Brunel Q1: strong performance in key verticals supports continued

growth

Amsterdam, 3 May 2024 – Brunel International

N.V. (Brunel; BRNL), a global provider of flexible workforce

solutions and expertise, today announced its first quarter (Q1)

2024 results.

Key points Q1 2024

- Revenue of EUR 349.2 million, up 10%

(up 13% organically) driven by the four global verticals renewable

energy, conventional energy, mining and life science

- Revenue per working day in DACH

region and NL up, despite continued challenging markets

- Recovery of perm market in renewable

energy

- Australasia, Middle East & India

and Rest of World continued strong growth

- Gross Profit of EUR 69.2 million, up

1% (up 6% organically)

- EBIT of EUR 14.3 million, down 9%

(up 14% organically), due the impact of working days

Jilko Andringa, CEO of Brunel International

N.V.: "During the first

quarter of this year, we continued our strong organic growth, both

top and bottom line. Our well-diversified portfolio of markets and

capabilities positions us to benefit from the energy and digital

transformation, enabling us to withstand the challenging

circumstances in some of our client segments and countries. Our

continued process improvements, digital tooling and leverage of our

infrastructure countered the gross margin pressure we had in the

quarter. Our four strategic segments, mining, life science,

renewable energy and conventional energy, showed continued growth

year over year, confirming we are on the right strategic path.

Our pipeline continues to be strong as we extended strategic

client contracts and won important new projects in the energy

business, which will support continued profitable growth in these

segments. Following the headwinds in our renewable perm business in

H2 of last year, the performance in Q1 2024 was back on last year's

level, and the pipeline looks strong.

We started to roll out our MyBrunel platform in multiple

regions, giving our contractors direct access to the Brunel

services, tools, training-platform and their personal data. This is

another step in our digital journey. We will continue to roll-out

tools for our clients, candidates and our internal colleagues to

increase efficiency and optimize our interactions. These tools

include the latest AI solutions to drive client/contractor intimacy

and improved conversions.

As shown in our 'Facts to the Future' industry insight reports,

recently released among 2,000 specialists and clients, our global

mobility and industry specific training services continue to gain

importance and the need for skilled talent only increases. Brunel

is investing in knowledge-leadership in chosen industries, as

demonstrated by these industry reports.

We expect circumstances in several of our markets to remain

tough in the short term, but we expect to be able to navigate well

through these times. This sets us up for 'the next level' results

on the medium term."

GROUP PERFORMANCE

|

Brunel International (unaudited) |

|

P&L amounts in EUR million |

|

|

|

| |

Q1 2024 |

Q1 2023 |

Δ% |

Organic Δ% |

| Revenue |

349.2 |

316.9 |

10% |

13% |

| Gross Profit |

69.2 |

68.8 |

1% |

6% |

| Gross margin |

19.8% |

21.7% |

|

|

| Operating

costs |

54.2 |

52.3 |

4% |

4% |

| Operating

result |

15.0 |

16.5 |

-9% |

13% |

| Earn out related

share based payments* |

0.7 |

0.7 |

0% |

0% |

| EBIT |

14.3 |

15.8 |

-9% |

14% |

| EBIT % |

4.1% |

5.0% |

|

|

| Conversion

ratio |

20.7% |

23.0% |

|

|

| |

|

|

|

|

| Average

directs |

11,103 |

11,000 |

1% |

1% |

| Average

indirects |

1,560 |

1,529 |

2% |

2% |

| Ratio direct /

Indirect |

7.1 |

7.2 |

|

|

| |

|

|

|

|

|

Organic change is measured by excluding the impact of currencies,

acquisitions, disposals and by adjusting for working days |

|

*Relates to the acquisition related expenses for Taylor

Hopkinson |

First quarter developments

RevenueOrganic revenue was up 13% YoY in Q1

2024. Our four strategic segments, mining, life science, renewable

energy and conventional energy, all showed YoY growth, with the

renewable perm business almost back on last year's level. Reported

revenue was up 10% YoY, with a negative impact from working days of

2% and a negative effect of FX of 1%.

Gross profitOrganic gross profit was up 6% YoY

in Q1 2024. Reported gross profit was up 1% YoY, of which working

days had a negative impact of 5% while FX had a negative effect of

1%.

EBITOrganic EBIT was up 14% YoY in Q4 2023.

