Brunel reports strong growth in revenue, gross profit and EBIT

29 Oktober 2021 - 7:30AM

Brunel reports strong growth in revenue, gross profit and EBIT

Amsterdam, 29 October 2021- Brunel International

N.V. (Brunel; BRNL), a global provider of flexibleworkforce

solutions and expertise today announced its third quarter (Q3) 2021

results.

Key points Q3 2021

- Revenue increased by 10% to EUR 227 million;

- Gross Profit increase of 15% compared to Q3 2020;

- Gross margin increased by 1.1 percentage points to 23.9%;

- All operating segments were profitable, with total EBIT

increasing by 34% to 13.6 million.

Key points YTD 2021

- Gross margin increased by 2.2 percentage points to 23.1%;

- Cost savings of EUR 4.9 million contribute to EBIT growth, up

68% to EUR 31.9 million;

- Strong cash position maintained at EUR 138.4 million.

OutlookContinued growth in Q4, resulting

in:

- Full year revenue between EUR 880 million and EUR 900 million

(2020: EUR 893 million)

- Full year EBIT between EUR 43 million and EUR 45 million (2020:

EUR 28.8 million)

Jilko Andringa, CEO of Brunel

International N.V.:“The month on month revenue growth over

the past period has now resulted in strong growth for the year to

date. Our revenue, gross margins and EBIT are improving fast,

driven by our strategic focus on higher added value for our

clients. The multi-year performance indicators in our markets show

positive momentum, and our positioning leads to revenue growth in

almost all regions, with the Americas, Asia and Russia standing

out. Despite the increasing shortages in the labour markets, we

remain successful in connecting more and more specialists to

pioneering projects. While doing so, we have been successful in

increasing our added value as is reflected in the strong increase

in gross profit. In combination with continued disciplined

execution, this results in a strong increase in our

profitability.

Whilst we continue to expand our business in our

strategic verticals, we also continue to develop our capabilities.

Some examples of new types of services we delivered in this quarter

are a recruitment solution (RPO) for a large mining site in Finland

and the commissioning of a newbuild chemicals plant in

Singapore we executed with a partner. We also accelerated our

success in our traditional global mobility and recruitment services

with many off-shore wind and hydrogen projects. We are

well-positioned to take advantage of the increased demand for

specialist and solutions for a more sustainable world, evidenced by

the high growth percentage in our renewable vertical.

Now that COVID-19 restrictions are getting

lifted in most regions, the return to topline growth provides the

fundament for high single digit growth in the years to come."

|

Brunel International (unaudited) |

| P&L

amounts in EUR million |

|

|

|

|

|

|

|

|

|

|

Q3 2021 |

Q3 2020 |

Δ% |

|

|

YTD 2021 |

YTD 2020 |

Δ% |

|

| Revenue |

227.2 |

207.1 |

10% |

a |

|

654.3 |

683.2 |

-4% |

b |

| Gross Profit |

54.3 |

47.1 |

15% |

|

|

151.1 |

143.1 |

6% |

|

| Gross margin |

23.9% |

22.8% |

|

|

|

23.1% |

20.9% |

|

|

| Operating costs |

40.7 |

36.9 |

10% |

c |

|

119.2 |

124.1 |

-4% |

d |

| EBIT |

13.6 |

10.2 |

34% |

|

|

31.9 |

19.0 |

68% |

|

| EBIT % |

6.0% |

4.9% |

|

|

|

4.9% |

2.8% |

|

|

| |

|

|

|

|

|

|

|

|

|

| Average directs |

9,994 |

9,599 |

4% |

|

|

9,636 |

10,464 |

-8% |

|

| Average indirects |

1,299 |

1,395 |

-7% |

|

|

1,303 |

1,481 |

-12% |

|

| Ratio direct / Indirect |

7.7 |

6.9 |

|

|

|

7.4 |

7.1 |

|

|

| |

|

|

|

|

|

|

|

|

|

| a 9 %

like-for-like |

|

|

|

|

|

|

| b -3 %

like-for-like |

|

|

|

|

|

|

| c 10 %

like-for-like |

|

|

|

|

|

|

| d -3 %

like-for-like |

|

|

|

|

|

|

| |

|

Q3 2021 results by divisionP&L amounts in

EUR million

Summary:

