WINFARM : 2023 Full-Year Results and outlook for 2024.

PRESS RELEASE Loudéac, 28 March

2024

2023 FULL-YEAR RESULTS

Revenue up 5% despite the widespread fall in

prices

Sharp fall in activity in the fourth quarter,

which weighed on EBITDA

OUTLOOK FOR 2024

A difficult first quarter but gradual growth in

business

Strict financial discipline to improve EBITDA

Commitment to reduce the Group’s debt

WINFARM (ISIN code: FR0014000P11 -

ticker: ALWF), the number one French distance-seller for the

farming industry, today released its consolidated results

for 2023.

At its meeting on 28 March 2024, the Board of

Directors approved the consolidated financial statements for the

financial year ended 31 December 2023. These financial statements

have been reviewed by the statutory auditors and the certification

reports are currently being prepared. The consolidated financial

statements for the 2023 financial year are available on the

company's website in the investor space.

|

Consolidated data, French accounting standards,Audited financial

statements in €m |

2023 |

2022 |

|

Revenue |

137.6 |

130.9 |

|

Gross margin |

45.1 |

41.7 |

|

As a % of revenue |

32.8% |

31.9% |

|

EBITDA |

2.3% |

4.5% |

|

As a % of revenue |

1.7% |

3.5% |

|

Depreciation, amortisation, and provisions |

(5.0) |

(3.6) |

|

Operating income/(loss) |

(2.5) |

1.1 |

|

Net financial income/(expense) |

(0.4) |

(0.2) |

|

Non-recurring profit/(loss) |

(0.0) |

(0.2) |

|

Corporate tax |

(0.2) |

(0.2) |

|

Share of net income of companies accounted for by the equity

method |

|

- |

|

Group net income/(loss) |

(3.0) |

0.6 |

After a strong inflationary effect in 2022, the

Group had to deal with a widespread easing of prices in 2023. This

concerned animal nutrition, hygiene products and, to a lesser

extent, fencing and spare parts. After increases ranging from 10%

to 20% in all these categories since 2021, representing one third

of Winfarm’s revenue, prices fell by 15% to 20% over the year.

2023 also saw a sudden slowdown in demand in the

fourth quarter, due in particular to disastrous weather conditions

(floods in Pas-de-Calais).

After several years of average sales growth of

between 15% and 20%, these factors naturally weighed on the Group’s

revenue, which rose by just 5% versus 2022 to €137.6m, and on its

profitability.

Increase in sales limited by the fall in

prices and the slowdown in the market in the fourth

quarter

In 2023, the Farming Supplies

business (91% of revenue at 30 December 2023), marketed under the

Vital Concept brand, posted revenue of €125.1m, an increase of

7.1%.

Given the negative price effect combined with an

unfavourable calendar effect (four fewer invoicing days compared to

2022), Winfarm managed to maintain a satisfactory level of activity

with a change in its organic scope, excluding the contribution of

Kabelis, which registered a limited decline of 2.4%.

The Farming Production business

(7% of revenue at 31 September 2023), marketed under the Alphatech

brand, generated revenue of €10.0m in 2023, down 18.2%. Despite

signs of a recovery during the second half, business activity in

the Middle East (Pakistan, Egypt, Iraq, Saudi Arabia, UAE),

accounting for 17% of the division’s revenue in 2023, remained weak

over the period (versus growth of 25% the previous year). In an

already difficult context marked by the unavailability of

currencies for export in the first half of the year, difficulties

in the Red Sea in the fourth quarter once again caused a slowdown

in sales momentum in the countries in that region with the deferral

of certain orders to 2024 due to an extension of their delivery

times.

The “Other activities”, which

include consulting and training services, marketed under the

Agritech brand, and the operating activities of the Bel-Orient

pilot farm, saw sales growth of 25%.

Increase in gross margin but operating

expenses weighed on profitability

The rapid downward trend in prices forced the

Group to act quickly and take immediate measures to protect its

margins, by optimising inventories and focusing on references that

make the biggest contribution. Over the full year, the Group

succeeded in recovering its margin, which reached 32.8% of revenue

compared with 31.9% in 2022.

However, revenue growth was not enough to offset

the rise in expenses. The rise in wages, with the integration of

the Kabelis Group companies over 12 months compared with five

months in 2022, and the necessary increases given the inflationary

environment weighed on profitability. The rise in operating

expenses linked in particular to the opening of three new Kabelis

depot centres in France and the costs linked to the commercial

launch of “Au Pré” also had an impact on EBITDA. Against this

backdrop, at 31 December 2023, EBITDA stood at €2.3m compared with

€4.5m at end-December 2022, representing 1.7% of full-year revenue

compared with 3.5% in 2022.

The sharp increase in depreciation, amortisation

and provisions of €1.5m related to the extension of the Alphatech

production unit and the implementation of the new ERP system also

impacted operating income, leading to an operating loss of €2.5m

compared with operating income of €1.1m at the end of 2022.

