Fnac Darty and Ruby successfully reach 91.1% of the share capital

of Unieuro, which will be delisted - final results

PRESS RELEASE

Ivry-sur-Seine, France — November 12, 2024, 5:45 pm CEST

THE RELEASE, PUBLICATION OR DISTRIBUTION OF THIS

PRESS RELEASE IN WHOLE OR IN PART, DIRECTLY OR INDIRECTLY, IS NOT

PERMITTED IN OR INTO THE UNITED STATES OF AMERICA, AUSTRALIA,

CANADA, JAPAN OR ANY OTHER COUNTRY WHERE SUCH COMMUNICATION WOULD

VIOLATE THE RELEVANT APPLICABLE REGULATION

FINAL RESULTS OF THE REOPENING OF THE

TENDER PERIOD

FNAC DARTY AND RUBY SECURE 91.15% OF THE

SHARE CAPITAL OF UNIEURO, WHICH WILL BE DELISTED

- Final

results of the Reopening of the Tender Period: 19.66% of Unieuro’s

share capital tendered, which cumulated to the 71.48% already owned

by Offerors, represents 91.15% of Unieuro’s share

capital

-

The payment of the Consideration for the Reopening of the

Tender Period will take place on 15 November 2024

-

The procedure for the fulfillment of the Obligation to

Purchase under Art. 108, Par. 2, of the CFA will take place

thereafter

NOTICE PURSUANT TO ARTICLE 41, PARAGRAPH 6, OF

THE REGULATION ADOPTED BY CONSOB BY RESOLUTION NO. 11971 OF MAY 14,

1999, AS SUBSEQUENTLY INTEGRATED AND AMENDED (THE “ISSUERS’

REGULATION”).

With reference to the voluntary public tender

and exchange offer (the “Offer”) pursuant to Articles 102 and 106,

paragraph 4, of the Italian Legislative Decree no. 58 of February

24, 1998, as subsequently integrated and amended (the “CFA”),

launched by Fnac Darty SA (“Fnac Darty”) and RUBY Equity Investment

S.à r.l. (“Ruby” and together with Fnac Darty, the “Offerors”) for

all of the ordinary shares of Unieuro S.p.A. (“Unieuro” or the

“Issuer”) not already held by the Offerors, including the treasury

shares directly or indirectly held, from time to time, by Unieuro,

following the notice issued on 8 November 2024 regarding the

preliminary results of the Reopening of the Tender Period (the

“Notice of the Preliminary Results of the Reopening of the Tender

Period”), the Offerors hereby announce the final results of the

Reopening of the Tender Period.

All terms not defined in this press release

shall have the same meaning given to them in the offer document,

approved by Consob with resolution no. 23231 of 23 August 2024, and

published on 24 August 2024 (the “Offer Document”) among others, on

the website of Unieuro (www.unieurospa.com) and on the website of

Fnac Darty (www.fnacdarty.com).

FINAL RESULTS OF THE REOPENING OF THE

TENDER PERIOD

Based on the final results communicated by

Intesa Sanpaolo S.p.A., in its capacity as Intermediary Responsible

for Coordinating the Collection of Tenders, during the Reopening of

the Tender Period, no. 4,099,491 ordinary shares of Unieuro were

tendered in the Offer. Such tendered shares represent (i) 19.66% of

the share capital of the Issuer and (ii) 20.56% of the Shares

Subject to the Offer.

The Offerors did not purchase any Unieuro Shares

outside the Offer during the period between the Date of the Offer

Document and today’s date.

The final results reported above reflect a

revision upward of no. 3,750 Shares compared with the preliminary

results of the Reopening of the Tender Period announced on 8

November 2024.

It should be noted that, as indicated in the

notice on the final results of the Tender Period published on 29

October 2024, at the Payment Date of the Tender Period, taking into

account the Unieuro Shares tendered in the Offer during the Tender

Period and the Unieuro Shares already held by Fnac Darty before the

start of the Tender Period, the Offerors, jointly considered, had

come to hold a total of no. 14,904,062 ordinary shares of Unieuro,

equal to 71.48% of its share capital.

Therefore, taking into account (i) the no.