|

Revenue |

Q3 2021 |

Q3 2020 |

Δ% |

|

YTD 2021 |

YTD 2020 |

Δ% |

| |

|

|

|

|

|

|

|

| DACH region |

55.6 |

54.6 |

2% |

|

164.7 |

177.0 |

-7% |

| The

Netherlands |

44.4 |

45.5 |

-2% |

|

136.6 |

142.7 |

-4% |

| Australasia |

27.7 |

26.7 |

4% |

|

77.6 |

85.0 |

-9% |

| Middle East &

India |

25.7 |

25.0 |

3% |

|

75.9 |

88.7 |

-14% |

| Americas |

25.4 |

18.2 |

40% |

|

69.2 |

69.5 |

0% |

| Rest of

world |

48.4 |

37.1 |

30% |

|

130.3 |

119.5 |

9% |

| Unallocated |

0.0 |

0.0 |

100% |

|

0.0 |

0.8 |

-100% |

| |

|

|

|

|

|

|

|

|

Total |

227.2 |

207.1 |

10% |

|

654.3 |

683.2 |

-4% |

| Gross

Profit |

Q3 2021 |

Q3 2020 |

Δ% |

|

YTD 2021 |

YTD 2020 |

Δ% |

| |

|

|

|

|

|

|

|

| DACH region |

21.0 |

19.6 |

7% |

|

58.2 |

55.2 |

5% |

| The

Netherlands |

14.3 |

12.4 |

16% |

|

40.3 |

37.9 |

6% |

| Australasia |

2.9 |

2.4 |

21% |

|

7.9 |

7.2 |

10% |

| Middle East &

India |

4.2 |

4.1 |

3% |

|

12.3 |

14.5 |

-15% |

| Americas |

3.4 |

2.2 |

55% |

|

9.1 |

7.9 |

15% |

| Rest of

world |

8.6 |

6.5 |

31% |

|

23.4 |

20.5 |

14% |

| Unallocated |

0.0 |

0.0 |

100% |

|

0.0 |

0.0 |

100% |

| |

|

|

|

|

|

|

|

|

Total |

54.3 |

47.1 |

15% |

|

151.1 |

143.1 |

6% |

|

EBIT |

Q3 2021 |

Q3 2020 |

Δ% |

|

YTD 2021 |

YTD 2020 |

Δ% |

| |

|

|

|

|

|

|

|

| DACH region |

7.4 |

6.8 |

9% |

|

16.8 |

10.2 |

64% |

| The

Netherlands |

4.4 |

3.0 |

48% |

|

11.6 |

7.8 |

48% |

| Australasia |

0.3 |

0.1 |

114% |

|

0.5 |

-0.2 |

429% |

| Middle East &

India |

2.2 |

2.0 |

10% |

|

6.7 |

7.1 |

-6% |

| Americas |

0.2 |

-0.5 |

142% |

|

0.3 |

-1.9 |

114% |

| Rest of

world |

2.2 |

1.1 |

103% |

|

5.1 |

3.0 |

70% |

| Unallocated |

-3.1 |

-2.3 |

-33% |

|

-9.0 |

-7.0 |

-28% |

| |

|

|

|

|

|

|

|

|

Total |

13.6 |

10.2 |

34% |

|

31.9 |

19.0 |

68% |

In Q3 2021, the Group’s revenue increased 10% or EUR 20.1

million y-o-y. Higher rates and a higher productivity resulted in

an improved gross margin to 23.9%, which is an increase of 1.1

percentage points versus Q3 2020. All regions are both increasing

both their gross margins and profitability, leading to an EBIT of

6%, an increase of EUR 3.4 million increase y-o-y, or 34%, compared

to the same period last year.