There was a Group net loss of €3.0m versus a

Group net profit of €0.6m in 2022.

A well-managed balance sheet

structure

At 31 December 2023, the Group had shareholders’

equity of €20.1m (versus €23.1m at the end of 2022) and a cash

position of €7.5m (versus €9.1m at the end of 2022). The latter

benefited from new financing arrangements with banking partners to

the tune of €10.2 million, resulting in financial debt of €39.9m at

end-2023 compared with €32.2m at end-2022.

The measures to revitalise business and ensure

stricter financial management should enable the Group to start

deleveraging and rebuild its cash position as from the 2024

financial year.

Outlook for 2024: revitalisation of

activity and strict financial discipline

In order to return to more profitable growth in

2024 and beyond, the Group has put in place several measures to

revitalise business, optimise its organisational structure and

limit the weight of operating expenses.

Commercially:

-

The Group intends to continue rationalising its product

offering and to favour references that represent the

biggest contribution. With this in mind, it will prioritise the

development of its own-brand references while supporting the

efforts already made on the BTN de Haas and Kabelis

catalogues;

-

Strengthening of campaigns involving targeted outgoing

calls in connection with the Group's historical expertise

will be a priority for developing sales of the Farming Supplies

activity;

-

In 2024, the Group will also be able to count on an

increase in revenue from the Farming Supplies business

following the launch at the end of February 2024 of version 2 of

the Vital Concept website. An in-depth review of the

general ergonomics of the site and optimised browsing speed have

helped to enhance the quality of the user experience. On foot of

these efforts, the Group has seen an increase in online sales of

nearly 20% a week since this launch;

-

Finally, after the successful launch of “Au Pré”,

its dairy recovery concept for a network of independent farmers,

the Group has entered into contracts with hospital groups, a

logistics platform, a high school and a group of nursing homes. A

total of seven contracts with group canteens have already been

concluded in the space of a few months.

In addition to measures to simplify its

organisation, the Group should also benefit from continued

synergies with Kabelis. The pooling of the new ERP system and the

grouping of activities at the central warehouse in Loudéac should,

for example, lead to a reduction in transport costs of around

€400k.

Finally, cost control measures

should enable the Group to increase its EBITDA. Alphatech, the

Farming Production activity, which until now has had a negative

export impact, should gradually improve. The efforts initiated in

2022 and 2023 in the Middle East and the strategic refocus on Asia

and Europe should materialise from the first half of the year with

a significant improvement in margins.

For the Group as a whole, operating expenses

will remain under strict control with, in particular, a freeze on

remuneration and hiring during the year.

Combined with strict financial discipline, these

measures should help to bring about a gradual improvement

in activity and profitability in 2024 despite expectations of a

difficult first quarter from a commercial perspective.

To achieve this, Winfarm will rely on its key

fundamentals which drive performance and enable it to stand out in

a sector that has been experiencing difficulties in recent

months:

- Competitive and

transparent pricing for customers,

- A vast catalogue

that is continuously updated thanks to innovation,

- A solid business

model combining an established historical activity and growth

drivers,

- Demonstrated

integration ability,

- An established

positioning giving the Group a unique place in the ecosystem.

Next release:Q1 2024 revenue, 6

May 2024 after market close

A propos de WINFARM

Fondé à Loudéac, au cœur de la Bretagne, au

début des années 90, le groupe WINFARM est aujourd’hui le premier

acteur français proposant aux marchés de l’agriculture, de

l’élevage, du cheval et du paysage, un ensemble de prestations de

conseil, de service, et de vente à distance de produits et de

solutions globales, uniques et intégrées, pour les aider à répondre

aux nouveaux défis technologiques, économiques, environnementaux et

sociaux de l’agriculture nouvelle génération.

Fort d’un un large catalogue de plus de 35 000

références (semences, produits d’hygiène et de récolte, …),

dont deux-tiers sont composés de marques propres, WINFARM compte

plus de 45 000 clients en Belgique et aux Pays-Bas.

Pour plus d’information sur la société :

www.winfarm-group.com

Contacts :

|

WINFARMinvestisseurs@winfarm-group.com |

|

|

SEITOSEI.ACTIFIN |

|

|

Communication financièreBenjamin LEHARI+33 (0) 1

56 88 11 25benjamin.lehari@seitosei-actifin.com |

Relations presse financièreJennifer JULLIA+33 (0)1

56 88 11 19jennifer.jullia@seitosei-actifin.com |

- WINFARM_CP_RA_2023_vdef_EN

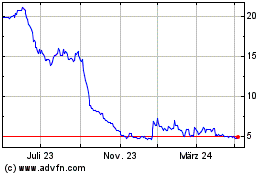

Winfarm (EU:ALWF)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

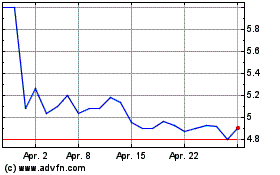

Winfarm (EU:ALWF)

Historical Stock Chart

Von Jan 2024 bis Jan 2025