4,099,491 ordinary shares of Unieuro tendered in the Offer during

the Reopening of the Tender Period and (ii) the no. 14,904,062

Unieuro Shares already held by the Offerors prior to the beginning

of the Reopening of the Tender Period, the Offerors, jointly

considered, will come to hold a total of no. 19,003,553 ordinary

shares of Unieuro, equal to 91.15% of the share capital of the

Issuer. Including the no. 70,004 Treasury Shares held by the Issuer

as of today’s date, the total stake held in the share capital of

Unieuro by the Offerors, directly and as regards the Treasury

Shares, indirectly, at the end of the Reopening of the Tender

Period consists of no. 19,073,557 shares, representing 91.48% of

the Issuer’s share capital.

PAYMENT DATE OF THE REOPENING OF THE

TENDER PERIOD

It is reminded that the Consideration due to the

holders of ordinary shares of Unieuro tendered in the Offer during

the Reopening of the Tender Period is equal to Euro 9.00, as per

the Cash Portion, and no. 0.1 newly issued Fnac Darty shares, as

per the Share Portion, for each Unieuro Share tendered in the Offer

during the Reopening of the Tender Period.

In order to pay the Consideration to the

shareholders of Unieuro who have tendered in the Offer during the

Reopening of the Tender Period, Fnac Darty, in execution of the

Offer Capital Increase, will issue no. 409,949 Fnac Darty shares,

equal to 1.4% of Fnac Darty’s share capital on the Payment Date of

the Reopening of the Tender Period. Following such issue, the

subscribed and paid-in share capital of Fnac Darty will be

represented by no. 29,587,592 ordinary shares.

The shareholders of Unieuro who tendered their

shares in the Offer during the Reopening of the Tender Period will

receive the Consideration on the Payment Date of the Reopening of

the Tender Period, i.e. 15 November 2024, against the transfer of

such Unieuro shares to the Offerors, according to the methods

described in Section F, Paragraph F.6 of the Offer Document

(including with reference to the treatment of any Fractional

Parts).

The obligation of the Offerors to pay the

Consideration will be considered fulfilled when the Consideration

and any Cash Amount of the Fractional Part are transferred to the

Responsible Intermediaries. The tendering shareholders of Unieuro

bear the entire risk of the Responsible Intermediaries or the

Depositary Intermediaries failing to transfer the Consideration or

any Cash Amount of the Fractional Part to the entitled parties

(including their heirs, where applicable) or delaying the transfer

thereof.

OBLIGATION TO PURCHASE UNDER ART. 108, PAR. 2, OF THE

CFA

Considering that the Offerors, following the

completion of the Reopening of the Tender Period, on the basis of

the final results thereof, have reached, directly and indirectly

(as to the Treasury Shares, which - for the purpose of calculating

the thresholds provided for by Article 108, Paragraph 2, of CFA and

Articles 108, Paragraph 1, and 111 of CFA - shall be added to the

Offerors’ shareholding (numerator) without being deducted from the

Issuer’s share capital (denominator)), a shareholding above 90% of

the Issuer’s share capital, the Offerors announce that the legal

requirements for the fulfillment of the Obligation to Purchase

under Art. 108, Par. 2, of the CFA have been met.

Therefore, the Offerors – as stated in the Offer

Document – will not restore a free float sufficient to ensure the

regular trading of Unieuro Shares and will fulfill the Obligation

to Purchase under Art. 108, Par. 2, of the CFA in relation to the

remaining 1,845,955 Unieuro Shares (the “Remaining Shares”), equal

to approximately 8.85% of the Issuer’s share capital. It should be

noted that the Remaining Shares include also the Treasury Shares

(no. 70,004 ordinary shares of the Issuer representing 0.34 % of

the Issuer’s share capital).

The terms and timing of the procedure through

which the Offerors will comply with the Obligation to Purchase

under Art.108, Par. 2, of the CFA (the “Procedure to Comply with

the Obligation to Purchase under Art. 108, Par. 2, of the CFA”) are

described below.

