illimity Ends the Third Quarter of 2022 With Solid Results in Line With Budget Forecasts

11 November 2022 - 1:45PM

illimity Ends the Third Quarter of 2022 With Solid Results in

Line With Budget Forecasts

Chaired by Rosalba Casiraghi, the Board of Directors of illimity

Bank S.p.A. (“

illimity” or the

“

Bank”) yesterday approved the illimity Group’s

results at 30 September 2022.

illimity continues its growth

path in the third quarter of 2022 as well, with a

solid financial performance and in line with budget

forecasts, posting a net profit of 19.1 million

euro (+21% q/q and 2% y/y), for a total of 50.6

million euro in the nine months of 2022, representing an

increase of 10% over the corresponding period of 2021. Growth is

expected to accelerate further in the fourth quarter of 2022,

taking net profit for 2022 to at least 75 million euro with an ROE

of ca. 10%. The expected results for the year include pre-tax

losses of approximately 20 million euro arising from the launch of

the initiatives b-ilty, Quimmo and Hype.

More specifically, the quarter was characterised

by the following factors:

-

net customer loans reached 3.3 billion euro at 30

September 2022, a rise of 4% over the previous quarter and 34% over

the same period of 2021. The growth in volumes was mainly driven by

the Growth Credit Division, and by the activities of the Investment

Banking Division. The Distressed Credit Division maintained volumes

broadly stable in the period, as the new investments were offset by

significant reimbursements, collections and disposals. Strong

volume growth is expected for the last part of the year driven by

the generation of new business, which in the month of October alone

reached a level exceeding that for the whole third quarter;

-

the quality of the organic loan book

continues to stand at excellent levels: at 30 September

2022 the ratio between gross doubtful organic loans and total gross

organic loans originated since the start of illimity’s operations

stood at 0.7%, a decrease over the previous quarter. This becomes

2.0% if the loan portfolio of the former Banca Interprovinciale,

which is gradually decreasing, is included;

-

a robust capital base, with ratios positioned at

the top levels of the system – a phased-in CET1 ratio of 18.0%

(17.5% fully loaded) and a phased-in Total Capital Ratio of 23.6%

(23.1% fully loaded);

-

a sound liquidity position of around 0.6 billion

euro as at September 2023 and well diversified funding

between retail, corporate and institutional funding sources, with a

largely stable average cost of funding of 1.6%;

-

revenue totalled 74.5 million euro in the third

quarter (-8% q/q and +12%y/y) driven by the Group’s

recurring activities and in particular by the net interest income

component. Revenue rose to 233.6 million euro in the first

nine months of 2022, representing an increase of 21% over

the first nine months of 2021.The Distressed Credit Division was

confirmed as the main contributor, generating approximately 66% of

total revenue in the first nine months of 2022. The Growth Credit

Division continued its advance by reaching an increase of almost

60% of its revenue over the same period of 2021 and taking its

contribution to consolidated revenue to ca. 21%, to which should be

added the Investment Banking Division, which also posted

significant growth and contributed a further 5%;

-

operating costs decreased to 46.9 million

euro in the third quarter (-3% q/q, +32% y/y)

taking the total for the nine months to 140.4 million

euro, representing an increase over the same period of the

previous year (+25% y/y) as the result of the substantial

completion of the organisational structure and the investments in

the new initiatives;

-

a Cost income ratio amounting to 63% in the third quarter

of 2022, (60% in the previous quarter) and 60% in

the first nine months of 2022, a rise of around two

percentage points over the same period of the previous year. This

dynamic is the result of the investments made in the new

initiatives which will begin to generate tangible revenue in 2023,

producing a positive effect on the Group’s operating leverage;

-

as a result of the above dynamics, operating

profit reached 27.6 million euro in the

third quarter of 2022 (-14% q/q and -11% y/y). This result

discounts the effects of the investments made to launch the

high-tech initiatives – b-ilty, Quimmo and Hype. Operating

profit accordingly reached 93.2 million euro in the first

nine months of 2022, representing an increase of 15% over the first

nine months of 2021;

