Result of capital increase with preferential subscription rights in

a gross amount of €5.6 million

This document may not be distributed, directly or

indirectly, in the United States of America, Canada, Australia or

Japan.

Result of capital increase

with preferential subscription rights in a

gross amount of €5.6

million

Evry, 29 March

2023: Global Bioenergies

(the “Company”) announces the result of its capital

increase with preferential subscription rights (“PSRs”), for which

the subscription period ran from 10 to 24 March 2023 (the

“Offering”), with €5.6 million in

funds raised.

Samuel Dubruque, Chief Financial Officer of the

Company, said: “We would like to thank all of our shareholders who

participated in this operation, enabling Global Bioenergies to roll

out its roadmap. This transaction giving priority to our

shareholders was carried out in a particularly turbulent stock

market environment.”

Marc Delcourt, Chief Executive Officer and

co-founder of the Company, said: " We will use these funds to :

- strengthen our current production

chain and generate strong short-term revenue growth

- complete the financing of the

2,000-ton plant carried out by our subsidiary ViaViridia by the

summer,

- and prepare the subsequent

exploitation of the process, on a larger scale, in the sustainable

aviation fuel market.

ASTM certification of our process is expected in

the coming weeks.”

Result of Offering

At the end of the subscription period, overall

demand (on an irreducible, reducible and unrestricted basis)

reached 2,574,934 new shares (the “New Shares”)

subscribed at a unit price of €2.07, 11.7% below the closing price

on 28 March 20231, representing 71.3% of the initial gross amount

of the Offering, broken down as follows:

- 2,080,266 New Shares on an

irreducible basis representing 81% of total New Shares;

- 283,585 New Shares on a reducible

basis representing 11% of total New Shares;

- 211,083 New Shares on an

unrestricted basis representing 8% of total New Shares.

The entire subscription demand on an

irreducible, reducible and unrestricted basis was satisfied.

In accordance with their subscription

commitments, Marc Delcourt, Chief Executive Officer and co-founder

of the Company, and the L’Oréal Group, through its BOLD (Business

Opportunities for L’Oréal Development) private equity fund,

participated in the Offering on an irreducible basis in the amount

of €160 thousand and €980 thousand respectively.

During the subscription period, the Cristal

Union Group also subscribed in proportion to its share of the

Company’s capital (1.3%), in the amount of €100 thousand.

Given that the total amount of subscriptions, on

an irreducible, reducible and unrestricted basis, represented

slightly less than 75% of the initial gross amount of the Offering

(€5.3 million), this engaged to a limited extent (€0.3 million) the

underwriting commitments made by 12 qualified investors (the

“Underwriters”), who undertook to subscribe for

New Shares not subscribed by the end of the subscription period up

to a maximum amount of €4,482,500 representing up to 75% of the

initial gross amount of the Offering. Accordingly, 132,518 New

Shares were issued and allocated among the Underwriters in

proportion to their underwriting commitments as follows:

|

|

New Shares allocated |

|

Alpha Blue Ocean |

114,175 |

|

Dynasty AM |

8,869 |

|

Sully Patrimoine |

5,912 |

|

Diede Van Den Ouden |

3,562 |

|

Total |

132,518 |

Reminder on use of Offering

proceeds

The gross amount of the Offering, including the

share premium, is €5,604,426, i.e. €5.1m net of transaction costs

(including €269 thousand for the Underwriters), and is intended to

provide the Company with the means to finance:

- working capital requirements for

the Horizon 2 production line (approximately 50% of the

Offering proceeds);

- further preliminary design studies

for the Horizon 3 plant, known as ViaViridia (approximately

40%);

- additional R&D to further

reduce process costs with a view to exploitation at Horizon 4

for the production of sustainable aviation and road fuels

(approximately 10%).

After the completion of the Offering, the

Company’s cash position stands close to €11 million. Given its aim

to progressively reduce the gap between cash in and cash out, the

Company has a financial visibility beyond 12 months.

Settlement-delivery

Settlement-delivery and admission of the New

Shares to trading on Euronext Growth Paris is scheduled for 31

March 2023 according to the provisional timetable. The New Shares

will carry full dividend rights, will be immediately fungible with

existing Company shares and will be traded on the same line as

those shares under the same ISIN code (FR0011052257 – Symbol:

ALGBE).

After settlement-delivery, the Company’s share

capital will stand at €887,443.05, comprising 17,748,681 shares

with a par value of €0.05 each.