CONSIDERATION FOR THE OBLIGATION TO

PURCHASE UNDER ART. 108, PAR. 2, OF THE CFA

In the context of the Procedure to Comply with

the Obligation to Purchase under Art. 108, Par. 2, of the CFA, the

Offerors will pay, to any shareholder of the Issuer who requests

the Offerors to purchase his/her/its Remaining Shares, the

following consideration for each Remaining Share, set in accordance

with Article 108, Paragraphs 3 and 5, of the CFA:

(i) a consideration equal to the

Consideration of the Offer, i.e. for each Unieuro Share, Euro 9.00,

as Cash Portion, and no. 0.1 newly issued Fnac Darty shares, as

Share Portion (the “Consideration for the Procedure to Comply with

the Obligation to Purchase under Art. 108, Par. 2, of the CFA”);

or, alternatively,

(ii) only to those shareholders so

requesting in the Request for Sale (as defined below), with respect

to all Remaining Shares that are the subject of such request, a

cash consideration per each Unieuro Share whose amount, determined

pursuant to Article 50-ter, Paragraph 1, letter a), of the

Issuers’ Regulation, will be equal to the sum of (x) the weighted

average of the official prices of the Fnac Darty shares recorded on

Euronext Paris during the five Trading Days prior to the Payment

Date of the Reopening of the Tender Period (i.e. 8, 11, 12, 13 and

14 November 2024) multiplied by 0.1 and (y) Euro 9.00 (the “Full

Cash Alternative Consideration”).

The exact amount of the Full Cash Alternative

Consideration will be announced by the Offerors through a notice

that is expected to be published by 15 November 2024.

PERIOD FOR THE SUBMISSION OF THE

REQUESTS FOR SALE

The period during which the Offerors will comply

with the Obligation to Purchase under Art.108, Par. 2, of the CFA

and the holders of Remaining Shares may, by submitting a Request

for Sale, request the Offerors to acquire such shares (the “Period

for the Submission of the Requests for Sale”) will be agreed with

Borsa Italiana and will be announced by the Offerors through a

specific notice, as soon as it will be agreed with Borsa Italiana

(and in any event prior to the beginning of the Procedure to Comply

with the Obligation to Purchase under Article 108, Paragraph 2, of

the CFA).

PROCEDURE FOR THE SUBMISSION OF THE

REQUESTS FOR SALE AND THE DEPOSIT OF THE REMAINING

SHARES

The holders of the Remaining Shares who intend

to request the Offerors to purchase such shares in the context of

the Procedure to Comply with the Obligation to Purchase under Art.

108, Par. 2, of the CFA (the “Requesting Shareholders”) shall

submit a request for sale by executing and delivering to a

Responsible Intermediary, by the end of the Period for the

Submission of the Requests for Sale, the specific form (which will

be available, inter alia, at the offices of the

Intermediary Responsible for Coordinating the Collection of Tenders

and the Responsible Intermediaries and at the Issuer’s and

Offerors’ websites) duly completed in all of its parts (the

“Request for Sale”) and simultaneously depositing the remaining

Shares with such Responsible Intermediaries. The Responsible

Intermediaries that will collect the Requests for Sale are the same

Responsible Intermediaries that have collected the tenders in the

Offer (as indicated in Section B, Paragraph B.3, of the Offer

Document), i.e. Intesa Sanpaolo S.p.A. (the Intermediary

Responsible for Coordinating the Collection of Tenders), Banca

Monte dei Paschi di Siena S.p.A., BNP Paribas Securities Services –

Italian Branch, and Equita SIM S.p.A. The holders of Remaining

Shares can also deliver the Requests for Sale to, and deposit the

remaining Shares indicated therein with, any of the Depositary

Intermediaries, provided that the delivery and deposit are made in

time for the Depositary Intermediaries to deposit the Remaining

Shares with a Responsible Intermediary no later than the last day

of the Period for the Submission of the Requests for Sale.

Only those Remaining Shares that are duly

registered (in dematerialized form) and available in an account of

the Requesting Shareholder opened at a Depositary Intermediary may

be sold to the Offerors in the context of the Procedure to Comply

with the Obligation to Purchase under Art. 108, Par. 2, of the CFA.