Reported EBIT was down 9% YoY, of which working days had a negative

impact of 24% while FX had a negative effect of 1%.Headline

performance by regionSummary (amounts in EUR million):

|

Revenue |

Q1 2024 |

Q1 2023 |

Δ% |

Organic Δ% |

| |

|

|

|

|

| DACH region |

64.3 |

64.9 |

-1% |

2% |

| The

Netherlands |

55.5 |

53.4 |

4% |

6% |

| Australasia |

54.7 |

43.5 |

26% |

32% |

| Middle East &

India |

47.4 |

37.8 |

25% |

28% |

| Americas |

45.9 |

44.0 |

4% |

6% |

| Asia |

44.2 |

44.2 |

0% |

5% |

| Rest of

world |

47.0 |

38.0 |

24% |

24% |

| Eliminations |

-9.6 |

-8.9 |

|

|

| |

|

|

|

|

|

Total |

349.2 |

316.9 |

10% |

13% |

|

EBIT |

Q1 2024 |

Q1 2023 |

Δ% |

Organic Δ% |

| |

|

|

|

|

| DACH region |

6.5 |

8.3 |

-21% |

3% |

| The

Netherlands |

4.4 |

4.8 |

-9% |

9% |

| Australasia |

1.2 |

0.9 |

25% |

36% |

| Middle East &

India |

3.2 |

3.0 |

7% |

10% |

| Americas |

0.7 |

0.4 |

53% |

74% |

| Asia |

2.1 |

2.0 |

7% |

17% |

| Rest of

world |

0.0 |

-0.2 |

82% |

-180% |

| Unallocated |

-3.8 |

-3.5 |

-9% |

-9% |

| |

|

|

|

|

|

Total |

14.3 |

15.8 |

-9% |

14% |

Gross profit (net fees) per vertical

The breakdown of gross profit per vertical is as follows:

| |

2024 |

2023 |

Δ% |

| Global

verticals |

|

|

|

|

|

| Conventional

Energy |

17.7 |

26% |

16.6 |

24% |

6% |

| Renewables |

9.8 |

14% |

8.1 |

12% |

21% |

| Mining |

5.6 |

8% |

4.0 |

6% |

43% |

| Life

Sciences |

4.7 |

7% |

4.2 |

6% |

13% |

| Local

verticals |

|

|

|

|

|

| Industrials

& Technology |

9.9 |

14% |

12.8 |

19% |

-23% |

| Future

Mobility |

8.3 |

12% |

8.4 |

12% |

-2% |

| Financial

Services |

3.9 |

6% |

3.9 |

6% |

-1% |

| Public

Sector |

5.1 |

7% |

4.6 |

7% |

9% |

|

Infrastructure |

2.7 |

4% |

3.4 |

5% |

-22% |

| Other |

1.6 |

2% |

2.9 |

4% |

-44% |

|

Total |

69.2 |

100% |

68.8 |

100% |

1% |

BREAKDOWN BY REGION

|

DACH region (unaudited) |

|

P&L amounts in EUR million |

|

|

|

| |

Q1 2024 |

Q1 2023 |

Δ% |

Organic Δ% |

| Revenue |

64.3 |

64.9 |

-1% |

2% |

| Gross Profit |

22.0 |

24.0 |

-9% |

0% |

| Gross margin |

34.2% |

37.0% |

|

|

| Operating

costs |

15.5 |

15.7 |

-2% |

-2% |

| EBIT |

6.5 |

8.3 |

-21% |

3% |

| EBIT % |

10.1% |

12.8% |

|

|

| Conversion

ratio |

29.5% |

34.6% |

|

|

| |

|

|

|

|

| Average

directs |

1,984 |

2,085 |

-5% |

-5% |

| Average

indirects |

393 |

428 |

-8% |

-8% |

| Ratio direct /

Indirect |

5.0 |

4.9 |

|

|

The DACH region includes

Germany, Switzerland, Austria and Czech Republic. Revenue per

working day in DACH increased by 2%. The gross margin adjusted for

working days improved to 37.3% in Q1 2024 (Q1 2023: 37.0%). Despite

the challenging conditions in part of our markets, we continue to

see high activity levels, both on the client side, as well as the

candidate side, supported by our focus on the right markets.