Impact of Offering on shareholding

structure

The following table shows the breakdown of share

capital and voting rights before and after completion of the

Offering on an undiluted basis:

|

|

Before completion of the Offering |

After completion of the Offering |

|

|

Number of shares and theoretical voting

rights |

Percentage of capital and theoretical voting

rights |

Number of shares and theoretical voting

rights |

Percentage of capital and theoretical voting

rights |

|

BOLD Business Opportunities for L’Oréal Development |

1,972,206 |

13.11% |

2,445,532 |

13.78% |

|

Marc Delcourt |

389,748 |

2.59% |

467,046 |

2.63% |

|

Cristal Union |

201,180 |

1.3% |

249,456 |

1.41% |

|

Treasury shares |

8,729 |

0.06% |

2,217 |

0.01% |

|

Free float |

12,469,546 |

82.94% |

14,584,610 |

82.17% |

|

TOTAL |

15,041,409 |

100% |

17,748,861 |

100% |

Impact of Offering on existing

shareholdings

The impact of the issuance of the New Shares on

the shareholding of a shareholder holding 1% of the Company’s share

capital prior to the Offering and not subscribing for the Offering

is as follows:

|

|

Shareholding (%) |

|

|

Undiluted basis |

Diluted basis2 |

|

Before issuance of the New Shares via the Offering3 |

1% |

0.83% |

|

After issuance of 2,707,452 New Shares via the Offering |

0.85% |

0.72% |

Retention and lock-up

undertakings

The Offering provided for no retention or

lock-up undertakings.

Prospectus

Pursuant to the provisions of Article L. 411-2-1

1° of the French Monetary and Financial Code and Article 211-2 of

the General Regulation of the Autorité des Marchés Financiers

(“AMF”), the Offering does not require the

submission of a prospectus to the AMF for approval, given that the

total amount of the offer calculated over a twelve-month period

does not exceed €8 million.

Risk factors

The Company notes that the risk factors relating

to the Company and its business are set out in its 2022 half-year

financial report and 2021 annual financial report, which are

available free of charge on the Company’s website

(https://www.global-bioenergies.com/rapport-semestriel-2022/ and

https://www.global-bioenergies.com/rapport-financier-annuel-2021/?lang=en).

The materialisation of some or all of these

risks could have an adverse impact on the Company’s business,

financial position, results, development or outlook. The risk

factors set out in the aforementioned documents are unchanged at

the date of this press release.

Financial intermediary

TP ICAP Midcap acted as Global Coordinator.

Share

details

Name: Global BioenergiesISIN code:

FR0011052257Symbol: ALGBEListing market: Euronext Growth ParisLEI:

969500H46XRAMTMVB676

About GLOBAL BIOENERGIES

Global Bioenergies converts plant-derived

resources into compounds used in the cosmetics industry, as well as

the energy and materials sectors. After launching the first

long-lasting and natural make-up brand LAST® in 2021, Global

Bioenergies is now marketing Isonaturane® 12, its key ingredient,

to major cosmetics companies to improve the naturalness of their

formulas whilst improving their carbon footprint. In the long run,

Global Bioenergies is also aiming at cutting CO2 emissions in the

aviation and road sector and thereby curb global warming. Global

Bioenergies is listed on Euronext Growth Paris (FR0011052257 -

ALGBE).

Receive information about Global

Bioenergies directly by subscribing to our

news feed on

www.global-bioenergies.com

Follow us on LinkedIn:

Global Bioenergies

Contacts

|

GLOBAL BIOENERGIES

augmentationdecapital@global-bioenergies.com 07 70 26 36 45

|

PRESS RELATIONS Iva

Baytchevaibaytcheva@ulysse-communication.com Nicolas

Danielsndaniels@ulysse-communication.com |

Disclaimer

This press release does not constitute an offer

of sale or solicitation of a purchase offer, nor will there be any

sale of ordinary shares in any State or jurisdiction where such an

offer, solicitation or sale would be unlawful in the absence of

registration or approval under the securities laws of said State or

jurisdiction.

The distribution of this press release may be

subject to specific regulations in some countries. Persons in

possession of this document are required to ascertain and comply

with any local restrictions.

This press release constitutes a promotional

communication and not a prospectus within the meaning of Regulation

(EU) 2017/1129 of the European Parliament and of the Council of 14

June 2017 (as amended, the “Prospectus

Regulation”).

Pursuant to the provisions of Article L. 411-2-1

1° of the French Monetary and Financial Code and Article 211-2 of

the AMF General Regulation, the Offering does not require the

submission of a prospectus to the AMF for approval, given that the

total amount of the offer calculated over a twelve-month period

does not exceed €8,000,000.