Moreover, such shares shall be freely transferable to the Offerors,

free from encumbrances of any kind and nature, whether in

rem, obligatory or personal. Finally, the Remaining Shares

obtained through transactions performed on the market may be the

subject matter of a Request for Sale only after settlement of such

transactions in the context of the clearing system.

The Requests for Sale by minors or persons under

guardianship or receivership, in accordance with applicable legal

provisions, which are executed by the parent(s), guardian(s) or

receiver(s), if not accompanied by the authorization of the

guardianship or receivership court, will be accepted under

reservation and will be counted for purposes of determining the

percentages of tenders in the Procedure to Comply with the

Obligation to Purchase under Art. 108, Par. 2, of the CFA only if

the authorization is received by the Depositary Intermediary or the

Responsible Intermediary before the end of the Period of for the

Submission of the Requests for Sale and the payment of the

consideration relating to such Requests for Sale will occur in any

case only after the authorization is received. Once authorization

has been obtained from the guardianship judge, the Requesting

Shareholder must inform the Responsible Intermediary so that the

“reserve” is no longer applicable and therefore definitively

accepted the Request for Sale. In the case of Remaining Shares

recorded in the name of minors and subject to usufruct, the

authorization of the competent court is also required for the

purpose of extinguishing the usufruct on the Remaining Shares and

the reconstitution of the usufructs on the Fnac Darty shares, as

the case may be.

Since the Unieuro Shares are held in a

dematerialized form, the execution and delivery of the Request for

Sale will constitute an irrevocable mandate and instruction given

by each holder of the Remaining Shares to the Responsible

Intermediary, or to the relevant Depositary Intermediary at whose

securities account the shares are deposited, to perform all the

necessary formalities for the transfer of the Remaining Shares to

the Offerors, including through temporary accounts at such

intermediaries, if applicable.

For the entire period that the Remaining Shares

set forth in a Request for Sale are bound to the Procedure to

Comply with the Obligation to Purchase under Art. 108, Par. 2, of

the CFA and, thus, until the payment date of the Procedure to

comply with the Obligation to Purchase under Art. 108, Par. 2, of

the CFA, the Requesting Shareholders may still exercise the

ownership rights (e.g., option rights) and administrative rights

(such as the right to vote) pertaining to the Remaining Shares,

which shall remain the property of such Requesting Shareholders.

However, during the same period, the Requesting Shareholders may

not transfer or dispose of the Remaining Shares.

The Requests for Sale submitted by the holders

of Remaining Shares (or by their duly empowered representatives)

during the Period for the Submission of the Requests for Sale may

not be withdrawn.

DATE AND PROCEDURE FOR THE PAYMENT OF THE CONSIDERATION FOR

THE OBLIGATION TO PURCHASE UNDER ART. 108, PAR. 2, OF THE CFA.

HANDLING OF THE FRACTIONAL PARTS

The transfer to the Offerors of the ownership of

the Remaining Shares subject of the Requests for Sale and the

payment to the Requesting Shareholders of the consideration for the

Procedure to Comply with the Obligation to Purchase under Art.108,

Par. 2, of the CFA will be made on the fifth Trading Day following

the end of the Period for the Submission of the Requests for

Sale.

In particular, on the payment date of the

consideration for the Procedure to Comply with the Obligation to

Purchase under Art. 108, Par. 2, of the CFA:

(i) the Share Portion will be paid

through the transfer of the Fnac Darty shares due in the securities

accounts at the Responsible Intermediaries or the Depositary

Intermediaries owned by the Requesting Shareholders;

(ii) the Cash Portion or, if any, the

Full Cash Alternative Consideration will be paid through the

transfer of the relevant amount to the Responsible Intermediaries,

which shall transfer the funds to the Depositary intermediaries,

which in turn shall credit such funds to the Requesting

Shareholders in accordance with the instructions issued by the

Requesting Shareholders (or their representatives) in the Requests

for Sale;

all in compliance with the procedures set forth

in the Requests for Sale.

No interest will be paid by the Offerors or any

other person on the Cash Portion and on the Full Cash Alternative

Consideration.

