Eurocastle Releases First Half 2022 Financial Results and Announces

Annual General Meeting on 8 September 2022

Contact: Oak Fund

Services (Guernsey) LimitedCompany AdministratorAttn: Tracy

LewisTel: +44 1481

723450

Eurocastle

Releases First

Half 2022

Financial Results

andAnnounces Annual

General Meeting on 8 September 2022

Guernsey, 9 August 2022 – Eurocastle Investment

Limited (Euronext Amsterdam: ECT) today has released its financial

report for the six months ended 30 June 2022.

-

Q2

ADJUSTED NET ASSET VALUE

(“NAV”)1 of €18.9 million, or €10.16 per share2,

down €0.37 per share vs. €10.53 per share at Q1 2022 (up €0.37 per

share since 31 December 2021) due to:

- Valuation increases:

- €0.06 per share, or 8% increase in Q2 2022 (€0.08 per share

increase in H1 2022) on the valuation of the remaining two NPL and

other loan interests.

- €0.04 per share, or 4% decrease in Q2 2022 (no movement in H1

2022) on the valuation of the remaining two real estate fund

investments.

- Recognition of tender offer costs in Q2 2022 of €0.38 per

share.

- No movement in reserves in Q2 2022 (release of €0.68 per share

of reserves in H1 2022).

On 8 July 2022, the Company announced the conclusion of the

strategic review and the decision to relaunch the Company’s

investment activity (the “Relaunch”). It also announced a tender

offer to provide a liquidity opportunity for those shareholders who

did not wish to participate in the Relaunch (the “Tender Offer”).

The Tender Offer was set at a price of €10.26 per share, a 28%

premium to the closing share price of €8.00 per share on 6 July

2022, and the maximum share buyback price authorised by the

Company’s shareholders.

On 20 July 2022, the Company held a general meeting (the

“General Meeting”) to vote on a resolution to waive the requirement

for the Company’s Manager and its affiliates (the “FIG Concert

Party”) to make a general offer for the Company should their

ownership interest in the Company exceed 30% as a result the Tender

Offer. This resolution was passed and as a result the Tender Offer

proceeded and closed on 4 August 2022 with 67% of eligible shares

tendered, resulting in Eurocastle accepting 864,980 shares in

exchange for €10.26 of cash per share tendered, or €8.9 million in

total.

H1

2022 BUSINESS HIGHLIGHTS

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Q1

2022

NAV |

|

Q2

Cash

Movement |

|

Q2 FV

Movement |

|

Q2

2022 NAV |

|

|

|

€ million |

€ per share |

|

€ million |

€ per share |

|

€ million |

€ per share |

|

€ million |

€ per share |

| Real Estate

Funds |

|

1.9 |

1.00 |

|

- |

- |

|

(0.1) |

(0.04) |

|

1.8 |

0.96 |

| Italian NPLs &

Other Loans |

|

1.3 |

0.71 |

|

(0.1) |

(0.04) |

|

0.1 |

0.06 |

|

1.3 |

0.72 |

| Net Corporate

Cash3 |

|

16.4 |

8.82 |

|

0.1 |

0.04 |

|

(0.7) |

(0.38) |

|

15.7 |

8.48 |

|

Adjusted NAV |

|

19.6 |

10.53 |

|

- |

- |

|

(0.7) |

(0.37) |

|

18.9 |

10.16 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

H1 2022 Overview

During H1 2022, the Company continued to make progress on

realising its remaining assets as part of its Realisation Plan with

41% of its YE 2021 NAV relating to investments realised in the

period. As at 30 June 2022, the Company’s investments comprised of

two RE Fund Investments and two NPL pools with a NAV of €3.1

million, or 10% of the Company’s NAV.

Investment Realisations & Highlights

- During H1 2022, the Company realised €2.1 million from its

investments, of which €1.9 million came from its Real Estate Funds

(~52% of their YE 2021 NAV) and €0.1 million from its minority NPL

and Other Loan holdings (~11% of their YE 2021 NAV).

