Advicenne Reports Its First Half Financial Results as of June 30, 2022

21 September 2022 - 7:00AM

Business Wire

- Sibnayal® revenue up 15% at EUR 0.64 million

- First commercial launch of Sibnayal® in Europe with more than

75 hospitals ordering

- Operating losses lowered by 42% to EUR 4.40 million

- Cash and cash equivalent at EUR 7.29 million

- Financial runway extended to Q3 2023

Regulatory News:

Advicenne (Euronext Growth Paris ALDVI - FR0013296746), a

specialty pharmaceutical company dedicated to developing and

commercializing innovative treatments for those suffering from rare

renal diseases, today reports its semi-annual financial results as

of June 30, 2022, as approved on September 20, 2022 by the Board of

Directors. The semi-annual financial report is available on the

Company’s website: www.advicenne.com.

Didier Laurens, Chief Executive Officer of Advicenne,

highlighted: “If during the first half of 2022 we completed the

operational rationalization of Advicenne through the consolidation

of all our activities in one single premise in Paris with immediate

impact on our cash consumption, the period was mostly remarkable

for Sibnayal’s progress. We are particularly satisfied with the 15%

increase in sales reported and achieved prior to any commercial

effort, which marks Sibnayal®’s added value to prescribers and

patients. With more than 75 hospitals already ordering Sibnayal® in

Europe, we expect sales to significantly accelerate in the second

half with the geographic expansion of sales for which we work

closely with our partners. Our ambition is to make Sibnayal®

available to the largest number of patients and obtain the best

conditions for registration, prices and reimbursement. The second

half should mark a further acceleration of our flagship product

given its entry into new territories. In terms of funding, we

estimate our financial visibility through the third quarter of

2023, based on our cash and outlook.”

Key Financial data

The key financial data for the first half of 2022 are presented

in the table below. They come from the financial statements drawn

up in accordance with IFRS and approved by the Board of Directors.

The audit work has been carried out by the Statutory Auditors who,

after limited review, have not identified any accounting anomalies

or presentation. All financial statements and notes are available

in the First Half Financial Report.

En K€

30/06/2022

30/06/2021

Revenues

1,934

1,746

Operating expenses

6,330

9,293

R&D costs

3,090

4,713

Sales & Marketing costs

635

1,631

G&A costs

1,989

2,409

Operating Result

-4,396

-7,547

Net income

-4,813

-7,990

Earnings per share (€/share)

-0.48

-0.93

Opening cash & cash

equivalent

16,771

16,629

Operating cashflow

-5,128

-8,527

Investing cashflow

-218

-459

Financing cashflow

-51

8,948

Closing cash & cash

equivalent

7,288

16,733

- Revenues amounted to €1.93 million, up 10.7% as compared

with H1 2021. Sales of Likozam® and Levidcen®, licensed by third

parties, and Sibnayal®, reached €1.55 million (+14%). Sibnayal®

sales increased by 15% to €0.64 million over the period.

- Operating losses in the first six months of 2022

amounted -€4.4 million (vs. -€7.5 million in H1 2021). R&D

expenses are mainly allocated to the on-going development of

ADV7103 in the United States. The 34% decrease of R&D expenses

is mainly explained by the end of clinical development of ADV7103

in Europe in connection with obtaining MA. In total, R&D costs

amount to €3 million. G&A expenses are also down sharply and

reflect the effects of the reorganization of activities, on a

single Parisian site, now finalized, and the tight control of

expenses.

- Financial result is a loss of €0.4 million at 30 June

2022, resulting of an €0.7 million interest charges mainly related

to the first €7.5 million tranche of the EIB loan. These charges

are partly offset by an overall net currency gain of €0.3 million,

resulting from the activity and financing of the US

subsidiary.

- Net Loss was significantly reduced at €4.81 million as

of June 30, 2022, compared to a net loss of €7.99 million over the

first six months of 2021.

- Net cash flows from operations in H1 2022 and H1 2021

amounted to €-5.13 million and € -8.53 million respectively. The

change in 2022 mainly relates to the increase in the contribution

of revenue, the decrease in clinical research expenditures in

Europe and the United Kingdom, and overall control of general

expenses.