If the Requesting Shareholder (who did not

request the Full Cash Alternative Consideration in his/her/its

Request for Sale) is entitled to a Share Portion composed of a

non-integer number of Fnac Darty shares (including in the event the

Requesting Shareholder request the sale of a number of Unieuro

Shares lower than 10, which is the minimum number of Unieuro Shares

that, when multiplied by 0.1, allows to obtain at least 1 Fnac

Share as Share Portion of the Consideration), the Responsible

Intermediary or the Depositary Intermediary to which the Requesting

Shareholder submitted his/her/its Request for Sale will indicate on

the Request for Sale the fractional component of such non-integer

number (any such fractional component, a “Fractional Part”). Each

Responsible Intermediary, also on behalf of the Depositary

Intermediaries that have delivered Requests for Sale to it, will

inform the Intermediary Responsible for Coordinating the Collection

of Tenders of the number of Fnac Darty shares resulting from the

aggregation of all the Fractional Parts delivered to such

Responsible Intermediary.

The Intermediary Responsible for Coordinating

the Collection of Tenders – on behalf and in the name of the

Requesting Shareholders and based on the communication received by

each Responsible Intermediary (also through the Depositary

Intermediaries) – will aggregate all the Fractional Parts of the

Fnac Darty shares and sell the resulting integer number of the Fnac

Darty shares on Euronext Paris at market conditions. The cash

proceeds of such sales will then be transferred to each Responsible

Intermediary that will distribute the respective Cash Amount of the

Fractional Part to the relevant Requesting Shareholders as follows:

within 10 Trading Days after the payment date of the Consideration

for the Obligation to Purchase under Art. 108, Par. 2, of the CFA,

the Intermediary Responsible for the Collection of Tenders will

credit the proceeds of the sale (in Euro) to the relevant

Depositary Intermediaries, through the Responsible Intermediaries,

proportionally to the Cash Amounts of the Fractional Part due to

the Requesting Shareholders that submitted a Request for Sale

(without requesting the Full Cash Alternative Consideration)

through each of the Depositary Intermediaries. The Depositary

Intermediaries will, in turn, distribute and credit such proceeds

to the Requesting Shareholders, according to the procedures

indicated in the Request for Sale.

Owners of the Remaining Share shall not bear any

cost or commission neither for the allotment of the Fnac Darty

shares nor for the payment of the Cash Amount of the Fractional

Part. In any event, no interest will be paid on the Cash Amount of

the Fractional Part.

The Offerors’ obligation to pay the

consideration for the Procedure to Comply with the Obligation to

Purchase under Art. 108, Par. 2, of the CFA shall be deemed to have

been met when the Consideration for the Procedure to Comply with

the Obligation to Purchase under Art. 108, Par. 2, of the CFA and

the Cash Amount of the Fractional Part (if applicable), or, should

the Full Cash Alternative Consideration be requested, the relevant

cash amount of the Full Cash Alternative Consideration, will have

been transferred to the Responsible Intermediaries. The Requesting

Shareholders will bear the entire risk that the Responsible

Intermediaries and/or the Depositary Intermediaries fail to

transfer the Consideration for the Procedure to Comply with the

Obligation to Purchase under Art. 108, Par. 2, of the CFA or the

Cash Amount of the Fractional Part or the Full Cash Alternative

Consideration to them (or their successor), or delay such

transfer.

GUARANTEES OF FULL PERFORMANCE OF THE

PROCEDURE TO COMPLY WITH THE OBLIGATION TO PURCHASE UNDER ART. 108,

PAR. 2, OF THE CFA

Fnac Darty will issue up to no. 184,596 new Fnac

Darty shares to be delivered as Share Portion of the Consideration

for the Procedure to Comply with the Obligation to Purchase under

Art. 108, Par. 2, of the CFA (assuming that all the holders of

Remaining Shares submit Requests for Sale for all their Unieuro

Shares without requesting the Full Cash Alternative Consideration),

on or before the payment date of the consideration for the

Procedure to Comply with the Obligation to Purchase under Art. 108,

Par. 2, of the CFA.

Before the Period for the Submission of the

Requests for Sale starts, the Offerors shall set up the guarantee

to comply with the obligation to pay the Cash Portion of the

Consideration for the Procedure to Comply with the Obligation to

Purchase under Art. 108, Par. 2 and the Full Cash Alternative

Consideration that should be due at the payment date of the

Consideration for the Procedure to Comply with the Obligation to

Purchase under Art. 108, Par. 2, of the CFA.