- RE Redevelopment Funds – REFI II & REFI V:

- In REFI II, all units have been sold and the fund is now in

liquidation. In REFI V, assuming all units currently under contract

successfully close, only 3% of units will remain to be sold.

- During H1 2022, Eurocastle received €1.9 million comprising (i)

€1.0 million from REFI II (~70% of its YE 2021 NAV) and (ii) €1.0

million from REFI V (~42% of its YE 2021 NAV).

Additional Reserves:

The Company reduced these reserves from €14.8 million to €12.8

million during the period. The reduction of €2.0 million reflects

€0.7 million of reserves being utilised, in line with anticipated

costs, and a release of €1.3 million of the existing reserves in H1

2022. The majority of this release relates to the legacy German tax

matter following a revision to the Company’s estimated total

liability. As at 30 June 2022, of the total Additional Reserves of

€12.8 million, €6.7 million related to the legacy German tax matter

with the balance of approximately €6.1 million in place to allow

for an orderly liquidation process.

- As previously announced, the Company made a payment of €4.6

million in March 2022 in relation to the legacy German tax matter

against which it raised a corresponding tax asset. The current

remaining financial impact (excluding associated costs of €0.2

million) is estimated to be between €1.7 million and €1.9 million.

Notwithstanding the Company’s expectation that the tax matter will

eventually be resolved in the Company’s favour, as at 30 June 2022,

the full potential liability is fully reserved for within the

Additional Reserves.

Subsequent Events To 30 June

2022:

Tender Offer

As stated above, the Tender Offer closed on 4 August 2022 and

the Company bought back 864,980 shares, or €8.9 million, resulting

in a current share count at the date of this announcement of

992,555.

Investment Realisations

Subsequent to H1 2022, the Company received €1.5 million from

its investments, or just under half of the Company’s total Q2 2022

NAV for its investments, comprising:

- €1.3 million from REFI V, or ~90% of its Q2 2022 NAV.

- €0.3 million from one of the two remaining NPL pools following

the completion of its sale on 29 July 2022 in line with its Q2 22

NAV.

Following these distributions, Eurocastle’s remaining Q2 ‘22 NAV

for all of its investments would be €1.6 million, or 8% of the

Company’s Adjusted NAV, which is expected to be realised within the

next 15 months.

Net Available Cash for Relaunch

Taking into account the Tender Offer settlement and cash flows

received from the investments subsequent to H1 2022, the Company

has a cash position of €17.8 million and approximately €8.4 million

of net available cash to commence seeking new investments under the

new investment strategy.

The tables below show the Company’s balance sheet and Net

Corporate Cash as at 30 June 2022 as well as pro forma for the

Tender Offer and investment cash flows received subsequent to H1

2022.

