Bitcoin Price Alert: Expert Warns Of Upcoming 25% Drop, Timing And Trends Explained

26 November 2024 - 8:30AM

NEWSBTC

After reaching a new all-time high of $99,600 last Friday, the

Bitcoin price has retraced to the $94,000 mark for the first time

in nearly a week. This pullback comes amid growing speculation

about a possible correction following a massive three-week uptrend

that saw the leading crypto surge by 40% after Donald Trump’s

election on November 5. Bitcoin Price May Drop To $70,500 Market

expert and technical analyst Rekt Capital recently voiced concerns

on social media platform X (formerly Twitter), drawing parallels

with historical price cycles. He highlighted that in the 2013

cycle, the Bitcoin price experienced six weeks of rising prices

leading into what is known as “Price Discovery,” followed by its

first major correction in Week 7. Similarly, in the 2017

cycle, a seven-week rally culminated in a significant retracement

of 34% in Week 8. In the 2020/2021 cycle, Bitcoin rallied for six

weeks before facing its first meaningful pullback of 16%.Currently,

Rekt Capital notes that Bitcoin is in the fourth week of its

current uptrend. Related Reading: Ethereum Analyst Predicts

$3,700 Once ETH Breaks Through Resistance Based on these historical

patterns, it suggests that the cryptocurrency may be poised for a

retest of lower support levels within the next two to four weeks,

aligning with the previous trends, where the average declines

have been substantial. Considering the data from past corrections,

the Bitcoin price could experience a 25% pullback, potentially

bringing the price down to around $70,500—a level not seen since

the election day. Who’s Selling Bitcoin? Contributing to the

current pullback, data from on-chain market intelligence firm

Glassnode reveals that long-term holders (LTHs) have significantly

increased their selling activity, with a notable selling pressure

recorded at -366,000 BTC per month—the highest level seen since

April 2024. The analysis indicates that among long-term

holders, the 6 to 12-month cohort is leading the charge, averaging

25,600 BTC sold per day. This group of investors has capitalized on

the recent Bitcoin price surge, having acquired their coins at an

average cost basis approximately 71% lower than the current market

price, which hovers around $57,900. Related Reading: Rocket

Fuel For Shiba Inu Price: Kusama Says 99% SHIB Supply Burn Possible

The increase in selling pressure among this group also reflects a

potential shift in market movement in the coming days. With Bitcoin

hitting new all-time highs just below $100,000, some investors may

choose to take profits rather than ride out potential

volatility. At the time of writing, the largest

cryptocurrency on the market is trading at $94,000, recording a

retracement of nearly 5% on the 24-hour time frame. For the

time being, however, the Bitcoin price continues to post gains in

all other time frames, with the year-to-date being the most notable

with a 150% surge in that time period. Featured image from

DALL-E, chart from TradingView.com

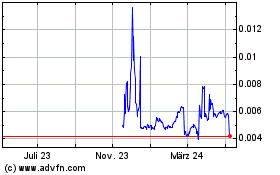

Four (COIN:FOURRUSD)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

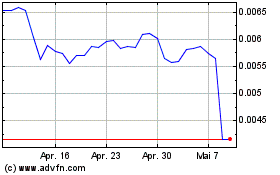

Four (COIN:FOURRUSD)

Historical Stock Chart

Von Jan 2024 bis Jan 2025