Antin Infrastructure Partners Closes Flagship Fund V Above €10 Billion Target

19 Dezember 2024 - 7:00AM

Business Wire

The new fund is expected to be the largest

infrastructure fund to hold a final closing worldwide in

2024

Regulatory News:

Antin Infrastructure Partners (Paris:ANTIN), one of the world’s

leading infrastructure investment firms, announces today that it

has successfully closed its fifth flagship fund above target,

raising €10.2 billion ($10.7 billion).

The new fund is expected to be the largest infrastructure fund

to reach a final closing worldwide in 2024. Its size represents an

increase of over 50% from Antin’s previous Flagship Fund IV, which

closed in 2020 at €6.5 billion. The outcome is a standout

achievement in the current fundraising environment.

Flagship Fund V achieved this successful result through the

support of both existing investors, as evidenced by the fund’s

re-up rate of more than 90%, and new relationships. Over 120 new

investors joined the fund, further diversifying Antin’s growing

investor base. Commitments from North America in the new fund were

nearly five times larger than in Antin’s prior flagship fund.

Commitments from Asia Pacific, the Middle East and Latin America

also significantly increased.

Alain Rauscher, Co-Founder, Chief Executive Officer and

Chairman of the Board, said: “Exceeding our target for Flagship

Fund V in today’s challenging fundraising environment is a major

achievement that underscores the trust our investors place in our

investment strategy and expertise. We are extremely grateful for

their continued partnership and look forward to investing the new

fund in essential businesses that support communities, drive

long-term value and foster a more resilient society.”

The new fund will continue Antin’s 17-year successful history of

making value added infrastructure investments across Europe and

North America in the energy and environment, digital, transport and

social infrastructure sectors. To date, Flagship Fund V has already

invested approximately 40% of its capital in five companies,

including Blue Elephant Energy, Consilium Safety, Opdenergy,

Portakabin and Proxima, with a strong pipeline of future

opportunities.

Evercore Private Funds Group acted as global placement agent for

the fundraise and Kirkland & Ellis acted as Antin’s legal

advisor.

About Antin Infrastructure

Partners

Antin Infrastructure Partners is a leading private equity firm

focused on infrastructure. With over €32 billion in assets under

management across its Flagship, Mid Cap and NextGen investment

strategies, Antin targets investments in the energy and

environment, digital, transport and social infrastructure sectors.

With offices in Paris, London, New York, Singapore, Seoul and

Luxembourg, Antin employs over 240 professionals dedicated to

growing, improving and transforming infrastructure businesses while

delivering long-term value to portfolio companies and investors.

Majority owned by its partners, Antin is listed on Euronext Paris

(Ticker: ANTIN – ISIN: FR0014005AL0).

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241218148128/en/

Media Contacts

Antin Infrastructure Partners Nicolle Graugnard,

Communication Director Email: media@antin-ip.com

Ludmilla Binet, Head of Shareholder Relations Email:

shareholders@antin-ip.com

Brunswick Email: antinip@brunswickgroup.com Tristan

Roquet Montegon +33 (0) 6 37 00 52 57 Gabriel Jabès +33 (0) 6 40 87

08 14

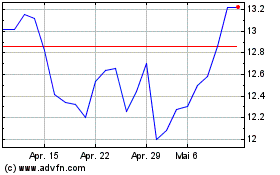

Antin Infrastructure Par... (EU:ANTIN)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

Antin Infrastructure Par... (EU:ANTIN)

Historical Stock Chart

Von Jan 2024 bis Jan 2025