| |

|

|

|

|

|

|

| |

|

Q2 2022 NAV |

|

Q2 2022

NAV PRO FORMA FOR TENDER & Q3

REALISATIONS |

|

|

|

€ million |

€ per share |

|

€ million |

€ per share |

| Investments |

|

3.1 |

1.68 |

|

1.6 |

1.61 |

| Cash |

|

25.2 |

13.54 |

|

17.8 |

17.94 |

| German

Tax1 and Other Assets |

|

4.7 |

2.53 |

|

4.7 |

4.73 |

|

Total Assets |

|

33.0 |

17.75 |

|

24.1 |

24.28 |

|

|

|

|

|

|

|

|

| Accrued

Liabilities |

|

(1.3) |

(0.72) |

|

(1.3) |

(1.34) |

|

IFRS NAV |

|

31.6 |

17.04 |

|

22.8 |

22.94 |

|

|

|

|

|

|

|

|

| Liquidation Cash

Reserves |

|

(6.1) |

(3.30) |

|

(6.1) |

(6.17) |

| Legacy German Tax

Cash Reserve |

|

(2.0) |

(1.08) |

|

(2.0) |

(2.02) |

| Legacy German Tax

Asset Reserve4 |

|

(4.6) |

(2.50) |

|

(4.6) |

(4.68) |

|

Adjusted NAV |

|

18.9 |

10.16 |

|

10.0 |

10.07 |

| Share count |

|

|

1,857,535 |

|

|

992,555 |

| |

|

|

|

|

|

|

| |

|

Q2 2022 NET

CORPORATE CASH |

|

Q2 2022

NET CORPORATE CASH PRO FORMA TENDER &

Q3 REALISATIONS |

|

|

|

€ million |

€ per share |

|

€ million |

€ per share |

| Cash |

|

25.2 |

13.54 |

|

17.8 |

17.94 |

| Other Assets |

|

0.1 |

0.03 |

|

0.1 |

0.05 |

| Accrued

Liabilities |

|

(1.3) |

(0.72) |

|

(1.3) |

(1.34) |

| Liquidation Cash

Reserves |

|

(6.1) |

(3.30) |

|

(6.1) |

(6.17) |

| Legacy

German Tax Cash Reserve |

|

(2.0) |

(1.08) |

|

(2.0) |

(2.02) |

|

Net Corporate Cash |

|

15.7 |

8.48 |

|

8.4 |

8.46 |

| Share count |

|

|

1,857,535 |

|

|

992,555 |

Income Statement for the Six and Three Months ended 30

June 2022 (unaudited)

|

|

H1 2022 |

Q2 2022 |

|

|

€ Thousands |

€ Thousands |

|

Portfolio Returns |

|

|

|

Italian NPLs & Other Loans |

152 |

104 |

|

Real Estate Funds |

(5) |

(82) |

|

Fair value movement on Italian investments |

147 |

22 |

|

Loss on foreign currency

translation |

(2) |

(1) |

|

Total gain |

145 |

21 |

|

|

|

|

|

Operating Expenses |

|

|

|

Interest expense |

11 |

6 |

|

Manager base and incentive fees |

75 |

26 |

|

Remaining operating expenses |

635 |

303 |

|

Other Operating expenses |

710 |

329 |

|

Total expenses |

721 |

335 |

|

|

|

|

|

Net loss for the

period |

(576) |

314 |

|

€ per share |

(0.31) |

(0.17) |

Balance Sheet and Adjusted NAV Reconciliation as at 30

June 2022

|

|

|

Italian Investments€

Thousands |

Corporate€ Thousands |

Total€ Thousands |

|

Assets |

|

|

|

| |

Cash and cash equivalents |

- |

25,153 |

25,153 |

| |

Other assets |

- |

50 |

50 |

| |

Tax Asset |

- |

4,645 |

4,645 |

| |

Investments: |

|

|

|

| |

Italian NPLs & Other Loans |

1,347 |

- |

1,347 |

| |

Real Estate Funds |

1,780 |

- |

1,780 |

|

Total assets |

3,127 |

29,848 |

32,975 |

|

Liabilities |

|

|

|

| |

Trade and other payables |

- |

545 |

545 |

| |

Tender offer costs |

- |

710 |

710 |

|

|

Manager

base and incentive fees |

- |

74 |

74 |

|

Total liabilities |

- |

1,329 |

1,329 |

|

IFRS Net Asset Value |

3,127 |

28,519 |

31,646 |

| Liquidation cash

reserves |

- |

(6,122) |

(6,122) |

| Legacy German tax

cash reserve |

|

(2,006) |

(2,006) |

| Legacy German tax

asset reserve5 |

- |

(4,645) |

(4,645) |

|

Adjusted NAV |

3,127 |

15,746 |

18,873 |

|

Adjusted NAV (€ per Share) |

1.68 |

8.48 |

10.16 |

| |

Tender Offer settlement |

- |

(8,875) |

(8,875) |

|

|

Distributions received subsequent to Q2 2022 |

(1,530) |

1,530 |

- |

|

Q2 2022 PRO FORMA ADJUSTED NAV |

1,597 |

8,401 |

9,998 |

| € per

Share based on 992,555 shares |

1.61 |

8.46 |

10.07 |

ANNUAL GENERAL MEETING

The Company will hold its Annual General Meeting

on Thursday, 8 September 2022, at the Company’s registered office

at 3:00 pm Guernsey time (4:00 pm CET). Notices and proxy

statements will be posted on 24 August 2022 to shareholders of

record at close of business on 23 August 2022.