-

net write-downs of organic loans for the third

quarter totalled 0.6 million euro, corresponding to an

annualised cost of risk3

of 11 bps, and arise from generic

provisions on customer loans. The rather contained cost of risk is

based on the excellent quality of the Bank’s loan portfolio, which

also arises from the involvement of specialists (Tutors) in every

important loan transaction, and the high guaranteed component that

characterises the loans disbursed during the quarter. Net

write-downs of organic loans totalled 3.7 million euro in the nine

months of 2022, with an annualised cost of risk of 22 bps;

-

positive credit revaluation on purchased distressed credit

positions amounting to 7.3 million euro were posted in the

quarter, arising from a series of events such as: the increase in

the value of collaterals on the basis of binding offers received on

certain portfolios for which a sales process is in progress;

write-backs on certain loans originally classified as UTP on

acquisition and now returning to performing status; the review of

expected cash flows from certain portfolios due to an enrichment of

the available data for the respective collaterals;

-

a pre-tax profit of 29.6 million euro was posted in the

quarter, representing a significant rise of 23% on a

quarterly basis and 9% on an annual basis; pre-tax profit

for the first nine months of 2022 accordingly reached

77.7 million euro, an increase of approximately

13% over the first nine months of the previous year.

Corrado Passera,

CEO and Founder of

illimity, commented: “Growth continued with the

results for the third quarter. These are solid and in line with our

forecasts, despite the fact that the scenario in which we operate

has undergone a profound change since when we originally approved

the budget. illimity has been able to continue along its planned

growth trajectory which has enabled it to profitably affirm its

various synergic core businesses on the market over a short period

of time. The positive trend seen in 2022 will accelerate in the

current quarter: October began with great momentum in terms of

business origination and the advances in profitability dynamics

will make it possible for us to end the year with a profit of at

least 75 million euro, once again confirming our budget estimates.

This is a result of particular interest because it includes

important investments for the future. The three technological

initiatives - b-ilty, Quimmo and Hype - have a combined effect of

approximately 20 million euro in pre-tax losses; we expect that

this negative result will drastically fall starting from 2023 and

that the three initiatives will contribute to consolidated profit

from 2024, creating significant value for the Group. We are also

looking confidently at 2023: illimity has just successfully

completed its fourth year of activity, and substantially completed

its organizational structure. The business model has now become

much more scalable thanks to the investments made and the critical

size reached. Of particular satisfaction for all illimiters is the

Best Place to Work certificate achieved at European level, as well

as the flattering recognitions in ESG ratings.”

For more details view the full press release:

Press Release

For further information:

Investor RelationsSilvia Benzi:

+39.349.7846537 - +44.7741.464948 - silvia.benzi@illimity.com

|

Press & Communication illimity |

|

|

Vittoria La Porta, Elena Massei |

Sara Balzarotti, Ad Hoc Communication Advisors |

|

+39.393.4340394 press@illimity.com |

+39.335.1415584 sara.balzarotti@ahca.it |

Wire Service Contact:InvestorWire

(IW)Los Angeles,

Californiawww.InvestorWire.comEditor@InvestorWire.com

________________________

1 Related to the business originated by

illimity, excluding the loan portfolio of the former Banca

Interprovinciale. 2 Phased-in CET1 ratio.3 Calculated as the ratio

between loan loss provisions and net organic loans to customers at

30 September 2022 (2,215 million euro) for the Factoring,

Cross-over, Acquisition Finance, Turnaround, b-ilty and Alternative

Debt segments, and for loans purchased as part of investments in

distressed credit portfolios that have undergone a passage of

accounting status subsequent to acquisition or disbursement

(excluding loans purchased as bad loans), for the loan portfolio of

the former Banca Interprovinciale and for Senior Financing to

non-financial investors in distressed loans.

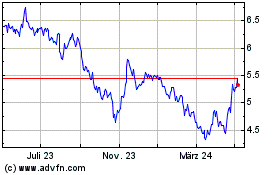

Illimity Bank (BIT:ILTY)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

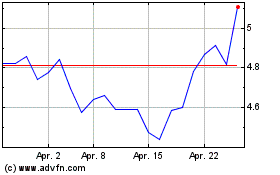

Illimity Bank (BIT:ILTY)

Historical Stock Chart

Von Nov 2023 bis Nov 2024