Worldcoin Rejection At $2.1 Sparks Concerns Of Prolonged Downtrend

01 November 2024 - 9:00PM

NEWSBTC

Worldcoin’s recent failure to breach the $2.15 resistance level has

put the token under renewed bearish pressure, leaving investors to

question if a prolonged downtrend may be unfolding. The $2.15 mark

has become a key battleground, with sellers pushing prices lower

each time buyers attempt a breakout. As Worldcoin struggles to

regain upward momentum, the risk of further declines grows,

signaling potential challenges ahead. This article aims to explore

the implications of Worldcoin’s recent struggle at the $2.1

resistance level and evaluate whether it could signal an extended

downtrend. Through an analysis of technical indicators and current

market dynamics, we’ll assess the possible risks and opportunities

for Worldcoin, offering traders insights into what may lie ahead

for the token’s price movement. Technical Indicators Signal

Potential For Extended Downtrend On the 4-hour chart, WLD’s price

is exhibiting negative momentum, trading below the 100-day Simple

Moving Average (SMA) as it trends downward toward the $1.27 support

level. A continued descent toward the $1.27 support suggests that

selling pressure is building, and if the support fails to hold,

Worldcoin could experience more declines. Also, the 4-hour

Composite Trend Oscillator for WLD is showing bearish signals, with

the SMA line crossing below the signal lines and approaching the

oversold zone, suggesting that sellers are becoming more dominant.

As the indicator nears oversold territory, it reflects heightened

selling pressure, raising the potential for a downtrend. Related

Reading: Worldcoin Gains Upside Momentum: Is A Major Breakout

Ahead? On the daily chart, Worldcoin is exhibiting strong downward

momentum, characterized by a bearish candlestick pattern following

a failed attempt to break through the resistance at $2.15,

indicating increased selling pressure and that the asset may

continue to drop. Additionally, WLD is currently facing challenges

as it attempts to drop below the 100-day SMA, a key indicator that

typically signals a pessimistic trend when breached. If WLD manages

to close below this level, it could further confirm the negative

sentiment in the market, potentially leading to additional selling

and a sustained downturn. A detailed analysis of the 1-day

Composite Trend Oscillator shows that WLD is likely facing extended

losses. The signal line has crossed below the SMA line and is

trending downward toward the zero line, indicating a negative shift

in momentum. Should the downward trend persist, Worldcoin could

encounter significant difficulties in recovering, resulting in a

prolonged period of waning price movement. Worldcoin Price Outlook:

Will Bears Maintain Control? As Worldcoin encounters heightened

downside pressure after being rejected at the $2.15 resistance

level, key support zones become crucial to monitor. If bears

continue to assert control, they may push the price down to the

$1.27 support level. Related Reading: Worldcoin Soars 31%: Will

Network Upgrades Push WLD Price Higher? A breakdown below this

level could lead to further losses, possibly testing other support

levels and intensifying pessimistic sentiment in the market.

Conversely, if support holds, it may restore confidence among

buyers and create an opportunity for a price recovery. Featured

image from YouTube, chart from Tradingview.com

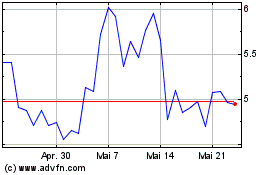

Worldcoin (COIN:WLDUSD)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Worldcoin (COIN:WLDUSD)

Historical Stock Chart

Von Dez 2023 bis Dez 2024