4 Surprising Insights From Coinbase’s Earnings, COIN Sees Bullish Surge

16 Februar 2024 - 4:00PM

NEWSBTC

The foremost crypto exchange in the United States, Coinbase,

released its earnings report on February 15th. As expected, there

were major takeaways from the financial report, highlighting the

crypto company’s performance in the fourth quarter of last year.

Related Reading: Bitcoin To Receive Monumental $150 Billion Inflow:

Expert Reveals Coinbase’s Trading Volume Exceeds Expectations

Coinbase maximalist Coinbase Duck noted in an X (formerly Twitter)

post how the crypto exchange defied expectations in the fourth

quarter of 2023. Coinbase recorded $170.6 billion in spot trading

volume, exceeding the estimated $168. Specifically, a considerable

influx of retail investors accounted for 18% of the total spot

trading volume against the estimated 16% that the crypto exchange

was projected to record. The return of these retail investors is

believed to have been partly due to the resurgence that Bitcoin and

the broader crypto market experienced towards the end of the

year. Meanwhile, consumer transaction revenue ($492.5

million) was way below the estimate of $570.9 million. However,

Coinbase Duck noted that this wasn’t necessarily bad, as some

investors started using advanced trading. In a letter to its

shareholders, the crypto exchange also revealed that some existing

users traded significantly higher volumes, which could have

necessitated the move to advanced trading. Coinbase also

recorded a total operating expense of $838 million, which happened

to be below the projected estimate of $878 million. Specifically,

the crypto exchange did a great job in its transaction expenses,

recording an expense of $126 million compared to the estimate of

$163 million. However, the company’s sales and marketing

expenses ($106 million) exceeded the estimate of $90 million.

Coinbase revealed that this growth was “primarily driven by higher

seasonal NBA spending, higher performance marketing spending due to

strong market conditions, and increased USDC reward payouts due to

growth in on-platform balances.” Coinbase Had A Profitable Fourth

Quarter Coinbase recorded a net income of $273 million, beating the

estimate of $104 million. Interestingly, going by figures from its

Shareholder letter, the fourth quarter of 2023 was the only one in

the year in which the crypto exchange didn’t record a loss for its

net income. Meanwhile, the company also recorded its largest net

revenue during that period. Coinbase suggested that the excitement

around the Spot Bitcoin ETFs and the expectations of more favorable

market conditions in 2024 had contributed to its success in Q4 of

2023. Coinbase is a primary custodian for most Bitcoin ETFs,

including BlackRock’s iShares Bitcoin Trust (IBIT). Related

Reading: Ethereum Inches Closer To $3,000 – Will February Deliver A

$4,000 Knockout? Meanwhile, the crypto exchange earned $1.13 per

share, beating the forecast of $0.43. This is without the crypto

exchange accounting for the FASB change, which Coinbase Duck

revealed could bring its earnings per Share (EPS) to $2.1.

Chart from Tradingview

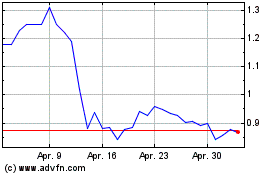

Flow (COIN:FLOWUSD)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Flow (COIN:FLOWUSD)

Historical Stock Chart

Von Jul 2023 bis Jul 2024