-4, II of the French

Code monétaire et financier and Articles 237-1 et seq. of the AMF

General Regulation in order to carry out the squeeze-out procedure

targeting the Shares are satisfied, given that:

- the 2,239,720 Shares not tendered to the

Offer, in addition to the 25,043 Blocked Shares mentioned above,

represented, at the closing of the Offer, 0.81% of the Company’s

share capital and theoretical voting rights;4

- when examining the clearance of the

proposed Offer, the AMF had at its disposal (i) the valuation

report prepared by Crédit Agricole Corporate and Investment Bank,

acting as presenting bank of the Offer, and (ii) the report of the

independent expert, Ledouble, represented by Mr. Olivier Cretté and

Ms. Stéphanie Guillaumin which concluded that the Offer price of

EUR 1.25 in cash per Share with a Conditional Price Supplement of

EUR 0.65 per Share in cash in consideration of the call and put

options on the shares held by NHOA Corporate S.r.l. (an Italian

subsidiary of NHOA) in Free2Move eSolutions S.p.A.,6 was fair in

the context of the Offer and the squeeze-out;

- the squeeze-out will be carried out on the

same financial terms as the Offer, i.e., EUR 1.25 per Share in cash

with a right to the Conditional Price Supplement of EUR 0.65 per

Share in cash, which will be payable only if the conditions set

forth in Section 2.2.1(B) of the Offer Document materialize.

By a letter dated November 21, 2024, Crédit Agricole Corporate

and Investment Bank, acting on behalf of the Offeror, informed the

AMF of the Offeror’s decision, in accordance with the intention it

had expressed in the Offer Document, to implement the squeeze-out

for the Shares which have not been tendered to the Offer (after

deduction of the 25,043 Blocked Shares held by assimilation),

pursuant to Article L. 433-4, II of the French Code monétaire et

financier and Articles 237-1 et seq. of the AMF General

Regulation.

In accordance with the AMF Notice no. 224C2418 of November 25,

2024, the squeeze-out will be implemented on December 10, 2024 and

will concern the Shares not already held by the Offeror (after

deduction of the 25,043 Blocked Shares held by assimilation). The

squeeze-out will therefore concern 2,239,720 Shares representing

0.81% of the Company’s share capital and theoretical voting

rights.4

The trading on the Shares was suspended on November 21, 2024

following the closing of the Offer and such suspension will

continue until the implementation of the squeeze-out.

In accordance with Article 237-5 of the AMF General Regulation,

the Offeror will publish a notice informing the public of the

squeeze-out in a legal gazette (journal d’annonces légales) in the

place of the Company’s registered office.

In accordance with Article 237-4 of the AMF General Regulation,

the Offeror undertook to pay the total amount of the compensation,

net of all costs, on a blocked account opened for this purpose with

UPTEVIA (Euroclear affiliate 023) – La Défense-Coeur Défense Tour

A, 90-110 Esplanade du Général de Gaulle, 92400 Courbevoie, France,

RCS Nanterre No. 439 430 976, designated as centralizing agent for

the compensation transactions, which will, on behalf of the

Offeror, carry out the compensation on the accounts of the

shareholders and will credit the rights to the Conditional Price

Supplement.

The unallocated funds and rights to the Conditional Price

Supplement corresponding to the compensation of the Shares will be

kept by UPTEVIA, or, if applicable, by the account keepers

financial intermediaries, for a period of ten years after the

squeeze-out and will be transferred to the Caisse des Dépôts et

Consignations following the expiry of such period. Such funds may

be claimed at any time by their respective beneficiaries, subject

to a thirty-year statute of limitations in favor of the French

State.

Availability of documents relating to the Offer: The

Offer Document of TCEH and the information relating in particular

to the legal, financial and accounting characteristics of TCEH are

available on the websites of the AMF (www.amf-france.org), of TCC

Group Holdings Co., Ltd (www.tccgroupholdings.com/en/) and NHOA

(www.nhoagroup.com), and may be obtained free of charge from Crédit

Agricole Corporate and Investment Bank:

Crédit Agricole Corporate and Investment

Bank 12 place des Etats-Unis CS 70052 92547 Montrouge Cedex

The response document of NHOA approved (visa) by the AMF on

November 5, 2024 under number 24-462 and the information relating

in particular to the legal, financial and accounting

characteristics of NHOA are available on the websites of the AMF

(www.amf-france.org), and NHOA (www.nhoagroup.com), and may be

obtained free of charge at NHOA’s registered office:

NHOA 93 boulevard Haussmann 75008

Paris

Disclaimer

This Press Release was prepared for

information purposes only. This Press Release does not constitute

an offer or part of an offer to sell, purchase or subscribe for any

securities and it shall not be considered as constituting any

solicitation of such an offer.

This Press Release may not be distributed

in countries other than France, subject to the publication of this

Press Release on TCC’s and NHOA’s websites pursuant to applicable

regulations.

The dissemination of this Press Release,

the Offer and its acceptance may be subject to specific regulations

or restrictions in certain countries. The Offer is not made for

persons subject to such restrictions, neither directly nor

indirectly, and may not be accepted in any way from a country where

the Offer would be subject to such restrictions. Consequently,

persons in possession of this Press Release shall inquire about

potential applicable local restrictions and comply with them.

TCEH and TCC will not be liable in the

event of any breach of the applicable legal restrictions by any

person.

1 AMF Notice no. 224C2193 of November 5, 2024. 2 AMF Notice no.

224C2201 of November 6, 2024. 3 AMF Notice no. 224C2394 dated

November 21, 2024. 4 On the basis of a total number of 275,402,417

Shares representing the same number of theoretical voting rights of

the Company (information as of July 28, 2024 resulting from the

decisions of the CEO of the Company dated July 28, 2024, filed with

the Trade and Companies Register on August 22, 2024) computed

pursuant to Article 223-11 of the AMF General Regulation. 5

Pursuant to the liquidity put and call option in respect of the

NHOA shares which are subject to a holding period (période de

conservation), provided under the liquidity agreement entered into

by and between Mr. Carlalberto Guglielminotti and the Offeror on

November 1, 2024 and the liquidity agreement entered into by and

between Mr. Giuseppe Artizzu and the Offeror on November 4, 2024,

as described in Section 2.6.2 of the Offer Document. See also AMF

Notice no. 224C2166 dated November 4, 2024. 6 Please refer to

Section 2.2 of the Offer Document for further details.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241125223934/en/

Investor:

For more detailed information relating to TCEH and to this Press

Release, please contact: Shelly Yeh – shellyyeh@taiwancement.com /

ir@taiwancement.com Simon Kung – simon.kung@taiwancement.com

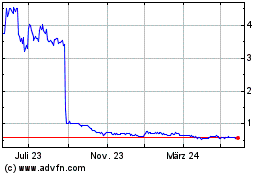

NHOA (EU:NHOA)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

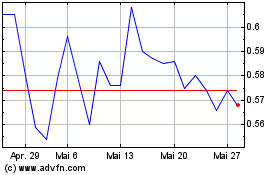

NHOA (EU:NHOA)

Historical Stock Chart

Von Jan 2024 bis Jan 2025