Working days Germany:

|

|

Q1 |

Q2 |

Q3 |

Q4 |

FY |

|

2024 |

63 |

61 |

66 |

62 |

252 |

|

2023 |

65 |

60 |

65 |

61 |

251 |

Headcount as of 31 March was 1,982 (2023:

2,078).

|

The Netherlands (unaudited) |

|

P&L amounts in EUR million |

|

|

|

| |

Q1 2024 |

Q1 2023 |

Δ% |

Organic Δ% |

| Revenue |

55.5 |

53.4 |

4% |

6% |

| Gross Profit |

14.2 |

15.0 |

-5% |

1% |

| Gross margin |

25.6% |

28.1% |

|

|

| Operating

costs |

9.8 |

10.2 |

-4% |

-4% |

| EBIT |

4.4 |

4.8 |

-9% |

9% |

| EBIT % |

7.9% |

9.0% |

|

|

| Conversion

ratio |

31.0% |

32.0% |

|

|

| |

|

|

|

|

| Average

directs |

1,687 |

1,701 |

-1% |

-1% |

| Average

indirects |

273 |

273 |

0% |

0% |

| Ratio direct /

Indirect |

6.2 |

6.2 |

|

|

Revenue per working day in The

Netherlands increased by 6%. The increase was mainly the

result of higher rates, partially offset by the lower headcount and

a lower productivity. The business line Legal continues to be the

major driver of the growth. The gross margin adjusted for working

days was 27.3% in Q1 2024 (Q1 2023: 28.1%).

Working days The Netherlands:

|

|

Q1 |

Q2 |

Q3 |

Q4 |

FY |

|

2024 |

64 |

62 |

66 |

64 |

256 |

|

2023 |

65 |

61 |

65 |

63 |

254 |

Headcount as of 31 March was 1,667 (2023:

1,735).

|

Australasia (unaudited) |

|

P&L amounts in EUR million |

|

|

|

| |

Q1 2024 |

Q1 2023 |

Δ% |

Organic Δ% |

| Revenue |

54.7 |

43.5 |

26% |

32% |

| Gross Profit |

5.5 |

4.6 |

21% |

28% |

| Gross margin |

10.1% |

10.6% |

|

|

| Operating

costs |

4.3 |

3.7 |

20% |

26% |

| EBIT |

1.2 |

0.9 |

25% |

36% |

| EBIT % |

2.2% |

2.1% |

|

|

| Conversion

ratio |

21.8% |

19.6% |

|

|

| |

|

|

|

|

| Average

directs |

1,746 |

1,495 |

17% |

17% |

| Average

indirects |

135 |

118 |

15% |

15% |

| Ratio direct /

Indirect |

12.9 |

12.7 |

|

|

| |

|

|

|

|

|

Organic change is measured by excluding the impact of currencies,

acquisitions, disposals and by adjusting for working days |

Australasia includes Australia

and Papua New Guinea. Our robust performance in conventional energy

and mining sectors has sustained our growth momentum. The

conversion ratio improved further as we leveraged this growth. The

decline in gross margin was primarily due to a change in our client

mix. Operating costs increased as we geared up to support the high

growth.

|

Middle East & India (unaudited) |

|

P&L amounts in EUR million |

|

|

|

| |

Q1 2024 |

Q1 2023 |

Δ% |

Organic Δ% |

| Revenue |

47.4 |

37.8 |

25% |

28% |

| Gross Profit |

5.8 |

5.6 |

4% |

6% |

| Gross margin |

12.2% |

14.8% |

|

|

| Operating

costs |

2.6 |

2.6 |

1% |

2% |

| EBIT |

3.2 |

3.0 |

7% |

10% |

| EBIT % |

6.8% |

7.9% |

|

|

| Conversion

ratio |

55.2% |

53.6% |

|

|

| |

|

|

|

|

| Average

directs |

2,079 |

2,196 |

-5% |

-5% |

| Average

indirects |

170 |

160 |

6% |

6% |

| Ratio direct /

Indirect |

12.2 |

13.7 |

|

|

| |

|

|

|

|

|

Organic change is measured by excluding the impact of currencies,

acquisitions, disposals and by adjusting for working days |

Middle East & India

includes Qatar, Kuwait, Dubai, Oman, Kurdistan, Iraq and India. The

growth in this region was mainly driven by our activities on the

fabrication yards in Dubai and the successful completion of one of

the projects in this quarter. Qatar continues to be a consistent

and robust contributor to the region's performance. The gross

margin decreased due to changes in the project mix. Maintaining

operating costs at a constant level resulted in an improved

conversion ratio.

