Will Recent Binance Events Trigger This Historical Bitcoin Bull Run Signal?

24 November 2023 - 6:00PM

NEWSBTC

The recent events at cryptocurrency exchange Binance could trigger

the next Bitcoin bull run if this pattern continues to form. Will

Bitcoin Exchange Reserve Ratio Turn Around After Binance News? As

explained by an analyst in a CryptoQuant Quicktake post, the BTC

exchange reserve ratio for US versus off-shore platforms has

followed a specific pattern during past bull markets of the asset.

The “exchange reserve ratio” here refers to an indicator that

compares the exchange reserves of any two platforms or group of

platforms. The exchange reserve is the total amount of Bitcoin

sitting in the wallets of the exchange/group in question. In the

context of the current discussion, the exchange reserve ratio

between the US-based exchanges and foreign platforms is of

interest. The trend in this metric can tell us about which type of

exchanges users prefer to use. Related Reading: Is Dogecoin About

To Reverse? Key Factors To Watch When the ratio’s value declines,

the off-shore exchanges gain steam as investors deposit their coins

to them faster than to the US platforms (alternatively, they are

withdrawing at a slower pace). On the other hand, an increase

implies the dominance of the American exchanges is going up as

their exchange reserve is growing relative to that of the global

platforms. Now, here is a chart that shows the trend in the Bitcoin

exchange reserve ratio for these two sets of exchanges over the

last few years: Looks like the value of the metric has been going

up in recent weeks | Source: CryptoQuant In the graph, the quant

has highlighted the two phases that the Bitcoin exchange reserve

ratio for these platforms appeared to have followed during the last

two bull runs. In the first phase (marked in green), the indicator

rises while the cryptocurrency goes through a buildup period for

the bull rally. This suggests that large entities start

participating in the American exchanges ahead of the bull run. Once

the bull run starts properly, the indicator’s value starts sliding

down as investors withdraw their coins from these platforms again

(the red box in the graph). From the chart, it’s visible that the

Bitcoin exchange reserve ratio for US vs. foreign exchanges was in

a continued decline since the start of the bear market but has

recently shown signs of turning around. The indicator has only

registered a small increase so far, so it’s hard to say if it’s a

sign of a trend taking shape or just a temporary deviation.

Whatever the case, though, a development has happened in the

Bitcoin market that can tip the favor towards the American

platforms regardless. Related Reading: Chainlink Retests $14:

Here’s What Will Happen If Support Holds Binance, the largest

cryptocurrency exchange based on trading volume, has seen a

leadership change following Changpeng Zhao’s resignation. The

instability has kickstarted outflows from the exchange, while

US-based Coinbase has enjoyed inflows. Thus, this may be the event

that leads to a proper reversal in the BTC exchange reserve ratio.

“If the recent regulations on CZ and Binance lead to an increase in

the percentage of Bitcoin held on US exchanges, we will be ready

for the next bull market,” notes the analyst. BTC Price Bitcoin has

once again been trying to breach the $38,000 level today, as the

chart below shows. BTC has registered some increase during the past

day | Source: BTCUSD on TradingView Featured image from Kanchanara

on Unsplash.com, charts from TradingView.com, CryptoQuant.com

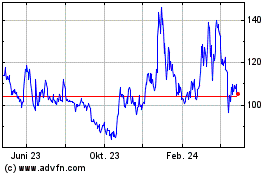

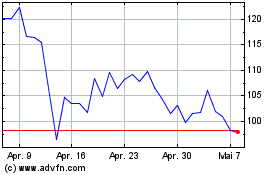

Quant (COIN:QNTUSD)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Quant (COIN:QNTUSD)

Historical Stock Chart

Von Jul 2023 bis Jul 2024