Haffner Energy publishes annual results for fiscal year 2023-2024

Haffner Energy publishes annual results

for fiscal year 2023-2024

A year of transition towards

expanding addressable market and project

portfolio

Vitry-le-François, June 20, 2024, 6:00

pm (CEST), France

- A

pipeline* multiplied by more than 4 (€1.4B) year-over-year, boosted

by market opportunities for the production of syngas and

Sustainable Aviation Fuel (SAF), including in the United

States

- An order

book at 03/31/2024 that reflects delays in the hydrogen market and

a blank year in terms of sales

- EBITDA**

contained at -€13,041k versus

-€12,480k last year

- Net

income for the year of -€9,935k

versus -€16,461k at

03/31/2023

- Net

available cash of €11,042k

at 03/31/2024, with fundraising

expected in Q3 2024 to finance the company's accelerated

development

-

Amplified potential and adjusted figures: Sales for the

current fiscal year reflecting the first expected contracts;

positive EBITDA by 03/31/2026; a sales target of €165M by

03/31/2027, ahead of a sharp acceleration driven by SAF projects

with a sales target of €330M at 03/31/2028

- The

targets for 03/31/2027 and 03/31/2028 represent installed capacity

that translates to approximately 1.2M and 2.9M tonnes respectively

of CO2 avoided per

year

HAFFNER ENERGY (ISIN code: FR0014007ND6

- Mnemonic: ALHAF) published its annual financial results

to 03/31/2024, approved by the Board of Directors on 06/19/2024.

This is an opportunity also for the Company to provide an update on

its business development and outlook.

Philippe HAFFNER, Co-founder and Chairman and

CEO of HAFFNER ENERGY said:

"For Haffner Energy, 2023-2024 will remain a

year of expanding our addressable markets. Faced with delays in the

onset of the renewable hydrogen market, we are prioritizing market

segments where we find the highest demand (SAF and syngas), for

which our offering is differentiating and value-creating both for

our customers and ourselves. To this end, we have adapted our

technology, notably with the commissioning of our Marolles

industrial site.

“This past financial year was both insignificant

in terms of financial results, yet highly value-creating in terms

of project portfolios in mature markets hungry for competitive

decarbonization solutions. Our addressable market and sales

prospects are now much higher than they have ever been. In fact,

compared with the hydrogen market alone, Haffner Energy's overall

target market has increased by a factor of more than 4.

Furthermore, these complementary markets offer the advantage of

making biomass an essential component in the composition of

biofuels (syngas, SAF, methanol) and e-fuels. Furthermore, we are

progressing our business model from technology supplier to project

developer. The Paris-Vatry SAF project is a case in point. It is

equivalent to the decarbonization of 3.6 billion passenger-km per

year by Airbus A320neo planes.

These new opportunities translate into

exponential growth in our pipeline, far beyond anything we've seen

to date; a potential which isn’t reflected yet in the Company's

market capitalization.

On the strength of these new commercial

prospects, new high-quality strategic partnerships, and a more

ambitious business plan, we are well positioned to launch a new

round of financing to support projects that will create significant

value. Based on our 30-year experience, our ability to provide

immediate decarbonization solutions at scale through producing

competitive biofuels, makes us confident that we can become a

global leader in the energy transition. Our 10-year target is to

help avoid over 90 million tonnes of CO2."

I. BUSINESS

ACTIVITY: ORDER BOOK, NEW OFFERS, PIPELINE, AND GROWTH

MARKETS

2023-2024, a year of expansion into new

markets in the context of the renewable hydrogen market’s slow

onset

The 2023-2024 financial year has been devoted to

expanding Haffner Energy's technical and commercial offering to

diversify and increase its addressable market. This, in the

context of the slow onset of the renewable hydrogen ecosystem,

particularly in Europe, with insufficient outlets and a

lack of "offtake-or-pay" contracts making the financing of most

projects difficult.

This situation, which has led to a delay

in the signing of new contracts, has also weighed on the

execution of the order book we had built. The 2023-2024 financial

year thus saw the termination or cancellation of our first

contracts relating to renewable hydrogen production, such

as the R-Hynoca contract, the termination of which was recorded on

12/13/2023 (see 12/14/2023 press release).

