Whale Accumulation Points to Bitcoin Gains, But Here’s Why Investors Should Stay Alert

20 November 2024 - 5:30AM

NEWSBTC

Bitcoin price movements often correlate with large-scale investors’

actions, commonly called “whales.” These individuals or entities

hold between 1,000 and 10,000 BTC, and their trading behavior is a

critical indicator of market trends. With that being said, recent

data indicates that these whales have been increasing their Bitcoin

holdings, which has fuelled momentum in the Bitcoin market thereby

capturing the interest of more investors. Related Reading:

Bitcoin’s Market Is Still In An ‘Healthy Growth’ Phase, Says

Analyst—Here’s Why BTC Whales Continue Accumulation: Implications

and Risks A CryptoQuant analyst known as Datascope recently

highlighted the trend of increasing BTC whale accumulation, noting

that a positive 30-day percentage change supports the accumulation

of Bitcoin by whales. This trend according to the analyst,

represents a shift that can significantly impact Bitcoin’s price

trajectory. When these major players accumulate, it often signals

more liquidity in the market and a likely impending price surge.

Datascope discloses that the correlation between whale balances and

Bitcoin’s price “highlights the growing dominance of these

investors in the market.” The CryptoQuant analyst added: Whale

Accumulation and Its Impact on Price Whales accumulating Bitcoin is

seen as a significant signal of an upward price trend. It indicates

a period of market confidence and sufficient liquidity.

Additionally, the 30-day Simple Moving Average (SMA30) helps

analyze the long-term tendencies of whale behavior. A positive

slope in the moving average suggests potential for upward price

momentum. However, datascope mentioned that there are potential

caveats to this accumulation trend. He noted that the accumulation

phase can lead to upward momentum, but it inherently carries the

risk of a sharp reversal when these large holders decide to sell

their assets. Selling pressure from whales, especially if executed

suddenly, could lead to rapid price declines, reversing gains

during accumulation. The analyst concluded by noting: Thus,

monitoring whale accumulation and selling cycles is critical.

Understanding the current market phase and timing exits correctly

are key success factors for investors. Bitcoin Market Performance

While the accumulation of BTC from whales continues, the asset

appears to be gearing up for another rally. It is worth noting that

prior to today’s price performance, Bitcoin has remained just above

$90,000 following its sharp decrease away from its all-time high

(ATH) of $93,477 registered last week. Related Reading:

Bitcoin Exchange Reserves Hit 5-Year Low—What Does This Signal?

However, today, the asset is beginning to see a return of upward

momentum. Particularly, at the time of writing, Bitcoin has

increased by 1.9% to a current trading price of $91,635, bringing

it to a 1.7% decrease away from its ATH. Featured image created

with DALL-E, Chart from TradingView

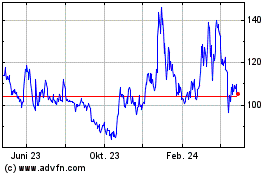

Quant (COIN:QNTUSD)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

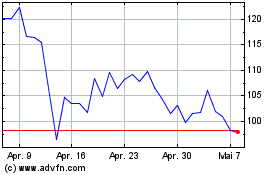

Quant (COIN:QNTUSD)

Historical Stock Chart

Von Nov 2023 bis Nov 2024