|

Americas (unaudited) |

|

P&L amounts in EUR million |

|

|

|

| |

Q1 2024 |

Q1 2023 |

Δ% |

Organic Δ% |

| Revenue |

45.9 |

44.0 |

4% |

6% |

| Gross Profit |

6.2 |

5.5 |

13% |

15% |

| Gross margin |

13.5% |

12.5% |

|

|

| Operating

costs |

5.5 |

5.1 |

10% |

10% |

| EBIT |

0.7 |

0.4 |

53% |

74% |

| EBIT % |

1.5% |

0.9% |

|

|

| Conversion

ratio |

11.3% |

7.3% |

|

|

| |

|

|

|

|

| Average

directs |

1,012 |

1,021 |

-1% |

-1% |

| Average

indirects |

148 |

150 |

-1% |

-1% |

| Ratio direct /

Indirect |

6.8 |

6.8 |

|

|

| |

|

|

|

|

|

Organic change is measured by excluding the impact of currencies,

acquisitions, disposals and by adjusting for working days |

The Americas includes Brazil,

Canada, USA, Guyana and Suriname. We continued to grow in our main

market in USA and Canada in conventional energy and mining. The

market for permanent placements in USA has experienced rapid

expansion, giving a boost to the gross margin and enhancing the

conversion ratio.

|

Asia (unaudited) |

|

P&L amounts in EUR million |

|

|

|

| |

Q1 2024 |

Q1 2023 |

Δ% |

Organic Δ% |

| Revenue |

44.2 |

44.2 |

0% |

5% |

| Gross Profit |

7.0 |

6.6 |

6% |

11% |

| Gross margin |

15.8% |

14.9% |

|

|

| Operating

costs |

4.9 |

4.6 |

5% |

9% |

| EBIT |

2.1 |

2.0 |

7% |

17% |

| EBIT % |

4.8% |

4.5% |

|

|

| Conversion

ratio |

30.0% |

30.3% |

|

|

| |

|

|

|

|

| Average

directs |

1,325 |

1,459 |

-9% |

-9% |

| Average

indirects |

193 |

146 |

32% |

32% |

| Ratio direct /

Indirect |

6.9 |

10.0 |

|

|

| |

|

|

|

|

|

Organic change is measured by excluding the impact of currencies,

acquisitions, disposals and by adjusting for working days |

Asia includes Singapore, China,

Hong Kong, South Korea, Taiwan, Japan, Indonesia, Thailand and

Malaysia. The sustained robust performance of our fabrication yards

in Indonesia and China has been the main driver of regional

success. Singapore trailed behind due to slower than expected

progress of a major project in yards. A favorable shift in our

client mix led to a further improvement in gross profit.

|

Rest of world (unaudited) |

|

P&L amounts in EUR million |

|

|

|

| |

Q1 2024 |

Q1 2023 |

Δ% |

Organic Δ% |

| Revenue |

47.0 |

38.0 |

24% |

24% |

| Gross Profit |

8.4 |

7.5 |

12% |

13% |

| Gross margin |

17.9% |

19.7% |

|

|

| Operating

costs |

7.7 |

7.0 |

10% |

7% |

| Operating

result |

0.7 |

0.5 |

53% |

96% |

| Earn out related

share based payments* |

0.7 |

0.7 |

0% |

0% |

| EBIT |

- |

-0.2 |

82% |

-180% |

| EBIT % |

0.0% |

-0.5% |

|

|

| Conversion

ratio |

0.0% |

-2.7% |

|

|

| |

|

|

|

|

| Average

directs |

1,272 |

1,042 |

22% |

22% |

| Average

indirects |

194 |

191 |

2% |

2% |

| Ratio direct /

Indirect |

6.6 |

5.5 |

|

|

| |

|

|

|

|

|

Organic change is measured by excluding the impact of currencies,

acquisitions, disposals and by adjusting for working days |

|

*Relates to the acquisition related expenses for Taylor

Hopkinson |

|

Rest of World includes Taylor

Hopkinson, Belgium and our other energy activities in Europe.