As regards the future of the three (3)

contracts signed with Carbonloop (one contract for the

supply of renewable gas production equipment with a capacity of 500

kW and two contracts for the supply of renewable hydrogen), it is

now acknowledged that they will not be executed. The contracts had

been suspended on 09/30/2023 (see 12/14/2023 press release) and the

risk of cancellation from the order book had been announced.

The recent receivership of Carbonloop

SAS, the engineering company behind the projects, corroborates the

fact that these contracts will not be pursued. This

situation justifies the Company's decision, on 03/31/2024, to

cancel the projects (€14.9M) from the order book, which stood at

€1,230k at that date (invoices only, never recognized as deferred

revenue).

Haffner Energy and Carbonloop have a dispute

concerning the execution of these contracts and a summary procedure

before the Paris Commercial Court is underway. Haffner Energy is

confident of a successful outcome.

A change in pipeline size: €1.4B for

projects in Europe and overseas

Since its SAFNOCA® and SYNOCA® offerings

launched last year in July and October respectively to address

aviation and industry decarbonization, Haffner Energy has recorded

an acceleration of its pipeline, from €300M at

03/31/2023 to €1.4B at 03/31/2024.

In terms of opportunities by sector,

industry became Haffner Energy's top short-term market

during the 2023-2024 financial year, validating the

commercial targeting announced in the second half of 2023.

Geographically, we note the rise of

North America, with several projects currently being

explored in the United States, especially regarding SAF.

Haffner Energy has thus succeeded in establishing itself

and gaining traction in the U.S., where its ambition

recently shifted into higher gear with the creation of the US

subsidiary Haffner Energy, Inc. (see 05/29/2024 press release).

II. KEY FIGURES AT 03/31/2024 (IFRS):

REVENUE, EBITDA, OPERATING PROFIT & NET INCOME, BALANCE SHEET

INCLUDING CASH, FUNDRAISING PROJECT

For Haffner Energy, 2023-2024 is not a

significant year in financial terms.

Revenue close to zero, reflecting the

refocusing undertaken during the year and lower losses

year-over-year

| In

thousands of euros |

03.31.24 (12 months) |

03.31.23(12 months) |

|

Net salesOther income |

-15769 |

30326 |

|

EBITDA |

-13,041 |

-12,480 |

|

Operating result |

-10,263 |

-16,484 |

| Net

income |

-9,935 |

-16,461 |

|

Shareholders’ equity |

26,768 |

36,887 |

|

Cash available |

11,042 |

35,476 |

Operating result, negative at

-€10,263k, at 03/31/2024, is a significant

improvement this year compared to the previous year at

-€16,484k.

EBITDA was

-€13,041k at 03/31/2024

compared to -€12,480k at

03/31/2023.

Total net income amounts to

-€9,935k, compared to a net loss of -€16,461k at

03/31/2023.

At 03/31/2024, the Company's net cash position

stood at €11,042k.

A fundraising round to create value

through the potential of Haffner Energy's technology

As was initially mentioned at the half-year

results presentation, Haffner Energy has taken steps to

seek additional financing to support the funding of its growth and

to expand its business model. From being a supplier of

technology for renewable hydrogen production, the Company is now

positioning itself both as a supplier of biofuel production

technology and as a producer of biofuels, as well as a project

developer. A mandate has been given to Avolta, a

European specialist in M&A and fundraising for innovative

companies, to seek investors (debt and/or equity) to support the

Company's development and its projects. The creation of combined

value for the Company and its shareholders is a key objective of

the planned transaction.

III. PROJECTS AND PROSPECTS: FIRST

FACTORY, MAROLLES TESTING AND TRAINING CENTRE, FIRST "PARIS-VATRY"

SAF PROJECT

Significant advances for Haffner

Energy's industrial system and showcase of know-how

The 2023-2024 fiscal year allowed Haffner Energy

to advance its FactorHy project at Première Usine.

Based in Saint-Dizier, France, this large-capacity plant will

assemble renewable gas and hydrogen production modules. The

objectives prevailing in the construction of this plant are:

- the control of

quality, costs and time for assembly

- potential for

factory testing of strategic equipment

- the protection

of intellectual property

Selected as part of France 2030

call-for-proposals program operated by Bpifrance and

supported by local elected officials and institutional partners,

the project has benefited throughout this fiscal year from the

granting of major subsidies, including €5.9M from

the State through France 2030 (including an advance of €1.47M

received during the financial year, 60% of which are subsidies and

40% are repayable advances).

