Exor N.V.: Periodic Report on the Buyback Program

22 Mai 2023 - 8:10AM

Exor N.V.: Periodic Report on the Buyback Program

EXOR N.V. (AMS: EXO) (“Exor” or the “Company”)

announces that, under the third tranche of the share buyback

program of up to €150 million announced on 17 April 2023 (the

“third tranche”), the Company has completed the following

transactions on Euronext Amsterdam and CBOE DXE:

|

EURONEXT AMSTERDAM |

|

|

Trading Date |

Number of ordinary shares purchased |

Average price per share excluding fees (€) |

Total consideration excluding fees (€) |

|

15 May 2023 |

39,833 |

78.0716 |

3,109,826.20 |

|

16 May 2023 |

40,915 |

78.4728 |

3,210,714.94 |

|

17 May 2023 |

40,964 |

78.2024 |

3,203,484.38 |

|

18 May 2023 |

41,268 |

79.6485 |

3,286,934.56 |

|

19 May 2023 |

41,909 |

80.4170 |

3,370,194.66 |

|

TOTAL |

204,889 |

|

16,181,154.74 |

|

CBOE DXE |

|

|

Trading Date |

Number of ordinary shares purchased |

Average price per share excluding fees (€) |

Total consideration excluding fees (€) |

|

15 May 2023 |

22,300 |

78.1139 |

1,741,939.30 |

|

16 May 2023 |

21,400 |

78.4623 |

1,679,092.90 |

|

17 May 2023 |

21,430 |

78.2281 |

1,676,428.44 |

|

18 May 2023 |

21,600 |

79.6438 |

1,720,305.20 |

|

19 May 2023 |

22,150 |

80.4206 |

1,781,315.72 |

|

TOTAL |

108,880 |

|

8,599,081.56 |

After these purchases, the total invested amount

under the third tranche is approximately €66.8 million for a total

amount of 872,429 ordinary shares purchased.

As of 19 May 2023, the Company held in total

8,248,643 ordinary shares in treasury (3.53% of total ordinary

issued share capital)1.

1 This corresponds to 1.13% of the total issued

share capital including both ordinary shares and special voting

shares.

A comprehensive overview of the transactions

carried out under the share buyback program, as well as the details

of the above transactions, are available on Exor’s corporate

website under the Share Buyback section.

- Exor Press Release - W20-23 Buyback

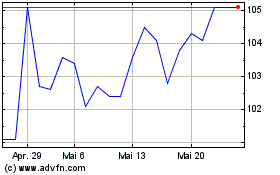

Exor NV (EU:EXO)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Exor NV (EU:EXO)

Historical Stock Chart

Von Dez 2023 bis Dez 2024