POSSIBLE RIGHT TO SQUEEZE-OUT PURSUANT

TO ARTICLE 111 OF THE CFA AND OBLIGATION TO PURCHASE UNDER ART.

108, PAR. 1, OF THE CFA

As declared in the Offer Document, if in the

context of the Procedure to Comply with the Obligation to Purchase

under Art. 108, Par. 2, of the CFA, the Offerors come to own - as a

result of the acquisition of the Remaining Shares that are the

subject of the Requests for Sale - a total shareholding equal to or

above 95% of the Issuer’s share capital, the Offerors will exercise

their Right to Squeeze-Out pursuant to Article 111 of the CFA and,

concurrently, will fulfill the Obligation to Purchase under Art.

108, Par. 1, of the CFA vis-à-vis the shareholders of the

Issuer that so request through a specific Joint Procedure that will

be agreed with CONSOB and Borsa Italiana (the “Joint Procedure”).

The terms of the Joint Procedure will be announced by the Offerors

prior to its commencement. The Joint Procedure will target all of

the remaining outstanding Unieuro Shares not yet held by the

Offerors and will result in the transfer of ownership of each of

those shares to the Offerors.

The consideration due for the Unieuro Shares

purchased by the Offerors as a result of the exercise of the Right

to Squeeze-Out and in compliance with the Obligation to Purchase

under Art. 108, Par. 1, of the CFA would be set in compliance with

Article 108, Paragraphs 3 and 5, of the CFA, as referred to in

Article 111 of the CFA, as well as in compliance with Articles 50,

50-bis and 50-ter of the Issuers’ Regulation as

referred to in Article 50-quater of the Issuers’

Regulation and, thus, will be equal to the consideration for the

Obligation to Purchase pursuant to Art. 108, Par. 2, of the CFA.

Hence, upon conclusion of the Joint Procedure, the remaining

Unieuro Shareholders would receive, for each Unieuro Share, the

Consideration for the Obligation to Purchase under Art. 108, Par.

2, of the CFA, unless, in the context of the Joint Procedure, they

have actively requested to receive the Full Cash Alternative

Consideration.

The Offerors will announce whether the legal

requirements for the Right to Squeeze-Out pursuant to Article 111

of the CFA and for the Obligation to Purchase under Art. 108, Par.

1, of the CFA – i.e. for the Joint Procedure – have been met, inter

alia, in the notice concerning the results of the Procedure to

Comply with the Obligation to Purchase under Art. 108, Par. 2, of

the CFA.

DELISTING OF UNIEURO SHARES

In accordance with article 2.5.1, paragraph 6,

of the Stock Exchange Regulations, since the requirements for the

fullfilment of the Obligation to Purchase under Art. 108, Par. 2,

of the CFA have been met and the Offerors will carry out the

mentioned procedure as described above, all of the Unieuro Shares

will be delisted from Euronext STAR Milan as from the Trading Day

following the payment date of the consideration for the Obligation

to Purchase under Art. 108, Par. 2, of the CFA, unless the

Procedure to Comply with the Obligation to Purchase under Art. 108,

Par. 2, of the CFA is followed by the Joint Procedure (in which

case the delisting will apply with the timing indicated in the

paragraph below). Should the delisting occur subsequent to the

Procedure to Comply with the Obligation to Purchase under Art. 108,

Par. 2, of the CFA, Unieuro shareholders that have not tendered

their shares in the Offer and will not request the Offerors to

purchase their shares in accordance with the Procedure to Comply

with the Obligation to Purchase under Art. 108, Par. 2, of the CFA,

will eventually hold financial instruments that are not traded on

any regulated market, with consequent difficulties in liquidating

their investment.

If, in the context of the Procedure to Comply

with the Obligation to Purchase under Art. 108, Par. 2, of the CFA,

the Offerors come to own a total shareholding equal to or above 95%

of the Issuer’s share capital, and, consequently, carry out the

Joint Procedure, Borsa Italiana, in accordance with article 2.5.1,

paragraph 6, of the Stock Exchange Regulations, will order the

suspension from trading of the Issuer’s shares and/or the

Delisting, taking into account the time required to exercise the

Right to Squeeze-Out.