NOTICE: This announcement contains inside

information for the purposes of the Market Abuse Regulation

596/2014.

ADDITIONAL INFORMATION

For investment portfolio information, please

refer to the Company’s most recent Financial Report, which is

available on the Company’s website (www.eurocastleinv.com).

Terms not otherwise defined in this announcement

shall have the meaning given to them in the Circular.

ABOUT EUROCASTLE

Eurocastle Investment Limited (“Eurocastle” or

the “Company”) is a publicly traded closed-ended investment

company. On 18 November 2019, the Company announced a plan to

realise the majority of its assets with the aim of accelerating the

return of value to shareholders. On 8 July 2022, the Company

announced the relaunch of its investment activity with the aim to

build a Southern European speciality finance and real estate

platform. For more information regarding Eurocastle Investment

Limited and to be added to our email distribution list, please

visit www.eurocastleinv.com.

FORWARD LOOKING STATEMENTS

This release contains statements that constitute

forward-looking statements. Such forward-looking statements may

relate to, among other things, future commitments to sell real

estate and achievement of disposal targets, availability of

investment and divestment opportunities, timing or certainty of

completion of acquisitions and disposals, the operating performance

of our investments and financing needs. Forward-looking statements

are generally identifiable by use of forward-looking terminology

such as “may”, “will”, “should”, “potential”, “intend”, “expect”,

“endeavour”, “seek”, “anticipate”, “estimate”, “overestimate”,

“underestimate”, “believe”, “could”, “project”, “predict”,

"project", “continue”, “plan”, “forecast” or other similar words or

expressions. Forward-looking statements are based on certain

assumptions, discuss future expectations, describe future plans and

strategies, contain projections of results of operations or of

financial condition or state other forward-looking information. The

Company’s ability to predict results or the actual effect of future

plans or strategies is limited. Although the Company believes that

the expectations reflected in such forward-looking statements are

based on reasonable assumptions, its actual results and performance

may differ materially from those set forth in the forward-looking

statements. These forward-looking statements are subject to risks,

uncertainties and other factors that may cause the Company’s actual

results in future periods to differ materially from forecasted

results or stated expectations including the risks regarding

Eurocastle’s ability to declare dividends or achieve its targets

regarding asset disposals or asset performance.

1 In light of the Realisation Plan announced in November 2019,

the Adjusted NAV as at 30 June 2022 reflects additional reserves

for future costs and potential liabilities, which have not been

accounted for under the IFRS NAV. No commitments for these future

costs and potential liabilities existed as at 30 June 2022. IFRS

NAV as at 30 June 2022 was €31.6 million or, €17.04 per share.2 Per

share calculations for Eurocastle throughout this document are

based on 1.9 million shares unless otherwise stated.3 Reflects

corporate cash, plus other assets, net of liabilities and

additional reserves.4 In March 2022, the Company made a payment of

€4.6 million in relation to the legacy German tax matter.

Notwithstanding the Company’s expectation that the tax matter will

eventually be resolved in the Company’s favour, as at 30 June 2022,

this tax asset was fully reserved for within the Additional

Reserves.5 In March 2022, the Company made a payment of €4.6

million in relation to the legacy German tax matter.

Notwithstanding the Company’s expectation that the tax matter will

eventually be resolved in the Company’s favour, as at 30 June 2022,

this tax asset was fully reserved for within the Additional

Reserves.

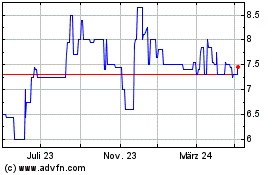

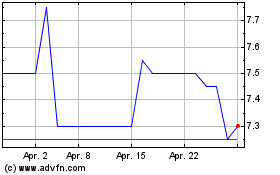

Eurocastle Investment (EU:ECT)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Eurocastle Investment (EU:ECT)

Historical Stock Chart

Von Jul 2023 bis Jul 2024