Taylor Hopkinson continued strong growth in the contracting market,

where we engage specialists to support our clients. The market for

permanent placements in the offshore wind industry started to

recover rapidly, and revenue for perm fees almost returned to the

level of Q1 2023. The gross margin slightly decreased due to the

faster growth in contracting compared to perm placements.

Cash positionThe net cash

balance at 31 March 2024 was EUR 6.2 million. The earlier exercise

of part of the put and call option on the shares in Taylor

Hopkinson (20%) was executed and settled according to plan in

Q1.

OutlookBased on our performance

and position in our key markets, we expect the current trend to

continue in Q2 2024.

ESG updateIn Q1 2024, the

Brunel Foundation supporting Brunel’s ESG strategy and the UN

Sustainable Development Goals, hosted some great events. All

initiatives of the Foundation are aimed at contributing to a

healthier planet and a better future for generations to come. Below

you can read how the Foundation has supported the CLEAR RIVERS’

litter trap innovation project and participated in the Trash ‘n

Trace challenge with Litterati, fitting right in with the planet

focus. In our professionals pillar, we joined the Brainport

Knowledge Fair for educational professionals, helping children to

face society and the labor market of the future in a resilient way

and we have set some ambitious targets to reach 2,400 children by

the end of 2024 with our OffshoreWind4Kids sessions, as we believe

that involving children at an early age in fun activities related

to renewable energy is a great way to create awareness for the

environment.

Donation CLEAR RIVERS The Brunel Foundation is

proud to financially support the CLEAR RIVERS’ litter trap

innovation project as part of the end of year donations on behalf

of Brunel’s clients in the Netherlands. CLEAR RIVERS is a

non-for-profit organization tackling the plastic pollution crisis

by catching river plastics before they reach the open waters,

organizing cleanups, educational workshops, and recycling the

retrieved litter into new durable products. The activities of CLEAR

RIVERS seamlessly fit within the planet focus of the Brunel

Foundation. Together we continue to strive for a cleaner and more

sustainable future for all.

Future professionals The Brunel Foundation

and OffshoreWind4Kids had the opportunity to join the Brainport

Knowledge Fair for educational professionals. Brainport Eindhoven

focuses on innovation, giving children the opportunity to face

society and the labor market of the future, in a resilient way.

Main goal of this event was to inspire teachers to incorporate

engineering and technology into their classrooms.

OffshoreWind4Kids, supported by the Brunel Foundation, informed

teachers about the Wind4Kids’ hands on learning experiences about

wind energy and invited them to add the workshop to their

curriculum.

OffshoreWind4KidsTaylor Hopkinson and the

Brunel Foundation have set a target of delivering OffshoreWind4Kids

sessions, both beach demos and school visits, to 2400 kids by the

end of 2024. To create maximum impact and unlock the talents and

interest of as many kids as possible, we will equip volunteer

Brunellers with workshop knowledge and gear, so they can drive

momentum in organizing local events in their regions.

Trash ‘n TraceIn this quarter we’ve reached the

enormous number of half a million pieces of litter picked in our

Trash ‘n Trace challenge with Litterati. Unfortunately, the

necessity is still there. We are proud that Brunel colleagues of

our Australian offices hit the sidewalks in Brisbane City and

Perth’s Cottesloe Beach to clean up together, on Clean up Australia

Day. They were surprised at the amount of litter they collected

from some much-loved locations. Once you’ll start litter picking,

you won’t un-see litter anymore.

Results callToday (May 3, 2024), at 10:30 AM

CET, Brunel will be hosting a results call.

To join the conference call, use access code 477583 and dial,

depending on your location. The dial-in number for the Netherlands

is +31.85.888.7233Other locations – see

www.brunelinternational.net.

You can listen to the call through a real-time

audio webcast. You can access the webcast and presentation at

https://events.q4inc.com/attendee/861976541. A replay of the

presentation and the Q&A will be available on our website by

the end of the day.

Source: Brunel International NV

- Press Release Q1 2024.pdf

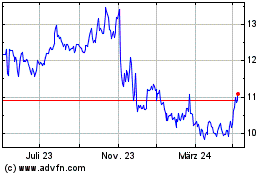

Brunel International NV (EU:BRNL)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Brunel International NV (EU:BRNL)

Historical Stock Chart

Von Dez 2023 bis Dez 2024