Vertu Motors PLC Trading Update (9516V)

07 Dezember 2023 - 8:00AM

UK Regulatory

TIDMVTU

RNS Number : 9516V

Vertu Motors PLC

07 December 2023

7 December 2023

Vertu Motors plc ("Vertu Motors" or "Company")

Trading Update

Vertu Motors, the UK automotive retailer with a network of 195

sales and aftersales outlets across the UK provides the following

trading update for the three months ended 30 November 2023 ("the

Period"), outlining the impact of a number of negative external

market factors resulting in profitability for FY24 now expected to

be lower than current market expectations.

The Period has witnessed a material change in the used vehicle

market with UK wholesale values experiencing a significant

reduction in October and November. This arose due to higher supply

into the wholesale markets, in conjunction with retail demand being

affected by the combination of higher interest rates and high

vehicle prices impacting affordability. At the start of the Period,

used car values in the UK were approximately 20% higher than in

January 2021 and had been resilient since the Pandemic. CAP (1)

have reported that values have fallen on average 4.2% in both

October and November, representing record levels of monthly

decline. There has been greater weakness in higher-end premium

product values, which the Group started to experience in September.

CAP (1) reports that the largest drops of 7% -11% per month arose

in the premium brand segment.

The Group adapted to these changing market dynamics, applying

its Vertu Insights pricing algorithm to ensure vehicles were priced

effectively, to ensure increased stock turn and thus a reduction in

Group inventory levels. Group like-for-like used vehicle volumes

fell 2.0% in the Period, an improvement on the 5.7% reduction in

the first half of the financial year. Gross profit generation from

used car sales were, however, below those anticipated.

The Board consider that UK used vehicle values are likely to

continue to weaken above historic norms in the near term. Once the

current pricing correction has eased, used car prices in the UK

will be more affordable to the consumer and margins should

stabilise. Reducing interest rates in the medium-term would also

aid affordability and provide a further stimulus to a market

benefitting from increased supply.

New vehicle supply to the UK continues to increase as production

constraints diminish and lead times reduce. The calendar year to

November 2023 has seen UK car registrations increase 18.6%, due to

significant product flow into the fleet market, whereas new car

retail volumes have only marginally increased. Retail demand has

become increasingly muted in recent months, and this is

particularly the case for Battery Electric Vehicles. The Group has

seen like-for-like new retail and Motability volumes broadly in

line with the UK market growth during the Period. New vehicle

margins have continued to reduce towards more normalised levels due

to increased supply, with the Group delivering higher overall core

gross profit generation from the sale of new vehicles

year-on-year.

Fleet and commercial volumes and gross profit generation rose in

the Period year-on-year.

Overall, new vehicle supply has started to exceed natural demand

levels, leading to an increased pipeline of new vehicle inventory,

which when combined with higher interest rates, has increased

manufacturer stocking interest charges significantly above expected

levels.

Aftersales demand remained strong and higher technician resource

levels are helping to drive increased revenues and an overall

increase in core aftersales gross profit in the Period compared to

the previous year. This improved resource level should help

underpin future aftersales performance. Service performance and

delivery of outstanding customer experiences has been held back by

the impact of dislocation in parts supply in respect of certain of

the Group's Manufacturer partners. This is likely to continue for a

number of months and may well be exacerbated by tightening

sanctions on Russia, impacting on the availability of parts

manufactured in Eastern Europe.

Control of operating expenses remains a major focus and costs in

the Period were well-controlled. The Board note the recently

announced, above expectation, increase of 9.8% in the level of the

National Living Wage from April 2024. This increase represents a

low single digit million GBP additional cost in FY25 to the Group,

both in terms of our own colleagues and certain of the Group's

suppliers, particularly in the areas of vehicle and premises

cleaning. The Group will continue to pursue areas of efficiency and

improved productivity from use of technology to offset these cost

headwinds.

(1) CAP-HPI Used car market report December 2023.

Outlook

The current consumer environment remains volatile, and the Board

remain cautious. In the light of the external negative market

factors highlighted above, the Board anticipate that profits for

the financial year ending 29 February 2024 will be below current

market expectations.

The recent pressures on short-term profitability of the sector

in general do not change the longer-term underlying attraction of

the business and do not have a significant negative impact on its

intrinsic value. The Board remain convinced that the Group is very

well positioned to deliver its stated strategy over the medium-term

and to take advantage of the increasing opportunities in the UK

sector.

Robert Forrester, Chief Executive Officer of Vertu, said:

"The current consumer environment remains volatile and recent

trends of sluggish new car retail demand and weakness in used car

pricing are likely to persist for some months. Vertu remains very

focused on delivering outstanding customer experience, tightly

controlling inventory and being diligent on costs. The Group has a

strong balance sheet and long track record of operational

excellence and financial discipline. These attributes mean we

remain very confident in our ability to take advantage of these

challenging market conditions and the resulting increased

opportunities in the sector."

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) 596/2014 as it

forms part of UK domestic law by virtue of the European Union

(Withdrawal) Act 2018 ("MAR"), and is disclosed in accordance with

the Company's obligations under Article 17 of MAR.

Vertu Motors plc Tel: +44 (0) 191 491 2121

Robert Forrester, CEO

Karen Anderson, CFO

Phil Clark, Investor Relations P.Clark@vertumotors.com

Zeus (Nominated Adviser and Broker) Tel: +44 (0) 203 829 5000

Jamie Peel

Andrew Jones

Dominic King

Camarco Tel: +44 (0) 203 757 4983

Billy Clegg

Tom Huddart

Notes to Editors

Vertu Motors is the fourth largest automotive retailer in the

UK with a network of 195 sales outlets across the UK. Its dealerships

operate predominantly under the Bristol Street Motors, Vertu

and Macklin Motors brand names.

Vertu Motors was established in November 2006 with the strategy

to consolidate the UK motor retail sector. It is intended that

the Group will continue to acquire motor retail operations to

grow a scaled dealership group. The Group's acquisition strategy

is supplemented by a focused organic growth strategy to drive

operational efficiencies through its national dealership network.

The Group currently operates 191 franchised sales outlets and

4 non-franchised sales operations from 145 locations across

the UK.

Vertu's Mission Statement is to "deliver an outstanding customer

motoring experience through honesty and trust".

Vertu Motors Group websites - https://investors.vertumotors.com

/ www.vertucareers.com

Vertu brand websites - www.vertumotors.com / www.bristolstreet.co.uk

/ www.vertuhonda.com / www.vertutoyota.com / www.macklinmotors.co.uk

/ www.vertumotorcyles.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTTFBMTMTBMTBJ

(END) Dow Jones Newswires

December 07, 2023 02:00 ET (07:00 GMT)

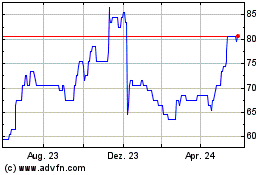

Vertu Motors (AQSE:VTU.GB)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

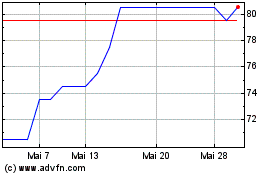

Vertu Motors (AQSE:VTU.GB)

Historical Stock Chart

Von Nov 2023 bis Nov 2024