Avalanche To Unleash 9.5 Million Tokens, Traders Brace For Impact

03 Februar 2024 - 7:30PM

NEWSBTC

Avalanche, the blockchain platform poised for a major event in the

month of love, is gearing up for a significant development. As

February unfolds, the cryptocurrency market is anticipating the

release of nearly $900 million worth of vested tokens from a

diverse array of projects. This imminent influx into the market has

sparked a wave of concerns among investors who are closely watching

the unfolding scenario. Projects involved in this token release

include Avalanche (AVAX), Aptos (APT), The Sandbox (SAND), Optimism

(OP), and SUI. Avalanche is strategically targeting strategic

partners, team members, and an airdrop to maintain a balance

between long-term commitment and potential short-term sell-offs.

Related Reading: Dogecoin Orbit Expands: Over 890,000 New Addresses

Join DOGE Community Avalanche Braces For Major Token Release

Scheduled for release on February 22, Avalanche is set to unleash

9.5 million tokens valued at approximately $320 million. Similarly,

Aptos is gearing up to release 24.8 million tokens worth around

$233 million on February 11. The distribution strategy for Aptos

aims to ensure market stability while fostering community

involvement. The impending release of these vested tokens has put

the crypto community on high alert. Investors and analysts are

closely monitoring the developments with a mix of excitement and

caution. While anticipation surrounds the token releases, there is

also a sense of vigilance as market participants evaluate how the

surge in supply might impact project valuations and overall

stability. Avalanche currently trading at $35.76 on the daily

chart: TradingView.com Navigating A Potential Correction Phase:

AVAX Price Analysis Avalanche (AVAX) has recently caught the

attention of the market with an impressive price performance,

boasting a remarkable 470% increase after breaking through its bear

market descending trendline on November 1. Recent analyses suggest

that AVAX is currently facing resistance at a descending trendline

from the December high, which could lead to a price rejection and

subsequent decrease. If this correction signifies the commencement

of a lasting bull phase for Avalanche, support levels around $20,

aligning with the 0.5 to 0.618 Fibonacci retracement levels, may

come into play. Following this correction phase, AVAX could

potentially embark on a new uptrend, surpassing its all-time high.

Image source: DefiLlama Meanwhile, AVAX has grown exponentially in

the last year, and according to DeFiLlama data, it is now the

sixth-largest DeFi chain. An artificial intelligence (AI) based

price prediction model has predicted that the AVAX token’s price

would soar by more than 500% from its present levels, reaching

over $200 by the beginning of 2025. Related Reading: Chainlink

Price Surge Powers Altcoin Market, Bulls Aim For $20 Target

Previous AVAX Unlock And Its Impact On The Market It’s crucial to

note that AVAX’s previous token unlock on November 23 did not cause

significant price fluctuations. However, in the anticipation

leading up to the unlock, the price experienced a 16% fall from

nearly $23 on November 20 to $19 at the tokens’ release. This

historical precedent underscores the importance of closely

monitoring market dynamics during token release events. Market

participants should exercise caution and carefully consider the

potential impact of these developments on their investment

strategies. Featured image from Adobe Stock, chart from TradingView

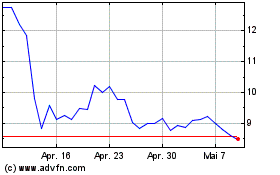

Aptos (COIN:APTUSD)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Aptos (COIN:APTUSD)

Historical Stock Chart

Von Jul 2023 bis Jul 2024