Nextensa: annual results 2023

21 Februar 2024 - 5:40PM

Nextensa: annual results 2023

REGULATED INFORMATIONBrussels, 21 February 2024,

5:40 PM

NEXTENSA: ANNUAL RESULTS 2023

Highlights

INVESTMENT PROPERTIES• Nextensa realises a higher rental income

(+€ 3.1 M) in 2023 compared to 2022, i.e. a like-for-like rental

growth of +12%.• Property costs decrease by € 0.9 M due to higher

occupancy rate.• The revaluation of the investment properties at

the end of 2023 has a limited negative impact of -0.9%.• A profit

of € 2.1 M was realised on the sale in early April 2023 of the

Treesquare office building in Brussels.DEVELOPMENT PROJECTS• Tour

& Taxis: Higher development result (€ 4.4 M margin recognised)

in Belgium due to successful sales at Tour & Taxis. Of the 346

apartments of Park Lane phase II 64% have already been sold or

reserved. • Cloche d’Or: 100% letting of the delivered office

buildings Emerald and White House. Slower sales of apartments and

office buildings lead to a lower contribution in the 2023 result

(contribution of € 13.8 M in 2023 vs contribution of € 19,8 M in

2022).

OPERATIONAL EFFICIENCYDecrease in overhead costs compared to the

same period last year (€ -2.1 M), despite the inflationary

environment.

ACTIVE FINANCIAL MANAGEMENTThe average cost of funding increases

slightly from 2.18% to 2.67%, thanks to the hedging policy. At the

end of 2023, the hedge ratio was 79% and a headroom existed of € 88

M on the existing credit lines.NET RESULTNet result (group share)

amounts to € 24.49M or € 2.45 per share.The lower result compared

to the exceptional year 2022 (net result of € 71.3 M) is mainly due

to:• Limited activity in the institutional real estate market in

2023, where in 2022 profits were realised on sales of the Monnet

and Titanium buildings (€ 28.3 M vs € 2.1 M in 2023).• The negative

revaluation of the financial assets and liabilities in 2023 (€ -7.3

M) versus the positive revaluation in 2022 (€ +15.6 M).SALE OF THE

RETAIL PROPERTY IN FOETZSale in early February 2024 at fair value

as at 31/12/2023 (€ 9.23 M). DIVIDENDProposal to pay a gross

dividend of €1.50 per share, which will be offered as an optional

dividend if appropriate. CLEAR CHOICE FOR A FOSSIL-FREE

PORTFOLIOIn 2023, the decision was taken to align all new

developments with the criteria of the EU taxonomy (within the

climate mitigation objective) and an action plan was drawn up to

move towards a fossil-free portfolio.For more

informationTim Rens | Chief Financial OfficerGare

Maritime, Picardstraat 11, B505, 1000 Brussels+32 2 882 10 08 |

investor.relations@nextensa.euwww.nextensa.euAbout

Nextensa Nextensa is a mixed-use real estate investor

and developer.The company’s investment portfolio is divided between

the Grand Duchy of Luxembourg (43%), Belgium (42%) and Austria

(15%); its total value as at 31/12/2023 was approximately € 1.3

billion.As a developer, Nextensa is primarily active in shaping

large urban developments. At Tour & Taxis (development of over

350,000 sqm) in Brussels, Nextensa is building a mixed real estate

portfolio consisting of a revaluation of iconic buildings and new

constructions. In Luxembourg (Cloche d’Or), it is working in

partnership on a major urban extension of more than 400,000 sqm

consisting of offices, retail and residential buildings.The company

is listed on Euronext Brussels and has a market capitalisation of €

488.6 M (value 31/12/2023).

- NEX_Annual Results_ENG_final

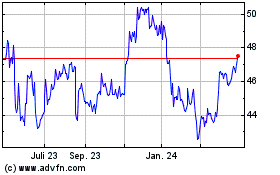

Nextensa (EU:NEXTA)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

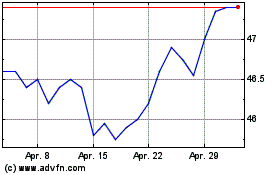

Nextensa (EU:NEXTA)

Historical Stock Chart

Von Nov 2023 bis Nov 2024