Bitcoin Crosses $59,000 In Surprise Pre-Halving Rally

28 Februar 2024 - 2:00PM

NEWSBTC

The Bitcoin price has now successfully crossed the $59,000 level

after an incredibly bullish month of February. The market leader

has also barreled ahead of all expectations during this time as

well, continuing to rally at a time when prices are expected to

crash ahead of the next halving. Institutional Investors Drive

Bitcoin Price Higher One of the major drivers behind the Bitcoin

performance over the last day has been institutional investors.

These investors have continued to take advantage of the

opportunities provided by the Bitcoin Spot ETFs approved by the

Securities and Exchange Commission (SEC) in January. Related

Reading: Can Ethereum Touch $4,000? Crypto Analyst Says ETH Rally

Far From Over While there have been outflows from the Grayscale

Bitcoin Trust due to concerns about high fees, the inflows have not

slowed. On Tuesday, Bloomberg Analyst James Seyffart revealed that

Spot ETF inflows rose once again, to cross $400 million in a single

day. In the same vein, the trading volumes have been on the rise.

With demand soaring, volumes crossed $2 billion on Tuesday and it

is the second time in a month that it has crossed this figure. This

rise in both inflows and trading volumes shows a willingness among

institutional investors to take positions in Bitcoin. Fidelity

Investments, one of the issues of the many Spot Bitcoin ETFs

available for trading in the market, also recently encouraged

investors to put a small portion of their portfolios in Bitcoin.

According to the asset manager, a portfolio allocation of 1-3% in

Bitcoin is ideal at this point. Now, while a 1-3% allocation may

seem small to the average investor, it is quite large when it comes

to institutional investing. These portfolios are often made up of

billions of dollars, and even a 1-3% allocation could work out to

hundreds of millions of dollars being funneled into Bitcoin. BTC

Dominance Not Budging While the price of Bitcoin has rallied in the

last week, expectations are that Bitcoin will begin to consolidate

and then give way to altcoins. However, the BTC dominance over the

crypto market remains quite high, suggesting that the time for

altcoins may not be here yet. Related Reading: Crypto Analyst

Predicts Dogecoin Parabolic Breakout Above $3.5, Here’s When

Presently, the BTC dominance is sitting at 54.1% after seeing a

local peak of 54.4%. This shows that Bitcoin is still leading

the entire market by a large margin, and until this dominance

subsides, Bitcoin will continue to lead the rally while altcoins

lag behind. For now, the bulls are focusing on maintaining support

at $59,000, giving it a bounce point toward $60,000. With the

previous all-time high at $69,000, the BTC price needs a less than

20% move from here to reach a new all-time high. BTC bulls push

price above $59,000 | Source: BTCUSD on Tradingview.com Featured

image from CBC, chart from Tradingview.com

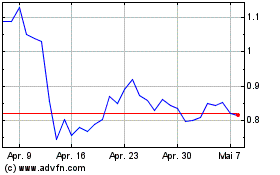

Mina (COIN:MINAUSD)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Mina (COIN:MINAUSD)

Historical Stock Chart

Von Jul 2023 bis Jul 2024