*****

Legal Disclaimer

The Offer is being launched exclusively in

Italy and will be made on a non-discriminatory basis and on equal

terms to all holders of Unieuro shares, as set out in the notice

published pursuant to Article 102 of Italian Legislative Decree No.

58 of February 24, 1998 and as further described in the Offer

Document that will be published in accordance with the applicable

regulations.

The Offer has not been and will not be made

in the United States of America (including its territories and

possessions, any state of the United States of America and the

District of Columbia) (the “United States”), Canada, Japan,

Australia and any other jurisdictions where making the Offer or

tendering therein would not be in compliance with the securities or

other laws or regulations of such jurisdiction or would require any

registration, approval or filing with any regulatory authority

(such jurisdictions, including the United States, Canada, Japan and

Australia, the "Excluded Countries"), by using national or

international instruments of communication or commerce of the

Excluded Countries (including, by way of illustration, the postal

network, fax, telex, e-mail, telephone and internet), through any

structure of any of the Excluded Countries’ financial

intermediaries or in any other way. No actions have been taken or

will be taken to make the Offer possible in any of the Excluded

Countries.

Copies, full or partial, of any documents

relating to the Offer, including this press release, are not and

should not be sent, or in any way transmitted, or otherwise

distributed, directly or indirectly, in the Excluded Countries. Any

person receiving any such documents shall not distribute, send or

dispatch them (whether by post or by any other mean or device of

communication or international commerce) in the Excluded Countries.

Any document relating to the Offer, including this press release,

do not constitute and shall not be construed as an offer of

financial instruments addressed to persons domiciled and/or

resident in the Excluded Countries. No securities may be offered or

sold in the Excluded Countries without specific authorization in

accordance with the applicable provisions of the local law of the

Excluded Countries or a waiver thereof.

This press release is not an offer to sell

or a solicitation of offers to purchase or subscribe for

shares.

This press release and the information

contained herein are not for distribution in or into the United

States. This press release does not constitute, or form part of, an

offer to sell, or a solicitation of an offer to purchase, any

securities in the United States. The securities of Fnac Darty have

not been and will not be registered under the U.S. Securities Act

and may not be offered or sold within the United States absent

registration or an applicable exemption from, or in a transaction

not subject to, the registration requirements of the Securities

Act. There is no intention to register any securities referred to

herein in the United States or to make a public offering of the

securities in the United States.

About Fnac Darty

Operating in 13 countries, Fnac Darty is a

European leader in the retail of entertainment and leisure

products, consumer electronics and domestic appliances. The Group,

which has almost 25,000 employees, has a multi-format network of

more than 1,000 stores at the end of December 2023, and is ranked

as a major e-commerce player in France (more than 27 million unique

visitors per month on average) with its three merchant sites,

fnac.com, darty.com and natureetdecouvertes.com. A leading

omnichannel player, Fnac Darty’s revenue was around €8 billion in

2023, 22% of which was realized online. For more information:

www.fnacdarty.com

CONTACTS

ANALYSTS/INVESTORS

Domitille Vielle – Head of Investor Relations –

domitille.vielle@fnacdarty.com – +33 (0)6 03 86 05 02

Laura Parisot – Investor Relations Manager –

laura.parisot@fnacdarty.com – +33 (0)6 64 74 27 18

PRESS

Marianne Hervé – mherve@image7.fr – +33 (0)6 23

83 59 29

- 20241112_PR Reopening of the Tender Period - Final Results

(ENG)_vclean

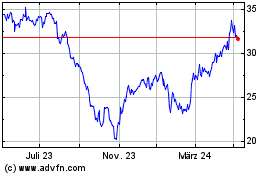

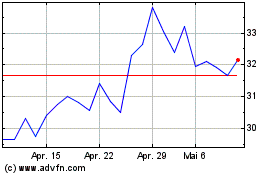

Fnac Darty (EU:FNAC)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

Fnac Darty (EU:FNAC)

Historical Stock Chart

Von Nov 2023 bis Nov 2024