Bitcoin Triggers Golden Cross: What This Means For The Crypto Trend

29 Oktober 2024 - 3:05PM

NEWSBTC

Bitcoin price is now above $70,000 per coin. The recent rally back

toward local all-time highs has carried BTCUSD high enough to

causes two important moving averages to form a “Golden Cross.” This

signal has appeared twice since the bear market bottom and yielded

significant results. Let’s take a look at the data and the most

recent signal now that it has confirmed. Bitcoin Daily

Golden Cross: 50-Day And 200-Day Moving Averages As pictured above,

BTCUSD has triggered a daily golden cross of the 50-day and 200-day

moving averages. In technical analysis, a golden cross happens when

a short-term moving average crosses above a long-term moving

average. This typically suggests that there is an actively trending

environment and price is expected to appreciate. Related Reading:

Bitcoin Hash Ribbons Flash ‘Buy’ Signal: Analysts See New Highs On

The Horizon The opposite, bearish signal is referred to as a death

cross. The chart above also depicts a death cross in August 2024.

However, its appearance didn’t lead to a prolonged downtrend. Could

this also mean that this latest golden cross might not produce a

sustainable uptrend? BTCUSD Golden Cross And Death Cross Recent

History Zooming out provides a more clear picture of the signal’s

effectiveness since the bear market bottom in November 2022. BTCUSD

rising from bear market lows around $16,000 to $23,000 was enough

to pull the 50-day moving average above the 200-day average,

triggering the first golden cross of 2023. This kept Bitcoin

trending higher until it reached roughly $32,000, then fell to

retest lows around $25,000. The bearish short-term price action

then triggered a death cross. Here, much like we saw in 2024,

Bitcoin trended sideways and avoided a downtrend. It didn’t take

much upside to force another golden cross. From that golden cross,

BTCUSD rallied another 100%, doubling in price. The chart above

shows that the golden cross in October 2024 occurred just months

after the death cross, just like it did in late 2024. Could that

mean another 100% rally from current levels? If so, Bitcoin price

could reach as high as $140,000 before beginning to show weakness.

Buy And Hold: Using Moving Average Crosses As A Trading System

Using the 50-day and 200-day moving averages as a buy and hold

trading system starting from 2018 would have yielded significant

results. The first golden cross fired in April 2019 at around

$5,000 per BTC. A death cross in October 2019 closed out the trade

and sold some coins. A quick golden cross and death cross combo in

early 2020 led to a small loss. May 2020’s golden cross more than

made up for it, triggering when Bitcoin was trading just below

$10,000. The trade stayed open while Bitcoin blasted off into its

most bullish trend in recent years and eventually closed with the

next death cross in Jun 2021 at around $35,000 per BTC. This kept

$25,000 in profit from the trade, combined with the initial $4,000

profit from the early 2019 trade to make $29,000. The small loss

takes the total closer to $28,500. Related Reading: Bitcoin

Dominates $3.4 Billion October Crypto Inflows—What’s Behind the

Boom? In September 2021, BTCUSD golden crossed again at around

$45,000, only to shortly later death cross at $3,000 lower. This

death cross stayed active until Bitcoin shed another $30,000.

Fortunately, using the two moving averages as a buy and hold

trading system meant the death cross moved you to cash – avoiding

the worst of the bear market. Come early 2023, Bitcoin was ready to

begin a new uptrend and the golden cross triggered at $23,000. A

death cross formed at $27,000, keeping another $6,000 worth of

profits. Another golden cross in October 2023 triggered at $35,000,

riding all the way to $62,000 when the most recent death cross

closed out the trade. In six trades total, the 50/200MA trading

system would have earned approximately $58,500 as Bitcoin traveled

from around $5,000 to $74,000. Four out of the six trades were

profitable and the two losses were relatively minor when compared

to the profits generated. Tony Severino, CMT is the author of the

CoinChartist (VIP) newsletter. Sign up for free. Follow

@TonyTheBullBTC & @coinchartist_io on Twitter. Or join the

TonyTradesBTC Telegram for daily market insights and technical

analysis education. Please note: Content is educational and should

not be considered investment advice. Featured image from ChatGPT,

Charts from TradingView.com

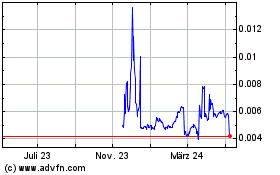

Four (COIN:FOURRUSD)

Historical Stock Chart

Von Okt 2024 bis Okt 2024

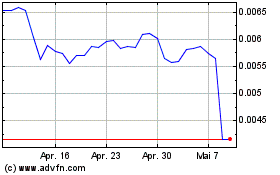

Four (COIN:FOURRUSD)

Historical Stock Chart

Von Okt 2023 bis Okt 2024