In the case of the Member States of the European

Economic Area (other than France) and the United Kingdom (the

“States Concerned”), no action has been or will be

taken to permit a public offering of securities requiring the

publication of a prospectus in any of the States Concerned.

Accordingly, the securities may be and will be offered solely to

(i) qualified investors within the meaning of the Prospectus

Regulation, in the case of any investor in a State Concerned, or

within the meaning of Regulation (EU) 2017/1129 as incorporated

into domestic law under the European Union (Withdrawal) Act 2018

(the “UK Prospectus Regulation”), in the case of

any investor in the United Kingdom, (ii) fewer than 150 natural or

legal persons (other than qualified investors as defined in the

Prospectus Regulation or UK Prospectus Regulation, as the case may

be), or (iii) in accordance with the exemptions provided for in

Article 1(4) of the Prospectus Regulation, or in other cases that

do not require Global Bioenergies to publish a prospectus under the

Prospectus Regulation, the UK Prospectus Regulation and/or the

regulations applicable in these States Concerned.

This press release is not disseminated and has

not been approved by an authorised person within the meaning of

Section 21(1) of the Financial Services and Markets Act 2000.

Accordingly, this press release is solely addressed to and intended

for persons located outside the United Kingdom, (i) investment

professionals within the meaning of Article 19(5) of the Financial

Services and Markets Act 2000 (Financial Promotion) Order 2005 (as

amended, the “Order”) (ii) persons referred to in

Article 49(2) (a) to (d) (high net worth companies, unincorporated

associations, etc.) of the Order or (iii) any other persons to whom

an invitation or inducement to engage in investment activities

(within the meaning of Section 21 of the Financial Services and

Markets Act 2000) in connection with the issuance or sale of any

security may be lawfully disclosed or communicated (all such

persons being referred to as “Authorised

Persons”). Any invitation, offer or agreement relating to

the subscription, purchase or acquisition of the securities covered

by this press release may only be addressed to or entered into with

Authorised Persons. All persons other than Authorised Persons shall

refrain from using or relying on this press release and the

information it contains.

This press release may not be published,

distributed or disseminated in the United States (including its

territories and possessions). This press release does not

constitute an offer or solicitation to purchase, sell or subscribe

for securities in the United States. The financial securities

mentioned in this press release have not been registered under the

U.S. Securities Act of 1933, as amended (the “Securities

Act”) or any securities regulation applicable in any state

or other jurisdiction in the United States and may not be offered

or sold in the United States without registration under the

Securities Act, except under an exemption scheme or in connection

with a transaction not subject to registration under the Securities

Act. Global Bioenergies does not intend to register the offer in

whole or in part in the United States under and in accordance with

the Securities Act or to make a public offering in the United

States.

This press release may not be distributed,

directly or indirectly, in the United States, Canada, Australia,

South Africa or Japan.

This press release contains information on the

objectives of the Company as well as forward-looking statements.

This information is not historical data and should not be

interpreted as a guarantee that the stated facts and data will

materialise. This information is based on data, assumptions and

estimates considered reasonable by the Company. The Company cannot

anticipate all the risks, uncertainties or other factors that may

affect its business, their potential impact on its business or the

extent to which the materialisation of any risk or combination of

risks may cause results to differ significantly from those

mentioned in any forward-looking statement. This information is

given only as at the date of this press release. The Company makes

no commitment to issue updates of this information or the

assumptions on which it is based, except as may be required by any

legal or regulatory obligation.

Lastly, this press release may be drawn up in

French and in English. In the event of a conflict between the two

versions, the French version shall prevail.

1 At the time of finalizing this press release, the closing

price of 29 March 2023 was not yet known.

2 Including the 2,394,616 ordinary warrants,

719,499 founders’ warrants and 65,562 bonus shares awarded by the

Company at the date of this press release3 Calculations based on

the number of shares comprising the share capital at the date of

this press release, i.e. 15,041,409 shares

- Global Bioenergies - Result of capital increase with

preferential subscription rights in a gross amount of €5.6

million

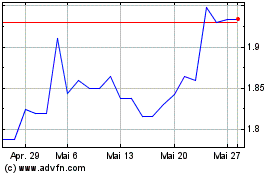

Global Bioenergies (EU:ALGBE)

Historical Stock Chart

Von Feb 2025 bis Mär 2025

Global Bioenergies (EU:ALGBE)

Historical Stock Chart

Von Mär 2024 bis Mär 2025