PERFORMANCE BY REGION

|

DACH region (unaudited) |

|

| P&L

amounts in EUR million |

|

|

|

|

|

|

|

|

|

|

Q3 2021 |

Q3 2020 |

Δ% |

|

|

YTD 2021 |

YTD 2020 |

Δ% |

|

| Revenue |

55.6 |

54.6 |

2% |

|

|

164.7 |

177.0 |

-7% |

|

| Gross Profit |

21.0 |

19.6 |

7% |

|

|

58.2 |

55.2 |

5% |

|

| Gross margin |

37.8% |

35.8% |

|

|

|

35.3% |

31.2% |

|

|

| Operating costs |

13.6 |

12.8 |

6% |

|

|

41.4 |

45.0 |

-8% |

|

| EBIT |

7.4 |

6.8 |

9% |

|

|

16.8 |

10.2 |

64% |

|

| EBIT % |

13.3% |

12.4% |

|

|

|

10.2% |

5.8% |

|

|

| |

|

|

|

|

|

|

|

|

|

| Average directs |

1,972 |

2,019 |

-2% |

|

|

1,936 |

2,200 |

-12% |

|

| Average indirects |

371 |

432 |

-14% |

|

|

378 |

475 |

-20% |

|

| Ratio direct / Indirect |

5.3 |

4.7 |

|

|

|

5.1 |

4.6 |

|

|

Revenue in DACH increased by

2%, mainly driven by a higher rates and a higher productivity,

partially offset by a 2% lower average headcount over the quarter.

The higher rates and productivity lead to a 2.0 percentage points

increase in gross margin.

The number of specialists in short-time working

reduced from 9 in Q2 2021 to 5 at the end of Q3 2021.

Headcount as of September 30th was 1,991 (2020:

2,007)

Working days Germany:

|

|

Q1 |

Q2 |

Q3 |

Q4 |

FY |

|

2021 |

63 |

60 |

66 |

65 |

254 |

|

2020 |

64 |

59 |

66 |

65 |

254 |

|

Brunel Netherlands (unaudited) |

|

| P&L

amounts in EUR million |

|

|

|

|

|

|

|

|

|

|

Q3 2021 |

Q3 2020 |

Δ% |

|

|

YTD 2021 |

YTD 2020 |

Δ% |

|

| Revenue |

44.4 |

45.5 |

-2% |

|

|

136.6 |

142.7 |

-4% |

|

| Gross Profit |

14.3 |

12.4 |

16% |

|

|

40.3 |

37.9 |

6% |

|

| Gross margin |

32.1% |

27.2% |

|

|

|

29.5% |

26.6% |

|

|

| Operating costs |

9.9 |

9.4 |

5% |

|

|

28.7 |

30.1 |

-5% |

|

| EBIT |

4.4 |

3.0 |

48% |

|

|

11.6 |

7.8 |

48% |

|

| EBIT % |

9.9% |

6.5% |

|

|

|

8.5% |

5.5% |

|

|

| |

|

|

|

|

|

|

|

|

|

| Average directs |

1,687 |

1,844 |

-9% |

|

|

1,713 |

1,919 |

-11% |

|

| Average indirects |

269 |

327 |

-18% |

|

|

282 |

346 |

-18% |

|

| Ratio direct / Indirect |

6.3 |

5.6 |

|

|

|

6.1 |

5.6 |

|

|

Revenue in The Netherlands

decreased by 2%. Gross margin increased by 4.9 percentage points in

Q3 2021, mainly driven by higher rates and a higher productivity.

While we saw a strong increase in gross profit, which was achieved

in almost all business lines, there was only a limited increase in

operating cost, showing our operational leverage. This resulted in

a 48% higher EBIT.

Headcount as of September 30th was 1,680 (2020:

1,835)

Working days per Q 2021 / 2020:

