Stacks: New Network Upgrades Push STX Price Up By 18% – Details

27 September 2024 - 11:00AM

NEWSBTC

Stacks (STX) has regained and built up its momentum over two weeks

after a bloody September start. Since then, the token has garnered

much-deserved attention as developments on the platform mount up.

According to CoinGecko, STX surged over 18% since last week,

representing a strong flip in investor sentiment. Related

Reading: Massive XRP Rally Incoming? Analyst Predicts 220% Price

Jump – Details Stacks continue to make noise as more partnerships

are unveiled this week; several of which might open a new reality

on Stacks. With the hyped potential of the so-called Bitcoin

economy underneath Stacks, investors and traders might see a lot of

green in the coming days. New Developments Fuel STX

Growth In an X post by the official Stacks account, the

platform has announced that Hermetica.fi, a stablecoin

provider in the Stack’s ecosystem, has deployed USDh. The

stablecoin has been described as the first “Bitcoin-backed,

yield-bearing” synthetic dollar available on the retail market.

Hermetica’s marketing of the new stablecoin is aggressive, with a

time-limited staking APR of 25%. Stacks’ leading Bitcoin L2

ecosystem continues to grow 🧡 Congratulations to @HermeticaFi for

the official launch of their USDh stablecoin on Stacks. To

celebrate, Hermetica is offering a prize pool to early movers. More

information is available below. 1/2 pic.twitter.com/3EYmefYEPI —

stacks.btc (@Stacks) September 25, 2024 Institutional investors

might also be around the corner as Anchorage Digital, an

institutional wallet provider, has announced their support for

Stacks, opening the door for the platform to be exposed to

institutional entities, possibly improving the Stacks’s future

development. Introducing institutional investors will push the

platform to develop at a faster pace. With the final step in

activating the Nakamoto upgrade, several SX users have released

posts regarding the benefits of the network upgrade. All in all,

the conclusion is the same: the Nakamoto upgrade will significantly

improve user experience while simultaneously allowing developers to

access the $1 trillion in liquidity under Bitcoin, with sBTC, a

1-to-1 Bitcoin-backed asset in Stacks, integrated with Solana and

Aptos for quicker distribution and adoption. Investors Should Watch

Stacks On These Levels STX retains some of its momentum, breaking

any short term possibility of a reversal as it breaks through $2.02

in the short term. This price action nets the bulls some serious

gains, but this triumph might only be temporary as the bulls lose

momentum to maintain a steady trajectory. The relative strength

index (RSI) of the token suggests that the bulls may encounter a

wall around $2.2 in the short term, possibly letting the bears gain

strength equaling the current bullishness. A movement like this

will keep the token’s price stable, possibly giving the bulls

enough time and room to maneuver upwards in the medium term.

Related Reading: Popcat Climbs By 35% – $1 Target Within Reach If

STX remains at its current support level of $2.02, we might see a

surge upward in the coming days; that’s if the the pullback the

market is currently experiencing to flip bullish. However, if the

bulls fail to hold this position for a medium term movement, the

bears might pull the token towards $1.885 or lower if they build up

enough momentum. Featured image from Stacks, chart from TradingView

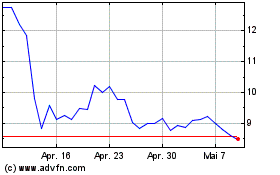

Aptos (COIN:APTUSD)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Aptos (COIN:APTUSD)

Historical Stock Chart

Von Dez 2023 bis Dez 2024