In addition to these €5.9M, other public funding

of €5.7M and an additional agreement in principle of €1.3M have

been secured. The realization of this project will require limited

additional financing, mainly through bank loans.

In addition, at the end of 2023, Haffner Energy

launched the creation of a testing and training center in

the Vitry-Marolles business park (Marne) near its

headquarters. This center, which is designed to operate for 8,000

continuous hour per year, will perform tests on different types of

biomass supplied by its customers— among other things. After

several months of site preparation and equipment installation, the

plant, equipped with new-generation standardized industrial

production equipment, went into syngas production on

06/18/2024. Having received the green light from the

authorities, Haffner Energy will add renewable

hydrogen production (nominal capacity of 15

kg/hour) before the end of 2024. All in all, the plant

will display the full range of possibilities offered by Haffner

Energy's technology: from the production of renewable gas to the

production of renewable hydrogen or even the co-production of

electricity, from the production of biochar to its

gasification...

SAF: a first project undertaken with

LanzaJet (Paris-Vatry SAF) and a confirmed potential

As announced a year ago, Haffner Energy has

adapted its disruptive technology to address the Sustainable

Aviation Fuel (SAF) market. The past year has confirmed the

significance of the actual development potential for the Company,

as it was approached by some of the biggest players in the

sector.

Haffner Energy just launched its first

project for a Sustainable Aviation Fuel (SAF) production plant at

Paris-Vatry airport (Marne, Grand-Est Region, France),

developed in collaboration with several public and private

partners, first and foremost US company

LanzaJet (see 06/06/2024 press release). This

global leader in Alcohol-To-Jet (ATJ) technology is one of the most

advanced players in the industry with more than 90 SAF projects in

its portfolio. It was recently named on the prestigious

"TIME 100 Most Influential Companies" list for

2024. This project will be submitted by 28/06 to France 2030 CARB

AERO, a €200M call-for-proposals program operated by the French

Environment and Energy Management Agency ADEME. Being selected for

a grant award would ensure the financing of part of the project's

development (pre-project engineering studies).

The financial statements, which are

currently being audited, were approved by the Board of Directors at

its 06/19/2024 meeting.

Upcoming events

Annual General

Meeting September

12, 2024

2024-2025 Half-Year

Results December 17,

2024

More detailed information on the financial

statements as at 03/31/2024 can be found on

www.haffner-energy.com.

About Haffner Energy

The company is specialized in clean fuels

production. Developed over 30 years of experience, its expertise

lies in the decarbonization of mobility and industry through the

production of competitive renewable biofuels. Its innovative and

patented biomass thermolysis technology makes it possible to

produce Sustainable Aviation Fuel (SAF), as well as renewable gas,

hydrogen, and methanol. The company also contributes to the

regeneration of the planet through the co-production of biogenic

CO2 and biochar. Haffner Energy is listed on Euronext Growth (ISIN

code: FR0014007ND6 – Ticker: ALHAF).

Investor contact

investisseurs@haffner-energy.com

Press

contact

HAFFNER ENERGY

Laure BOURDONChief of Staff to the Chairman and

Chief Executive OfficerDirector of

Communicationslaure.bourdon@haffner-energy.com+33 (0) 7 87 96 35

15

Lexicon:

* Pipeline refers to a business

opportunity when at least one of the following occurs:

- a preliminary feasibility study for

the installation of equipment is or has been carried out; or

- a budget offer or a preliminary

business plan for the project or a complete commercial offer

including specifications has been sent to the customer and Haffner

Energy is awaiting its response; or

- a letter of intent is sent to

Haffner Energy by the customer; or

- Haffner Energy has received an

invitation to participate and is part of a bidding process.

** EBITDA corresponds to

operating income before depreciation and amortization, net

impairment of fixed and current assets, and before operating

provisions net of reversals.

- PR_Annual Results 2024_Haffner Energy

- PR_Annual Results 2024_Haffner Energy

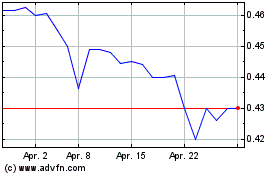

Haffner Energy (EU:ALHAF)

Historical Stock Chart

Von Mai 2024 bis Jun 2024

Haffner Energy (EU:ALHAF)

Historical Stock Chart

Von Jun 2023 bis Jun 2024