|

|

Q1 |

Q2 |

Q3 |

Q4 |

FY |

|

2021 |

63 |

61 |

66 |

66 |

256 |

|

2020 |

64 |

60 |

66 |

65 |

255 |

|

Australasia (unaudited) |

|

| P&L

amounts in EUR million |

|

|

|

|

|

|

|

|

|

|

Q3 2021 |

Q3 2020 |

Δ% |

|

|

YTD 2021 |

YTD 2020 |

Δ% |

|

| Revenue |

27.7 |

26.7 |

4% |

a |

|

77.6 |

85.0 |

-9% |

b |

| Gross Profit |

2.9 |

2.4 |

21% |

|

|

7.9 |

7.2 |

10% |

|

| Gross margin |

10.5% |

9.0% |

|

|

|

10.2% |

8.4% |

|

|

| Operating costs |

2.6 |

2.3 |

13% |

c |

|

7.4 |

7.4 |

0% |

d |

| EBIT |

0.3 |

0.1 |

114% |

|

|

0.5 |

-0.2 |

429% |

|

| EBIT % |

1.1% |

0.5% |

|

|

|

0.6% |

-0.2% |

|

|

| |

|

|

|

|

|

|

|

|

|

| Average directs |

981 |

936 |

5% |

|

|

948 |

1,012 |

-6% |

|

| Average indirects |

95 |

80 |

19% |

|

|

88 |

82 |

8% |

|

| Ratio direct / Indirect |

10.3 |

11.7 |

|

|

|

10.7 |

12.4 |

|

|

| |

|

|

|

|

|

|

|

|

|

| a 3 %

like-for-like |

|

|

|

|

|

|

| b -12 %

like-for-like |

|

|

|

|

|

|

| c 14 %

like-for-like |

|

|

|

|

|

|

| d -2 %

like-for-like |

|

|

|

|

|

|

| |

|

Australasia includes Australia

and Papua New Guinea. Revenue was up 4% over Q3. Australia

continued to be hindered by COVID-19 restrictions, while the travel

restrictions in PNG were lifted, allowing expats to travel,

supporting the region’s performance. Focus on higher value added

activities increased the gross margin with 1.5 percentage

points.

|

Middle East & India (unaudited) |

|

| P&L

amounts in EUR million |

|

|

|

|

|

|

|

|

|

|

Q3 2021 |

Q3 2020 |

Δ% |

|

|

YTD 2021 |

YTD 2020 |

Δ% |

|

| Revenue |

25.7 |

25.0 |

3% |

a |

|

75.9 |

88.7 |

-14% |

b |

| Gross Profit |

4.2 |

4.1 |

3% |

|

|

12.3 |

14.5 |

-15% |

|

| Gross margin |

16.3% |

16.2% |

|

|

|

16.2% |

16.3% |

|

|

| Operating costs |

2.0 |

2.1 |

-5% |

c |

|

5.6 |

7.4 |

-24% |

d |

| EBIT |

2.2 |

2.0 |

10% |

|

|

6.7 |

7.1 |

-6% |

|

| EBIT % |

8.6% |

8.0% |

|

|

|

8.9% |

8.0% |

|

|

| |

|

|

|

|

|

|

|

|

|

| Average directs |

2,068 |

2,089 |

-1% |

|

|

2,056 |

2,435 |

-16% |

|

| Average indirects |

125 |

130 |

-3% |

|

|

125 |

139 |

-10% |

|

| Ratio direct / Indirect |

16.5 |

16.1 |

|

|

|

16.5 |

17.5 |

|

|

| |

|

|

|

|

|

|

|

|

|

| a 1 %

like-for-like |

|

|

|

|

|

|

| b -10 %

like-for-like |

|

|

|

|

|

|

| c -5 %

like-for-like |

|

|

|

|

|

|

| d -21 %

like-for-like |

|

|

|

|

|

|

| |

|

In Middle East & India we

see the start of new projects as well as some extensions that drive

the growth throughout the region compared with Q3 2020. Travel

restrictions have eased in Qatar, India and the Emirates. Revenue

is lower in Kuwait as travel restrictions continue to limit our

activities. Supported by higher revenue, slightly better gross

margin and lower costs, the EBIT percentage has increased with 0.6

percentage points to 8.6%.