- Net cash flows from investments amounted to €0.22

million in the first half of 2022 (vs. €0.46 million in H1 2021),

reflecting the investments in the company’s production tool as well

as the result of regrouping on a single site in Paris

- As of June 30, 2022, Cash and Cash equivalent stood at

€7.29 million. As of the date of the current press release,

financial visibility runs through the third quarter of 2023 (see

Chapter 5.2 of the 2022 Half-Year Financial Report)

H1 2022 Operating

Highlights

About Sibnayal™/ ADV 7103, Advicenne’s

lead product

- Continued growth in sales, up 15%, to €0.64 million. Sibnayal®

is now prescribed in 9 European countries and more than 75

hospitals

- Commercial launch of Sibnayal® in Great Britain and

Scotland

- The manufacturing of Sibnayal® is ramping up and supports its

commercial development. The production of a new packaging tool is

underway and should lead to a significant improvement of

manufacturing costs from 2023 onward.

- In the United States, the company is continuing its clinical

work in ATRd. Regulatory procedures have been clarified as well as

some technical constraints in the conduct of the test.

About Company’s activity and

governance

- The company has entered into numerous partnership agreements,

including the most recent one to make Sibnayal® available in the

Middle East with Taiba Healthcare. In parallel Advicenne continues

its discussions with partners to cover other European countries as

well as other geographical areas.

- Implementation of the partnerships is progressing in line with

the business plan. Pricing & Reimbursement dossiers were

submitted in several countries covered by FrostPharma AB partners

for the Nordic countries and TwinPharma for the Benelux countries.

In Central and Eastern Europe, ExCEEd Orphan has filed several

requests for early access program to Sibnayal®.

- Advicenne’s governance has changed with the appointment of Mr.

Philippe Boucheron as Chairman of the Board of Directors. The Board

of Directors also welcomed a new Director, Mr. Didier Laurens, CEO

of the company. André Ulmann was elected as Observer.

- The company’s listing has been transferred to Euronext Growth;

in parallel, the listing on Euronext Brussels was cancelled. The

Company also relocated its headquarters. These changes are part of

the management’s global plan of leanness and effectiveness.

About Advicenne Advicenne (Euronext: ALDVI) is a

specialty pharmaceutical company founded in 2007, specializing in

the development of innovative treatments in Nephrology. Its lead

product Sibnayal® (ADV 7103) has received its Marketing Approval

for distal renal tubular acidosis in EU and the UK. ADV 7103 is

currently in late-stage development in cystinuria in Europe and in

dRTA and cystinuria in the US and in Canada. Headquartered in

Paris, Advicenne, listed on the Euronext Paris stock exchange since

2017, has now been listed on Euronext Growth Paris since its

transfer on March 30, 2022. For additional information see:

https://advicenne.com/.

Disclaimer This press release contains certain

forward-looking statements concerning Advicenne group and its

business, including its prospects and product candidate

development. Such forward-looking statements are based on

assumptions that Advicenne considers to be reasonable. However,

there can be no assurance that the estimates contained in such

forward-looking statements will be verified, which estimates are

subject to numerous risks including the risks set forth in the 2021

Universal Registration Document filed with the French financial

market authority on April 29, 2022 (a copy of which is available on

www.advicenne.com) and to the development of economic conditions,

financial markets, and the markets in which Advicenne operates. The

forward-looking statements contained in this press release are also

subject to risks not yet known to Advicenne or not currently

considered material by Advicenne. The occurrence of all or part of

such risks could cause actual results, financial conditions,

performance, or achievements of Advicenne to be materially

different from such forward-looking statements. Advicenne expressly

declines any obligation to update such forward-looking

statements.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220920006256/en/

Advicenne Didier Laurens, CEO +33 (0)1 87 44 40 17

investors@advicenne.com

Ulysse Communication Media relations Bruno Arabian +33

(0)6 87 88 47 26 barabian@ulysse-communication.com

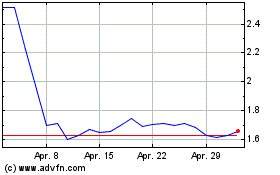

Advicenne (EU:ALDVI)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Advicenne (EU:ALDVI)

Historical Stock Chart

Von Dez 2023 bis Dez 2024