|

Americas (unaudited) |

|

| P&L

amounts in EUR million |

|

|

|

|

|

|

|

|

|

|

Q3 2021 |

Q3 2020 |

Δ% |

|

|

YTD 2021 |

YTD 2020 |

Δ% |

|

| Revenue |

25.4 |

18.2 |

40% |

a |

|

69.2 |

69.5 |

0% |

b |

| Gross Profit |

3.4 |

2.2 |

55% |

|

|

9.1 |

7.9 |

15% |

|

| Gross margin |

13.5% |

12.2% |

|

|

|

13.1% |

11.3% |

|

|

| Operating costs |

3.2 |

2.7 |

19% |

c |

|

8.8 |

9.8 |

-10% |

d |

| EBIT |

0.2 |

-0.5 |

142% |

|

|

0.3 |

-1.9 |

114% |

|

| EBIT % |

0.8% |

-2.7% |

|

|

|

0.4% |

-2.8% |

|

|

| |

|

|

|

|

|

|

|

|

|

| Average directs |

816 |

689 |

18% |

|

|

801 |

771 |

4% |

|

| Average indirects |

104 |

103 |

1% |

|

|

102 |

109 |

-6% |

|

| Ratio direct / Indirect |

7.8 |

6.7 |

|

|

|

7.8 |

7.1 |

|

|

| |

|

|

|

|

|

|

|

|

|

| a 35 %

like-for-like |

|

|

|

|

|

|

| b 3 %

like-for-like |

|

|

|

|

|

|

| c 15 %

like-for-like |

|

|

|

|

|

|

| d -7 %

like-for-like |

|

|

|

|

|

|

| |

|

Revenue growth in the Americas

was very strong in Q3 and achieved in all countries in the region,

proving our successful positioning. The gross margin increase of

1.3 percentage points is supported by an increase in recruitment

revenue in the United States. All countries contributed to the

increase, delivering a positive EBIT against a loss in 2020.

|

Rest of world (unaudited) |

|

| P&L

amounts in EUR million |

|

|

|

|

|

|

|

|

|

|

Q3 2021 |

Q3 2020 |

Δ% |

|

|

YTD 2021 |

YTD 2020 |

Δ% |

|

| Revenue |

48.4 |

37.1 |

30% |

a |

|

130.3 |

119.5 |

9% |

b |

| Gross Profit |

8.6 |

6.5 |

31% |

|

|

23.4 |

20.5 |

14% |

|

| Gross margin |

17.7% |

17.6% |

|

|

|

18.0% |

17.2% |

|

|

| Operating costs |

6.4 |

5.4 |

19% |

c |

|

18.3 |

17.5 |

5% |

d |

| EBIT |

2.2 |

1.1 |

103% |

|

|

5.1 |

3.0 |

70% |

|

| EBIT % |

4.5% |

2.9% |

|

|

|

3.9% |

2.5% |

|

|

| |

|

|

|

|

|

|

|

|

|

| Average directs |

2,471 |

2,022 |

22% |

|

|

2,182 |

2,107 |

4% |

|

| Average indirects |

273 |

261 |

5% |

|

|

266 |

267 |

0% |

|

| Ratio direct / Indirect |

9.0 |

7.7 |

|

|

|

8.2 |

7.9 |

|

|

| |

|

|

|

|

|

|

|

|

|

| a 34 %

like-for-like |

|

|

|

|

|

|

| b 16 %

like-for-like |

|

|

|

|

|

|

| c 16 %

like-for-like |

|

|

|

|

|

|

| d 7 %

like-for-like |

|

|

|

|

|

|

| |

|

Rest of world includes Asia,

Russia & Caspian, Belgium and rest of Europe & Africa. The

main driver of growth continues to be Asia with two projects

completed in Q3. In Russia we also achieved significant growth,

leading to an overall 1.6 percentage points EBIT improvement. The

region’s growth is partially offset by unfavourable exchange rate

developments.

Cash positionThe cash balance

at 30 September 2021 amounts to EUR 138.4 million (EUR 155.0 per 31

December 2020), of which EUR 17.5 million restricted (EUR 15.1

per 31 December 2020). The cash balance decreased compared to 31

December 2020 in line with the normal seasonality, the distribution

of dividend and the share buyback program in Q2.

Outlook We expect the current

trends to continue in Q4 2021, supported by the lifting of COVID

restrictions in most regions. The economic outlook for our sectors

remains strong. Based on this, we expect revenue for the full year

to be between EUR 880 million and EUR 900 million (2020: EUR 893

million), with EBIT between EUR 43 million and EUR 45 million

(2020: EUR 28.8 million).

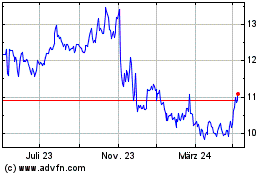

Brunel International NV (EU:BRNL)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Brunel International NV (EU:BRNL)

Historical Stock Chart

Von Dez 2023 bis Dez 2024